S&P Faces $2 Billion “Gamma Gravity” Trap At 3,650

Tyler Durden

Tue, 12/01/2020 – 09:42

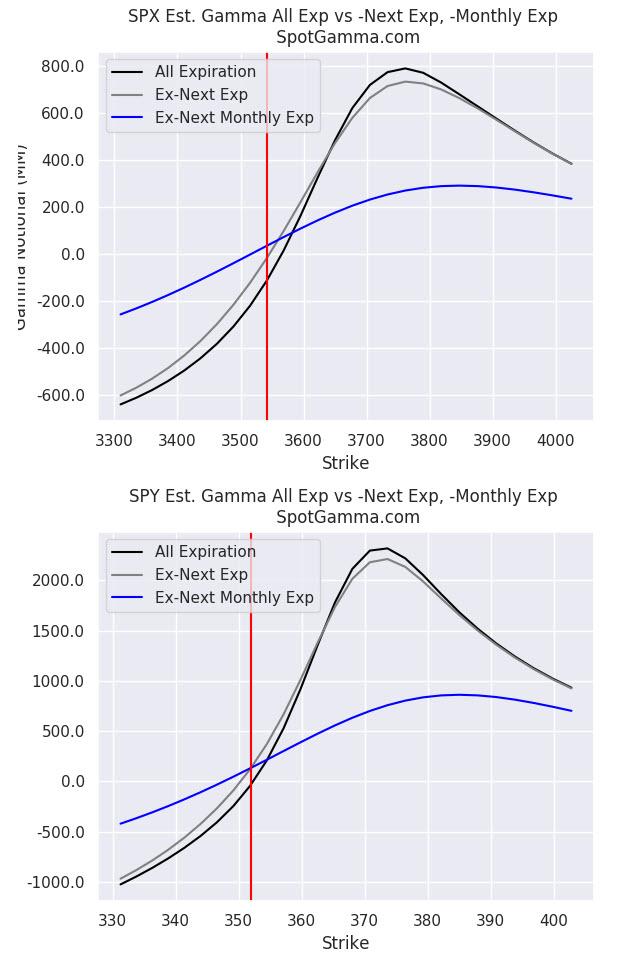

With emini futures trading just shy of all time highs, and the cash S&P hitting record highs, the question is will momentum accelerate to the upside or will the infamous gamma gravity kick in? According to our friends at SpotGamma, along with the move higher in the S&P, gamma levels in the index have built to over $2bn notional (between both the SPX+SPY) “which typically indicates mean reverting market action in the context of upward – trending prices.”

Additionally the climbing such “walls of gamma” also often leads to a reduction in volatility: according to SpotGamma, with the VIX at 20 this morning, a break of that level will incentivize dealers “to buy deltas as those large DEC put positions decay.”

Finally, the largest gamma level on the board is now 3650 indicating that options positions are filling in around recent SPX prices.

This all sets up as a “constructive base” for a push to new record highs above 3700 as virtually nothing stands in the way of even more market levitation in a world where central banks will immediately step in and rescue traders at the first sign of trouble.

via ZeroHedge News https://ift.tt/3fTWoMB Tyler Durden