S&P Inclusion Of Tesla At All-Time-Highs Zaps The Stock Of Its Alpha-Generating Power

Tyler Durden

Wed, 12/02/2020 – 11:45

Wouldn’t it be something if Tesla was joining the S&P index just in time for its spectacular fall from grace? Or better yet, if its index inclusion actually caused a fall from grace?

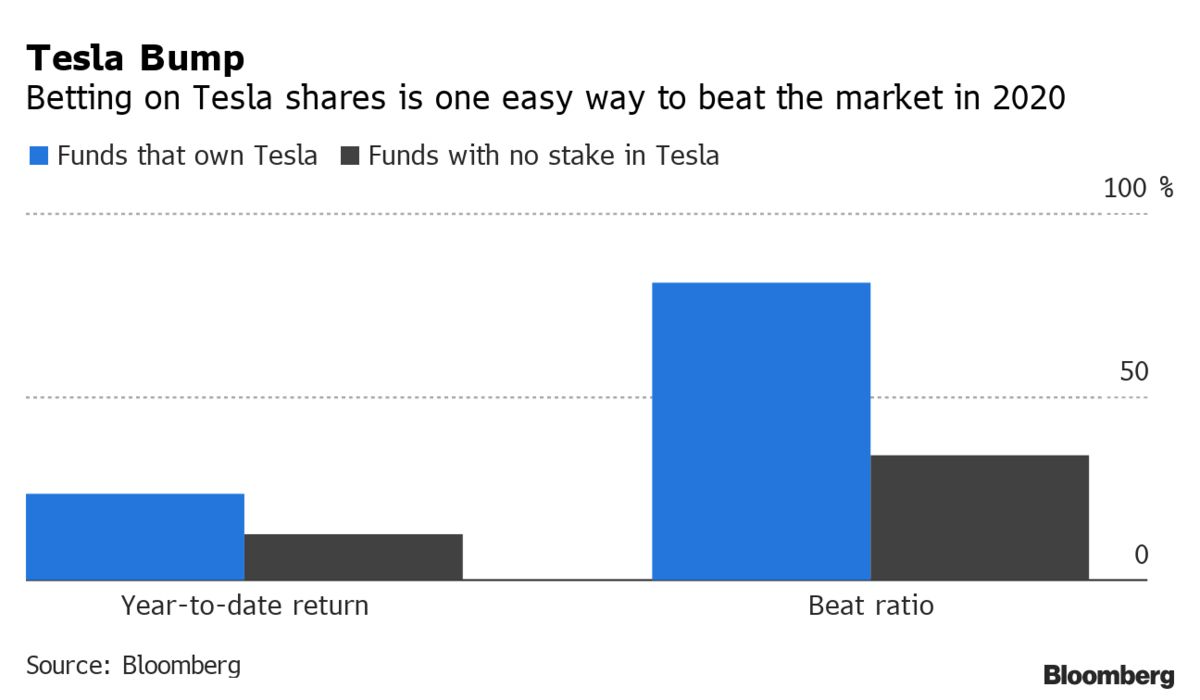

Regardless of whether or not that becomes the case, the use of Tesla as an investment for hedge fund managers to generate alpha – which, admittedly, holding Tesla over the last year did in excess – comes off the table with its inclusion into the index.

Out of 215 active managers with more than $500 million in assets who gauge their performance versus the S&P, only 21 owned Tesla, Bloomberg noted this week. Tesla is going to be entering the index as a Top 10 weighting, due to its nearly $550 billion market cap, before the end of the year.

This means that anyone looking to “pile on” and generate alpha from Tesla are going to find it harder to beat the index it is now a part of. It also means that large-brained managers who used Tesla as their “secret weapon” to generate returns, like Cathie Wood and Ross Gerber, could have to start looking elsewhere.

Matt Bartolini, head of SPDR Americas Research at State Street Global Advisors, told Bloomberg: “It could create more of a hurdle for active managers because this is obviously a stock that’s had phenomenal performance over the past few years that hasn’t been included in a lot of active managers’ prospective benchmarks and now will be. If Tesla continues on its run, that could be a second-derivative of including it into the S&P 500 — it’s a more challenging environment for active managers.”

But what a stroke of irony it would be if this caused fund managers to sell out of, or reduce positions in, the name.

Tim Hoyle, chief investor officer at Haverford Trust Co., seems to think that could be possible: “It’s more of a question of whether Tesla will be a winner in the future like it has been in the past. Putting stuff into an index after they’ve quintupled, probably makes it easier for active managers to beat the index.”

Tesla is up about 7x this year and up about 46% in November alone as investors have aimed to frontrun the coming forced buying that will be associated with the index inclusion.

On generating alpha going forward, Bartolini concluded: “Stock selection is obviously a big part of it, and owning Tesla, an outside of a benchmark name was one way. But going forward, it’s going to be trickier.”

And lest we forget: without a SoftBank gamma squeeze to move things onward and upward anymore – what fundamentals can drive Tesla stock and fill out its valuation at these levels?

via ZeroHedge News https://ift.tt/3lwHPzN Tyler Durden