Hedge Funds Go “All-In” As Bears Go Extinct: Shorts Drop To All Time Lows

Tyler Durden

Fri, 11/20/2020 – 10:09

In recent weeks we have read one report after another from JPMorgan’s quants who, in trying to justify their explosive S&P forecast for 2021 and 2022 which sees the S&P rising as high as 4,500, make the false claim that hedge funds are barely invested in the market and have lots of dry powder, i.e., cash on the sidelines.

We now hope to bring these lies to an end once and for all, for the simple reason that as of this moment, hedge funds have never been more long stocks on both a gross and net basis.

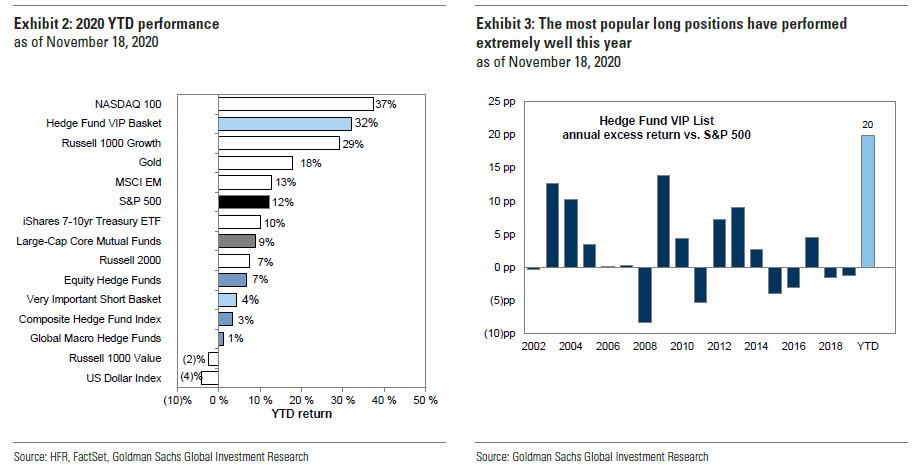

The reason for that, as Goldman’s Ben Snider points out in its latest hedge fund trend monitor, is that in the third quarter having given up on generating alpha, hedge funds have “increasingly relied on beta to support returns.” Confirming this, Goldman’s Hedge Fund VIP basket, which tracks the most popular hedge fund long positions, has outperformed the S&P 500 by 20% points YTD (+32% vs. +12%). And while it still lags the Nasdaq 100, the basket is now on pace for its strongest annual excess return vs. the S&P 500 on record as shown in the second chart below.

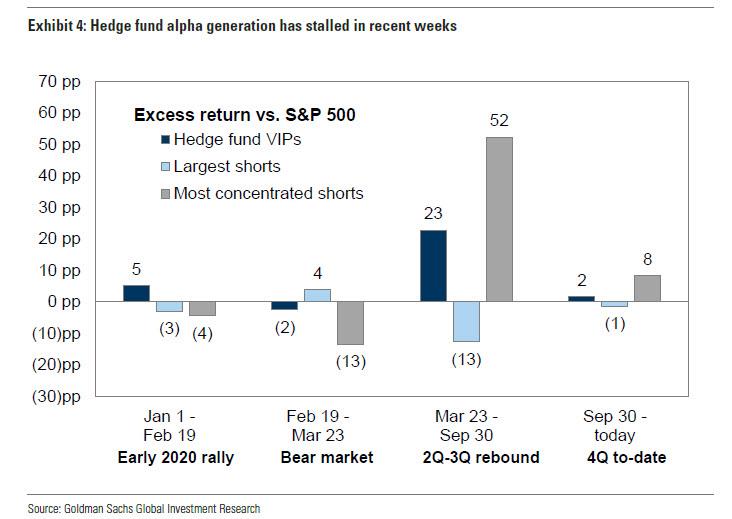

As an aside, following the recent 15-sigma rotation out of growth and into value on the back of vaccine news, Goldman caveats that in recent weeks, the outperformance of the most popular hedge fund long positions has moderated. Since the start of the fourth quarter, VIPs have outperformed the S&P 500 by about 2 percentage points (+8% vs. +6%), as the US elections and vaccine announcements drove sharp rotations within the market.

Ironically, and as we have claimed since 2013, the biggest outperformance came on the back of soaring shorts: as Snider writes in his report, “since the market trough in March the most concentrated short positions have consistently outperformed as funds covered their short exposures in a rapidly rising market.“

This should not come as a surprise to our readers: as we first observed all the way back in 2013, “The Best Trading Strategy In This Market: Buy The Most Hated Stocks, Short The Most Widely Held“, going long a basket of the most shorted names has best the best alpha generating trade year after year after year, and nowhere more so than in 2020. And now Goldman confirms this.

Sadly, hedge funds once again were not aware of this, and even as they went long the hedge fund VIP basket which has soared, they were collectively short (as a group) the same handful of names, which has ripped higher, in many cases more than offsetting any gains from the long book.

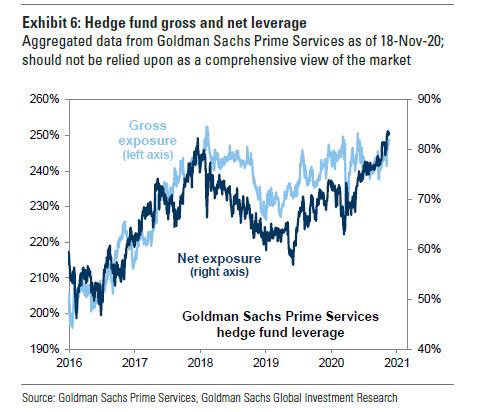

As a result, hedge funds have resorted once again to the oldest trick in the book – piling leverage upon leverage to chase not alpha, which they have failed to do once again in 2020, but beta.

Indeed, as Goldman notes, “record net leverage has supported hedge fund returns in recent weeks despite the erosion of alpha.”

And here is our – and Goldman’s counter – to anyone who incorrectly claims that hedge funds are not all in: aggregate hedge fund net leverage calculated based on publicly-available data registered 56% at the start of 4Q 2020, tying the record from early 2015. Exposures calculated by Goldman Sachs Prime Services also show extremely elevated net leverage; in fact net leverage has never been higher: as Snider explains: “According to their data, net leverage has risen quickly since the March market trough and is now at the highest level on record.”

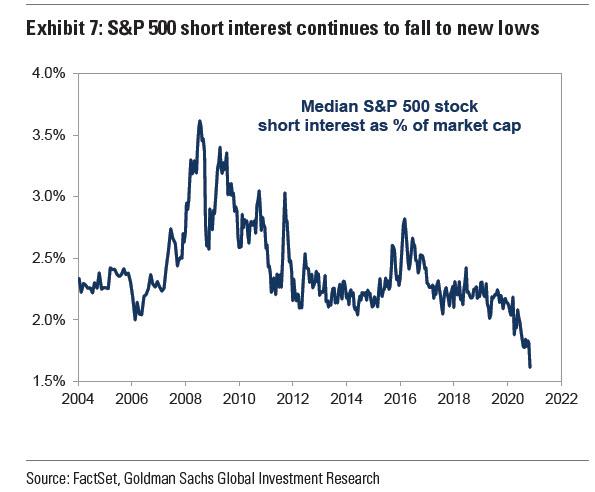

The flipside to the above is that that now that shorts have been absolutely crushed and steamrolled, there are none left.

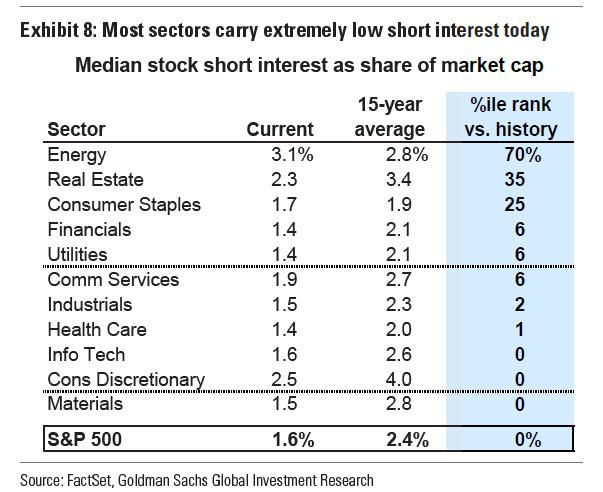

As Goldman points out, as funds increased length in the rising market (i.e., covered their shorts), “short interest has continued to fall, reaching new record lows.” As shown in the final chart, the median S&P 500 stock has outstanding short interest equating to just 1.6% of market cap, the lowest level in Goldman’s 16-year data history.

In most sectors, short interest outstanding currently ranks in the bottom decile of the last 15 years, with only Energy sector shorts registering above the historical average.

This means that with no shorts left, the market’s ability to “squeeze” higher is now finished… except for energy where we expect some catalyst to unleash what will soon be the only short squeeze left in the market.

via ZeroHedge News https://ift.tt/390ADJr Tyler Durden