Was That It For Value? How Does Last Monday’s Quant Crash Compare To The “June Swoon” And What Happens Next

Tyler Durden

Sun, 11/15/2020 – 13:25

While last Monday’s “Pfizer vaccine”-inspired 15-sigma momentum crash, which unleashed an unprecedented rotation out of growth and into value stocks crushed countless momentum-heavy quant (and Robinhood) portfolios, traders may have forgotten that a similar if not greater plunge in momentum names was observed in early June when the Dow Jones market neutral momentum index – which had escaped the March covid crash largely unscathed – lost all of its YTD gains virtually overnight.

However, considering that the June momentum crash was completely reversed in less than a month, traders are asking if the November 9 plunge is just another headfake in the “great rotation” from value to growth which Wall Street strategists have been predicting as imminent virtually every week for the past 2 years, only to leave their clients nursing massive P&L losses.

Picking up on this skepticism, on Friday JPM’s Nick Panigirtzoglou writes in his iconic Flows and Liquidity newsletter that there are indeed indications that last Monday’s manic reflation moves may already be U-turning again with “almost half of the recent selloff in global government bond yields has been reversed over the past two days, echoing last June’s pattern.”

It is this re-flattening of global government bond yield curves which to JPM represents a headwind for value stocks given the signaling importance of the slope of the yield curve.

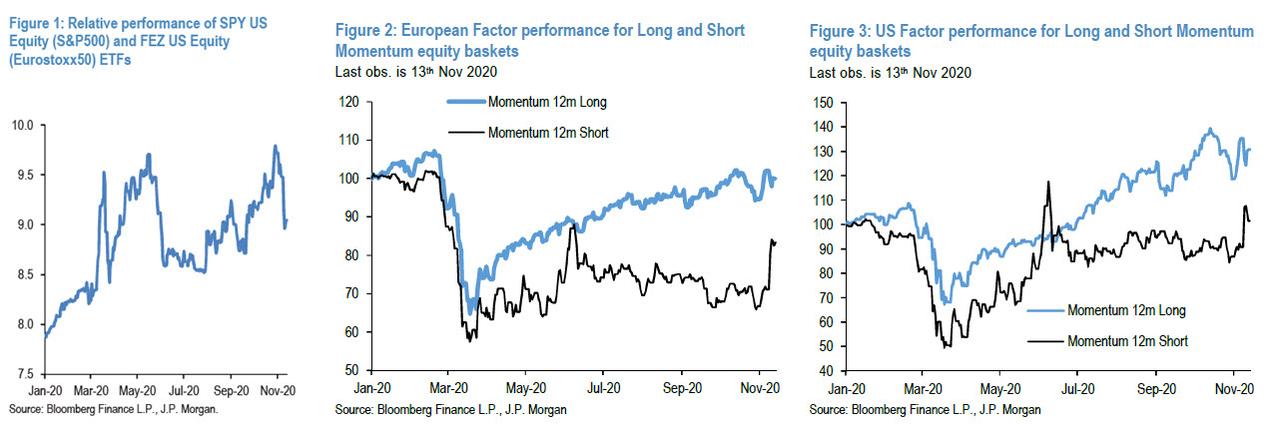

Pointing to the charts below, JPM notes that “the rotation trade lost steam later on the week” with the relative underperformance of the S&P500 vs. the Eurostoxx50, the main manifestation of the value rotation trade in the equity index space, stalled echoing last June’s pattern. Additionally, the Short Momentum equity baskets reversed some of their previous gains at the beginning of the week, especially in the US, though the reversal has not yet showed the steepness of last June’s reversal (Figure 2 and Figure 3).

So what happens next?

Unlike Nomura’s Charlie McElligott’s who predicted that the momentum crash will persist following last Monday’s epic crash, JPM is not so sure and according to Panigirtzoglou, “for this week’s value rotation to be sustained it likely needs some continued positive news on the vaccine front or positive news on growth prospects, such as support from further fiscal stimulus.” This makes the forthcoming vaccine announcement by Moderna particularly important as a comparable vaccine effectiveness to that of the Pfizer earlier this week “would help to sustain this week’s value rotation trade. At the same time, an announcement of vaccine effectiveness by Moderna that would be seen as significantly weaker could prompt some further reversal of the value rotation trade.“

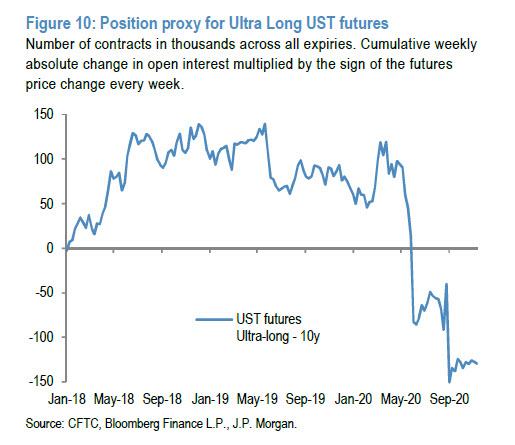

Finally, JPM also finds headwinds for a continued rotation from “elevated curve steepening exposure” as a result of a record net short positioning in Ultra Treasury futures.

Drilling down into the technicals, the JPM quant says that the latest reversal of the bearish global government bond duration impulse in yield and curve space “raises questions about the investor position backdrop in the rate space.” To answer these questions JPMorgan resorts to its arsenal of bond position indicators to look at how extended or concentrated these positions are. In short, it finds the following:

- First, looking at dedicated bond funds, JPM finds that both US and Euro active bond mutual funds have played a role in driving the market swings over the past two weeks, “and that positions are now likely on the short side.”

- Second, looking at CTA, the bank concludes that CTAs may have contributed to amplifying market moves, “but likely not significantly given that the momentum signals were far from extreme territory that would have signalled a greater risk of profit taking or mean reversion signals kicking in.” In sum, JPM finds CTA signals modestly long in 10y Bunds and short in 10y USTs.

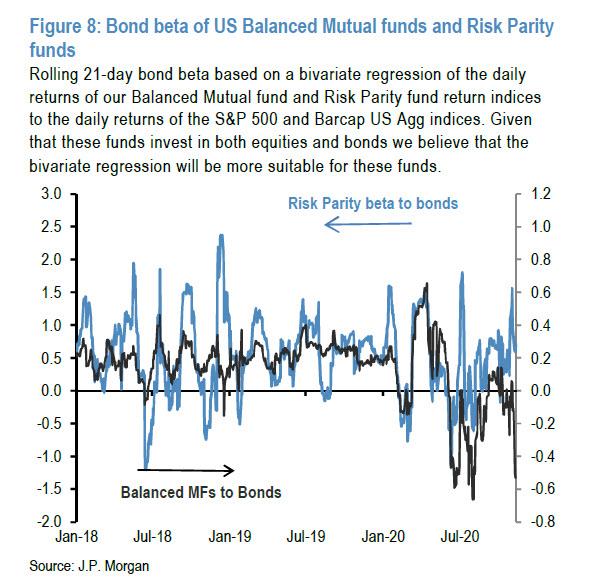

- What about risk parity and balanced mutual funds? The chart below shows the rolling 21-day partial betas to bonds, which shows that bond betas of risk parity funds saw a short-lived, sharp spike in the aftermath of the election from close to or modestly below their longer-term averages. This suggests the gradual decline in vol had seen increase leverage and found themselves longer duration as volatility spiked, likely reversed at least in part post-election. By contrast, balanced mutual funds appear to have remained modestly short and added to those short positions this week.

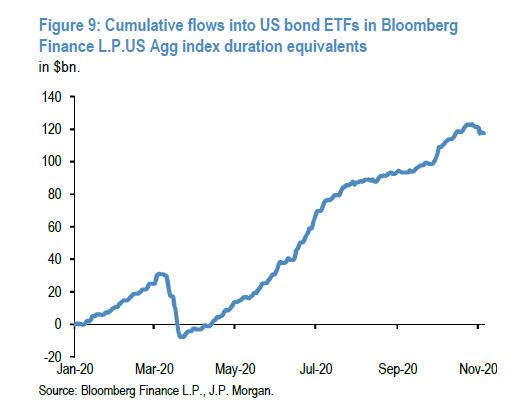

- Next, looking at retail investors, we find that inflows into bond funds in 2020 have been “robust”, particularly against the backdrop of the $270bn of outflows seen in March. But what about the duration impulse of these flows? To look at this duration impulse, JPM calculated the duration impact of bond ETF flows by adjusting for the empirical duration of each bond ETF. When the bank adjusts for empirical duration, shown in Figure 9, the bullish duration impulse appears to have peaked in the second half of October, but only shown tentative signs of a reversal.

- Finally, JPM looks curve positions via its position proxy for futures contracts based on the cumulative absolute change in the open interest multiplied by the sign of the futures price change each week. It finds that at the very long-end of the curve its position proxy for the 10s/30s part of the UST curve suggests that speculative investors continue to hold elevated curve steepening exposure, with only modest signs of reversal in recent weeks.

In summary, and intuitive, JPMorgan finds that active bond mutual funds played a role in recent yield swings, amplified by momentum investors, while positions appear to be skewed short overall on duration among active bond mutual funds, balanced mutual funds and, in the case of USTs, for momentum-based investors.

In conclusion, JPM finds that absent more fundamental drivers to bolster the value to growth rotation, such as good news on the Moderna vaccine front, even more concerning for the value trade in the near-term is the headwind from elevated curve steepening exposure, where a peak value rotation appears to already be priced in.

via ZeroHedge News https://ift.tt/38ObUYO Tyler Durden