Foreign Central Banks Buy TSYs For 2nd Month, China Holdings Near 4-Year Lows

Tyler Durden

Tue, 11/17/2020 – 16:15

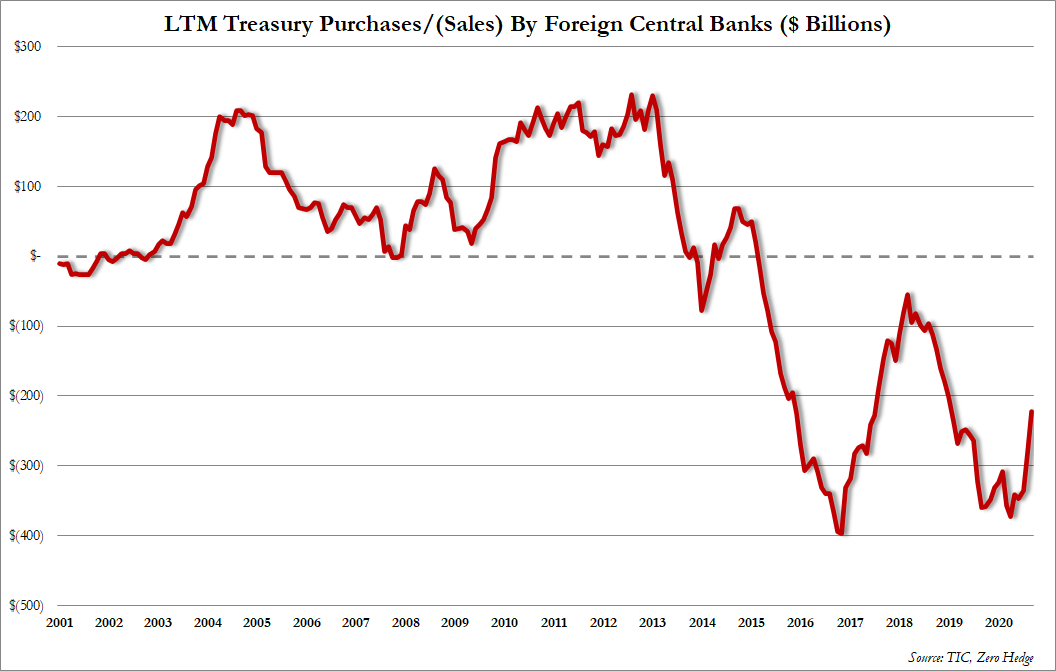

Some relatively positive news in the latest TIC data shows that the last 12 months purchases of Treasuries by foreign central banks surged by $59 billion to $221.6 billion – its highest since Jan 2019…

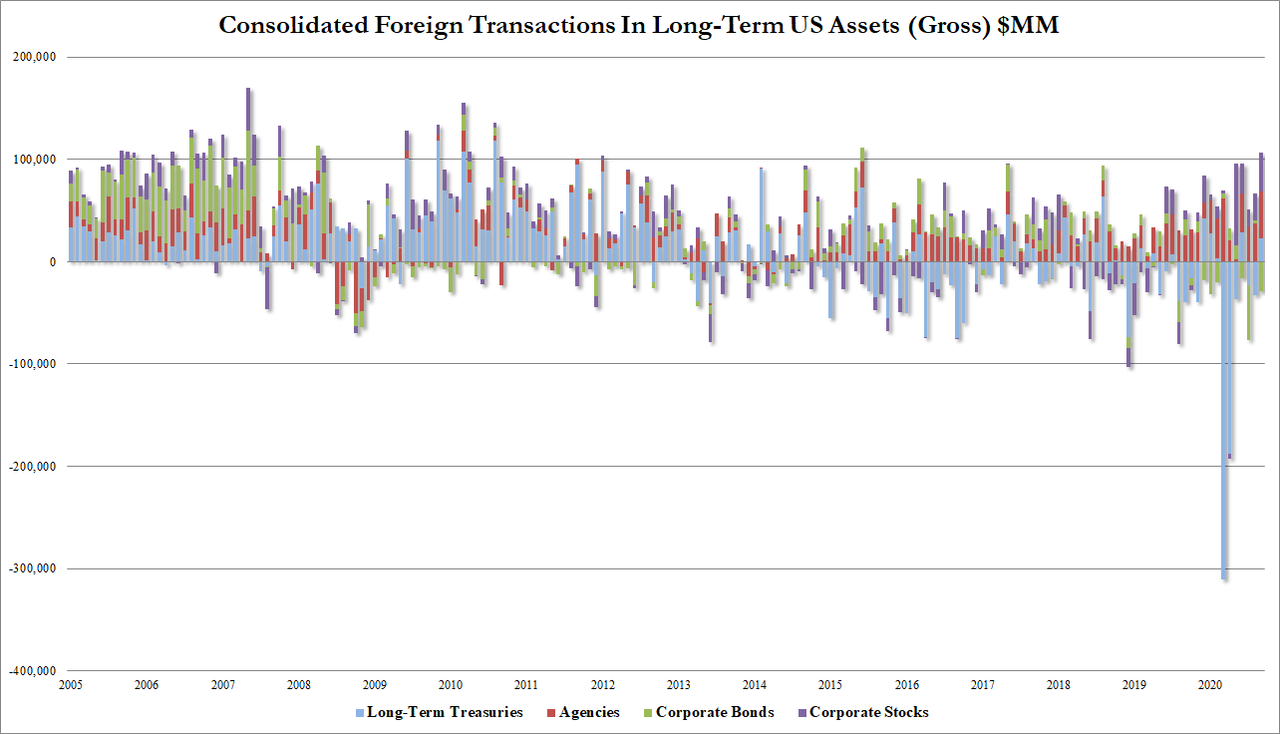

Under the hood, foreigners

Total Long-Term Treasury Purchases: $22.5BN, sharp reversal from $33BN in sales in August

Purchases of Agencies $46.2BN, highest since Feb 2020

Foreigners sold a total of $28.7BN in corporate bonds, after $2.3BN in purchases in August

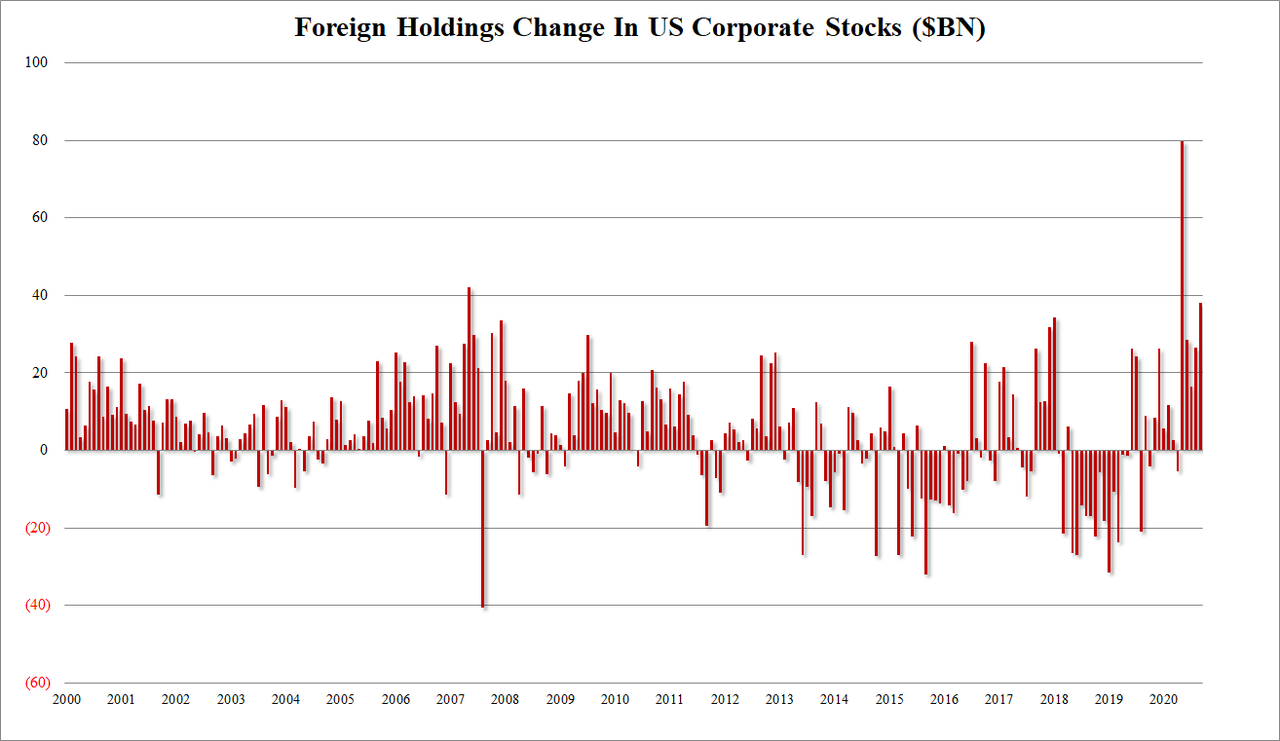

Stock purchases by foreigners $38.2BN, up from $26.6BN in August and most since May 2020

While that is all bright and shiny news for the US Government’s massive deficits, one trend continues – China is dedollarizing, dumping more of its Treasury holdings to the lowest since Jan 2017…

Source: Bloomberg

Other high- (and low-) lights include:

-

Japan holds $1.28t, a decrease of $2.2b from last month

-

China holds $1.06t of U.S. Treasuries, a decrease of $6.3b from last month

-

Belgium holds $218.1b of U.S. Treasuries, an increase of $3.1b from prior month

-

Cayman Islands hold $231.6b, an increase of $2.7b from last month

-

Saudi Arabia holds $131.2b, an increase of $1.2b from last month

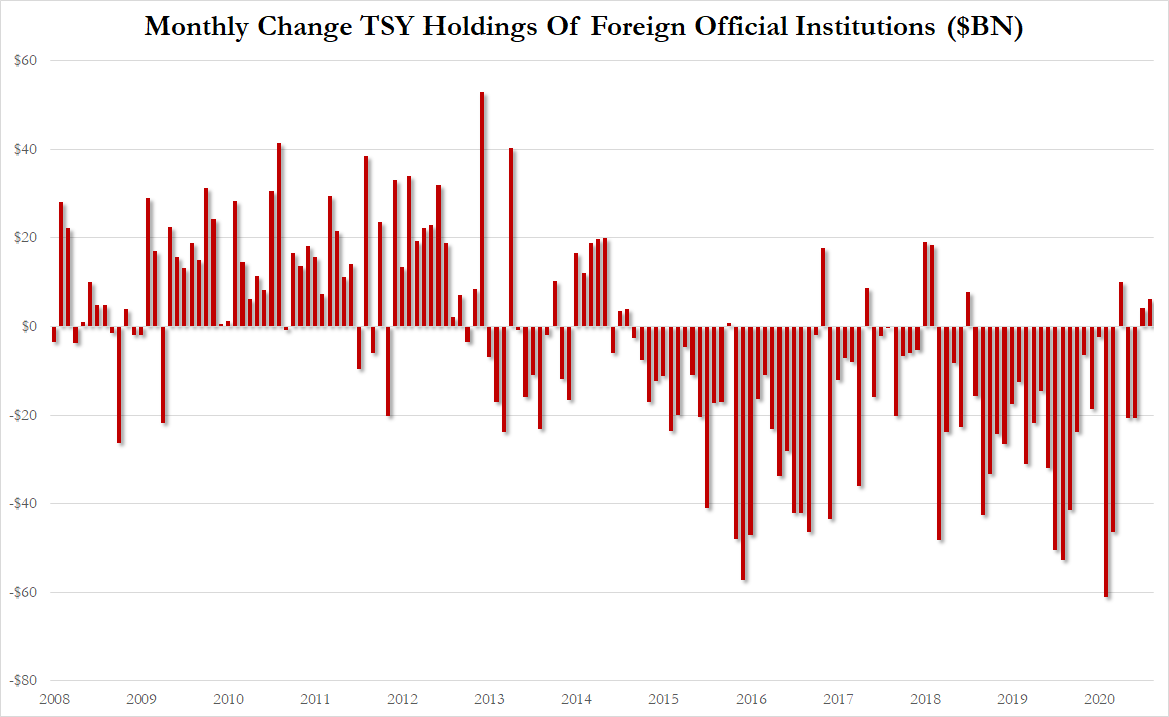

What is more interesting is that foreign official institutions bought for 2nd month in a row, something they haven’t done since March 2018…

But the trend is clear…

Is it any wonder the dollar is tumbling?

via ZeroHedge News https://ift.tt/2IBiWFP Tyler Durden