“Don’t Need Congress – Just Flick Of Pen”: Schumer Demands Day 1 Biden $50K Student Debt Cancelation

Tyler Durden

Mon, 12/07/2020 – 18:44

“You don’t need Congress – All you need is the flick of a pen,” Sen. Minority Leader Chuck Schumer demanded of President-Elect Joe Biden during a Monday press conference outside his Midtown Manhattan office, continuing to pile on the pressure for a controversial immediate student debt forgiveness of $50,000 for each and every borrower (with the exception of course for all who’ve previously dutifully paid off their debt).

Schumer is urging Biden to act on the very first day he takes office after January 20. “We have come to the conclusion that President Biden can undo this debt, can forgive $50,000 of debt the first day he becomes president,” he said.

.@SenSchumer stepping up pressure today on Biden to use executive action to cancel $50K of student loan debt per borrower — and to pick an education secretary who will do that.

“You don’t need Congress,” Schumer said. “All you need is the flick of a pen.” pic.twitter.com/gh0eRQbJfu

— Michael Stratford (@mstratford) December 7, 2020

But given that analysts speaking from the perspective of both sides of the aisle are unanimous in saying there’s no way the Schumer-Warren plan would ever get past Congress, Schumer is pushing for an “overnight” solution to what would be the inevitable impasse crucially without legislation.

Biden has previously vowed to forgive up to $10,000 in student debt for all (with an additional slashing of all debt for public university and Black college attendees whose families are below a certain income level); however, progressives are angered that it’s ‘simply not enough’ especially amid the coronavirus pandemic, they argue.

1. Biden-Harris can cancel billions of dollars in student loan debt, giving tens of millions of Americans an immediate financial boost and helping to close the racial wealth gap. This is the single most effective executive action available for a massive economic stimulus.

— Elizabeth Warren (@SenWarren) November 12, 2020

Biden’s current plan would result in, according to some common estimates, a whopping $1.7 trillion outstanding student loan debt being wiped out.

But it’s far from enough, says Schumer – echoing statements of Elizabeth Warren – in the Monday press conference which was held alongside New York congressman-elects Mondaire Jones, Jamaal Bowman and Ritchie Torres.

“College should be a ladder up but student debt makes it an anchor down. For far too many students and graduate students, some years out of school, student loans and federal student loans are becoming a forever burden,” Schumer said.

But look at the language and word choice:

“They stand in the way of people getting the job they want, they stand in the way of buying a home, of starting a family, of buying a car and they hurt our economy dramatically,” Schumer added.

So apparently if someone doesn’t get something for nothing this is a supposed barrier to a job, home, and even starting a family.

Progressive Dems have already been attempting to lay legal groundwork in an effort to bypass Congress, as noted in CNBC:

During the 2020 Democratic presidential primary, Massachusetts Sen. Elizabeth Warren vowed to forgive student loans in the first days of her administration, including with her announcement an analysis written by three legal experts, based at the Project on Predatory Student Lending at Harvard Law School, who described such a move as “lawful and permissible.”

“The Federal Reserve says this would be a huge shot in the arm to the economy,” Schumer claimed.

Just like that. Really the senator should stop with the medical analogy and go with something else like… Poof! it’s magic.

But, pushing back against such wishful and fanciful imaginings of the woke, here’s Goldman Sachs with a new report out which shows Even Substantial Student Debt Relief Would Only Have a Small Effect on GDP and in particular that—

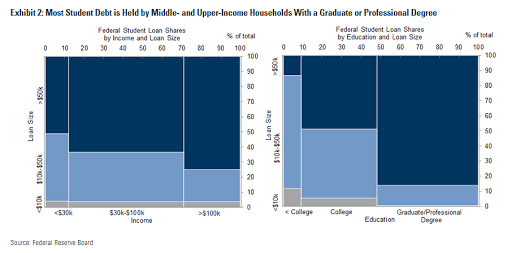

Most student debt—and the vast majority of debt with a large balance—is held by households with a graduate or professional degree that have high earnings potential and are less likely to be resource constrained.

* * *

Here’s the executive summary of Goldman Sachs’ research (emphasis ZH)…

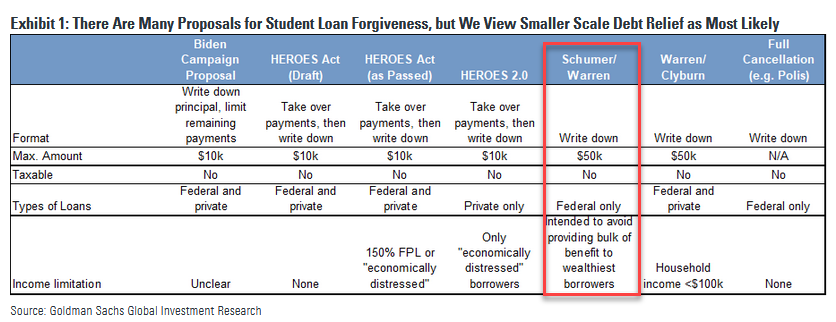

Barring surprise Democratic wins in the Georgia Senate runoffs, a divided government appears most likely, meaning any fiscal expansion will likely be limited by Senate Republicans. Against this backdrop, some Democrats have recently proposed forgiving existing federal student debt through executive action. In this US Daily we consider student debt relief proposals and analyze their potential effects on the federal budget and GDP.

President-elect Biden will likely have the authority to forgive federal student debt through executive action. Although some Democrats have suggested wiping away all federal student debt (or all loans under $50k), we think smaller-scale debt forgiveness up to $10k/borrower would be more likely if the incoming Biden Administration chooses to act. In light of tax rules, this might be structured as a payment reduction rather than immediate cancellation.

There are several reasons to be skeptical that forgiving student debt would provide a large boost to consumption. Most student debt—and the vast majority of debt with a large balance—is held by households with a graduate or professional degree that have high earnings potential and are less likely to be resource constrained.

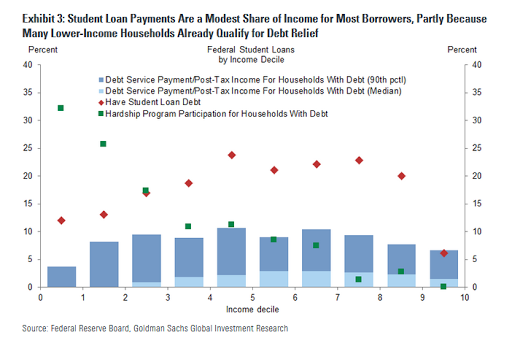

Furthermore, student loan payments reflect a modest share of after-tax income for most borrowers, partly because many lower-income households already qualify for debt relief.

We estimate that forgiving federal student loans up to $10k would add less than 0.1% to the level of GDP starting in 2021, and cumulatively add only $0.43 in real GDP for each $1 of forgiven debt over the next 10 years.

A more generous debt relief program that forgives federal loan balances up to $50k would provide a slightly bigger boost to GDP, but would have a smaller per-dollar impact.

Forgiving federal student loans up to $10k would likely cost around $300bn (1.6% of GDP), while forgiving loans up to $50k would cost around $800bn (4.1% of GDP).

However, since these loans have already been funded through prior Treasury issuance, the impact on Treasury financing would be spread out over many years due to the lack of interest and principal payments. If loans were forgiven immediately, Treasury’s financing needs might actually decline, as tax payments on the forgiven amounts would likely more than offset the lack of scheduled loan payments.

via ZeroHedge News https://ift.tt/2JNkCMN Tyler Durden