A Euphoric Morgan Stanley Lists “Three Features That Will Distinguish The Global Economy In 2021”

Tyler Durden

Sun, 11/15/2020 – 18:50

By Chetan Ahya, Morgan Stanley chief economist and global head of economics

Twice a year, the Morgan Stanley macro research team huddles in a time-honoured ritual – outlook season. We come together to debate and reassess our forecasts and narratives, challenging each other while collaborating to provide clients with a consistent and coherent view of the world.

In a few hours’ time, you will be receiving our 2021 outlooks in your inboxes. As a preview, here’s a summary of our views.

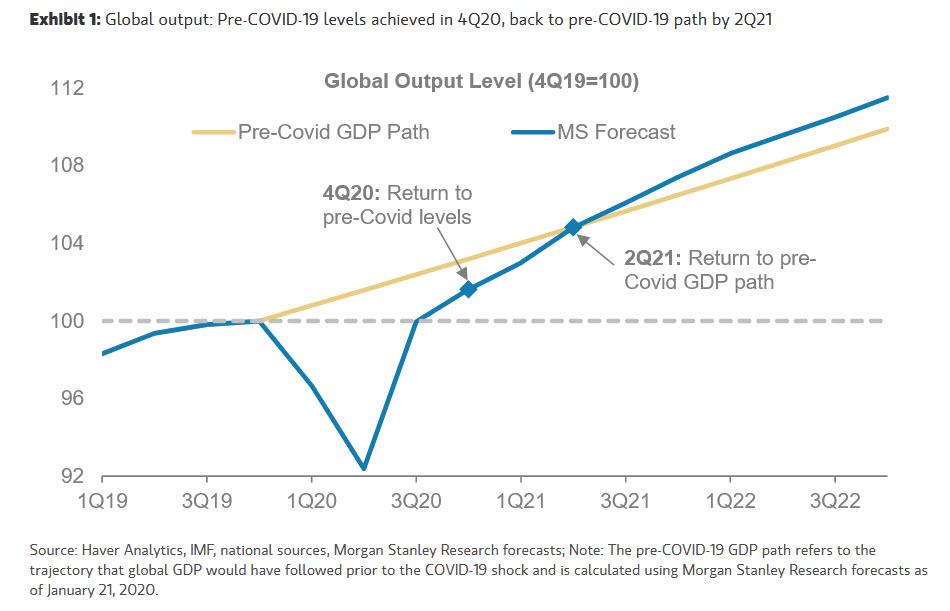

We remain constructive on the prospects for macro and markets in 2021. On the macro side, we think that the global economy will enter the next phase of the V-shaped recovery. In the first stage, the global economy has reached pre-COVID-19 output levels, a milestone we expect to pass this quarter. By 2Q21, we envision the economy getting back on its pre-COVID-19 path (i.e., where GDP would have been absent the COVID-19 shock).

Three features will distinguish the global economy in 2021:

- A synchronous global recovery: At 6.4%Y, our 2021 global growth forecast remains above consensus (5.3%Y), a stance bolstered by the news on vaccines and antibody treatments. We are more bullish than consensus because we believe that the COVID-19 shock has not dampened private sector risk appetite significantly, while policy stimulus has proved to be more than a backstop. We think that a global synchronous recovery, last seen in 2017, will unfold in 2021. While rising COVID-19 cases may lead to tighter restrictions and weigh on DM activity in the near term, EM growth will continue to accelerate. Emerging from the winter, the easing of restrictions will lift growth in DMs, which will join the rest of the world from March/April 2021. While the consumer has been driving the recovery so far, we expect the capex cycle to kick in from 2Q21.

- EMs boarding the reflation train: The past eight years have been tough for EMs, as a series of challenges have brought about a prolonged downturn. While it is tempting to blame structural issues for weak EM growth, we think that cyclical challenges and exogenous shocks (e.g., China and commodity price slowdowns, trade tensions and COVID-19) played a bigger role in keeping EM growth well below potential. However, we see a turn in 2021. The COVID-19 situation is now improving in a broad range of EMs and their recoveries are gaining momentum. In 2021, a widening US current account deficit, low US real rates, a weaker dollar, China’s reflationary impulse and EMs ex China’s own accommodative domestic macro policies will lead to a sharp rebound in growth. As this cyclical recovery takes hold, it can help create a virtuous cycle where stronger nominal GDP growth alleviates some of the pressure from structural issues like the need to consolidate public finances.

- Inflation regime change in the US: We see an altogether different inflation dynamic taking hold, especially in the US. While we argued for the return of inflation in this cycle earlier this year, 2021 will lay down the marker for this thesis. The US economy will reach both pre-COVID-19 levels and its pre-COVID-19 path over the course of 2021. Even so, both monetary and fiscal policy will remain much more accommodative relative to 4Q19. Our chief US economist Ellen Zentner expects underlying core PCE inflation to rise to 2% in 2H21 and move sustainably higher from 1H22. In contrast, the consensus doesn’t expect inflation to reach 2% until 2022.

A constructive macro view provides a supportive backdrop for risk assets: Our chief cross-asset strategist Andrew Sheets believes that while abnormality defined 2020, 2021 will be characterised by a return to more normal conditions (economic growth recovering, control of the virus improving and uncertainty declining). Markets will also follow much of the ‘normal’ post-recession playbook. Our strategy team recommends investors overweight equities and credit against government bonds and cash and sell USD. Within equities, they would overweight cyclicals and underweight defensives across regions, and expect US small-caps to outperform large-caps.

The risks to our views are twofold. In the near term, an even sharper rise in hospitalisations in the US or Europe could prompt policy-makers to adopt stricter lockdown measures than our base case, pushing near-term growth lower and also delaying the return to the pre-COVID-19 path. Looking a bit further out, US inflation could surprise to the upside from 2H21, particularly if we get a large fiscal package. This could challenge the market’s view on inflation and create a disruptive shift in expectations for Fed policy.

via ZeroHedge News https://ift.tt/2UvBDNy Tyler Durden