Bank of America Issues A “Code Red” For Stocks

Tyler Durden

Fri, 12/04/2020 – 15:40

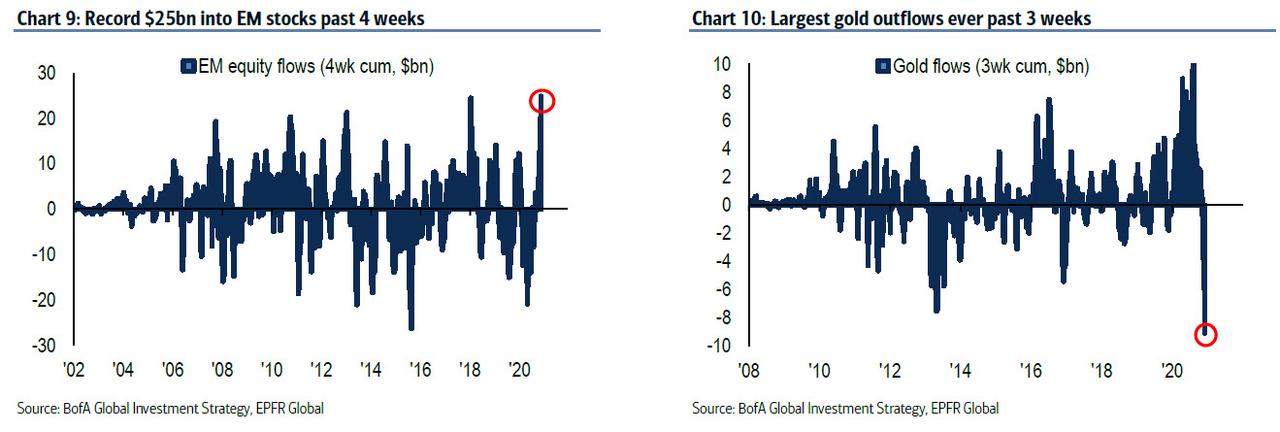

We already discussed how the current market euphoria levels have surpassed dot com levels, but what’s going now, the asset bubble blown by central banks, is absolutely staggering… and it’s only getting crazier. Consider that in just the past 4 weeks there has been a record $115BN inflows into stocks, a record $25BN into EM stocks, a record $9BN outflows from gold past three weeks…

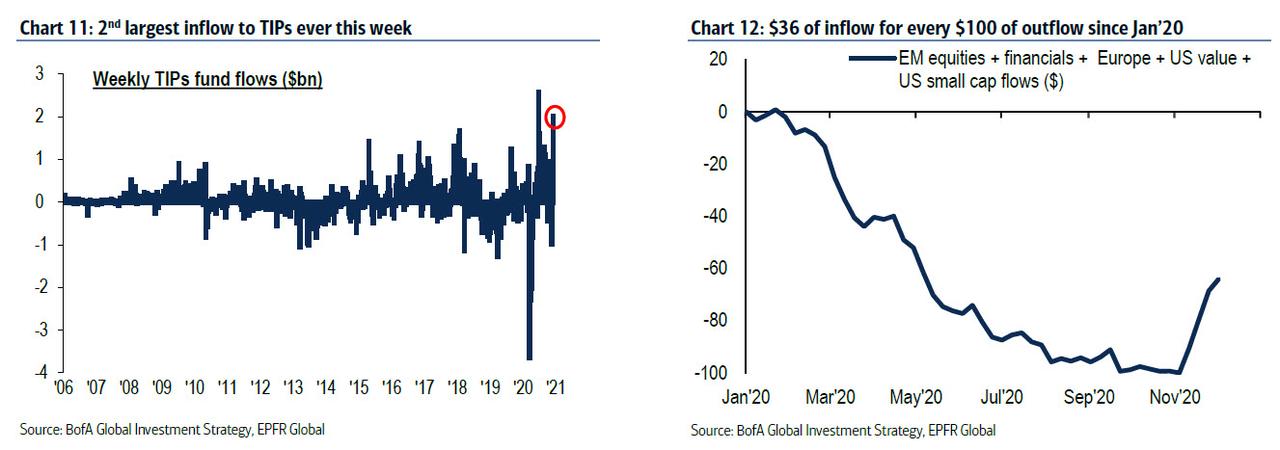

… and the 2nd largest inflow ever to TIPS this week at $2.0BN (although in the grand scheme of the past year inflows are still a fraction of the total outflows).

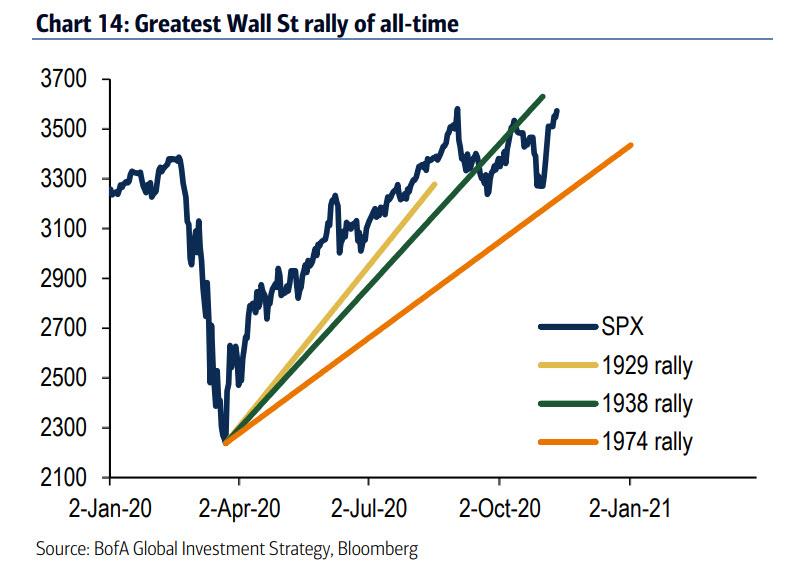

In retrospect, however, the record investor flood into risk assets is probably not all that surprising: as BofA CIO Michael Hartnett writes, the past 10 months have been an unprecedented “Greatest Of All Time” (GOAT) blur: pandemic/crash/lockdown/recession… all culminating in the quickest bear market of all-time…. which then led to the greatest policy panic of all-time… and eventually the greatest Wall St rally of all-time.

This means that in Q4 investors are rushing to discount the greatest Main St recovery of all-time.

Is such euphoria merited?

Not according to Hartnett who last month said to “sell the vaccine”… and yet stocks keep rising. To underscore his skepticism Hartnett repeats several key points:

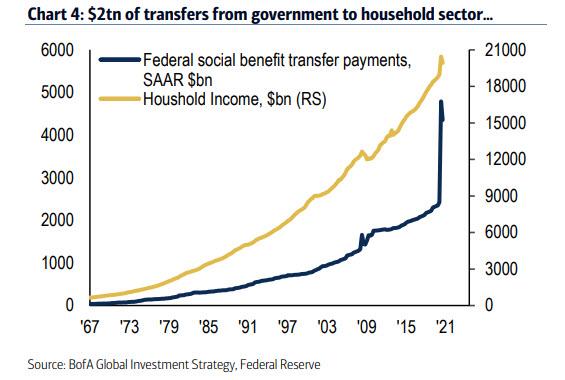

Peak consumer: stock market & housing market wealth effect, $3.6tn of corporate issuance, $2tn increase in transfers from government to household sector in 2020.

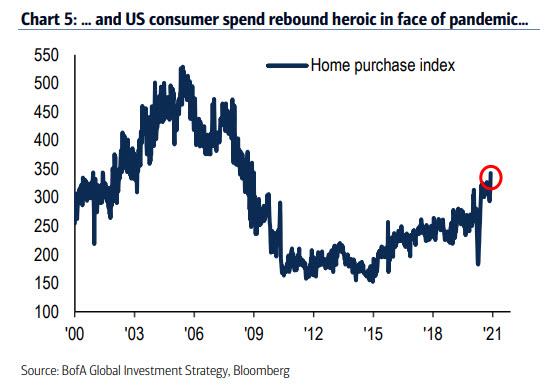

Indeed, US consumer spending is nothing short of heroic in face of pandemic (see soaring mortgage application )…

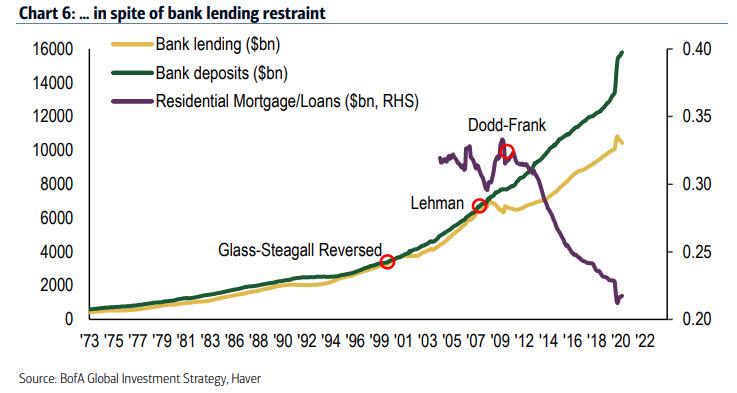

… and unemployment and ongoing bank lending restraint.

As such, while it is “too early to implement given Q4 fiscal and Q1 vaccine” BofA thinks “peak consumer important 2021 theme as wealth/balance sheet/fiscal +ves fade and corporations reluctant to expand workforce.”

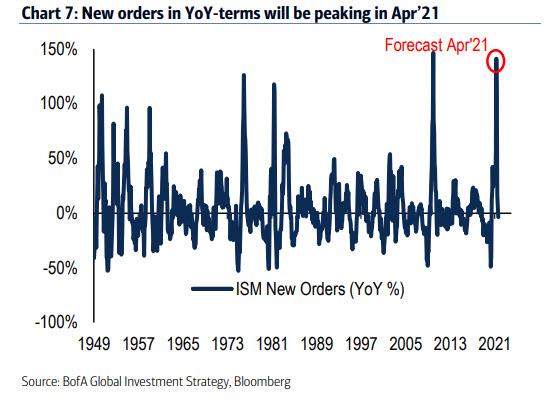

Peak profits: EPS bulls driven by V-shaped recovery in global PMIs & Asian exports; however, even assuming PMIs stay high (Nov ISM fell), new orders in YoY-terms will be peaking in Apr’21 & EPS expectations before then.

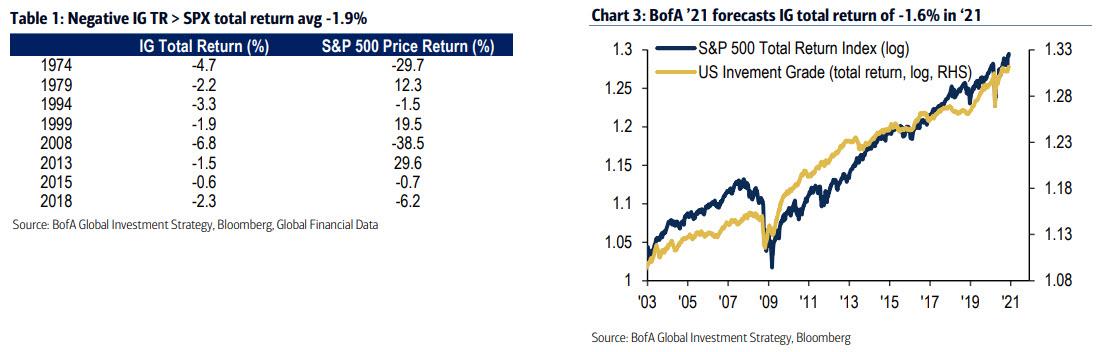

Peak credit: BofA forecasts total 2021 return for investment grade debt of -1.6%. There have been negative IG returns only 8 of past 47 years; ’74, ’94, ’08, ’15, ’18… which were also rough years for stocks (avg -2% – Table 1/Chart 3). Of note: credit did not lead stocks lower in ’79 (late-cycle), ’99 (dot-com bubble) and ’13 (Great Rotation).

Peak policy: 2020 saw a mindblowing $22 trillion of policy stimulus (QE $8tn + 190 rate cuts + fiscal $14tn); this number tumbles to $4tn in 2021 of policy stimulus (QE $3.3tn + fiscal $0.7tn) assuming phase IV fiscal agreed Dec’20; policy tailwind for Wall St fades dramatically next year; no bear market without Fed tightening in 2021; but watch Chinese tech stocks as correction lead indicator (China policy/financial conditions tightening & corporate credit under pressure).

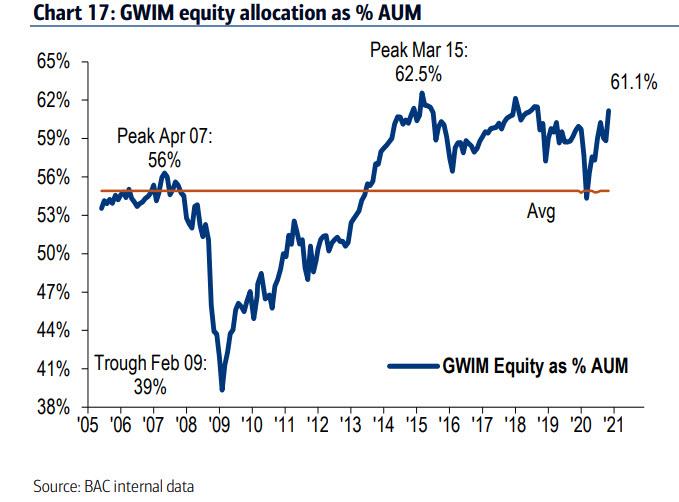

Peak positioning: BofA private client equity allocation 61.1% AUM (all-time high 62.5% in Mar’15).

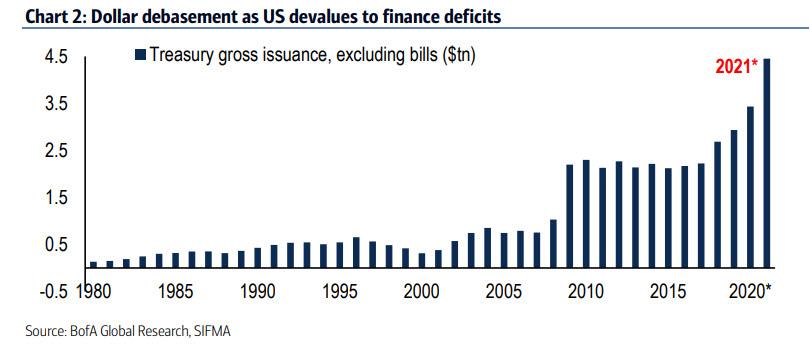

Peak dollar debasement: US dollar plummeting on US fiscal stimulus means that the “dollar debasement” theme is real as new administration devalues to finance deficits (US Treasury issuance $4.5tn in 2021 vs $3.4tn in 2020, $2.9tn in 2019 )

Hartnett warns that should DXY break 90, a disorderly decline in the dollar would lead to disorderly jump in US Treasury yields (and pop in speculation in Bitcoin, China EV…).

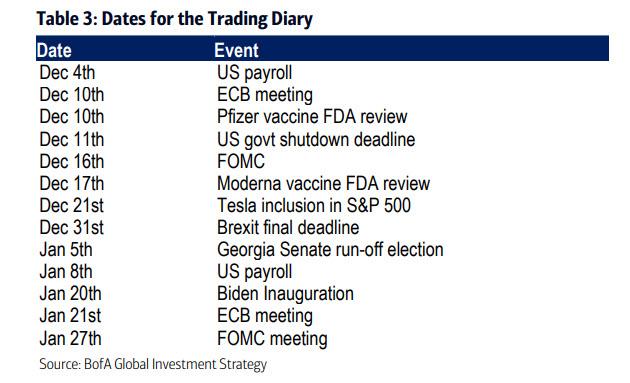

It’s not just the past but also the near future that has sparked euphoria with BofA noting that Dec is facing a peak bull test: before Dec 21st it is likely that we will get phase IV of the US fiscal stimulus (for $0.9tn), while on Dec 10th the ECB will up its QE, and that same week (Dec 10th/17th) Pfizer/Moderna FDA vaccine will get approvals; then there is Dec 16th FOMC, next on Dec 21st Tesla joins S&P500, then on Jan 5th Georgia we get the Senate run-off (prob GOP wins Senate = 72% according to PredictIt). On Jan 20 is the Biden inauguration (absent a major intervention from SCOUTS)

This means that if investors believe 2021 = uber-Goldilocks, then Dec good news = credit/stocks rally; if not, it’s correction time, buy vol.

And while there is a chance that everything works out as expected, BofA is not taking chances and issues a “Code Red” for stocks as virtually every single one of the bank’s proprietary indicators are on the very of a “sell signal”:

- BofA Bull & Bear Indicator accelerating toward extreme bullish (surges from 4.7 to 5.8);

- BofA FMS Cash Rule close to “sell signal” (FMS cash at low 4.1%),

- BofA Breadth Rule = “sell-signal” triggered Nov 11th;

- BofA EM Flow Rule now triggers “sell signal” as inflow past four weeks >1.5% AUM (16 sell signals since ’07, median EM equity pullback 3% in eight weeks, 63% hit-rate);

- BofA Global Flow Trading Rule close to “sell signal” (equities + HY inflows 0.9% of AUM over past four weeks)

Which brings us back to where Hartnett was three weeks ago when he recommended to…

- #Sell the vaccine: client zeitgeist is “you are either 6-8% too early, or 6-8 weeks too early, or both” but we say sell into strength on vaccine on peak price, positioning, policy, profits (analog is US tax cuts in 2018).

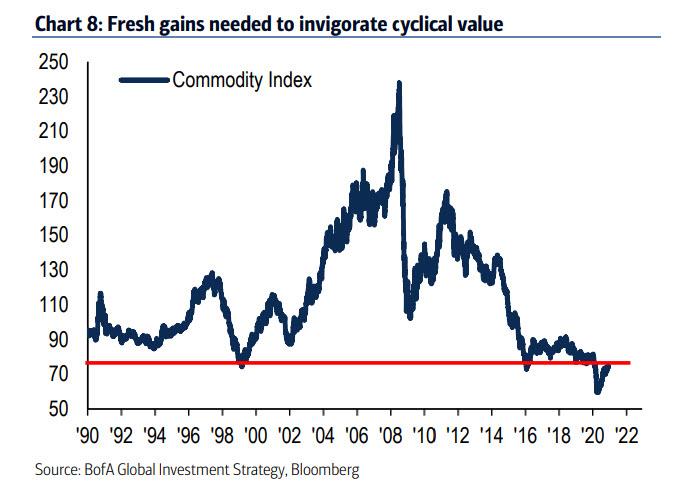

- #Buy the reopening: 2021 reopening/recovery/rotation… outperformance of commodities>credit, CRE>housing, HY>IG, EM/EAFE>SPX, small>large, value>growth; BCOM has recovered to secular 1999 and 2016 levels of 75; fresh gains needed to invigorate cyclical value; gains >85 likely cause higher bond yields:

That said, just like Morgan Stanley’s Michael Wilson, Hartnett is confident what is coming is just a rough patch and tells clients that “if risk asset correction occurs next 3-6 weeks, investors should buy the dip in cyclical value; if correction in 3-6 months, investors should buy defensive growth.”

Finally, here is Hartnett recommendation how to hedge what is not only the biggest bubble in history, but also the most goldilocks-ed market ever:

- a. inflation & GT10>2%: best hedges would be volatility, commodities, CRE, EM;

- b. stagnation & GT10<0%: best hedges would be cash, yield curve flatteners, utilities & staples

via ZeroHedge News https://ift.tt/3lIq4NV Tyler Durden