Kodak Executives Received Millions In Stock For Options They Never Owned

Tyler Durden

Thu, 11/12/2020 – 14:21

Today in “new and creative ways to potentially increase your executive compensation” news…

Kodak took a $5.1 million expense in the third quarter related to handing five of its former executives stock for options they never owned to begin with.

The issue has “raised questions about the company’s controls,” Financials Times said this week, putting it lightly. The company has blamed internal “deficiencies” that allowed five former officers to exercise 300,000 options that had previously been forfeited.

The company also warned that additional errors of a similar nature that have yet to be uncovered could result in additional “inappropriate expenses”. Kodak also said it is planning to try and claw back $3.9 million from the executives for the fair value of the shares, though it also said it wasn’t sure it would succeed in doing so.

The company’s CFO, David Bullwinkle, said on Tuesday the company’s “controls were inadequate with regard to the timely input and verification of master data updates for equity grants and therefore, resulted in errors or misstatements in employee equity account balances”.

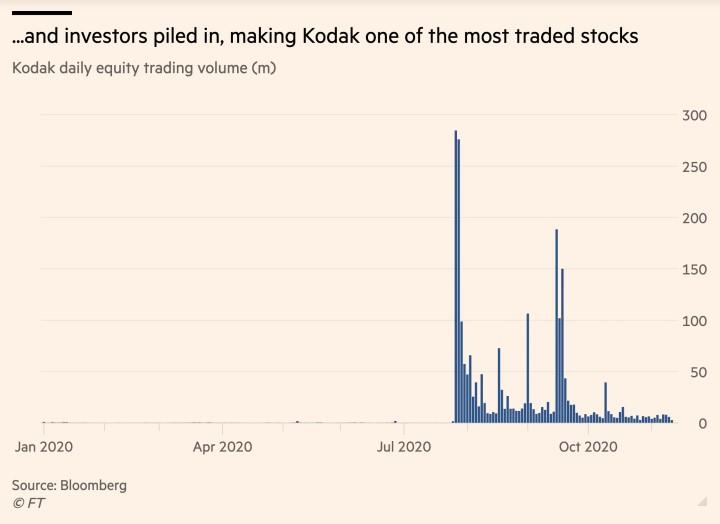

He failed to offer clarity on when the options had been exercised, which seems like a very relevant question given that Kodak shares went from “completely off the radar” to “number one momentum stock in the market” after it announced on July 28 it was nearing a deal with the U.S. to help become a generic drug manufacturer.

As part of the deal, Kodak was to receive a $765 million loan from the U.S. government. Kodak stock soared, rising 15x after the announcement.

The plans of Kodak working with the government were later put on hold after the deal was questioned by a number of congressional Democrats, including Elizabeth Warren.

Akin Gump, who was retained by the company to review the company’s loan application with the the government, said though it found concerns about the company’s governance, it didn’t notice the company’s issuance of its non-existent options.

Meanwhile, the news comes as Kodak’s business continues to falter. The company’s net losses rose from $5 million to $445 million during the third quarter, while revenue fell by $63 million to $252 million. The company’s CEO said on its recent conference call he still had “tremendous confidence that we are on the right track to restoring Kodak to its rightful place as an iconic global brand”.

via ZeroHedge News https://ift.tt/3lrnVHc Tyler Durden