Carnival Announces $1.5Bn Offering One Day After Biggest Stock Jump On Record

Tyler Durden

Tue, 11/10/2020 – 09:36

Easy come, easy go to market.

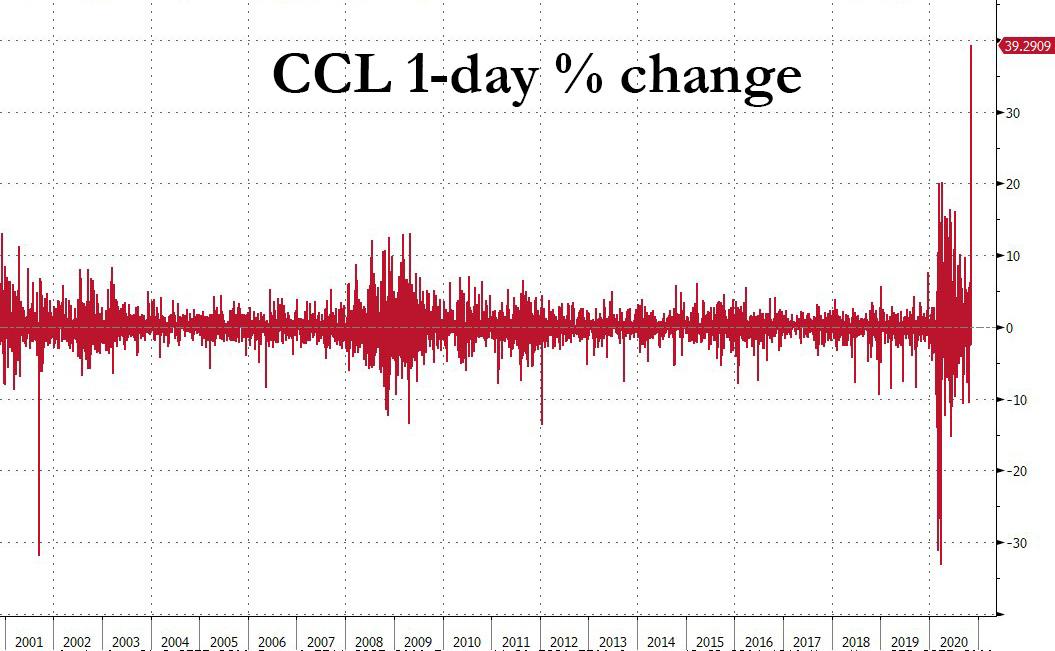

One day after Carnival stock soared by the most on record, jumping over 39% following the Pfizer vaccine news which gave its shareholders hope that cruises just may return one day…

… the company has rushed to lock in the gains and raise some much needed liquidity by announcing a new $1.5 billion “at the market” stock offering, similar to the one recently completed by Tesla and attempted by Hertz. The news sent the stock sharply lower after rising as high as $21.1 pre-market.

From the press release:

Carnival Corporation & plc (NYSE/LSE: CCL; NYSE: CUK) announce that following the completion on October 30, 2020 of the sale of 67.1million shares of Carnival Corporation common stock under its previous $1 billion “at-the-market” equity offering program, Carnival Corporation has filed a prospectus supplement with the U.S. Securities and Exchange Commission (the “Commission”). Under the prospectus supplement, Carnival Corporation may offer and sell shares of its common stock, through any of its Sales Agents (the “Shares”), having an aggregate offering price of up to $1.5 billion from time to time through an “at-the-market” equity offering program (the “New ATM Offering”). Carnival Corporation expects to use the net proceeds from sales of Shares under the New ATM Offering for general corporate purposes. The timing of any sales will depend on a variety of factors. J.P. Morgan Securities LLC and Goldman Sachs & Co. LLC (the “Sales Agents”) are acting as sales agents under the New ATM Offering. PJT Partners is serving as independent financial advisor to Carnival Corporation.

The New ATM Offering was registered under the U.S. Securities Act of 1933, as amended, pursuant to a registration statement on Form S-3 (File Nos. 333-322555 and 333-332555-01) (the “Registration Statement”) filed by Carnival Corporation and Carnival plc with the Commission on March 9, 2018. The terms of the New ATM Offering are described in the prospectus dated March 9, 2018, as supplemented by the prospectus supplement dated November 10, 2020.

In connection with the New ATM Offering, on November 10, 2020, Carnival Corporation and Carnival plc entered into an equity distribution agreement (the “Equity Distribution Agreement”) with the Sales Agents. The Equity Distribution Agreement contains customary representations, covenants and indemnification provisions. A copy of the Equity Distribution Agreement is as Exhibit 1.1 to the Current Report on Form 8-K filed by Carnival Corporation and Carnival with the Commission on November 10, 2020, and the descriptions of the material terms of the Equity Distribution Agreement therein are qualified in their entirety by reference to such Exhibit, which is incorporated by reference into this Current Report on Form 8-K and the Registration Statement.

We expect many more “deep value” stocks which were hammered by covid and whose stocks jumped in the aftermath of the pfizer news will do the same and rush to come to market with similar at the market offerings, taking advantage of the still lingering market euphoria.

via ZeroHedge News https://ift.tt/3eISkOJ Tyler Durden