Biden’s Student Loan Forgiveness Promises Likely Depend On A Democratic Senate

Tyler Durden

Sun, 11/15/2020 – 17:35

If Joe Biden wants to deliver on the Democrats’ promise of eliminating hundreds of billions of dollars in student debt, he is likely going to need a Democratic Senate to do so.

And a Democratic senate hinges on two Georgia races in January, the Wall Street Journal notes. If Democrats lose those, they could try to force through forgiveness as an executive order, though there is no guarantee it will survive a legal challenge.

Democrats know that nothing secures voting loyalty more than promises of “free stuff” – maybe this is why it was literally days after the election, on November 12, with results still being contested, that Elizabeth Warren reminded Joe Biden publicly that she wanted him to cancel the debt (as if we all didn’t already know):

WARREN URGES BIDEN TO CANCEL BILLIONS DOLLARS OF STUDENT DEBT

Congrats to everyone who paid theirs off legitimately

— Quoth the Raven (@QTRResearch) November 12, 2020

Warren had previously paired with Chuck Schumer and joined another 13 Democrats who introduced a resolution urging up to $50,000 in loan forgiveness per borrower via executive action. It was never taken up by a full Senate.

As a reminder, Biden campaigned on trying to forgive $10,000 in debt for every American with student loans to help them deal with the economic effects of the pandemic. He has also sought to forgive debts to public colleges for those earning under $125,000 per year and anyone who can show they were “defrauded” by for-profit colleges.

Democrats already tried to get $10,000 in relief through for all borrowers this year as part of the CARES Act, but wound up compromising with a Republican Senate to suspend debt payments through September 30. The Republican Senate still broadly opposes large-scale debt forgiveness, an aide told the WSJ.

Robert Shireman, an Education Department official, formerly of the Obama administration, said: “I do expect that the Biden administration will take some action on student debt outside of anything that happens through Congress. The question is how far they will go.”

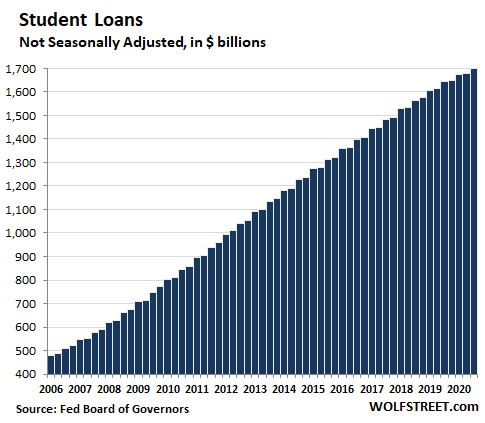

Meanwhile, we noted a Schiff Gold report days ago that said in Q3, student loan balances rose by $23 billion from the second quarter, citing Federal Reserve data. Forty-five million Americans now owe $1.7 trillion in student loan debt. Total outstanding student loan balances have surged by $54 billion year-on-year.

One of the reasons student loan debt continues to increase despite falling college enrollment is the glut of student loan money pushed up the cost of a college education. The federal government pushed the widespread availability of student loans. It was supposed to make it possible for everybody to go to college.

But there was an unintended consequence. It made a university education unaffordable and ended up saddling millions of Americans with crushing levels of debt. Studies have shown the influx of government-backed student loan money into the university system is directly linked to the surging cost of a college education.

Another reason student loan balances continue to surge upward is that borrowers aren’t making payments on their loan principal. This was a trend before the pandemic that has accelerated in the year. Many student loans were moved into automatic forbearance as the coronavirus economic chaos unfolded. President Trump signed an executive order extending interest-free federal student loan forbearance through Dec. 31, 2020.

More than 1 in 4 student loan borrowers are either in delinquency or default.

But don’t worry. Neel Kashkari has an app for that. Brrr…

via ZeroHedge News https://ift.tt/334dand Tyler Durden