Value Rotation Stalls As Bond Yields, Dollar Slide

Tyler Durden

Thu, 11/19/2020 – 16:01

Stocks have never been more expensive, but that doesn’t stop the machines panic-buying them to record-erer expensive levels.

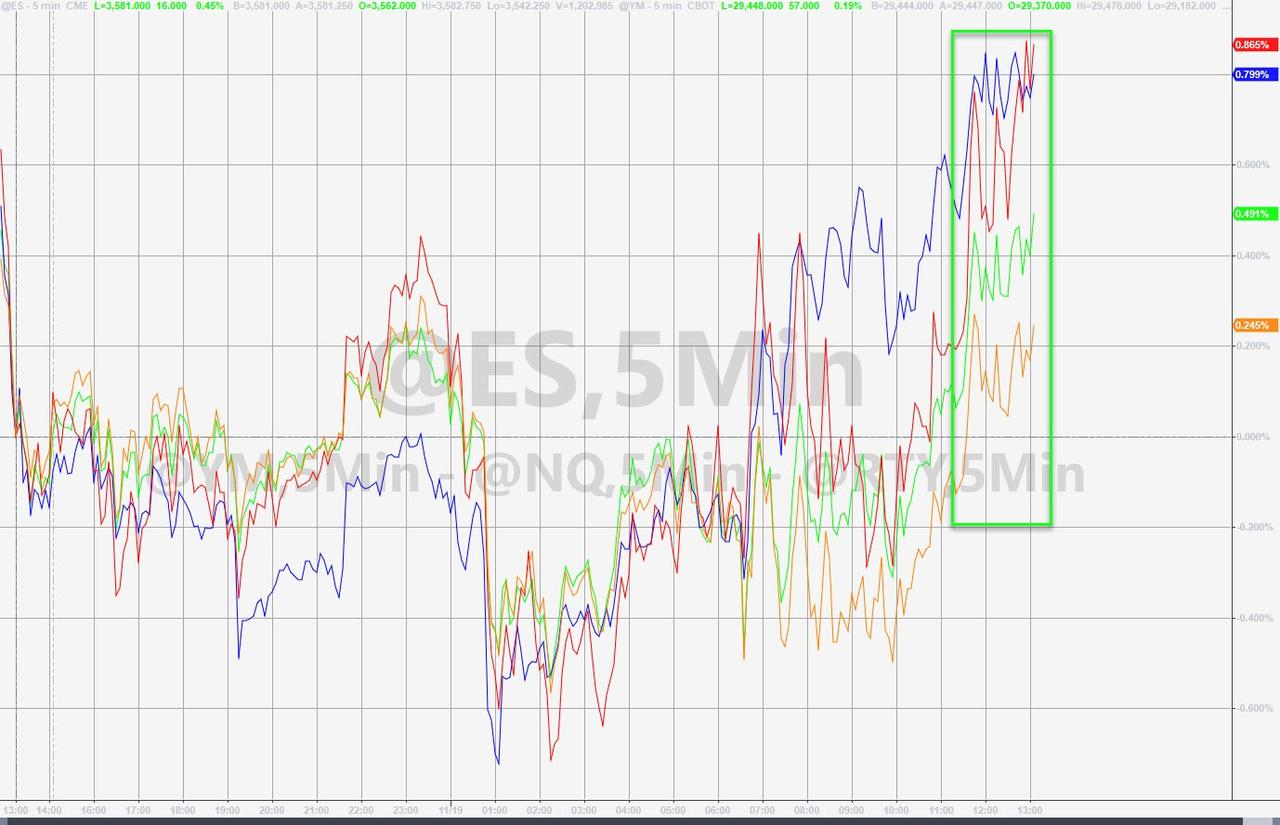

The major US equity indices were loitering with no intent for much of the day, gently unwinding the recent value-rotation when headlines hit on Schumer-McConnell talks (stimulus!!!! buy mortimer buy!)… The machines the headline, figured stimulus and were insta-bid…

But, the algos ignored the fact that Republicans said the meeting was about the government funding deadline, not COVID relief.

And after all that, all the majors ended higher on the day, with Nasdaq and Small Caps outperforming, Dow lagging…

This market has gone to ’11’ in terms of utter irrationality.

The value rotation unwound a little today…

Source: Bloomberg

The Russell 2000 / Nasdaq 100 pair reverted a little today…

Energy stocks surged once again today (despite a marginal move in crude), pushing the Energy sector to its best Q4-to-date in at least 30 years…

Source: Bloomberg

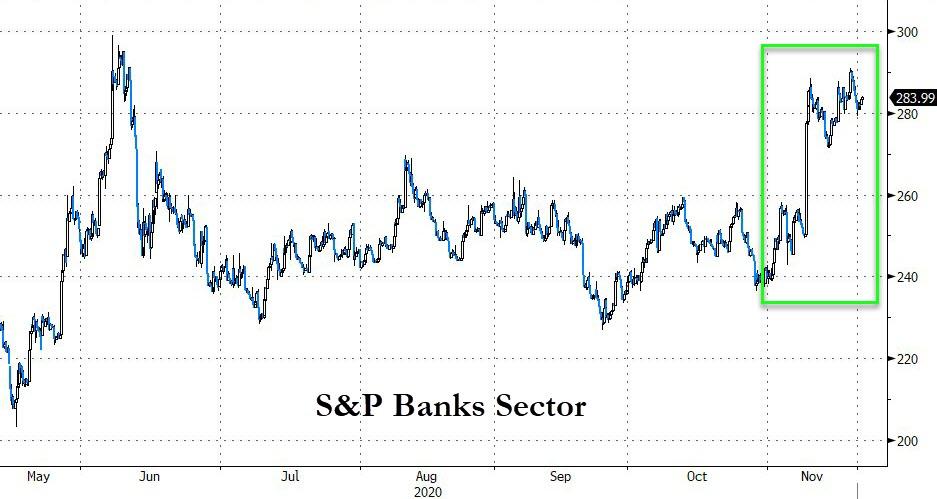

Banks were higher today…

Source: Bloomberg

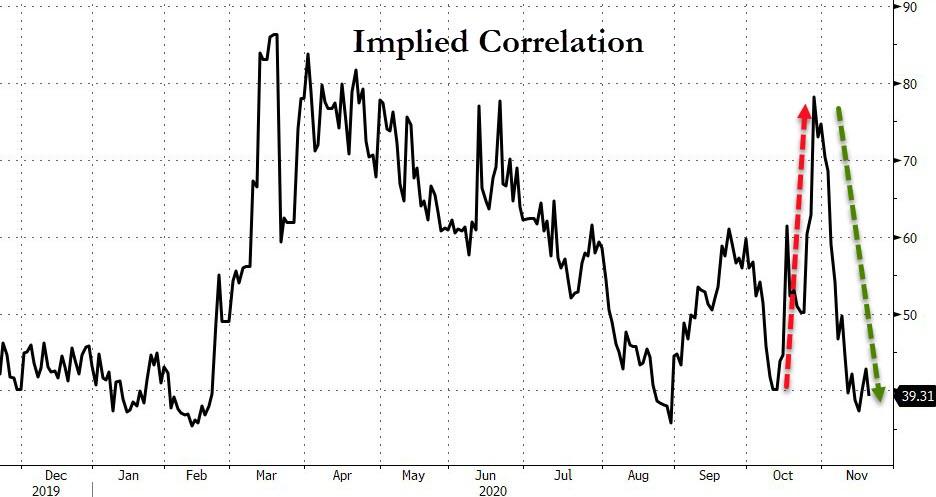

As VIX fell back to a 22 handle once again, implied correlation has tumbled to pre-COVID crisis levels (no systemic risk priced in to macro overlays)…

Source: Bloomberg

Cyclicals outperformed Defensives (pushing to their highest since Jan 2020), completely decoupled from bonds…

Source: Bloomberg

Treasuries were bid (with yields down around 2-3bps at the long-end, flat at the short-end)…

Source: Bloomberg

30Y Yields dropped below pre-Pfizer vaccine levels…

Source: Bloomberg

The Dollar roller-coastered higher then tumbled lower intraday, accelerating weaker on the Schumer headlines…

Source: Bloomberg

This is the lowest close for the dollar since April 2018…

Source: Bloomberg

Bitcoin held steady around $18,000…

Source: Bloomberg

Oil prices clung to positive gains on the day, closing just above $42…

Gold traded lower, back near Pfizer vaccine lows…

Finally, we note John Hussman’s latest note highlighting the fact that the valuation of U.S. stocks has never been more extreme, even at the 1929 and 2000 market peaks. Hussman points out that he has intentionally excluded the impact of pandemic GDP and profit weakness, which would otherwise make this measure even more extreme.

Hussman continues to expect the S&P 500 Index to lose two-thirds of its value over the completion of the current market cycle. That loss would not even breach historical valuation norms, but it would at least bring estimates of long-term expected S&P 500 returns closer to their historical average, in contrast to the negative 10-12 year prospects we observe at present.

“…we’re also well aware of how closely the speculative features of this market resemble the pre-crash peaks of August 1929 and March 2000, as well as lesser ones like January 1972 August 1987, and October 2007.”

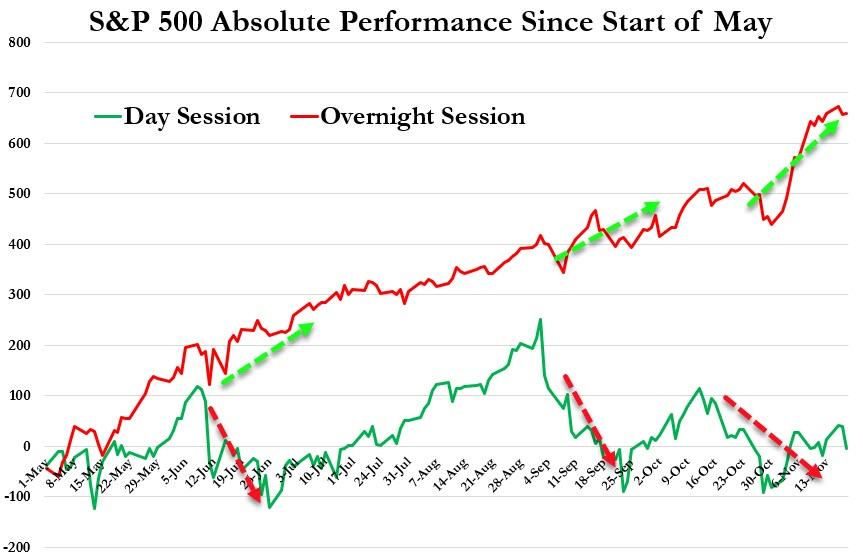

Still, there’s always the overnight session to make the big bucks…

via ZeroHedge News https://ift.tt/32ZPAHQ Tyler Durden