Walmart Jumps After Smashing Expectations As Average Ticket Soars 24%

Tyler Durden

Tue, 11/17/2020 – 07:39

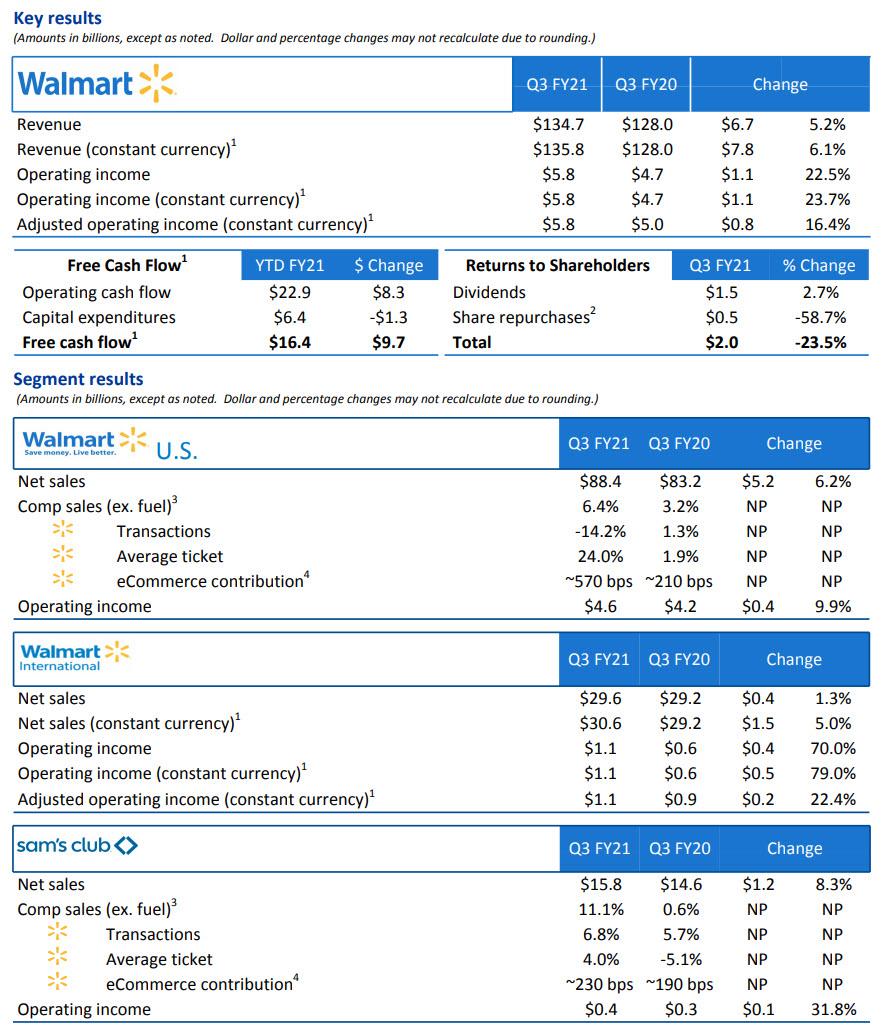

While it may be facing an uncertain near-term future with partial economic shutdowns returning, at least for its brick and mortar stores, Walmart’s immediate past was quite impressive with the world’s largest retailer reporting stellar Q3 earnings which surged past estimates as consumers continued to flock to the essential retailer to stock up on stay at-home products and entertainment while the virus rages on.

Walmart beat handily on the top and bottom line:

- Q3 adjusted EPS of $1.34, smashing estimates $1.18 and coming above the highest sellside forecast (range $1.06 to $1.26)

- The adjusted EPS excluded the effects, net of tax, of an unrealized gain of $0.80 on equity investments and $0.34 for the loss of Walmart Argentina

- Q3 revenue $134.71 billion, up 5.2% Y/Y and also beating estimates of $132.42 billion (range $130.52 billion to $135.50 billion)

More good news: the company said new member sign-ups and renewal rates were strong, particularly Plus membership. Membership income increased 10.4%. In terms of covid-linked disclosure, Walmart said it incurs 3Q incremental costs related to COVID-19 of 0.6 billion.

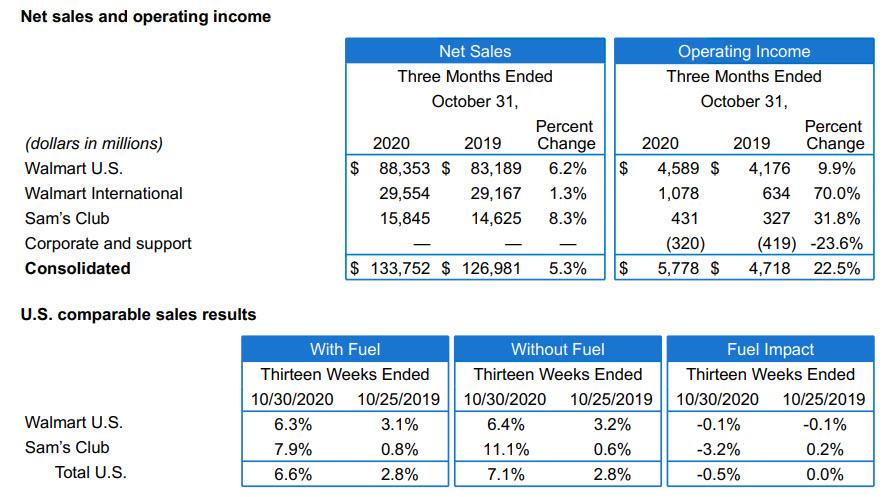

But the most impressive result was that same store sales blew estimates out of the water, with Walmart-only US comps of 6.4% almost double the 3.8% estimate.

- Q3 Walmart-only U.S. stores comparable sales ex-gas +6.4%, estimate +3.8%

- Q3 Sam’s Club U.S. comparable sales ex-gas +11.1%, estimate +7.10%

- Q3 total U.S. comparable sales ex-gas +7.1%, estimate +4.3%

What is notable is that the 6.4% surge in comps was even as the number of transactions tumbled 14.2% Y/Y at U.S. Walmart locations, yet the average purchase surged 24.0% which means shoppers are consistently buying more every time they place an order.

Alternatively, Sam’s Club also reported sales that beat estimates as it pushes to lure more members with delivery, pickup and smaller serving sizes to appeal to those not planning large holiday gatherings this year, according to Bloomberg. Sam’s Club same-store sales growth of 11.1% surpassed expectations for a 7.1% gain, the result of an increased number of transactions (+6.8%) and higher average ticket (+4.0%).

As the company continues to ramp up its online offering, U.S. e-commerce sales at Walmart rose 79% in the quarter and 41% at its warehouse chain. The company said in September that it would hire more than 20,000 workers to prepare for a surge in online shopping amid the pandemic. According to Bloomberg, that was the company’s first large seasonal hiring in five years.

As a reminder, Walmart’s response to Amazon Prime, Walmart+, launched in September at a price of $98 a year that includes unlimited free delivery from stores and gasoline discounts. There were few details on this venture in the release, so investors will be waiting to hear more on the call today.

Walmart shares spiked in kneejerk reaction to the report, then faded some of their gains, but were comfortably higher from Monday’s open.

via ZeroHedge News https://ift.tt/36MVPjo Tyler Durden