Record 10Y Auction Prices At 9 Month High Yield Amid Sharp Drop In Foreign Demand

Tyler Durden

Tue, 11/10/2020 – 13:16

While stocks long ago surpassed their pre-covid February 2020 record highs, Treasury yields stubbornly refused to follow risk assets higher amid widespread concerns that a lingering covid pandemic would lead to more economic weakness in the future (read deflation). All of that changed today, when the 10Y refunding auction just priced at the highest yield since before the covid pandemic.

Today’s sale of $41 billion in 10Y paper, which incidentally was another record-sized auction, and double the average auction size in the period 2010-2018…

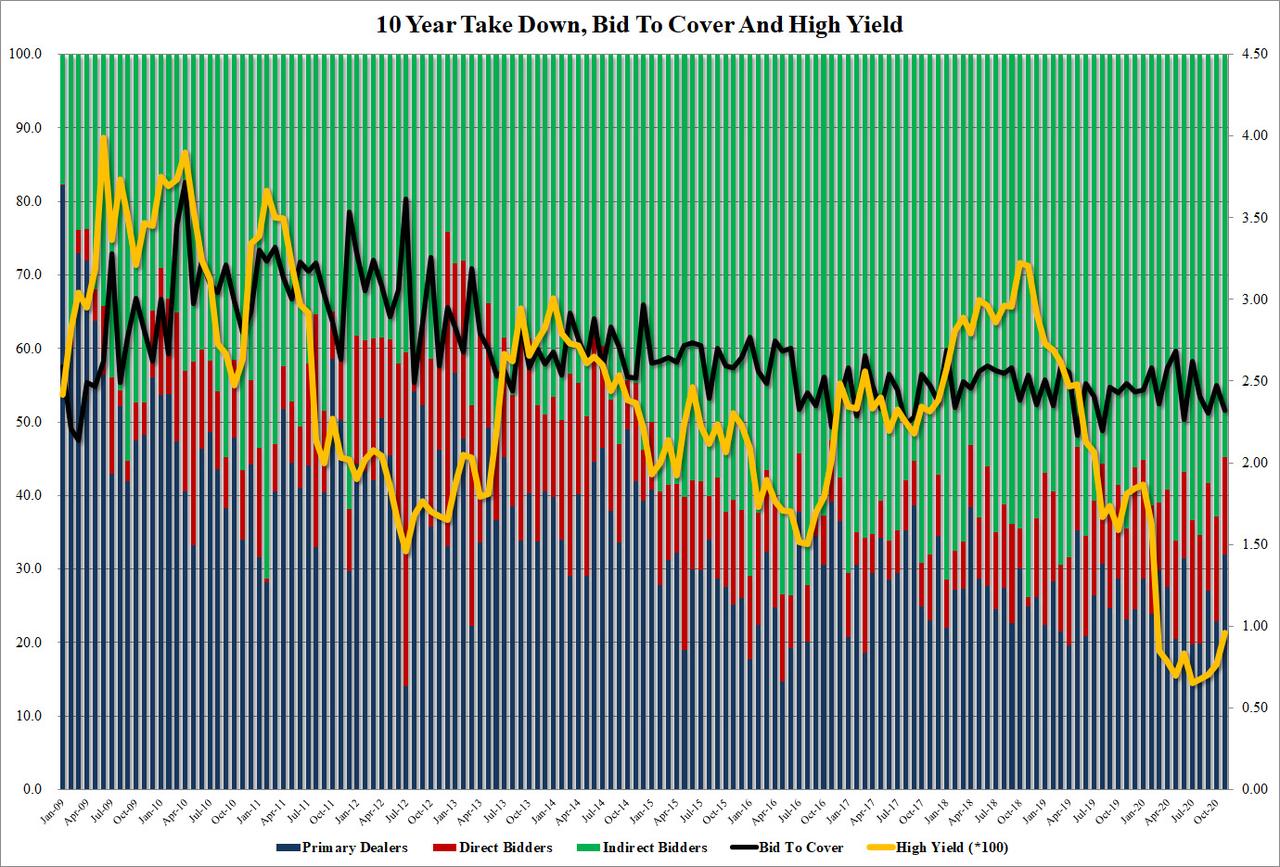

… priced at a high yield of 0.96%, which while stopping through the When Issued 0.962% by 0.2bps, was far above last month’s 0.765% and was also the highest yield since the March 11 auction which priced at just 0.849% in a time when markets were in turmoil following the arrival of the covid pandemic on US soil.

The other metrics were no prettier: the Bid to Cover dropped from 2.47 to just 2.32, well below the 2.46 six-auction average and only the second lower BTC since June.

The internals were also hardly pretty: while not nearly as dismal as yesterday’s 3Y auction where the foreign demand absolutely collapsed, the 10Y Indirect Bid slumped again, sliding from 62.9% last month to just 54.8%, the lowest since May 2019.

And with Directs taking down 13.1%, in line with recent auctions, the Dealer bid jumped to 32.0%, the highest since May 2019 as US banks had no choice but to step in and take the place of foreign buyers who were strangely missing (but don’t worry, Dealers will quickly flip back their holdings to the Fed).

Overall, a decidedly subpar auction despite the rising yield, but judging by yesterday’s even uglier 3Y, it could have been far worse.

via ZeroHedge News https://ift.tt/35fgRI4 Tyler Durden