Is TINA Dead?

Tyler Durden

Tue, 11/10/2020 – 14:15

Day after day, with stocks at record-er and record-er highs (despite surging COVID cases, earnings implosions, and ‘blue-wave’ uncertainty), we are told by the smartest-people-in-the-room that you have to buy stocks because “there is no alternative.”

TINA has overtaken FOMO as the commission-rakers and asset-gatherers go to messaging to encourage clients to put their hard-earned savings into an increasingly zombified (and concentrated) stock market.

But… what if there was an alternative?

After yesterday’s chaotic market moves, it turns out that stocks are about as expensive relative to Treasuries as they have been in two years.

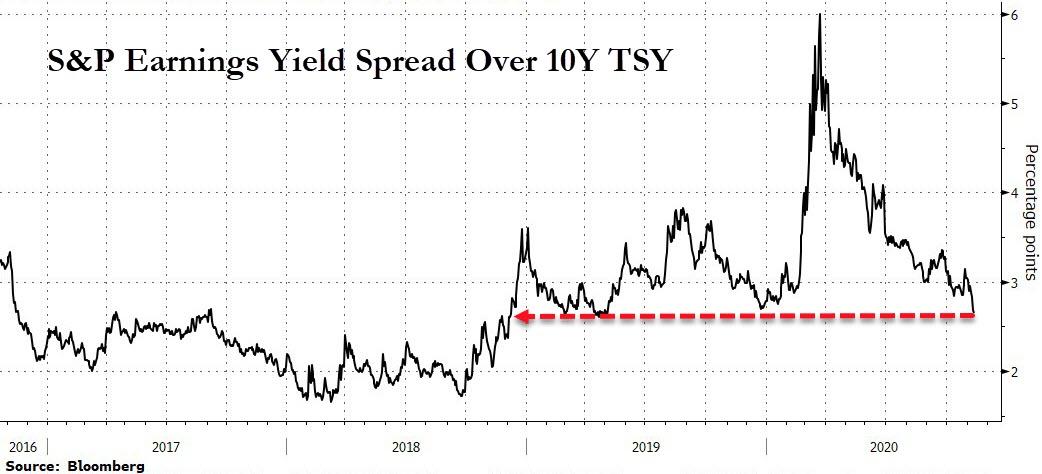

As Bloomberg’s David Wilson notes, comparing the S&P 500 Index’s earnings yield, the inverse of its price-earnings ratio, to the yield on 10-year Treasury notes shows as much…

The yield differential shrank by 16bps Monday to a two-year low of 2.68 points, according to data compiled by Bloomberg.

Higher share prices accounted for about a third of the narrowing, as the S&P 500 rose 1.2%. The rest came from losses in Treasuries, which lifted the 10-year yield by 0.11 point to 0.93%.

So, is TINA dead? Certainly, The Fed will need to do something soon if rates keep rising, and given the massive record short positioning in bonds, that yield collapse could come very fast… and besides, owning bonds this year has been a much better bet than owning big blue-chip stocks…

But buying bonds just isn’t sexy to discuss at your next (Zoom) cocktail party…

via ZeroHedge News https://ift.tt/3ljnRJw Tyler Durden