SocGen Calculates The S&P Would Be At 1,800 Lower Without QE

Tyler Durden

Fri, 11/06/2020 – 14:20

One of the most challenging questions traders have faced over the past 11 years, ever since the Fed’s first QE, has been what is the fair value of stocks without the Fed’s chronic intervention in capital markets via trillions in spontaneously appearing liquidity used to prop up risk assets.

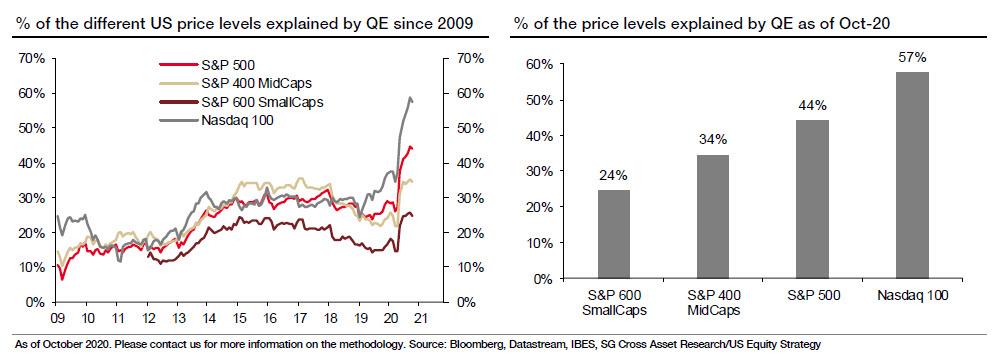

Today, in an attempt to answer this $64 trillion question, SocGen strategists Sophie Huynh and Charles de Boissezon calculate that nearly half of the U.S. benchmark’s current level is due to quantitative easing, while claiming that the impact of QE on the Nasdaq was even higher at 57%, with small cap less affected.

First, some background.

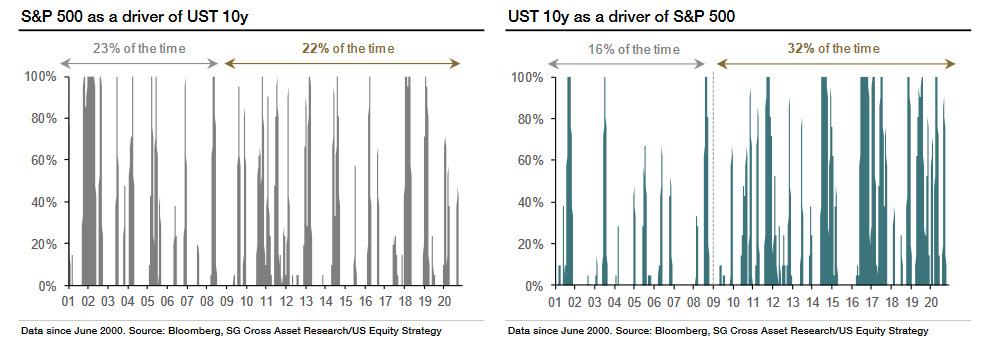

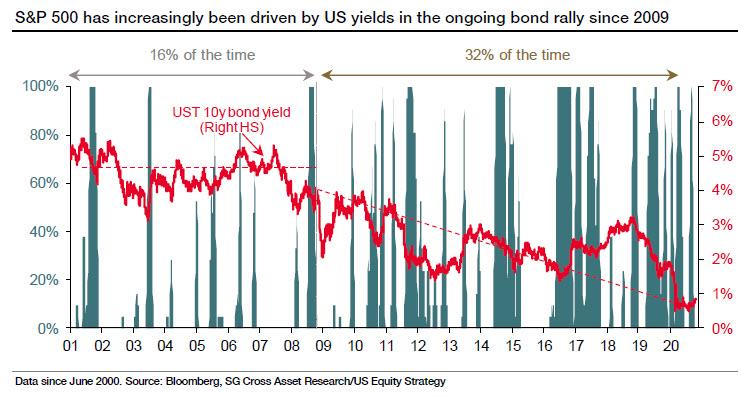

As part of their analysis, the socgen strategists find that the acceleration of the secular trend for bond yields since 2009 has triggered a shift in the causality between equity and bonds.

Specifically, before QE, US equities were more often the driver of US bonds, as investors would add either more or fewer bonds to their portfolios in response to the risk-on/off signals provided by the equity complex. However, this causality has totally changed since QE: US equities have been increasingly driven by US bond yields.

With that in mind, we move on the core of the analysis, namely what is the impact of QE on different equity indices.

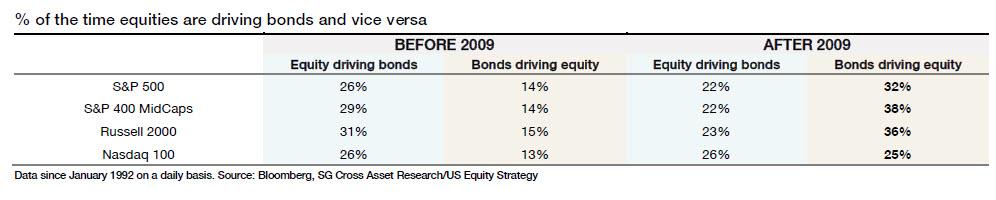

SocGen find that for all US equity indices – from large, mid and small caps to the more tech-focused Nasdaq 100 – the US bond yield has played an increasing role in equity returns. Since 2009 until today, bonds have driven the S&P 500 32% of the time (on daily data), S&P 400 Midcaps 38% of the time, the Russell 2000 36% of the time and the Nasdaq 100 25% of the time. “All in all, the causality relationship of bonds driving equities was approximately two times more frequent than in the pre-2009 period”, according to SocGen.

While frequency is one aspect which gives perspective on how the low interest rate environment pushed investors into the equity complex by default, given the more attractive combined yield – dividend and buyback yield – to US government bonds ever-declining coupons, what about the scale of the impact? SocGen tries to quantify the impact of QE on the different US equity indices through the discount rate.

To do that, the bank uses its proprietary Equity Risk Premium framework, applying a dividend discount model to the equity market, and considering the whole market as a company paying a dividend each year. Therefore, the present value of the equity market (as reflected by the index price) is equal to the discounted value of future dividend flows. The first step would be to quantify the impact of QE on the UST 10y bond yield – which we use as the risk-free rate in our framework.

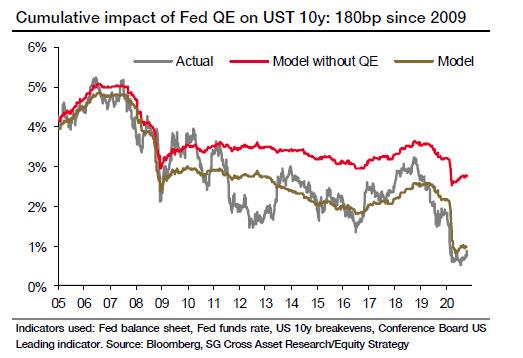

1. Quantifying the impact of QE on UST 10y bond yield

SocGen uses a simple regression to estimate the impact of QE. Since 2009, the cumulative impact of the different waves of QE on UST 10y bond yield was approximately 180bp. In other words, without QE, 10Y Yields would have been around 2.8%, a number which many would claim is unthinkable in the current environment.

2. Quantifying the impact of QE on the different US equity indices

Using the bank’s equity risk premium framework and work on the impact of QE on UST 10y allows it to understand how the different US equity indices have been impacted since 2009: there is a huge dispersion among the equity indices under review: the Nasdaq 100 has been the most impacted – and even more so this year – versus the S&P 600 Small Caps, which has been the least impacted. As of Oct-2020, the Nasdaq 100 price level was 57% explained by QE.

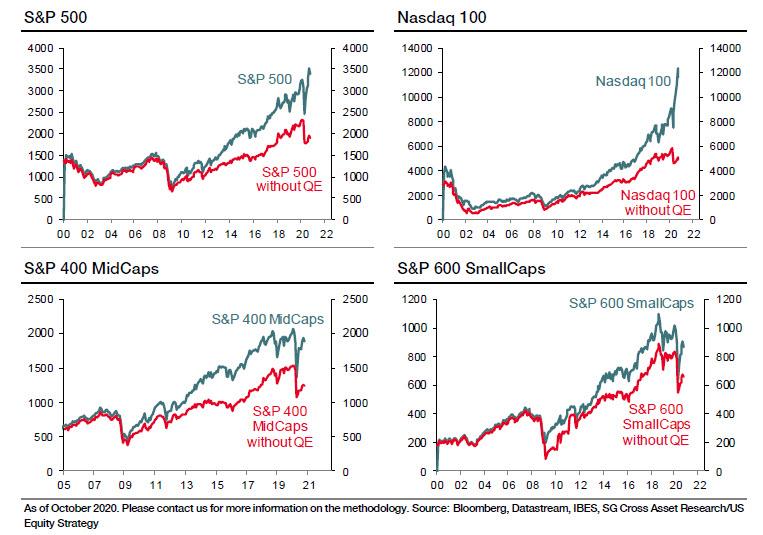

Here are the stunning findings: without QE the Nasdaq 100 should be closer to 5,000 than 11,000, while the S&P 500 should be closer to 1,800 rather than 3,300.

Clearly, large caps have benefited the most from the ever-lower interest rate environment resulting from QE. The sensitivity to bond yield can also be explained by the low payout and higher price-to-book ratios of Nasdaq 100 companies versus peers. Growth companies are overall less focused on dividends, but rather more on share buybacks as a way of neutralizing the impact of restricted share units. Small and mid caps, on a relative basis, given their higher payout and lower price-to-book value ratios, are less sensitive to swings in bond yields.

* * *

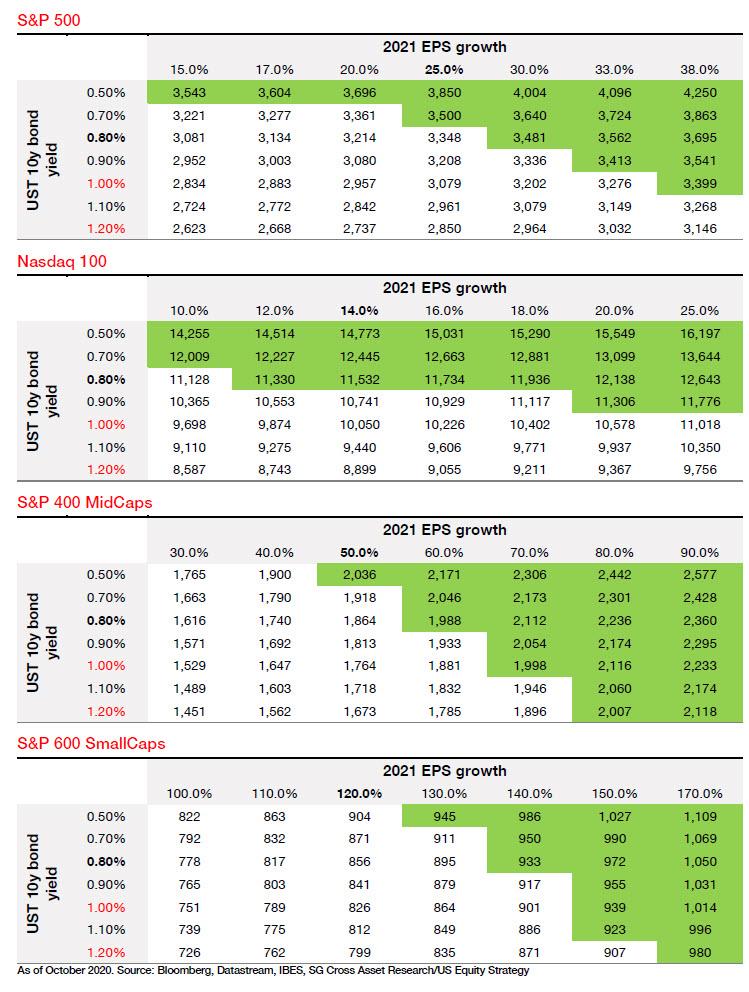

Having quantified the past, SocGen next looks at the future, and says that it expects 10-year Treasury yield to reach 1% by year-end and 1.2% by mid-2021 on less Fed intervention, increasing the need for earnings to deliver to justify valuations. For S&P 500 to “weather” a 10-year yield of 1%, expected EPS growth in 2021 would need to be at least 38% vs current expectation of 24%; more ominously, for the Nasdaq 100, a doubling of the 2021 EPS growth would not be sufficient to absorb a UST 10y yield of 1%. In the case of mid and small caps, it would be considerably less. Needless to say, this suggests that if yields do indeed rise even modestly, there will be lots of pain for growth/tech/momentum names.

In conclusion, SocGen warns that the focus on the feedback loop between equities and bonds has already started in the US:

With the UST 10y breaching the 50-80bp range in October and with the US election newsflow, the underperformance of Nasdaq 100 has been quite noticeable.

Meanwhile, the rotation into cyclical sectors, which have lagged the more defensive and growth sectors since the start of the bear market rally combined with a preference for value versus growth, were a reflection of the bond sell-off. The undecided outcome of the US election has triggered an unwinding of these positions for now.

Going forward, SocGen believes that currently causality order will hold and US Treasuries should continue to drive US equities, which is bad news for those who believe a continued rise in yields will not impact stocks: according to SocGen the impact will be very pronounced unless companies succeed in boosting their EPS well beyond current consensus estimates.

This is why, as SocGen ominously warns, “there will be a breaking point where a bond sell-off will impact the highly leveraged corporates which typically benefit from a higher yield environment as being of a shorter duration.” All in all, the bank’s suggestion is to go long S&P 400 MidCaps versus the Nasdaq 100 “as this could offer good leverage on the higher US yield environment, while taking into account the leverage dimension.”

Finally, and aside from SocGen’s analysis which may be off by a few percentage points but is directionally accurate, the fact that Fed, through, QE now holds trillions in equity value hostage is also who Powell and his successors will never again dare to tighten financial conditions as the resulting asset price crash would have catastrophic consequences for both capital markets and US household net worth, which is roughly 70% in the form of stocks, bonds, financial assets, and other non-tangibles.

via ZeroHedge News https://ift.tt/32keh1n Tyler Durden