Will The Blockchain Economy Run On Bitcoin, Ethereum, Or Central Bank Digital Currency?

Tyler Durden

Tue, 11/10/2020 – 22:05

Welcome to the new world. The symptoms have shifted. What we see prioritized now is different. We welcome the return of respect for expertise, the love of rigor and curiosity, and a pursuit of dignified equity. A lot of calories have gone into this transformation. Our mental map of the territory is remade. Let’s mark things to market so that we are able to walk forward again.

Yet, underneath it all is still the human swirl of chaos, organized only briefly into flashes of coherence and structure. The virus gorges on the social animal. The sovereign beasts continue to threaten each other with geopolitical, economic, and technological dominance. Markets still reflect financial constructions and schemes decoupled from the experience of the average person. High tech firms continue to build into software their addictive digital nation states. The vectors of change for software and money remain deeply anchored to the fractal of blockchain.

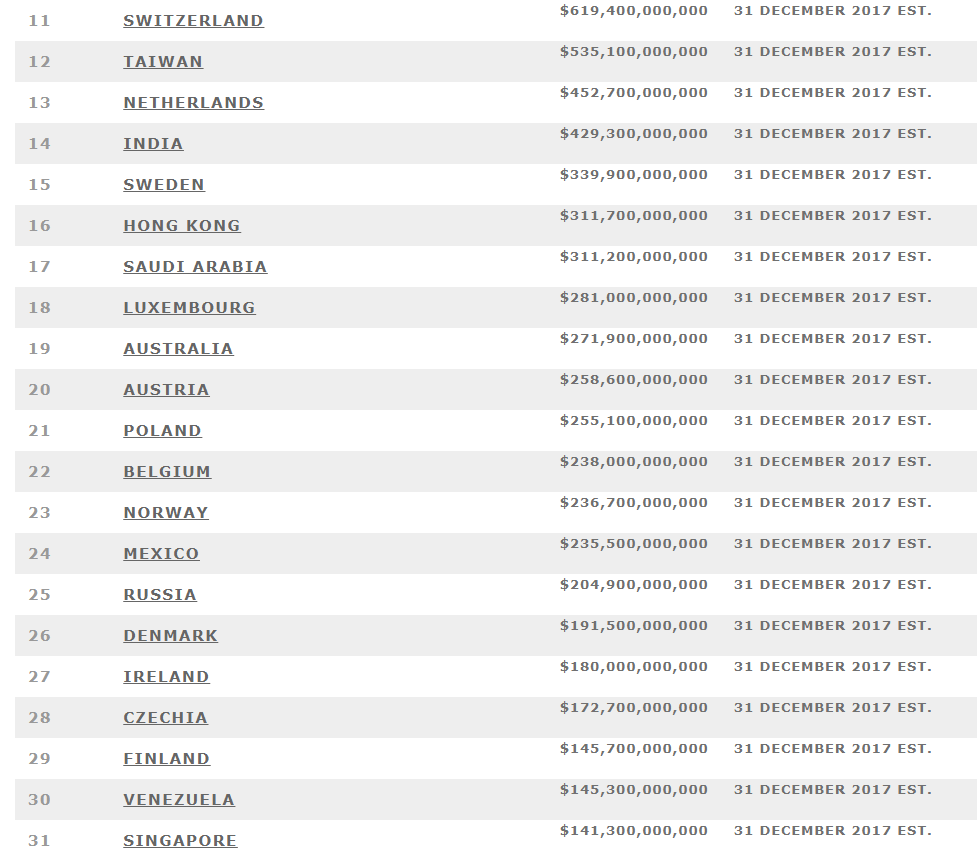

The election’s end – and perhaps its reminder of the fragility of political governance – has reinforced the value of Bitcoin. When the old world wobbles, the new one seems more safe by comparison. The price of the cryptocurrency rose to over $15,000, breaking again the $250 billion market capitalization barrier. You can compare that $250 billion to the M1 money supply of a number of countries (link here) — Poland, Belgium, or Austria.

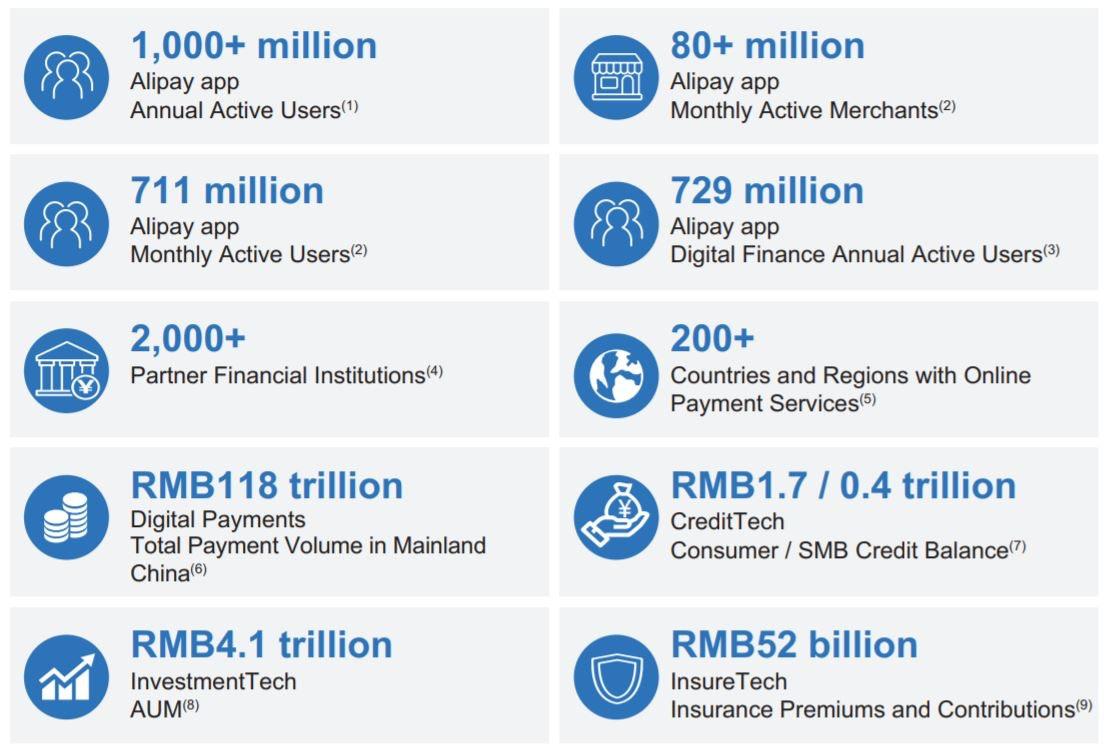

Perhaps this was also driven by the much discussed move from PayPal, the payment processor, to finally incorporate Bitcoin into its currency options. PayPal connects to something like 25 million merchants and 350 million users. Reminder that Ant Financial has 80 million merchants and 1.3 billion users — more on that later. We think the PayPal news is interesting and promising, but still in early stages. Allowing the purchase and sale of a commodity using a third party trust company (Paxos) is quite different from using a currency for economic activity. But we are getting there.

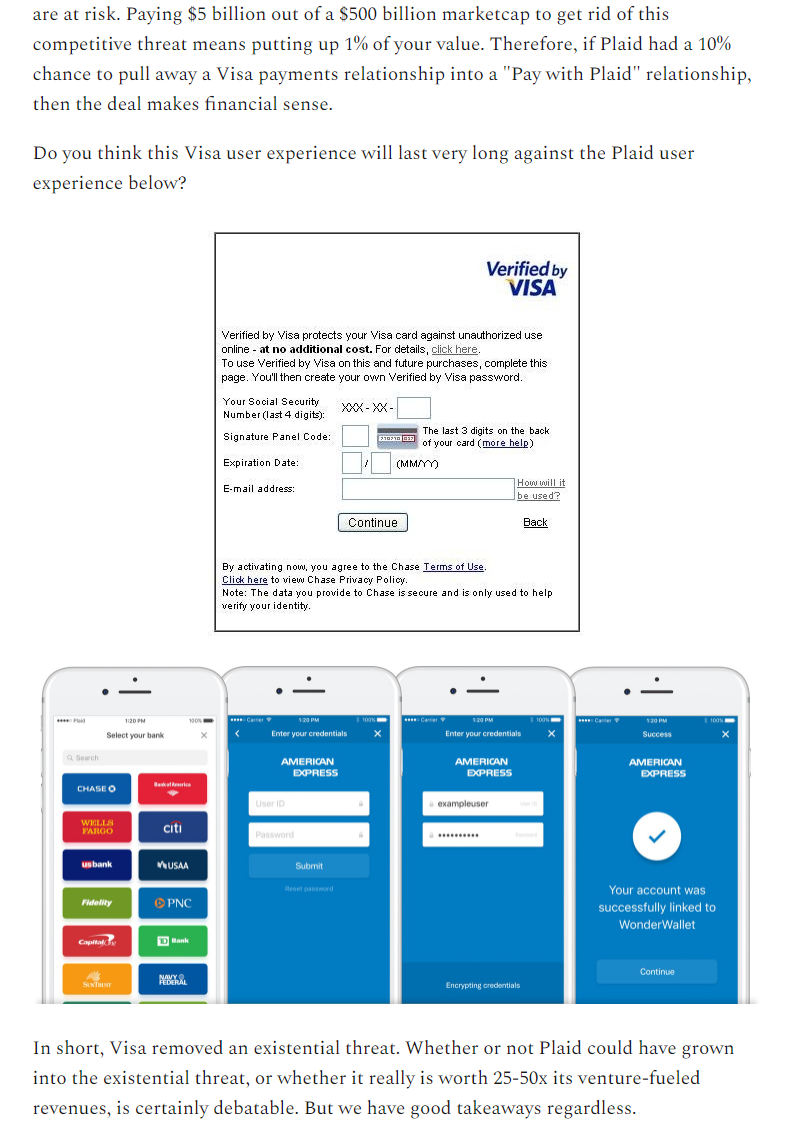

For comparison, Visa today sits at about $420 billion in market capitalization, representing the discounted cash flows of owning a payment network. Its deal with Plaid, the data aggregation company, is on the rocks as the US Department of Justice files an anti-trust lawsuit to prevent the acquisition. Our prior write-up on the deal (link here) agreed with the logic of monopoly as it relates to Visa taking out a black-swan competitor. But we find the concept of blocking this deal on those grounds fairly absurd. A $100 million revenue data aggregation company is many steps away from offering a global payments network.

Let’s think about industry structure for a moment. The card network provides the payments infrastructure in the sense that it allows for money to move around on its network of nodes. Those nodes are financial or economic in nature, and speak in the language of money — banks, card issuers, e-commerce sites, point of sale terminals, regulators, and so on. You can send a little bit of messaging around, but primarily you are sending a financial instrument. And you don’t ask questions about the financial instrument. It simply is sovereign fiat. Value accrues to the network shareholder due to the small rent you take across all transactions.

Therefore, your incentive as Visa is to maximize the organizational share of all transactions by broadening the network across the world and into every technological sphere. Through scale, your network gets better for participants. You start saying “network of networks” and paying $5B for start-ups. A naturally occurring monopoly, like Facebook and Google.

PayPal is one layer higher up the stack. It is the check-out experience for a meaningful portion of the Internet. Square is the check-out experience for a meaningful portion of terrestrial small business. And so on. You can talk about payment processing and payment gateways and points of sale until everyone is confused. What’s nice about PayPal, and Stripe, and Square and generally that footprint of modern payments companies, is that they are software-native and have APIs and UIs. They integrate into things, and are part of the modern world. Most still ride the Visa or Marstercard “rails” and all prioritize the financial instrument of sovereign money. Their value accrues from aggregating the consumer or merchant footprint, and giving economic activity a way to flow in novel patterns.

So what comes next, and how does it relate to the above?

Central Bank Digital Currencies

ConsenSys has been on a tear recently announcing 4 different CBDC projects on Ethereum infrastructure. Let’s briefly highlight those:

-

Bank of Thailand to use enterprise Ethereum for retail CBDC prototype with ConsenSys

-

Australia’s central bank announces CBDC project with ConsenSys

-

ConsenSys wins Hong Kong central bank digital currency project

The discussion of CBDCs is often a stark reaction to the development of Facebook’s Libra private stablecoin / USD network, and the Chinese deployment and expansion of their national digital currency. The discussion often splits into (1) wholesale CBDCs, which largely reinforce and optimize the role of banking institutions relative to the central bank’s money management authority, (2) retail CBDCs, which would bypass the banks and go directly into the wallets of consumers. The first option is about efficiency and industry cost mutualization. The second is more deeply transformative, and analogizes more closely to owning Bitcoin and using it to transact.

In many of the projects above, there is a combination of a financial institution, a technology consulting firm, and a blockchain company coming together. ConsenSys brings forward enterprise Ethereum, which is a variant of the open source programmable blockchain optimized for a permissioned deployment with large transaction throughput. Unlike public Ethereum, which just launched the first phase of its scalability upgrade (Eth2), private permissioned networks scale more easily because you do not start with an open adversarial environment. Other examples of such enterprise networks would be IBM and Hyperledger Fabric, or R3 and its Corda technology, as the chassis for digital value transfer and settlement.

How should we contextualize Ethereum-based CBDCs relative to Bitcoin, Visa, and PayPal?

First, there is the actual network itself. Much of the current thinking is about the software protocol as the ledger. Where does the information actually live? Who hosts it? Who processes it? In the previous world, data centers and servers run by some firm (e.g., Visa or a cloud-provider like Google / AWS) hold a copy of the information and run software which performs computation about the transactions. In the current world, the blockchain is itself a set of some large number of duplicates of the data set, held by each of the network participants. In the case of programmable blockchains, those network participants are also each executing software programs, which are then synced across the entire system.

Making sure this network functions and reflects the requirements of a central bank, or other constituents, is a key part of standing up a CBDC. This is, we think, what most industry participants are really thinking about. But it is missing a large part of the story.

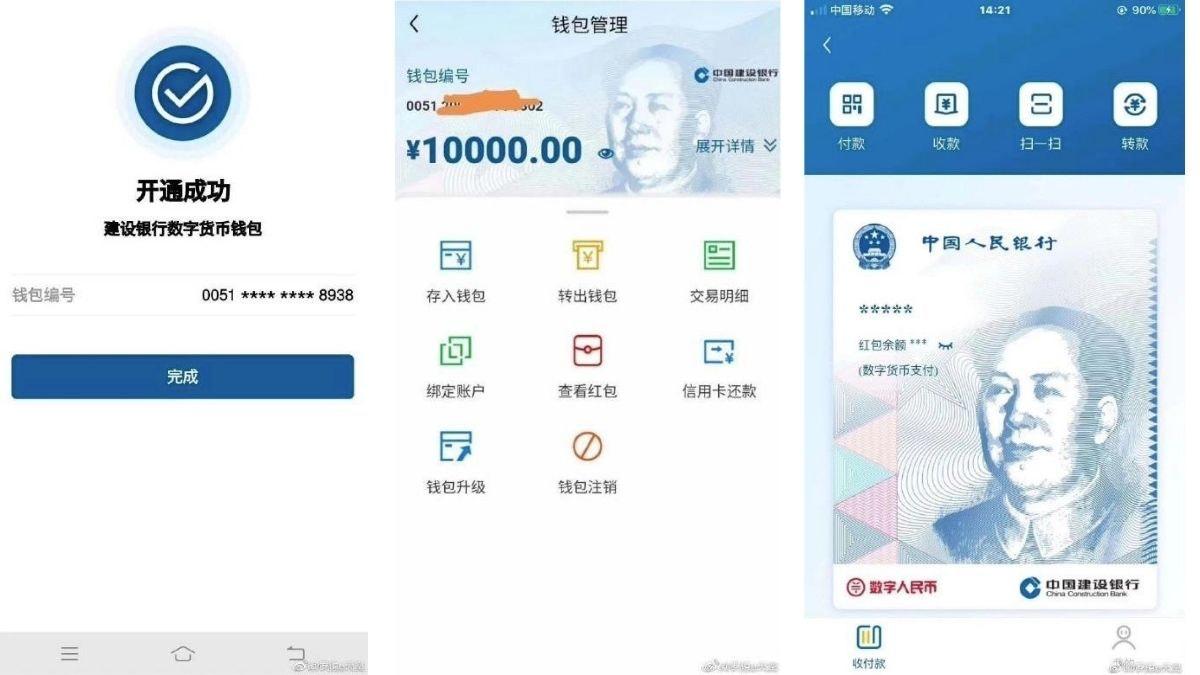

Take China. Its digital yuan has over 20 companies involved in development and launch, with a preferred spot given to the state-run banks (a detailed overview here). The state has been giving out free money to citizens in the form of the new currency to prove the viability of the concept. Yes, there can be discussion about the software architecture, centralization, and trying to combat the dollar. But the part that stood out most to us is a defensive posture towards WeChat and Alipay.

The digital yuan is the money — when it sits in a wallet on the phone, it is *merely* a financial instrument. When you transfer it around between participants, you are reconciling financial data with the data hosted by the central government. Financial institutions hold accounts at central banks and do this all the time, already. Don’t get us wrong, it is certainly disruptive. You could build taxation directly into consumer transaction flows, or implement universal basic income, or deliver Covid-related distributions with ease.

Still, it is an instrument.

The Smart Money Economy

Let’s come back to Ant Financial. The world’s largest IPO of $34 billion was 870x oversubscribed. Ant is a fantastic story of innovation, global technology and payments progress, and the digital growth of Chinese small business. And yet, the Chinese authorities shut it down and are forcing the company to return money to investors.

Quite the surprise! Perhaps it was Jack Ma, the country’s wealthiest private business man ($50+ billion net work), not sufficiently following the party line about regulation.

Or, perhaps, as the country tries to launch a national digital money, one must flex against the largest digital storefront in which that money must be used. As a reminder, Ant opened up its platform to many third parties across the banking, wealth management, and insurance industries in order to position itself as an impartial distributor (while taking distribution fees). An example of this open approach would be Western asset manager Vanguard coming in to offer its roboadvisor to the Ant audience. If the Chinese government is trying to close down competition related to its digital yuan, removing stablecoins and other cash equivalents in order to scale out its national solution, having Tencent and Ant under clear instruction becomes paramount.

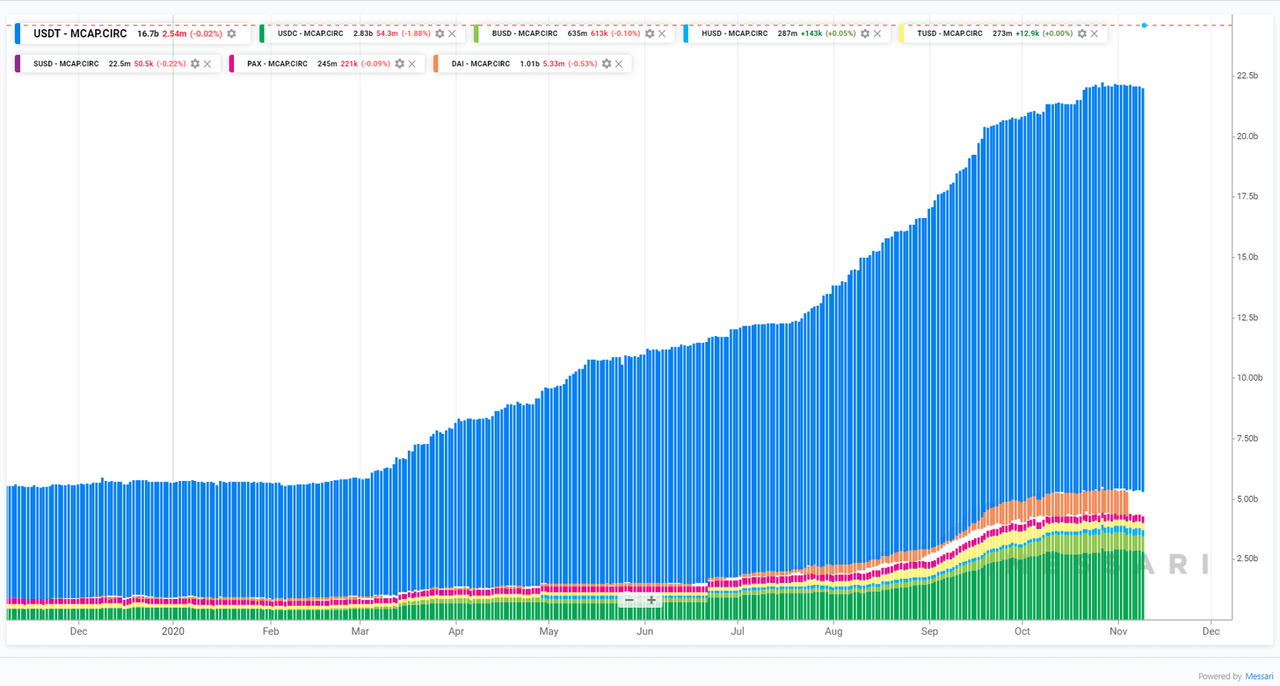

This brings us back to Ethereum. Public Ethereum already has a money on it — it is the digital dollar. And there is now $22 billion of it on the Ethereum chain.

What is interesting about money supply is not the money, but what you can do with it. Bringing back the discussion of the card networks and payment processors, we find that a programmable chain is able to incorporate into its software stack the gateways and business logic that used to sit outside of the network. Instead of adding PayPal on top of Visa, you can run all the software you need onchain — assuming scaling works out of course. This is why the “layer 2” developments for Ethereum, whether as part of Ethereum or adjacent to it, merit continued research and watch.

Further, the applications with which the money would interact eventually live on the network as well. Today, that primarily points to decentralized finance, crypto art, and various virtual worlds. Over time and with deeper maturity, more commerce can become incorporated into the digital network itself.

Remember that this happened to the Internet on a 20 year time horizon. The trillion dollar valuations supported by emergent business models — the operating system of the iPhone (30% on all commerce) and the shopping footprint of Amazon (the digital value chain) — give us the necessary patience and proof. Neither commercial path was yet available when people were trying to figure out the protocols to stitch together the Web. And who could have imagined that proprietary media production, like the Amazon exclusive “The Boys”, would be the axis for competition that locks users into a subscription for the walled gardens. You couldn’t even stream an MP3!

What is a CBDC really?

Ant Financial succeeded by aggregating 80 million merchants on a payment rail with an operating system. PayPal succeeded by pulling together 25 million merchants across the Web. Apple succeeded by keeping a share of economic transactions across the mobile applications that it powered. What matters is not just the money, but what people do with it. And what they do with it is creativity, and the free exchange of goods and services.

The CBDC projects today ask the question of how to move money around. Bitcoin has answered this question, and perhaps an applied architecture like permissioned Ethereum will solve this for national currencies.

The deeper question is — what does an economy connected to a CBDC look like? What is the shape of merchants and applications that accept digital currency? Where do they perform their economic functions? If we think the venue for computing will increasingly be on blockchains, that suggests that CBDC rails should come not just with pre-installed national money, but also pre-installed applications for the use of that money. A payment rail will only be adopted if it is useful, and if it is applicable to a meaningful portion of human economic activity.

Would you rather store value, or create it?

via ZeroHedge News https://ift.tt/35jB13O Tyler Durden