Dow, S&P, & Bitcoin Soar To Record Close As Dollar & Gold Sink

Tyler Durden

Tue, 11/24/2020 – 16:01

Consumer Confidence tumbled…

Source: Bloomberg

…COVID cases are soaring, lockdowns are crushing small businesses, and ‘hope’ is fading fast…

Source: Bloomberg

…so Buy The F**king Record Highs in stocks and dump the dollar, bonds, and gold (because who needs ‘protection’ when there is Yellen, vaccines, and stimulus-y hopes).

As we noted earlier, The Dow topped 30k for the first time today – all thanks to $14 trillion in global liquidity puked into the markets (not the economy)…

Source: Bloomberg

Bitcoin also closed at a record high (not quite intraday high), above the $19,100 close on Dec 16thm 2017…

Source: Bloomberg

The reopening/work-from-home trade continues to hold its recent rotation but is not extending…

Source: Bloomberg

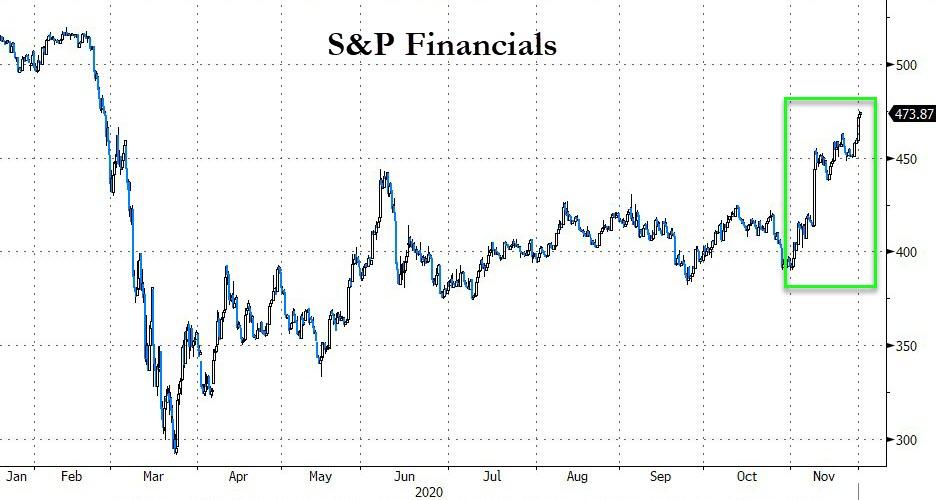

Bank stocks soared today…

Source: Bloomberg

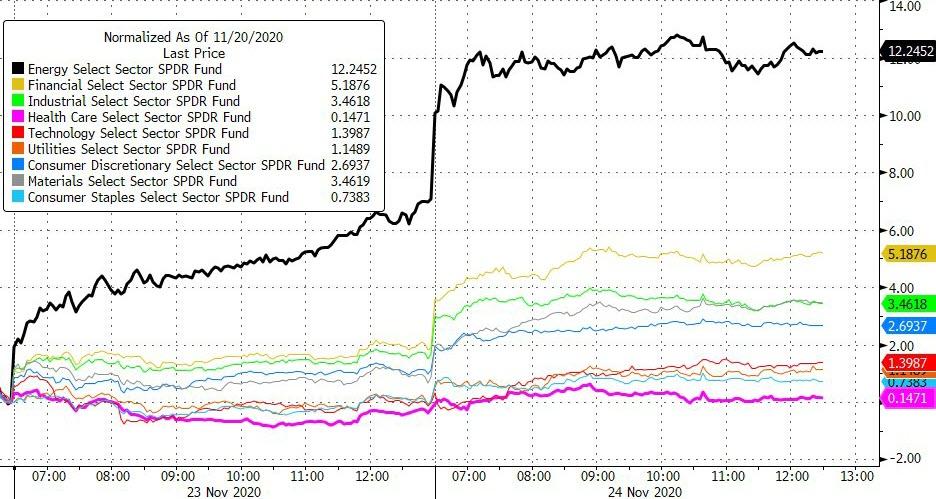

But energy stocks continued their massive surge (as healthcare lagged)…

Source: Bloomberg

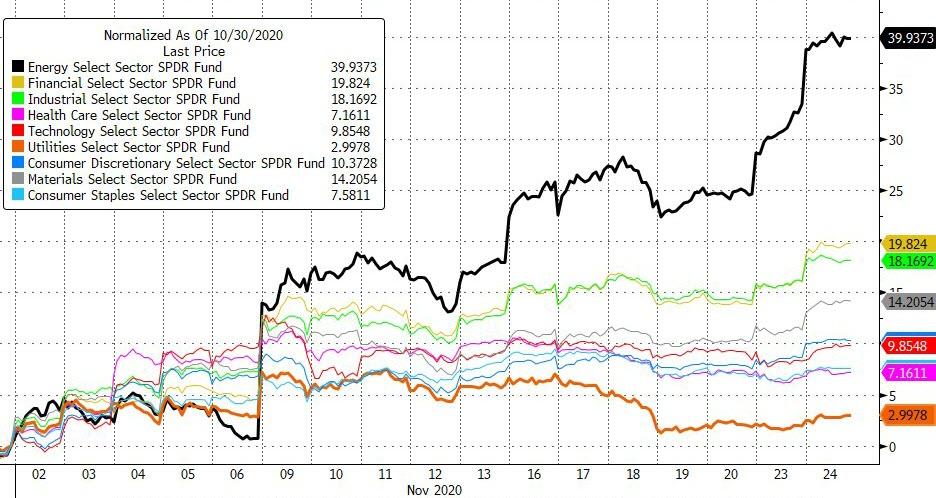

Extending its month’s massive gains…

Source: Bloomberg

Another day, another short-squeeze. This is just endless since the election!

Source: Bloomberg

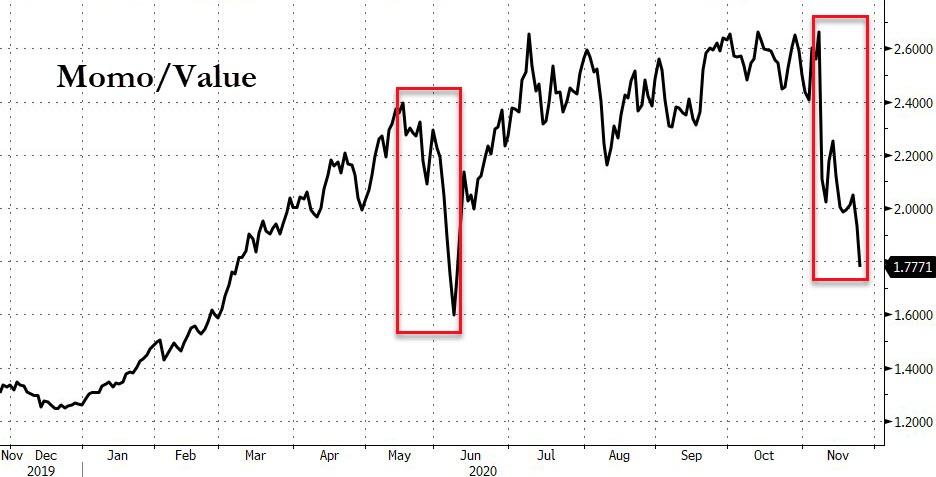

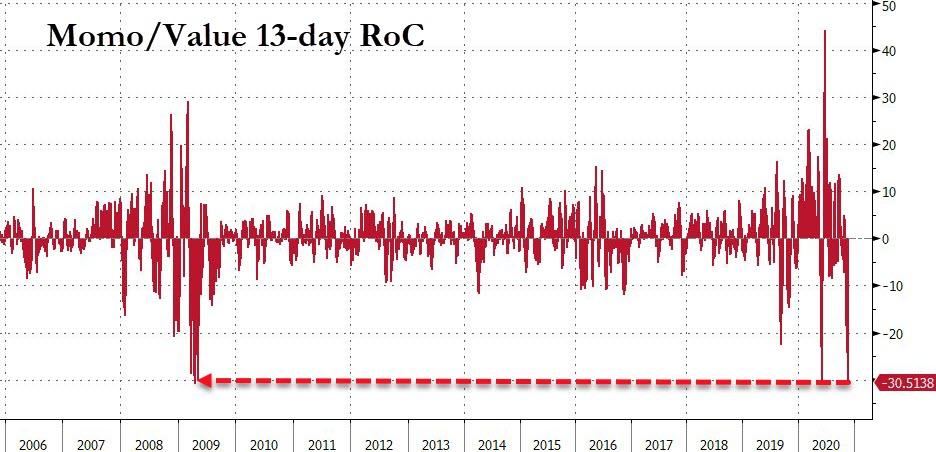

Momentum continued its carnage relative to value…

Source: Bloomberg

This 13-day crash is the same 30.6% as we saw in May/June… which is equal to the 2009 collapse…

Source: Bloomberg

If “greed is good”, then “extreme greed is better”…

And no one needs any protection…

Source: Bloomberg

Which perhaps explains the plunge in gold, breaking below $1800 intraday…

…finding support at the 200DMA…

Source: Bloomberg

And the selling of bonds (30Y up 8bps in the last two days, 2Y flat)…

Source: Bloomberg

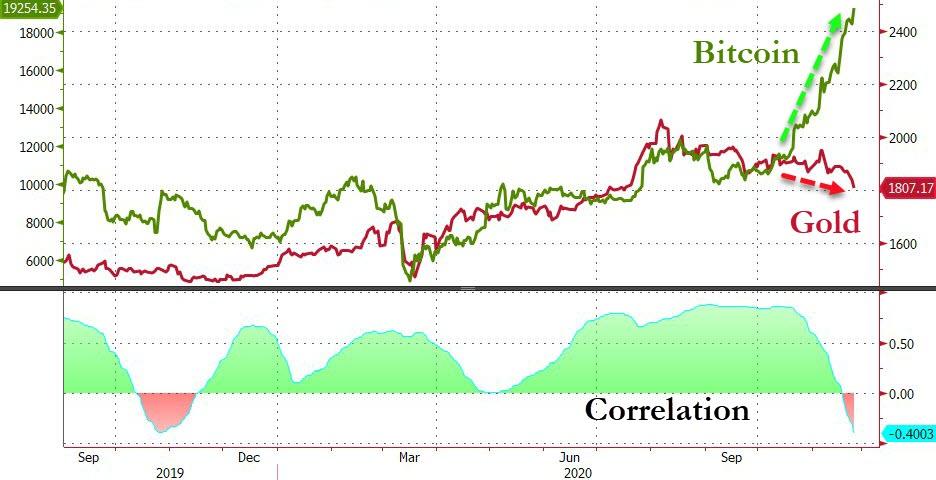

The correlation between bitcoin and gold has entirely reversed…

Source: Bloomberg

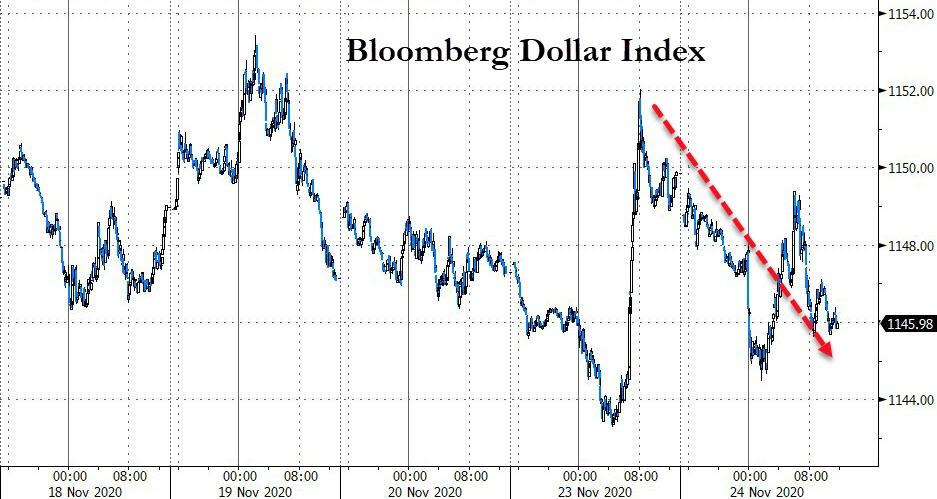

The dollar chopped around the last 24 hours, but ended down today…

Source: Bloomberg

…falling to its weakest against its fiat peers since April 2018…

Source: Bloomberg

While gold and silver sank today, oil prices jumped with WTI back above $45 (its highest since March)…

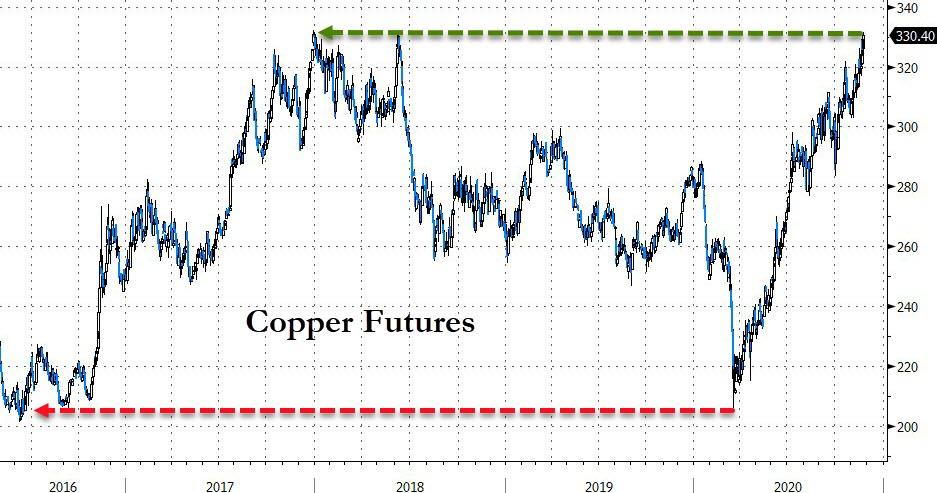

And copper soared back to 2018 highs…

Source: Bloomberg

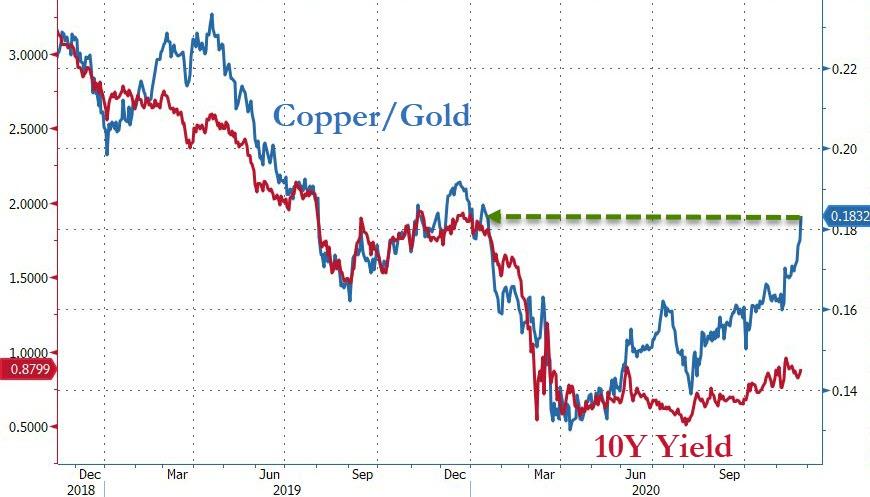

The surge in copper sent the copper/gold ratio to its highest since January and implies 10Y Yields should be 120bps higher than they currently are (or copper/gold should plunge)….

Source: Bloomberg

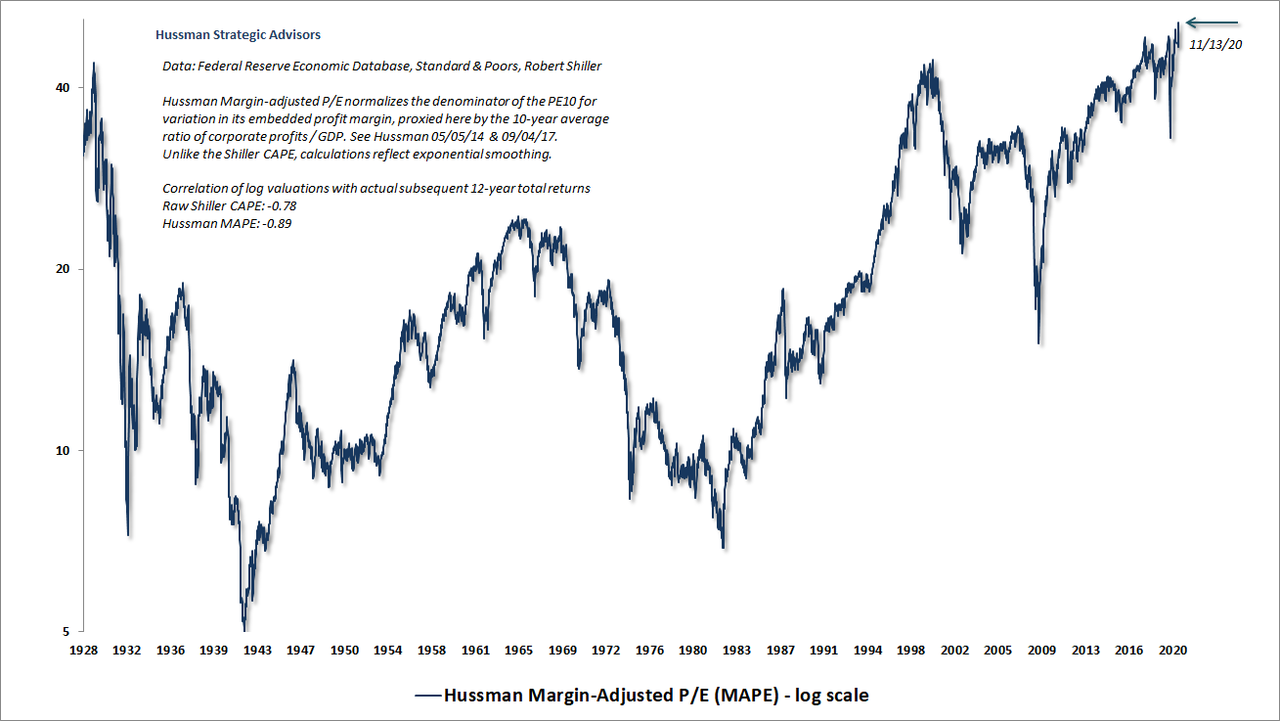

Finally, it seemed appropriate to give John Hussman the final words today as The Dow reaches record highs amid capitulation in the face of overwhelming liquidity…

One of the remarkable features of financial television is the single-minded focus of its talking heads on the latest move – their full-fledged immersion in the now. In contrast, the thinking of a disciplined value-investor is primarily on the long-term and the complete cycle. Our measures of market internals are certainly helpful in navigating shorter periods of speculation and risk-aversion. Still, investors who abandon the Iron Law of Valuation are inviting a world of pain.

Take a set of future cash flows and the current price of those cash flows: the relationship between the two reflects the rate of return that investors can expect to attain over time. That’s not a theory, it’s just arithmetic.

The CNBC interview with Jeremy Grantham offered a striking example of the difference between long-term and short-term thinking. Even as Grantham reiterated the extreme valuation concerns he discussed a few months ago, the interviewer countered, “Markets have risen since then. Why are you still convinced?”

Grantham responded, “Actually, it works quite the other way around. The more spectacular the rise, and the longer it goes, the more certainty one can have that you’re in a real McCoy bubble.”

At the most extreme valuations in history, that proposition might, and should, be obvious, but it simply did not compute in the short-term thinking of the anchors – one whose furrowed brow and scrunched facial expressions vacillated between annoyance, ridicule, and derision. The post-interview discussion instead included this interchange:

“I mean, last time around when you talked to him and he called it a bubble, it did seem a little more plausible. It seems like he’s doubling down.”

“You start to weigh out the possibilities that he could be missing a further rally in the markets.”

Oh, man. The unwinding of this bubble is going to be painful.

via ZeroHedge News https://ift.tt/2J3XkSs Tyler Durden