In Painful Flip-Flop Deutsche Says It “Was Wrong To Close Dollar Short”, Reinstates It… As Dollar Surges

Tyler Durden

Mon, 11/09/2020 – 17:40

Last Wednesday, as the market gyrated in response to what appeared to be the collapse of “Blue Wave” expectations, Deutsche Bank jumped the gun when its chief FX strategist George Saravelos rushed to close out his dollar short position, saying that “with the US election outcome extremely uncertain” he changed his USD view and turning neutral as he “no longer sees a compelling narrative of dollar weakness into year-end for three reasons.”

-

First, whoever wins the White House, the odds of a structural shift towards easier fiscal policy in the US have dramatically declined. Should the Democrats lose the Senate (the risk of this now appears high) and unified government becomes impossible, this would make agreement on sizeable fiscal expansion more difficult. Wider twin deficits and reflationary steepening in the US yield curve was an important driver behind our negative dollar view and this has been put on hold.

-

Second, the risks of a protracted contested election outcome appear significant. The market is likely to be most concerned by genuine uncertainty on the vote margin rather than political uncertainty relating to a refusal to concede. At the time of writing, the margins on numerous key states are very narrow (Georgia, Nevada, Wisconsin) or uncertain (Pennsylvania, Michigan), leading to a risk of protracted recount and litigation battles. This could last well into December.

-

Third, and beyond the election, the COVID winter wave has proven quicker and bigger than we thought. Europe is already on “soft” lockdown and the US numbers are likely to get worse.

Ironically, and as we pointed out last week, shortly after DB reversed its position, the dollar reversed its brief jump and collapsed, suffering its biggest decline since August.

One day after Deutsche Bank closes its USD short, dollar has worst day since August

— zerohedge (@zerohedge) November 5, 2020

The US currency then continued to slide and dropped every single day since DB closed out its dollar short…

… bringing us to today, when in yet another delightful moment of Wall Street revisionism on par with that from JPMorgan, the Deutsche strategist flip-flopped on his last week all, writing “we were wrong to close our dollar short. We reinstate it.“

Here is why according to George, everything he said less than a week ago is dead wrong and in fact the opposite case is now in play:

For the last three months we have been arguing that a Biden election victory would be the single most important negative event for the dollar this year. We closed our bearish dollar view on Wednesday as it looked like the US election was going to be contested. We were wrong: Biden has emerged as the clear President-elect this weekend and the market is sending a strong message of looking through any remaining uncertainty. We were therefore wrong to close out our dollar short and we reinstate it. We believe the broad trade-weighted dollar has the potential to drop by another 3-5% into the end of the year with EUR/USD convincingly breaking 1.20, USD/JPY reaching 100 and USD/CNH 6.40, as highlighted by our Asia colleagues on Friday. It all boils down to three drivers:

-

The unwind of the Trump dollar risk premium. we have demonstrated the strong positive correlation between measures of global uncertainty and the dollar.

The two biggest drivers of this uncertainty have been President Trump’s foreign policy as well as the Coronavirus. A shift to a more multilateral approach under Biden and a probable end of diplomacy by Tweet is going to be an important structural shift for the market in coming months that will take time to price in. Additionally, any vaccine announcement that reduces the market’s perception of the Coronavirus “tail” is likely to further reduce uncertainty. In all, an unwind of global uncertainty to pre-2016 levels would be associated with another 5-10% drop in the dollar.

-

The return of carry and the dollar as a funder: a Blue Wave was the most dollar negative outcome in the scenario analysis we published last week: more fiscal spending under unified government and widening twin deficits would have been important structural headwinds for the dollar. Yet the flipside of (a likely) divided government is that the market no longer has to worry about higher US yields. We have long emphasized how extremely underweight the market is in EM FX, especially the high-yielders. As we argued last week, we are moving back into a “secular stagnation” regime of low growth, low inflation and low yields – with no trade wars and no Fed hikes like 2018-19. There is plenty of potential for the market to build dollar shorts and use the greenback as a funder.

-

More virus divergence ahead of us: We noted a couple of weeks ago that what matters more for Europe is not the lockdowns but the second virus wave being brought under control. The virus case numbers are already peaking in the Netherlands and Spain, decelerating in Germany and there is evidence that the French positivity rate is peaking. North Asia continues to stand out for its superior virus and growth outcomes. In contrast, we not only worry the US virus numbers will get worse, but given the reluctance to impose more serious control measures in earlier waves it may take longer than Europe. This would be reminiscent of the first “virus divergence” episode of early summer.

Summing up DB’s latest position: “the removal of global uncertainty, a shift to dollar funding, and virus divergence against the US all favor a weaker dollar into the end of the year. China is emerging as the clear antipole of global growth and yield outperformance with CNH serving as an important anchor for broader dollar weakness. Our official forecasts already incorporate expectations of a weaker dollar into year-end so remain intact in line with the targets above.”

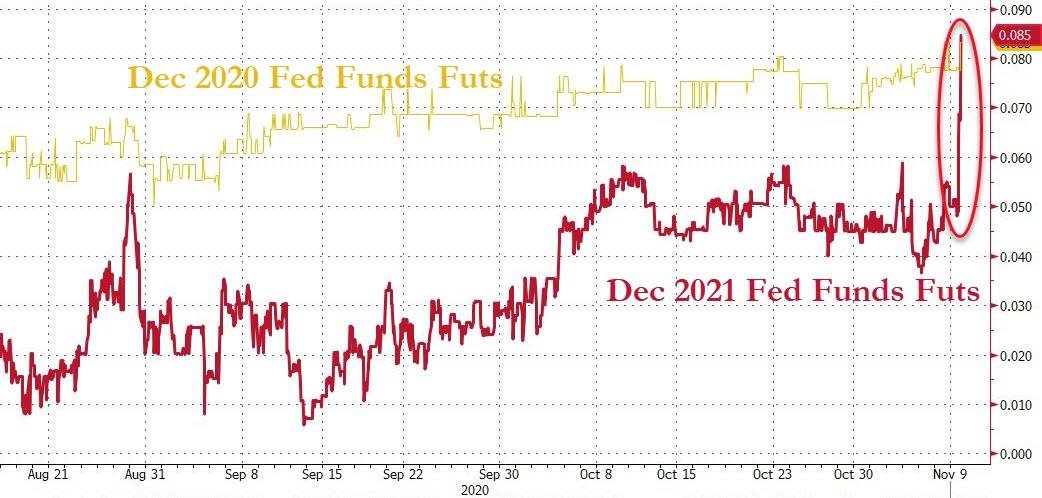

There was just one problem: having published this note overnight, it failed to account the latest market-moving Pfizer news which have sent Treasury yields surging, and bringing rate hike odds much closer to the present, as we noted earlier.

As a result, the market is starting to look through the entire deflationary phase of the next 2-3 years which had been fully priced in by now, and is instead starting to price in what may be Fed rate hikes as soon as 2023, or even 2022 (if note sooner) which – drumroll – has sent the dollar sharply higher!

One truly really couldn’t make this up, and for the sake of DB’s Saravelos, we can only hope that the spike in the dollar fades, or else the FX strategist will have no choice but to tell his whiplashed clients that he was wrong about being wrong about closing his dollar short.

via ZeroHedge News https://ift.tt/3n8NJbz Tyler Durden