Dow Drops Below 30,000, Global Rally Fizzles Ahead Of Data Deluge

Tyler Durden

Wed, 11/25/2020 – 07:57

U.S. equity indexes futures dropped alongside shares in Europe with Dow futures sliding back under 30,000…

… as a furious three-day rally paused ahead of a slew of pre-holiday economic indicators. Data, from jobless claims to consumer confidence and personal income, are due before markets close and traders head off for Thanksgiving.Ppositive vaccine news and the formal start of President-elect Joe Biden’s transition to power – including the selection of Janet Yellen as Treasury secretary – have fueled optimism about the outlook helping global shares hit record highs earlier on Wednesday, and were on course for their best month ever. S&P 500 futures, which roll from the December to the March contract, rose as much as 0.6% before reversing gains.

“All eyes on U.S. data,” David Madden, an analyst at CMC Markets UK, wrote in a note. He cited durable goods, an advanced reading of the third quarter gross domestic product and jobless claims among some of the indicators traders will be looking at on Wednesday.

Joe Biden on Tuesday introduced his foreign policy and national security team which was basically extracted from the Obama administration, after President Donald Trump cleared the way to prepare for the start of his administration. Reports that Biden planned to nominate former Federal Reserve Chair Janet Yellen as Treasury Secretary, potentially easing the passage of a fiscal-stimulus package to counter COVID-19 damage, also cheered markets. As a result of the newly found optimism, the MSCI all world index rose to a record high of 622.12. It was last trading flat, on course for a record monthly gain, before the rally reversed overnight, although that will likely prove temporary: a Reuters poll found that the rally for global stocks is set to continue for at least six months.

“The world is going to look a lot better this time next year than it does now, and that’s what equity markets are reflecting,” said Mike Bell, global market strategist at J.P. Morgan Asset Management. “The fact is the outlook has dramatically changed in the last month.”

The Stoxx Europe 600 Index edged lower, as cyclicals such as mining and energy firms fell, offsetting advances in defensives including utility shares. ABN Amro Bank NV and Commerzbank AG dropped more than 4% and led euro-area lenders lower after the European Central Bank said the industry will probably have to set aside more money to soak up losses when government pandemic support ends. European banking stocks retreated reversing gains following good news on dividend prospects from an FT report, according to which bank dividends would be allowed in 2021. However, less promising headlines from the ECB’s financial stability review poured cold water on that . While the central bank hasn’t made its stance clear, consensus seems to be that banks with bigger buffers and strong capital generation will be allowed to pay out some of the excess cash. However, dividend futures are barely moving, which implies that markets remain cautious on the outlook for payouts and are probably awaiting more clarity on the path of the economy.

Still, optimism around vaccine developments and expectations of a recovery in corporate confidence and profitability should also push European stocks to near record highs next year, a separate Reuters survey found.

Earlier in the session, MSCI’s index of Asia-Pacific shares outside Japan fell 0.4% erasing a gain of 1.1%, with Chinese shares capped by worries about rising debt defaults. Japan’s Nikkei rose to a 29-year high, though analysts and fund managers polled by Reuters foresaw a correction in the near term. Markets in Taiwan and South Korea also retreated.

As noted above, there is a literal tsunami of pre-holiday data on deck which includes everything from initial claims, to GDP, to capex, to new home sales, to the FOMC minutes:

- 8:30am: Initial Jobless Claims, est. 730,000, prior 742,000; Continuing Claims, est. 6m, prior 6.37m

- 8:30am: Advance Goods Trade Balance, est. $80.4b deficit, prior $79.4b deficit

- 8:30am: Wholesale Inventories MoM, est. 0.4%, prior 0.4%; Retail Inventories MoM, est. 0.6%, prior 1.6%

- 8:30am: GDP Annualized QoQ, est. 33.1%, prior 33.1%; Personal Consumption, est. 40.85%, prior 40.7%

- 8:30am: Core PCE QoQ, est. 3.5%, prior 3.5%

- 8:30am: Durable Goods Orders, est. 0.85%, prior 1.9%; Durables Ex Transportation, est. 0.5%, prior 0.9%

- 8:30am: Cap Goods Orders Nondef Ex Air, est. 0.5%, prior 1.0%; Cap Goods Ship Nondef Ex Air, est. 0.4%, prior 0.5%

- 10am: Personal Income, est. -0.1%, prior 0.9%; Personal Spending, est. 0.4%, prior 1.4%

- 10am: PCE Deflator MoM, est. 0.0%, prior 0.2%; PCE Deflator YoY, est. 1.2%, prior 1.4%

- 10am: U. of Mich. Sentiment, est. 77, prior 77; Current Conditions, prior 85.8; Expectations, prior 71.3

- 10am: New Home Sales, est. 975,000, prior 959,000; New Home Sales MoM, est. 1.67%, prior -3.5%

- 2pm: FOMC Meeting Minutes

“Now, there’s big event risk up ahead: FOMC minutes,” said Ilya Spivak, head Asia-Pacific strategist at DailyFX. “The worry is that the Fed will continue to signal that they’re keeping to a hands-off posture. No tightening, but no new easing either.”

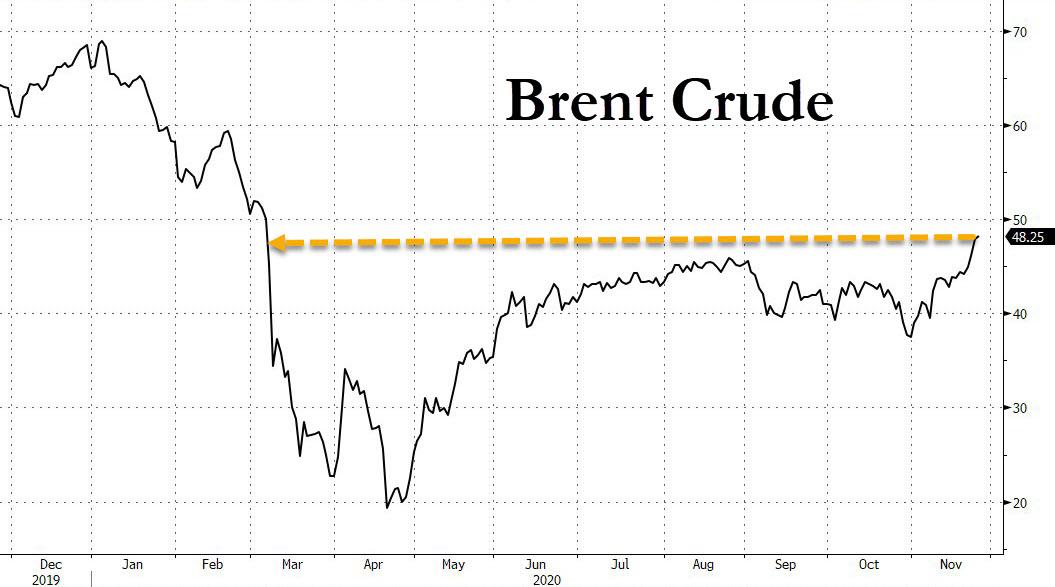

Despite the overnight market wobble, investors remain optimistic that upcoming virus vaccines would help the industries hit hardest by the pandemic, from tourism to energy. Global energy shares have risen almost 34% so far this month, on track for their best month on record as crude prices rally. Oil prices held near their highest levels since March on the improved global economic outlook. Brent futures were up 1.2% to $48.42 per barrel, touching a high last seen in March.

In FX, riskier currencies gained against safe havens, though the under-pressure dollar showed resilience as the morning went on. The Australian dollar moved to its highest since early September, already helped by investors unwinding bets on additional monetary easing. The Bloomberg Dollar Spot Index erased losses after dipping in early European hours and the dollar traded mixed versus G-10 peers, though most currencies were confined to narrow ranges ahead of the U.S. Thanksgiving holiday on Thursday. The dollar is expected to fall further as progress on a vaccine and the expected choice of Yellen as the next U.S. Treasury secretary relieved two big uncertainties for investors. The euro fell against the dollar, and was last down 0.1% at $1.18835, giving up an earlier gain to trade near the $1.19 handle while Norway’s krone led G-10 gains as oil prices continued to rally. The pound swung between gains and losses, as investors awaited more news on Brexit and U.K. Chancellor of the Exchequer Rishi Sunak’s spending review. The New Zealand dollar held up following the central bank governor’s clarification on negative interest rates and a round of quantitative easing purchases.

Risk-on moves played out in bond markets, too. Yields on benchmark euro zone debt rose from record lows, with German Bund yields edged to near their highest levels in almost a week before reversing. In the US, Treasuries were slightly richer across the curve in early U.S. trading as S&P 500 futures retreated from near-record highs. Yields were lower by ~1bp at long end of the curve, flattening 2s10s and 5s30s spreads by less than 1bp; the 2- , 5- and 7-year notes sold at auction Monday and Tuesday trade at profits, and potential exists for large month-end buying flows. No coupon supply events are slated ahead of Thursday’s U.S. holiday, however a pending economic data dump includes 3Q GDP revision, October durable goods orders and Nov. 5 FOMC minutes.

Bitcoin edged up 0.8% to $19,1420, staying within sight of its record peak of $19,666 after notching gains of nearly 40% in November alone.

Looking at today’s calendar, it’s a shitshow, with data on everything from initial jobless claims, the second estimate of Q3 GDP, durable goods orders, personal income, personal spending and new home sales, along with the final University of Michigan sentiment reading for November. From central banks, the Fed will be releasing the minutes of their November meeting, the ECB will publish their Financial Stability Review, and the ECB’s Holzmann will be speaking. Finally, the aforementioned spending review in the UK will be taking place.

Market Snapshot

- S&P 500 futures little changed at 3,632.50

- STOXX Europe 600 down 0.2% to 391.65

- MXAP down 0.06% to 191.33

- MXAPJ down 0.4% to 630.98

- Nikkei up 0.5% to 26,296.86

- Topix up 0.3% to 1,767.67

- Hang Seng Index up 0.3% to 26,669.75

- Shanghai Composite down 1.2% to 3,362.33

- Sensex down 1.6% to 43,813.45

- Australia S&P/ASX 200 up 0.6% to 6,683.33

- Kospi down 0.6% to 2,601.54

- Brent futures up 1% to $48.34/bbl

- Gold spot up 0.3% to $1,812.63

- U.S. Dollar Index down 0.1% to 92.12

- German 10Y yield fell 1.1 bps to -0.574%

- Euro up 0.03% to $1.1896

- Italian 10Y yield fell 1.2 bps to 0.501%

- Spanish 10Y yield fell 1.0 bps to 0.064%

Top Overnight News from Bloomberg

- Euro-area banks will probably have to set aside more money to soak up losses when government pandemic support ends and the economy grapples with massively increased debt, the European Central Bank said

- European Commission President Ursula von der Leyen said the coming days will be “decisive” for trade negotiations with the U.K. and crucial differences between the two sides remain

- As Treasury secretary, Janet Yellen is almost certain to pursue tighter coordination with the U.S. Federal Reserve next year — repairing recent frictions — though observers say she will be careful to avoid any specific move that could trigger a wave of Republican protests

- German Chancellor Angela Merkel is proposing a further tightening of the country’s coronavirus restrictions, setting the stage for another tense round of discussions with the country’s state premiers who favor more lenient measures

- The deadlock over the European Union’s $2 trillion spending package may not be resolved soon, potentially depriving Hungary of much of its funding from the bloc next year, Finance Minister Mihaly Varga told the Vilaggazdasag business daily

- A ECB-backed committee is exploring options for a transition should Euribor, one of the cornerstones of the European Union’s financial system, cease to exist

- A significant number of asset managers risk being locked out of the interest-rate swaps market early next year unless they sign on to a new protocol designed to smooth the transition away from Libor, warned the chairman of the U.S. Commodity Futures Trading Commission

- Coronavirus restrictions in the U.K. will be eased over Christmas to allow as many as three households to meet indoors

- BOE policy maker Michael Saunders warned that the turn of the year will be rocky under the twin impacts of the coronavirus and Brexit — though the latter will ultimately be the bigger challenge

US Event Calendar

- 8:30am: Initial Jobless Claims, est. 730,000, prior 742,000; Continuing Claims, est. 6m, prior 6.37m

- 8:30am: Advance Goods Trade Balance, est. $80.4b deficit, prior $79.4b deficit

- 8:30am: Wholesale Inventories MoM, est. 0.4%, prior 0.4%; Retail Inventories MoM, est. 0.6%, prior 1.6%

- 8:30am: GDP Annualized QoQ, est. 33.1%, prior 33.1%; Personal Consumption, est. 40.85%, prior 40.7%

- 8:30am: Core PCE QoQ, est. 3.5%, prior 3.5%

- 8:30am: Durable Goods Orders, est. 0.85%, prior 1.9%; Durables Ex Transportation, est. 0.5%, prior 0.9%

- 8:30am: Cap Goods Orders Nondef Ex Air, est. 0.5%, prior 1.0%; Cap Goods Ship Nondef Ex Air, est. 0.4%, prior 0.5%

- 10am: Personal Income, est. -0.1%, prior 0.9%; Personal Spending, est. 0.4%, prior 1.4%

- 10am: PCE Deflator MoM, est. 0.0%, prior 0.2%; PCE Deflator YoY, est. 1.2%, prior 1.4%

- 10am: U. of Mich. Sentiment, est. 77, prior 77; Current Conditions, prior 85.8; Expectations, prior 71.3

- 10am: New Home Sales, est. 975,000, prior 959,000; New Home Sales MoM, est. 1.67%, prior -3.5%

- 2pm: FOMC Meeting Minutes

DB’s Jim Reid concludes the overnight wrap

Well I heard “Fairytale of New York” for the first time in 2020 yesterday and my wife put on a Michael Buble Xmas album over dinner last night, but as regular readers know I don’t get into the Xmas spirit until I hear “Last Christmas” by Wham! Today marks a month until Xmas and only 22 trading days until the big day including today. If you assume that Thanksgiving tomorrow and Friday are near write offs then that leaves you with two less. So we are certainly getting to the end of a forgettable but ultimately unforgettable year.

The Santa Claus rally has already been underway since the election with the extra cyclical Santa treat coming in the form of the recent vaccine news. Indeed global equity markets rallied once again yesterday with the notional highlight being the Dow Jones breaking through the 30,000 barrier for the first time as investors were relieved by the prospect of a smooth presidential transition following the General Services Administration’s move to commence the process. Though President Trump said in a tweet yesterday that “the GSA does not determine who the next President of the United States will be”, the move has allayed market fears that the US will face extended political uncertainty in the coming weeks, and comes as increasing numbers of states have moved to certify their election results, with Pennsylvania the latest to announce yesterday. As well as this, another catalyst from after the previous day’s European close was the choice of former Fed Chair Yellen to be Biden’s Treasury Secretary, since she’s seen as someone who’ll coordinate well with the Federal Reserve and be market friendly.

As mentioned, the Dow Jones (+1.54%) moved to an all-time high, aided by a +4.56% move from Boeing. The S&P 500 was also up +1.62% to its own all-time high, though the NASDAQ lagged a little with a +1.31% rise as tech stocks underperformed the broader equity market. Our new favourite measure, namely the equal weight S&P 500, was +2.18% showing the bias to the non-mega caps. On this, in yesterday’s CoTD we showed how the top ten largest companies in the world were at that highest share relative to the next 90 largest since we have data and probably a lot further back than that. We think a vaccine will be the turning point towards normalising that relationship. See the graph here .

With the mega-cap tech stocks underperforming the story remains on the normalisation theme. US small caps stocks rose +1.94%, having gained in seven of the last eight sessions. The ratio of the Russell 2000 over the NASDAQ is just shy of its highest level of the pandemic so far with the small cap index on track for its best month ever. On the single stock level, the strong performances by Carnival (+11.28%), United Airlines (+9.85%), MGM Resorts (+8.80%) and Royal Caribbean Cruises (+7.72%) showed how the travel industry continues to respond positively to the vaccine headlines. In other back-to-normal moves, bank stocks continued improving on both sides of the Atlantic with S&P 500 Banks rising +5.53% and their European counterparts rising +4.66% yesterday as core yields continued to rise.

Big moves higher were also seen from energy stocks (+5.16% in US and +4.65% in Europe) as both Brent Crude and WTI oil prices rose to a post-pandemic high of $47.86/bbl and $44.91/bbl respectively. Europe missed out on the last legs of the US rally last night but the STOXX 600 rose +0.91% to reach a post-pandemic high, while the DAX rose +1.26% to move back into positive territory on a YTD basis.

Overnight, Xinhua has reported that Sinopharm has submitted an application in China to bring its Covid-19 vaccine to the market. The application is believed to include data on the company’s Phase III trials conducted in the Middle East and South America. This application will likely make Sinopharm the first developer outside of Russia to see its shots made available for general public use. Sinopharm’s vaccine already had emergency use authorisation in China and according to reports they have been given to hundreds of thousands of people so far. They have not released any public data on the efficacy of its shots though. A Chinese vaccine would be helpful for the ASEAN countries as most of them have pre-dose agreements with China. Elsewhere, we saw new information from AstraZeneca that showed that the more successful half dose/full dose measure was only given to those under 55 years old.

Asian markets are trading a little more mixed this morning after paring early larger gains. The Nikkei (+0.76%) and Hang Seng (+0.44%) are still up while the Shanghai Comp (-0.33%) and Kospi (-0.94%) have turned red. Meanwhile, futures on the S&P 500 are up a modest +0.08% and the US dollar index is down -0.14%.

In other overnight news, Bloomberg has reported that Treasury Secretary Steven Mnuchin will put $455bn in unspent Cares Act funding into the agency’s General Fund which will then require Treasury Secretary elect Yellen to seek congressional approval for using the monies. Most of this money had gone to support the Fed’s emergency-lending facilities. Elsewhere, the FT has reported that the ECB is signaling that it could lift the ban on bank dividends next year.

The flip side of the positive news yesterday was that safe havens struggled once again, and gold prices fell another -1.65% to a fresh 4-month low of $1,808/oz. In FX as well, the traditional safe-haven Japanese yen was the worst-performing G10 currency for the second day running. As referenced above, it was a similar story for core sovereign bonds, with yields on 10yr Treasuries (+2.6bps), bunds (+1.8bps) and gilts (+1.2bps) all rising, though there was a tightening of peripheral spreads in line with the broader rally in risk assets. Notably, yields on Italian 10yr BTPs fell to an all-time low yesterday of 0.61%, and their spread over 10yr bund yields fell to a 2-year low of 1.17%.

One asset that didn’t struggle yesterday was Bitcoin, which surged another +2.84%, closing at $18,945 which was just shy of the all-time closing high of $19,042. It didn’t quite breach its all-time intraday high in December 2017 of $19,511, but the cryptocurrency broke the $19,400 mark intraday. The move still leaves Bitcoin up +164.66% up on a YTD basis. Meanwhile Tesla rose +6.43% to a fresh record high that saw the company’s market cap surpass $500bn for the first time, with the share price having surged +564% since the start of the year.

Here in the UK, attention today will focus on the government’s Spending Review, as well as the Office for Budget Responsibility’s latest forecasts for the economy and the public finances. This is just a one-year review for 2021-22, but it will be interesting to see what the long-term fiscal picture looks like as well as the extent of tightening pencilled in for the year ahead. Fortunately for the government there have been signs that the latest lockdown is having an effect on the Covid numbers, with the number of daily confirmed cases falling to 11,299 yesterday, the lowest since October 2, while the latest 7-day average of 18,295 was also the lowest in just over a month.

Elsewhere on Covid, French ICU occupants which currently sits at just shy of 4500 is expected to fall below 3000 by the end of the month, and to under 1500 by the middle of December according to the Istitut Pasteur. The research centre added that they estimate that 11% of the overall French population has already been infected by the virus. This came as President Macron announced that the lockdown measures will be lifted gradually from this Saturday onward when small stores can reopen. Notably, restaurants will remain closed until January 20, but much of the lockdown is set to be lifted by December 15. However ski resorts will stay shut until the new year which means I now won’t be skiing at Xmas.

In an effort to contain the virus’s spread around the Thanksgiving holiday in the US, New York City will have checkpoints at specific bridges and crossings to enforce the travel quarantine and set up testing appointments. These will not be used for those travelling to contiguous states but the city’s measures will be enforced for those using the city’s airports and train stations.

On the data side, the Ifo’s business climate indicator from Germany fell to 90.7 in November (vs. 90.2 expected). That’s the second consecutive monthly decline and comes on the back of rising restrictions in Europe in response to the second wave of the pandemic. Over in the US, the Conference Board’s consumer confidence indicator also fell in November to 96.1 (vs. 98.0 expected), and the expectations indicator fell for a second month running to 89.5.

To the day ahead now, and there’s an array of US data releases ahead of tomorrow’s Thanksgiving holiday, including the weekly initial jobless claims, the second estimate of Q3 GDP, the preliminary reading of October’s durable goods orders, October’s personal income, personal spending and new home sales, along with the final University of Michigan sentiment reading for November. From central banks, the Fed will be releasing the minutes of their November meeting, the ECB will publish their Financial Stability Review, and the ECB’s Holzmann will be speaking. Finally, the aforementioned spending review in the UK will be taking place.

via ZeroHedge News https://ift.tt/33dYlhW Tyler Durden