McConnell Hints Next Stimulus Will Be Much Smaller

Tyler Durden

Fri, 11/06/2020 – 13:45

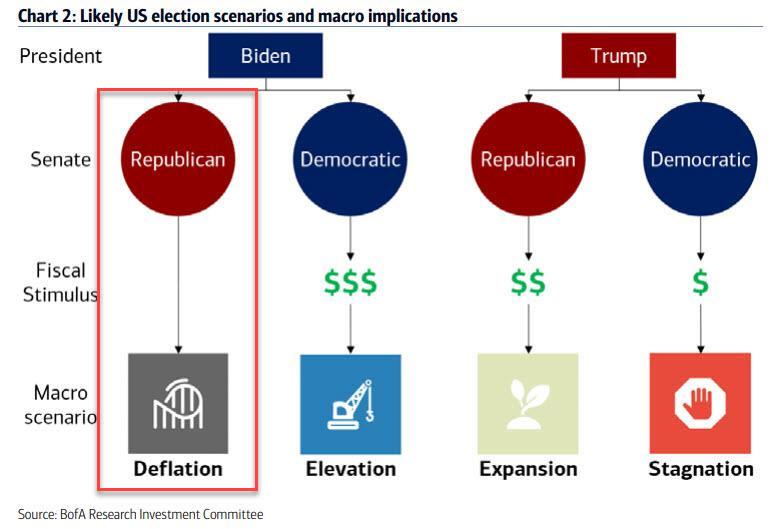

While the media is focused on the outcome of the presidential election, where Joe Biden has taken the lead in states like Pennsylvania and Georgia, while adding to his lead in Nevada even as Trump appears to be gaining in Arizona, a bigger question for the broader population is what is the fate of the next fiscal stimulus, especially since Republicans will likely hold on to a slim majority in the Senate, barring some major reversals in two possible runoff elections in Georgia in January.

And unfortunately, the “gridlock” scenario that was highlighted by Bank of America and which markets have so far blissfully ignored…

… is starting to read its ugly head because the previous Republican bid of approximately $1.9 trillion no longer appears to be on the table.

Speaking after today’s stronger than expected payrolls report, Trump’s economic adviser Larry Kudlow said the administration now opposes a $2 trillion fiscal stimulus in the wake of stronger-than-expected economic numbers, even as Speaker Nancy Pelosi – who may be facing an internal party revolt in the coming weeks – again rejected a scaled back pandemic relief package.

The comments Friday suggested a continuing impasse despite promises from both sides to renew negotiations after Tuesday’s election.

“We’re not interested in you know two or three trillion,” Kudlow told reporters. House Democrats had pressed for a $2.4 trillion package before the election. “It would still be a targeted package to specific areas” that the administration wants, Kudlow said, even after the administration last month proposed a deal around $1.9 trillion, which unless Trump wins, is clearly off the table.

Echoing Kudlow’s view, Senate Majority Leader Mitch McConnell, who refused to budge and meet Democrat stimulus demands ahead of the election, called for a scaled-back relief bill, highlighting that Democrats failed to make significant gains in congressional elections and that the latest jobs numbers showed a bigger-than-expected drop in the U.S. unemployment rate.

Justifying his calls for a far smaller stimulus than what the Democrats have tabled, McConnell points to the 6.9% unemployment rate, saying “that clearly ought to affect the size of any additional stimulus package we do,” As a reminder, Senate Republicans have proposed a $500 billion relief plan.”

And in an amusing reminder of what Bank of America said a month ago when it quipped that “political parties historically have used obstructionist tactics when out of power to thwart key legislation, most often through the ‘rediscovery’ of commitments to fiscal discipline, Republican Senate Lindsay Graham confirmed just that, saying that “If we keep the Senate which I think we will and I become Budget chairman. I’d like to create a dialogue about how can we finally begin to address the debt.“

Needless to say, it is ironic that the GOP has rediscovered its fiscal conservatism after allowing total debt to grow by over $7 trillion in the past 4 years.

Perhaps sensing that her political career is at stake if she is unable to pass another massive stimulus bill, the House speaker argued that Biden will have a bigger mandate than John F. Kennedy had following his narrow win of the popular vote in 1960. That means major “legislation on everything from infrastructure to prescription drugs, she said, though Kennedy had significant Democratic majorities in the House and Senate at the time.”

“The public wants a big jobs bill,” Pelosi said, although whether or not the public gets that will depend on whether Democrats can clinch both seats in the Georgia runoff election in January. As of this moment, it does not look likely.

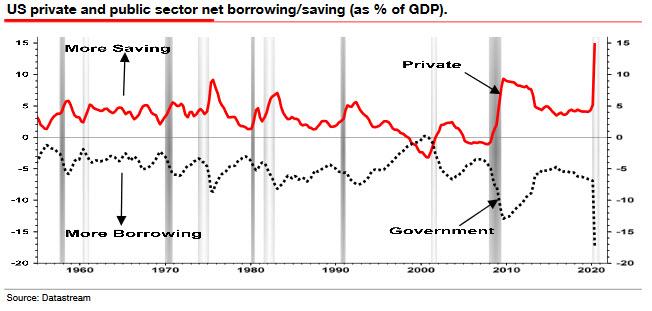

One final point: without more stimulus the US economy will likely suffer a historic double-dip hit. As Albert Edwards wrote in his latest note, “the likely fiscal impasse in the US from a divided government is important. Even before the Covid-19 crisis, massive fiscal expansion had sustained the US economy and during the recession it financed a huge rise in the private (household) sector savings ratio (as it usually does in recessions). That largesse is now under threat – and the bond market knows it.”

via ZeroHedge News https://ift.tt/3n5HghH Tyler Durden