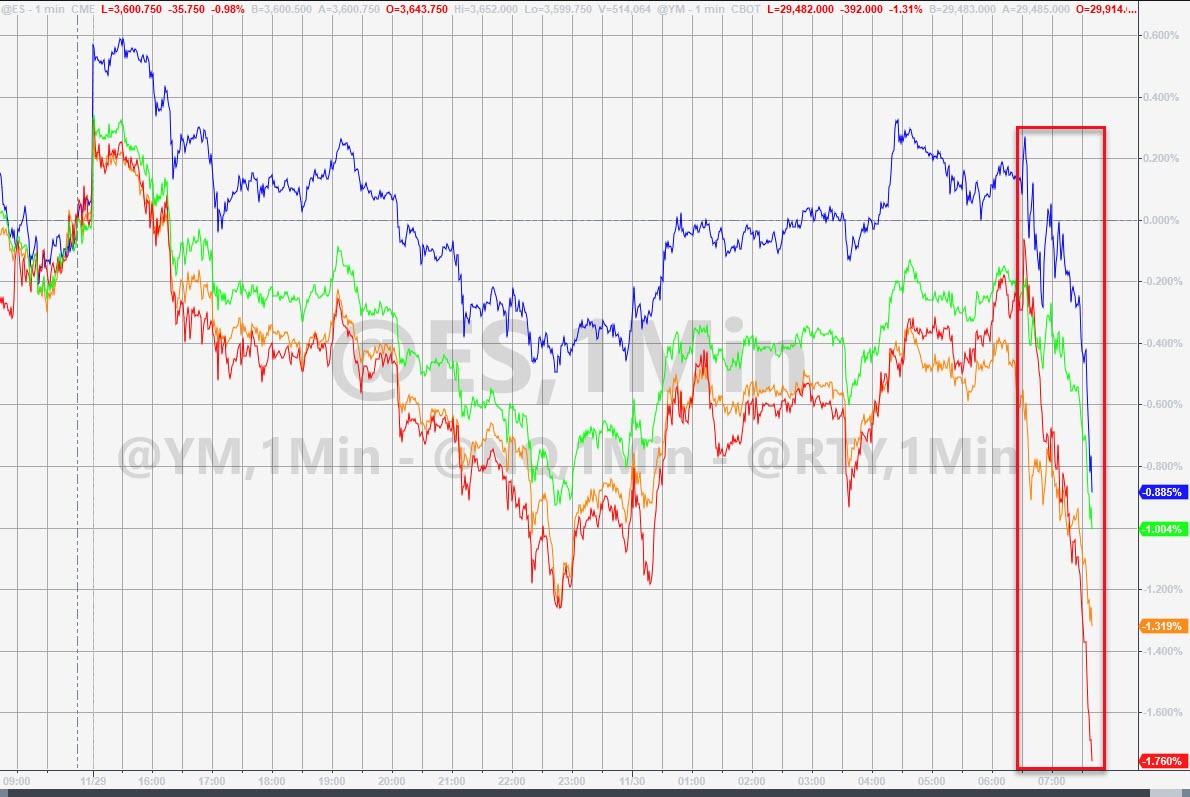

Stocks Slammed As Month-End Selling Accelerates, Yellen Tweets

Tyler Durden

Mon, 11/30/2020 – 10:46

Today’s selling began as Joe Biden announced his economic team – coincidence?

Janet Yellen – Biden’s nominee for Treasury Secretary – tweeted for the first time:

We face great challenges as a country right now. To recover, we must restore the American dream—a society where each person can rise to their potential and dream even bigger for their children.

As Treasury Secretary, I will work every day towards rebuilding that dream for all.

— Janet Yellen (@JanetYellen) November 30, 2020

And stocks tanked…

Additional selling catalysts include major month-end selling, as JPMorgan recently noted.

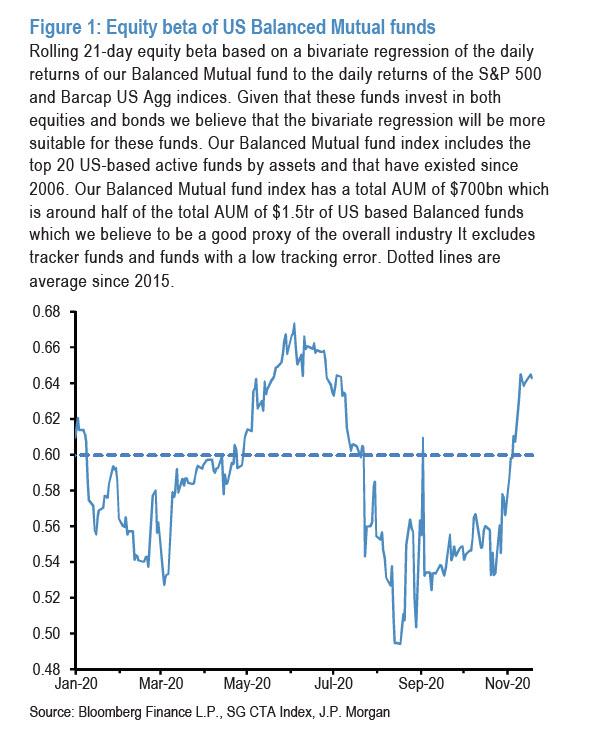

According to Panigirtzoglou, “if the picture in Figure 1 is a true reflection of how balanced mutual funds have been positioned in recent weeks, then there would be some vulnerability in equity markets in the near term from balanced mutual funds having to sell equities to revert to their 60:40 equity:bond target allocation, either by the end of November or by the end of December at the latest.”

There’s more: according to JPM, the equity rebalancing flow is likely to also be an issue into year or quarter-end, i.e. the end of December, especially if equity markets continue to grind higher into December. This is because of likely negative pending rebalancing by entities that tend to rebalance on a quarterly basis, such as US defined benefit pension plans, Norges Bank, i.e. the Norwegian oil fund, and the Japanese government pension plan, GPIF.

-

US defined benefit pension plans are a big $7.5tr AUM universe. They tend to rebalance more slowly over 1-2 quarters or so. Assuming they were fully rebalanced at the end of September, and by taking into account the QTD performance of US equities and bonds, JPM believes that the pending equity rebalancing flow by US defined benefit pension plans into the current quarter-end is negative at around -$110bn.

-

By doing the same calculation for Norges Bank, a $1.2tr AUM entity, the bank estimates that the pending equity rebalancing flow by Norges Bank into the current quarter-end is likely negative at around $15bn.

-

A similar calculation for the giant Japanese government pension plan, GPIF, a $1.5tr AUM entity, JPM estimates that the pending equity rebalancing flow by GPIF into the current quarter-end is likely negative at around -$25bn.

In all, Panigirtzoglou echoes Goldman’s month/quarter end year-end selling concerns, writing that he sees “some vulnerability in equity markets in the near term from balanced mutual funds, a $7tr universe, having to sell around $160bn of equities globally to revert to their target 60:40 allocation either by the end of November or by the end of December at the latest.”

Of course, if this is the real catalyst, there is a lot more downside here, but did these massive managers really leave their allocation shift until the last day of the month?

via ZeroHedge News https://ift.tt/36kAq24 Tyler Durden