In Striking Reversal, One Bank Warns That 2021 Could See The “Biggest Fiscal Contraction In History”

Tyler Durden

Sun, 11/15/2020 – 14:15

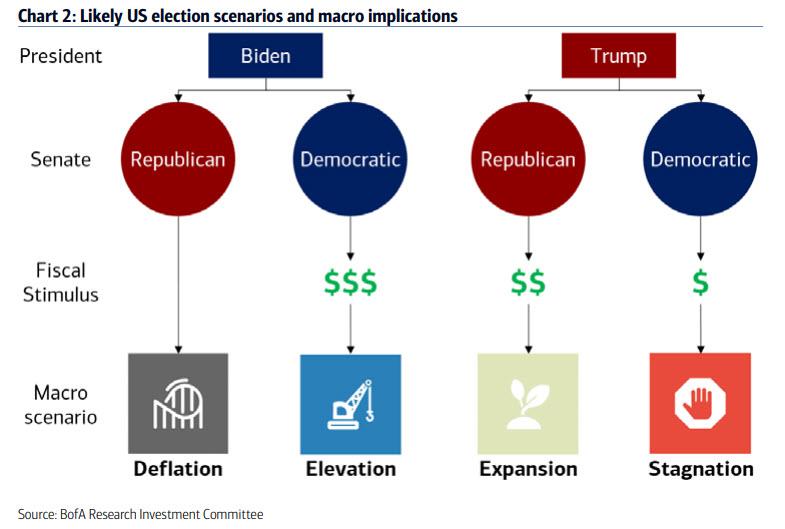

Echoing the skepticism voiced on Friday by BofA CIO Michael Hartnett who bucked the Wall Street trend of optimism, and said to “sell the vaccine“, another BofA strategist, Jared Woodard, writes in the bank’s latest Research Investment Committee note that a confirmed Biden presidency & GOP-led Senate would imply modest growth and corporate profits, maximum QE, and mediocre returns to risky assets, quite contrary to the euphoria gripping Wall Street which is now projecting the S&P rising to (or above) 4,500 by 2022.

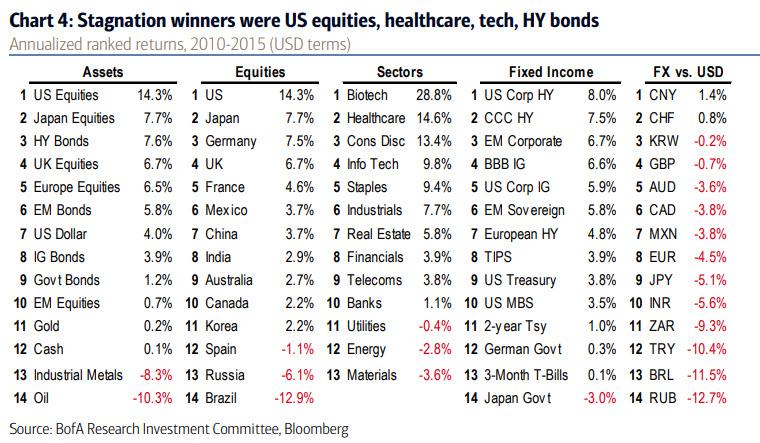

Not so fast, Woodard says, arguing that the closest comparison may be 2010-2015 with secular stagnation, an easy Fed, and an iceberg of austerity and when winners were US growth stocks & HY bonds (similar to now). As a result, while he expects small policy progress on Global-to-Local, health care coverage, and a capex/R&D rebound, he anticipates only temporary gains for cyclicals & inflation. AS a result, the “all one trade” market – which he first defined back in August – is still with us.

Meanwhile, according to Woodard, the greatest risk is that benefits of a divided government are front-loaded.

This means that while good vaccine news & macro data may be short-term bullish they will prove to be “medium-term bearish if used as a pretext for tighter budgets, with 2021 set to be the fastest fiscal contraction on record.”

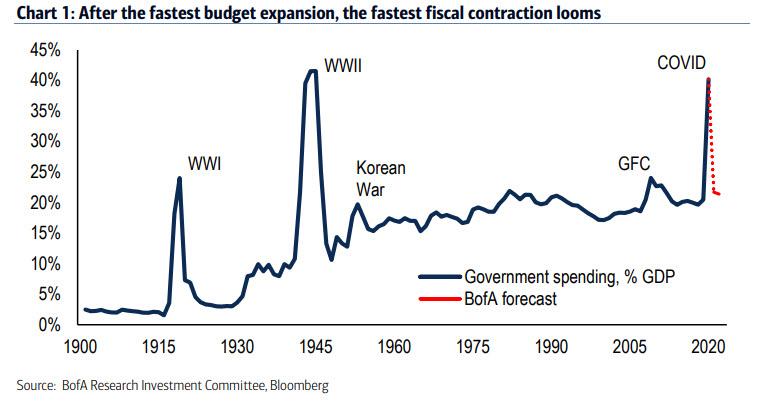

Indeed, in a world where what goes up must come down – unless extended indefinitely which however can’t happen under gridlock – Woodard warns that after the fastest budget expansion on record, “the fastest fiscal contraction ever looms.”

In his narration of election night, Woodard who one month ago put together the 4 election scenarios for markets…

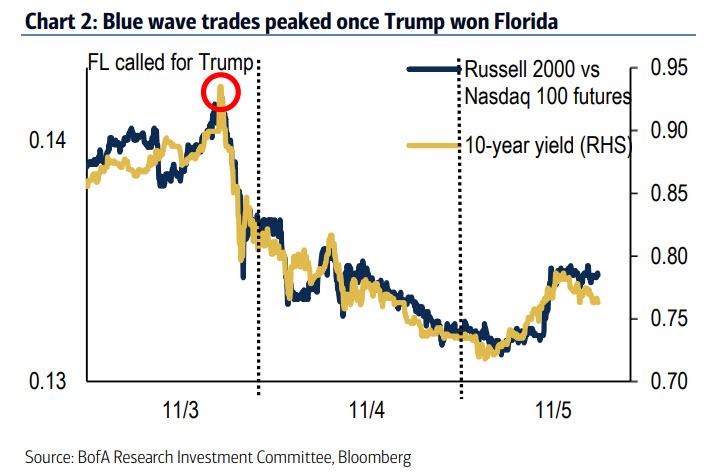

… said there was no surprise in the market’s response: investors initially reacted that a unified government is bullish if short-lived: as “Blue wave” odds peaked on election night, small caps rallied and Treasury yields spiked to 5-month highs, then reversed as it became clear the election results would be close and contentious.

That said, the worst-case deflation scenario Woodard highlighted last month has been postponed after Senate leadership promised more pandemic relief this year (although the number will likely be far smaller than many had expected). In any case, the estimated package of up to $1.0tn (coupled with the year’s previous fiscal injections) would make 2020 the largest year of fiscal expansion relative to GDP in US history.

However, and this goes back to BofA’s key warning, “the challenge for investors is that with a divided Congress and appetites for budget austerity rising in both parties, 2021 could also become a record year via the fastest and largest fiscal contraction in history” according to Woodard who says that the “best historical comparison might be 2010-2015, which also featured a Democratic president, divided Congress, and an iceberg of austerity keeping the economy in a freeze.” The next chart shows the annualized returns from that period.

Back then, secular stagnation winners were:

- US vs. the rest of the world,

- defensive growth (health care, discretionary, tech) vs. cyclical value (financials, energy, materials),

- high yield & EM bonds vs. cash and government bonds.

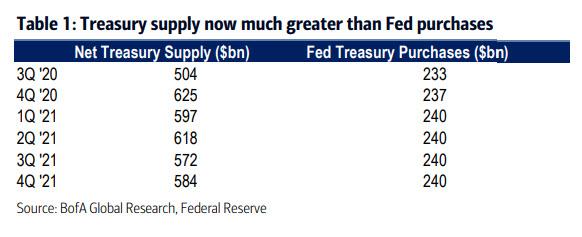

Then, as now, investors were rewarded by a maximally-dovish Fed, and while Woodard expects the QE boost to markets to be smaller now, we remind readers that earlier today we noted that for 2021 we expect the Fed to double its QE as the Treasury is expected to net $2.4 trillion in TSY issuance next year…

… more than double the $1 trillion in scheduled debt monetizations.

In other words, if Woodard is right and the fastest ever fiscal contraction is imminent, it only means that the Fed will have no choice but to offset it with an even greater monetary injection. In retrospect, Goldman’s 2022 price target for the S&P of 4,600 may prove to be too conservative after what is shaping up as the biggest monetary deluge ever.

via ZeroHedge News https://ift.tt/3kx0VoT Tyler Durden