Market Euphoria Surpasses Dot Com Levels: What’s An Investor To Do?

Tyler Durden

Tue, 12/01/2020 – 14:25

As Knowledge Leaders Capital poetically puts it, there couldn’t be a greater bullish cocktail of recent news, with three COVID vaccines showing strong promise against a backdrop of zero interest rates, a record fiscal deficit and an uber-dove – Janet Yellen – in charge of it all.

There is another way of putting it: extreme euphoria, the likes of which surpass even the dot com bubble.

Naturally, stocks have taken the recent newsflow very well, with prices hitting record highs despite elevated valuations. In fact, as discussed here recently, the November rally has been driven by the most shorted stocks, taking the S&P 500 to technical levels not seen in years, while valuations are back to 2000 levels.

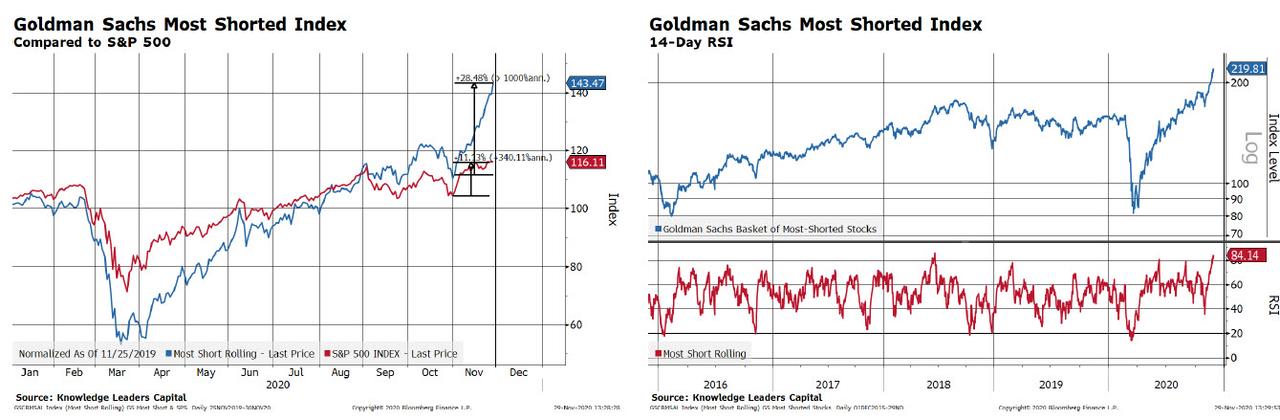

Confirming yet again what we said most recently last August in “Going Against The Wall Street Crowd Has Been The Most Profitable Strategy“, KLC notes that the November rally was clearly a short covering rally. As shown below, the most shorted stocks were up 28.48% since November 2, while the S&P 500 is up about 11.1%. The Goldman Sachs Most Shorted Index’s RSI reading is 84.14, only eclipsed by June 20, 2018.

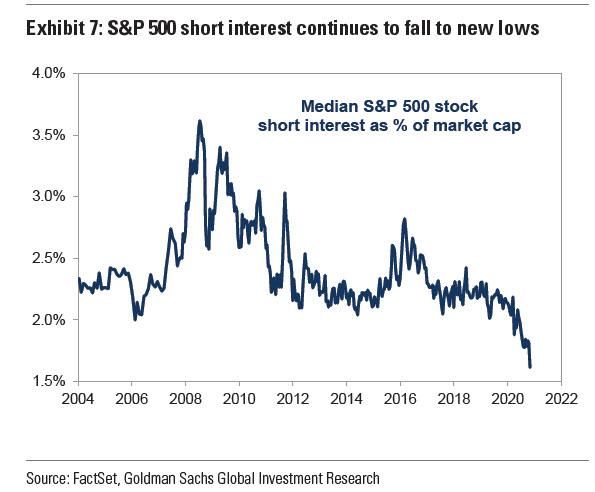

However, as we also showed two weeks ago, shorts are now almost extinct, and as KLC notes, the tank appears to be running low. Indeed, looking at the median stock in the S&P 500, short interest is the lowest in 15 years.

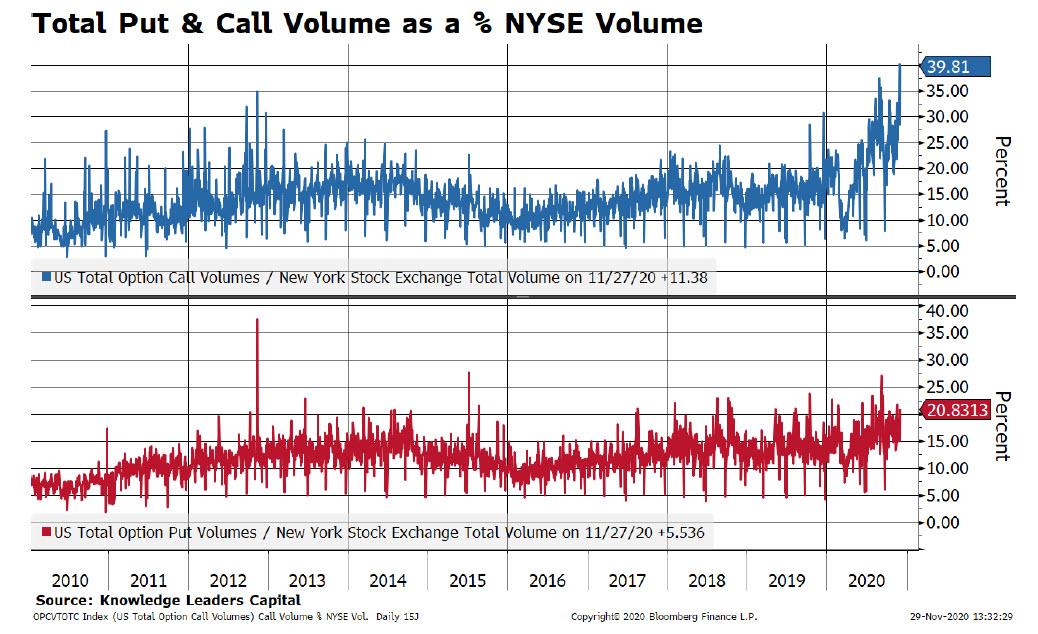

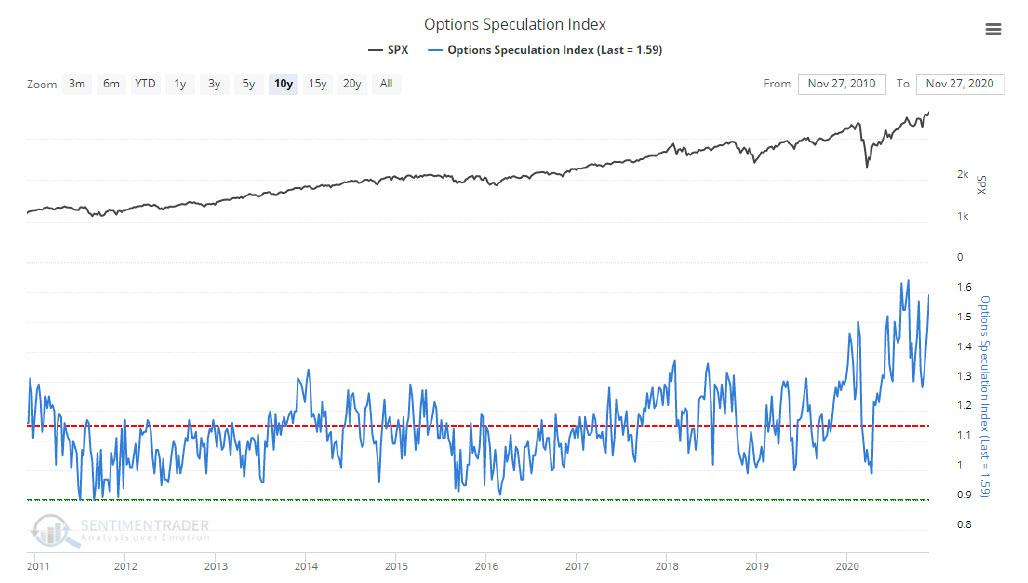

However, it’s not just forced short covering that is driving the meltup: activity in the options market is just “downright euphoric” in and according to KLC, a huge source of potential dislocation. As of last week, call volumes were 4x normal, and even more striking: call buying has just gone parabolic and now represents about 40% of NYSE total volume. This is the highest reading in history.

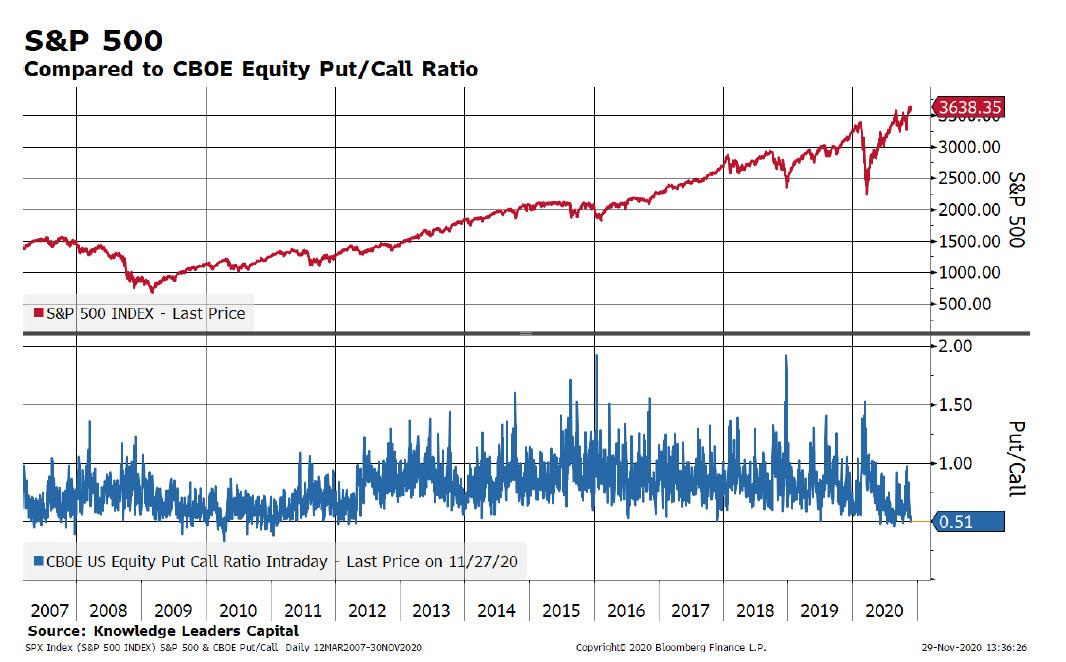

At the same time, the put/call ratio is at multi-year lows.

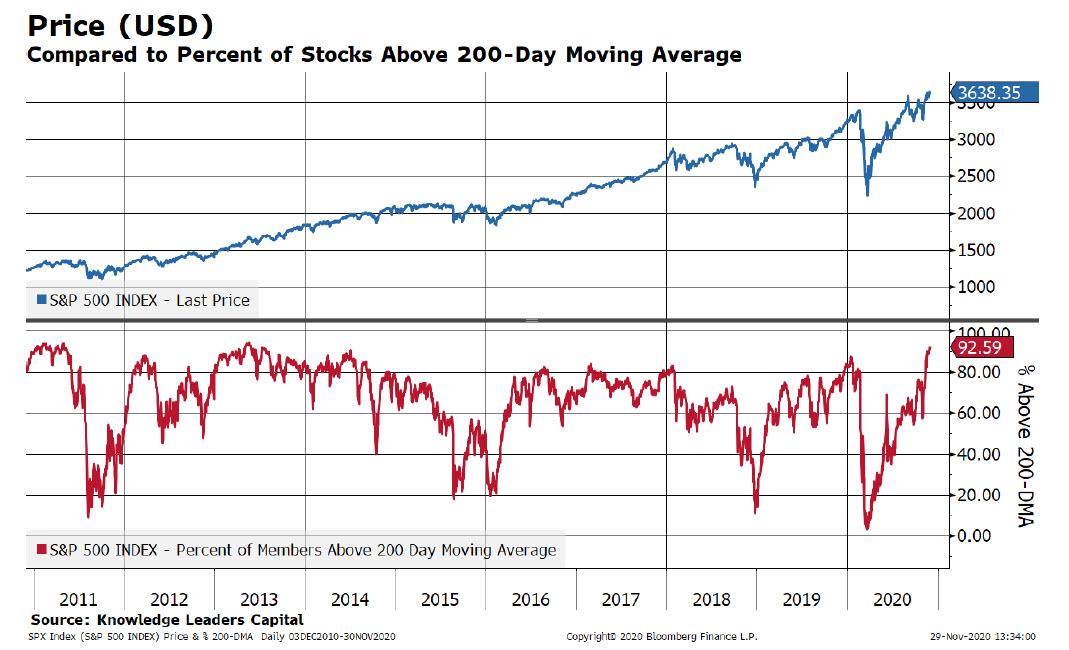

To be sure, the euphoria is not just in calls, it’s everywhere with 92.5% of S&P 500 stocks now trading above their 200-day moving average, reaching an overbought level last seen in 2014.

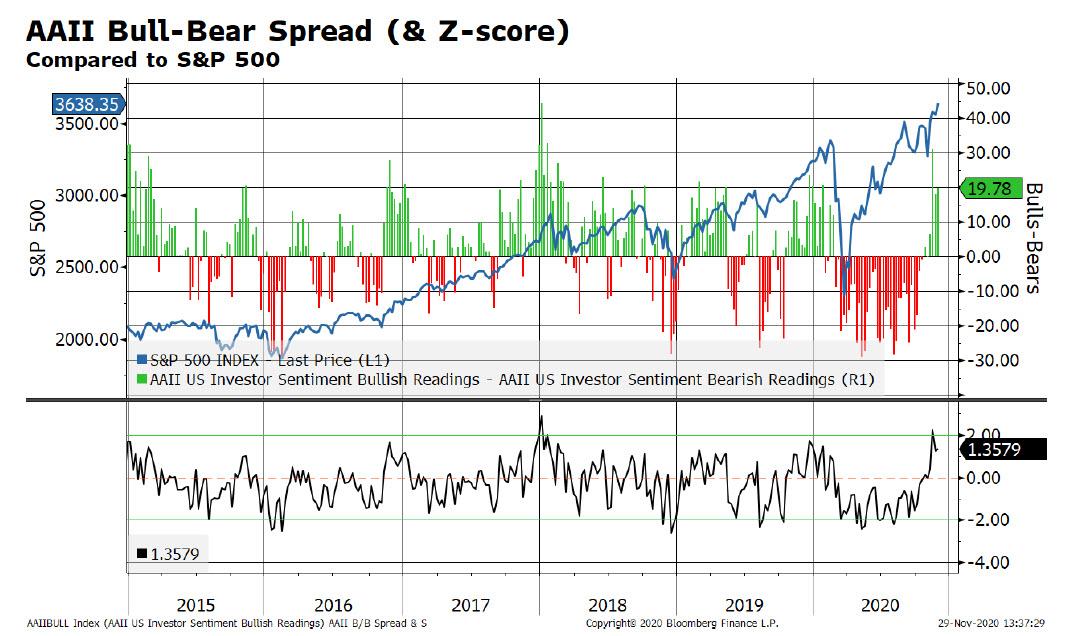

AAII bulls minus bears hit +30 recently, a two standard deviation event not seen since January 2018.

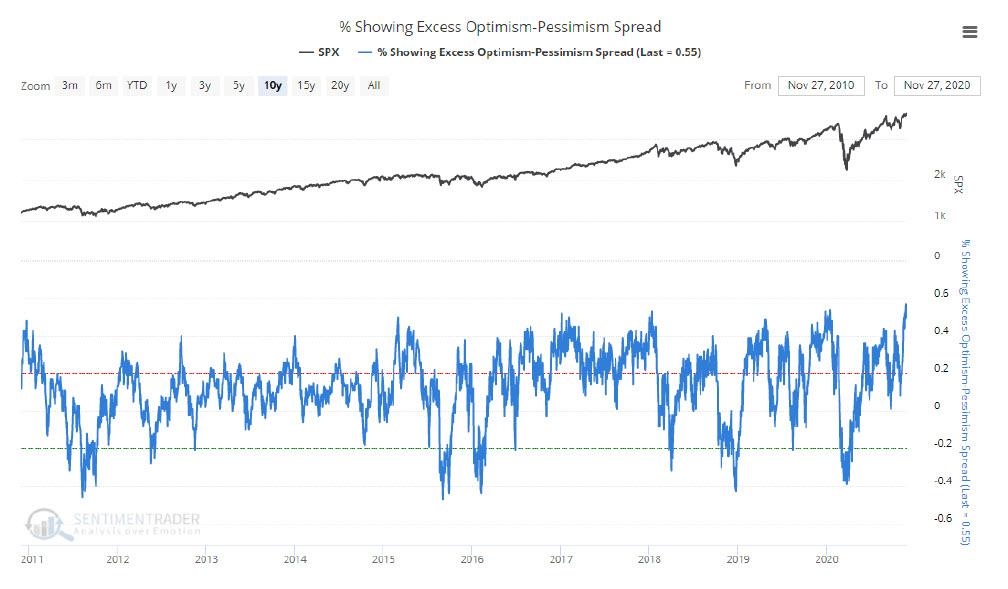

At the same time, the Sentiment Trader percent of indicators showing excessive optimism minus the indicators showing excessive pessimism is at record levels of net optimism…

… while Sentiment Trader’s Options Speculation Index is in historically elevated territory, a function of the surge in call buying:

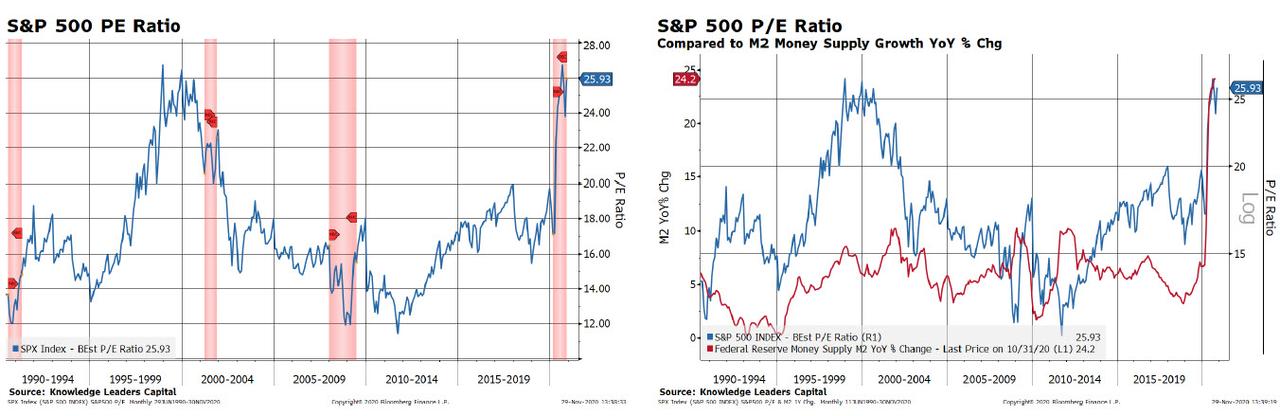

This flood into equities has pushed the forward P/E of the S&P 500 back to 2000 levels. This is also a function of the surge in money growth.

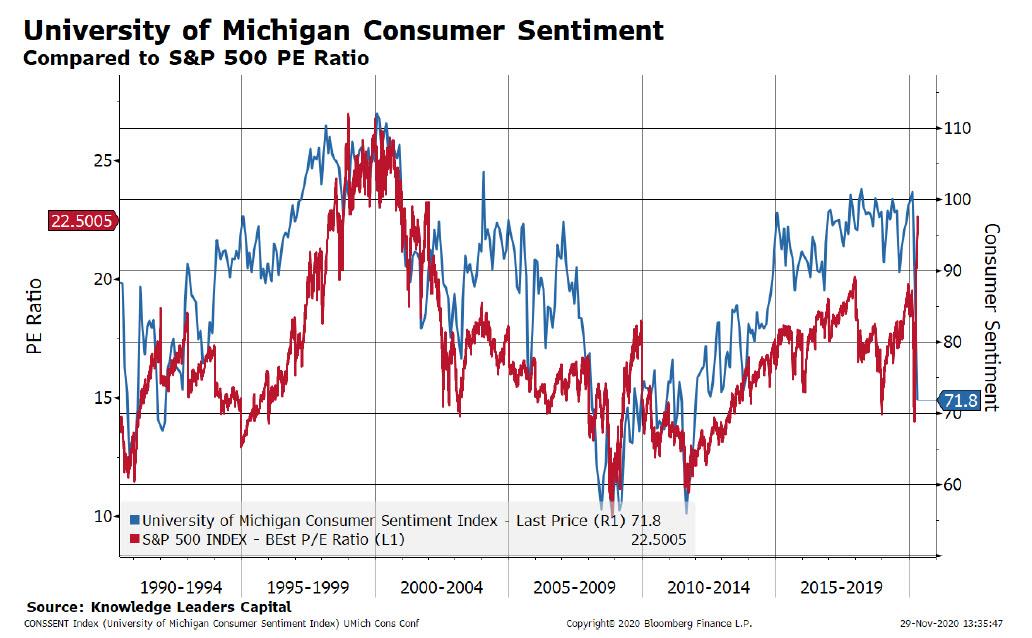

But, as KLC points out, across a variety of indicators this market euphoria is increasingly disconnected from economic variables, like consumer confidence which has recently rolled over.

The University of Michigan consumer sentiment has plunged to levels associated with much lower valuations.

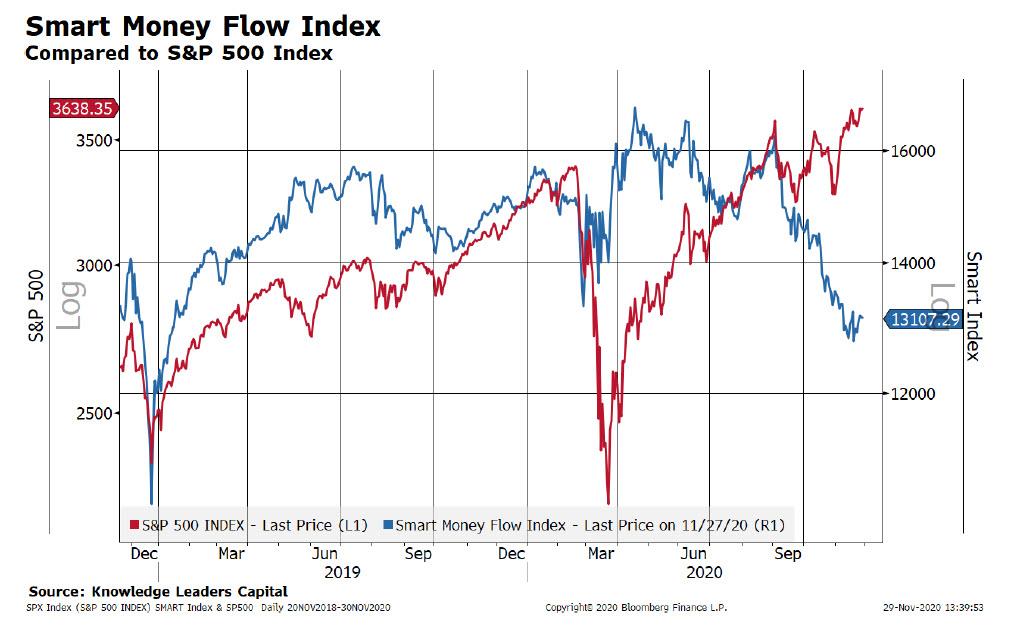

Financial divergences are becoming more widespread too, with the SMART Money Flow index tumbling as stocks rise, indicating a continued distribution from whales to retail investors.

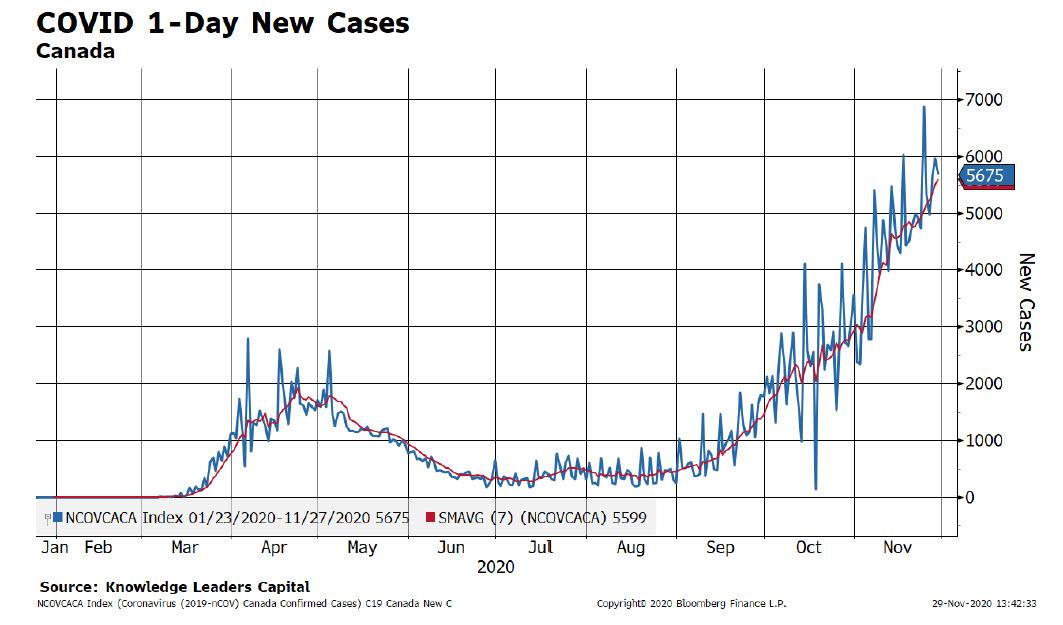

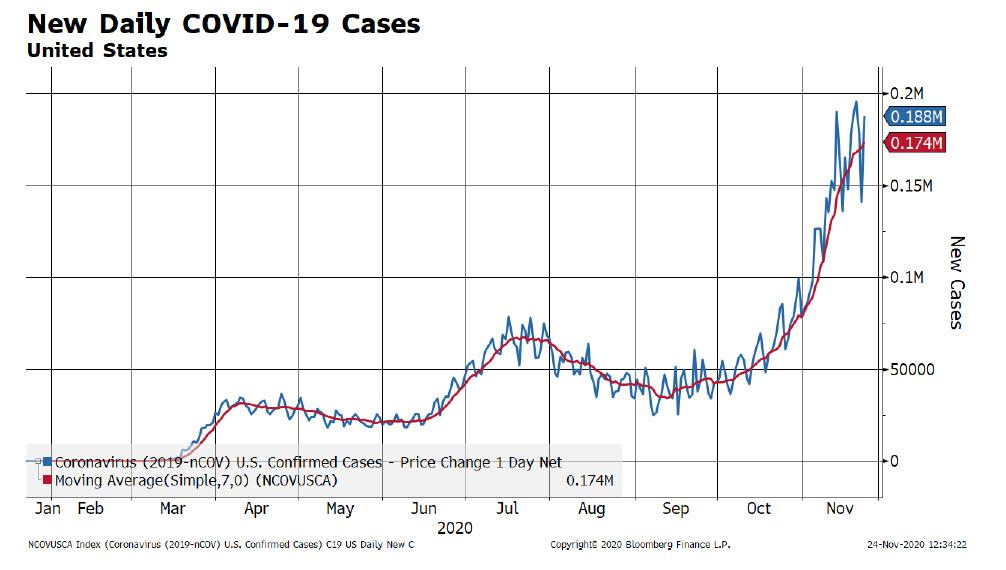

It is also disconnected from the potential escalation of the COVID pandemic, which will likely see even more cases in the coming weeks. Consider that Canada celebrated its Thanksgiving on Monday October 11, 2020. Daily new COVID cases have surged by 3.5x since the holiday.

If Canada is any template, the US could see daily new cases rise to 600,000/day by Christmas.

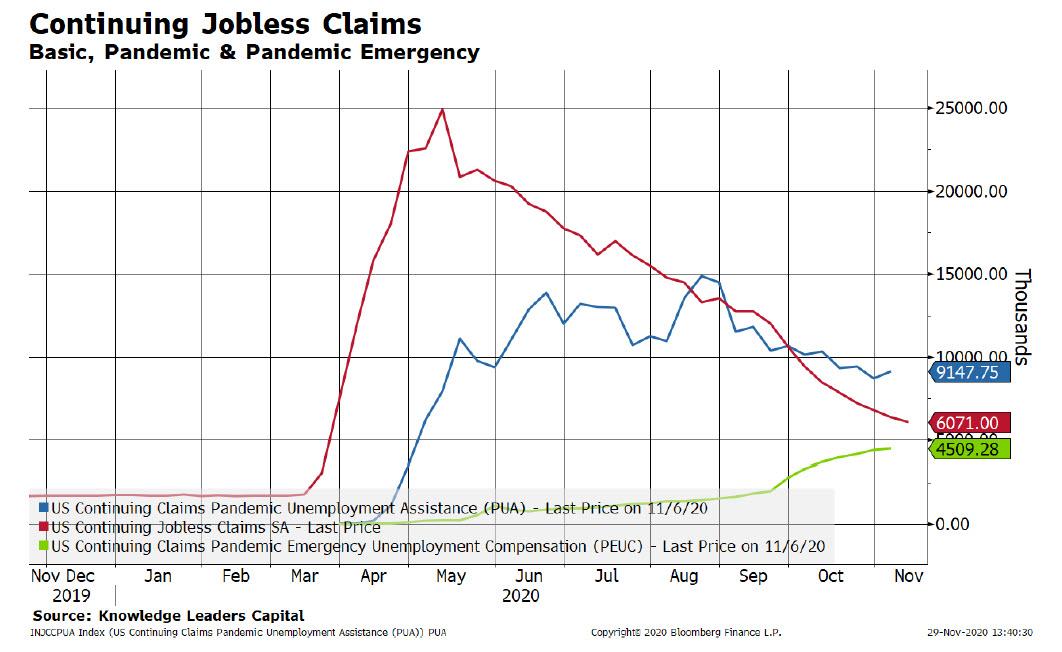

At the same time, as discussed last week, the economy faces a double whammy from the expiration of extraordinary unemployment benefits at the end of the year.

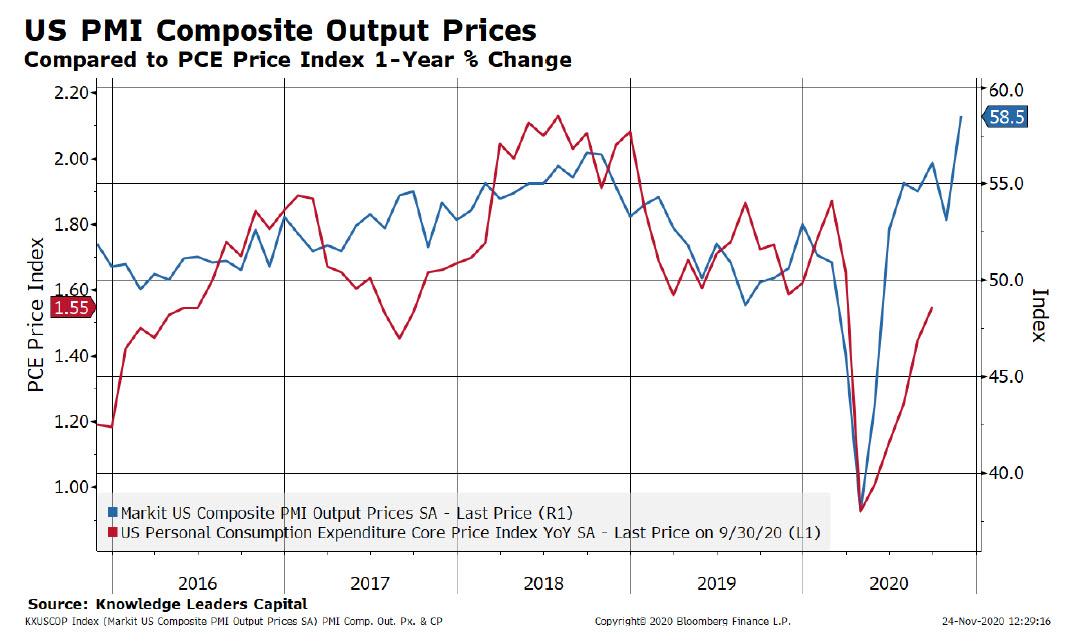

Meanwhile, inflationary pressures – no matter how hard the Fed tries to ignore them – are building: the PMI Composite Output Price index just posted its highest reading ever.

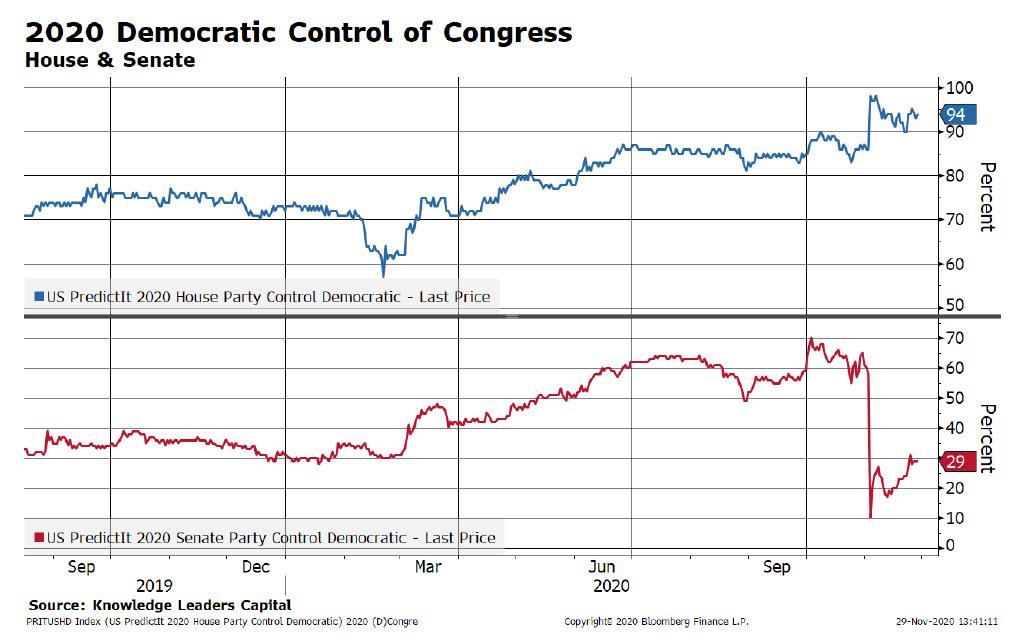

Inflation will only become more pressing if Democrats win the Senate: while still low, odds for a Democratic controlled Senate are rising, and were at 30% last.

With the disconnected between markets and the economy stretched like a rubberband, what are investors to do: go all in stocks hoping the biggest bubble in history keeps growing, or pull back?

And further to that point, the question whether gold a leading indicator for the stock market?

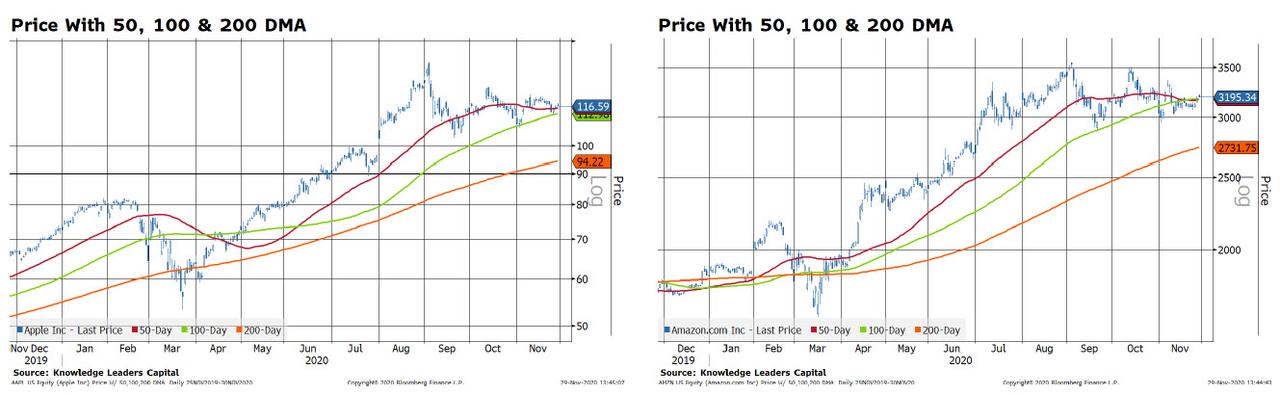

Consider that market leaders Apple and Amazon peaked on September 2, 2020 (yet still sit some 20% above their 200-day moving average). According to KLC, “the consolidation in these names portends further drops”:

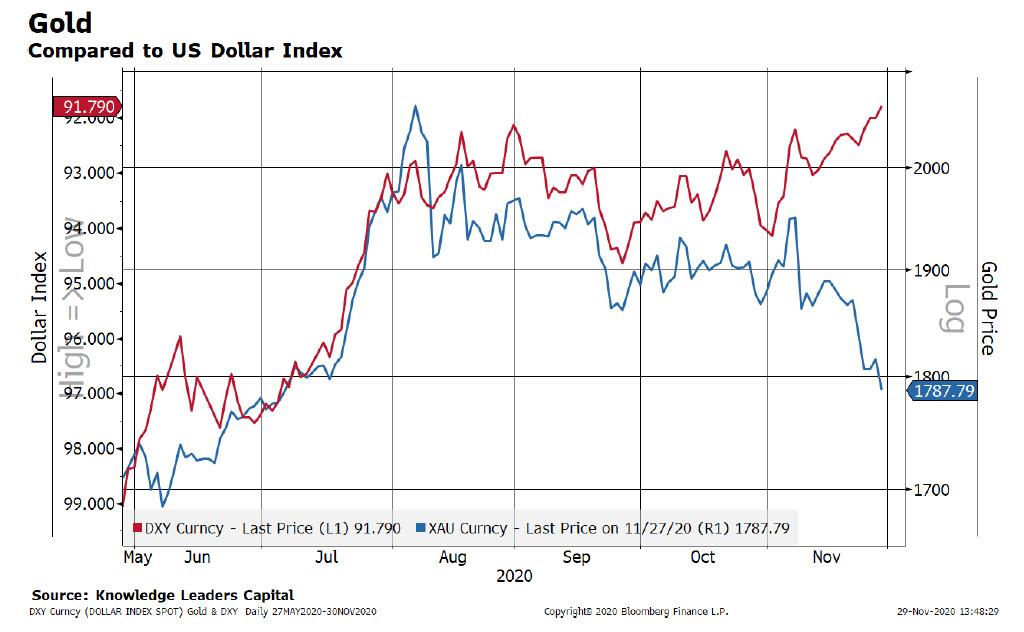

Meanwhile gold peaked about a month before the FAAMGs, and has fallen 10%, testing the 200-day moving average (gold miners already crossed through their 200-day moving average on November 23, 2020).

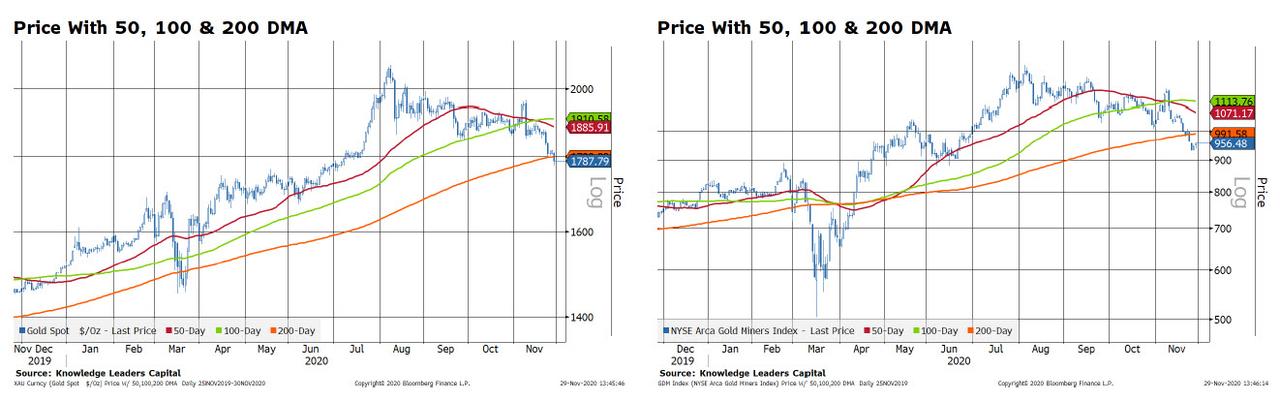

The S&P 500 has underperformed gold since 2018, and this is the third time that the S&P 500 has rallied back to its downward

trendline relative to gold since 2018.

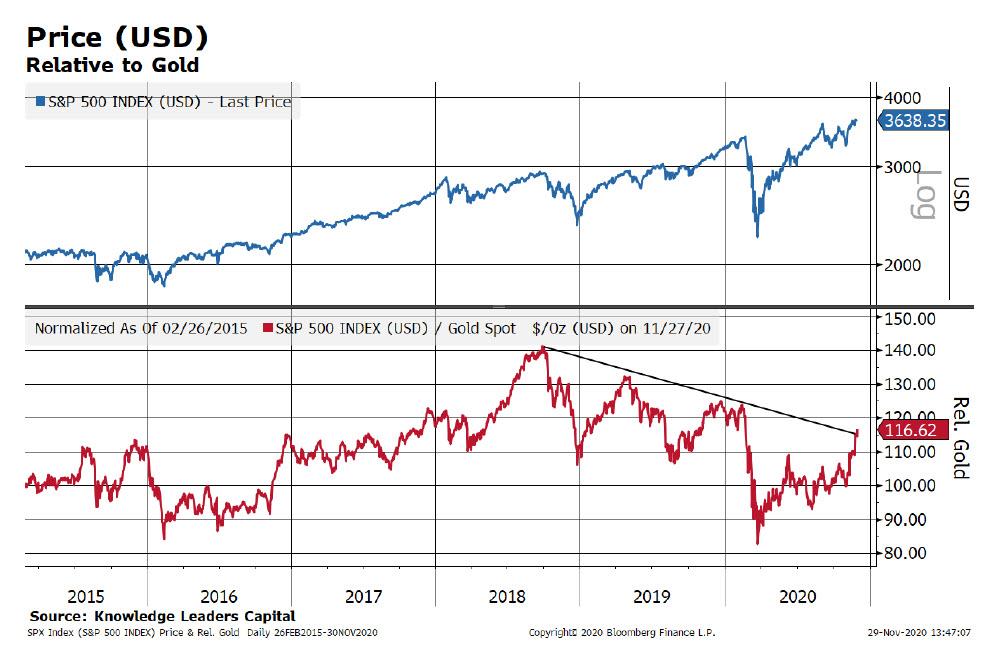

In this context, it shouldn’t come as a surprise that KLC believes that while stocks are poised to drop, gold should rise for two reasons: 1) TIPS yields and 2) USD.

TIPS yields have been falling all month, from -79bps to -93bps, yet gold has failed to recouple.

And while the DXY Index has broken down to new lows for the year, gold has also retreated. This means that gold has a catch-up period relative to the USD.

The authors’ conclusion: “Going into the end of the year, we think the risks in the equity market are high while gold and gold miners look relatively attractive.”

via ZeroHedge News https://ift.tt/2KYiH8w Tyler Durden