Futures Slide On Fresh Brexit Turmoil, US-China Tensions

Tyler Durden

Mon, 12/07/2020 – 08:01

After opening at a new all time high on Sunday evening following Friday’s record close, S&P futures drifted lower as fresh Sino-U.S. tensions over Hong Kong dented sentiment and renewed last minute disagreements threatened to torpedo Brexit negotiations, while investors also awaited concrete signs of progress on a coronavirus relief bill. Oil fell while the dollar rose.

Shares of U.S. banks including Morgan Stanley, Wells Fargo & Co, JPMorgan & Chase, Citigroup and Goldman Sachs fell between 0.4% and 1% in premarket trading. Intel dropped on a report that Apple Inc. is planning a series of new Mac processors aimed at outperforming Intel’s fastest chips.

Risk aversion hit global markets after Reuters reported late on Sunday that Washington was preparing to impose sanctions on some Chinese officials over their alleged role in Beijing’s disqualification of elected opposition legislators in Hong Kong. China said it firmly opposed U.S. interference in its domestic affairs, in response to the report.

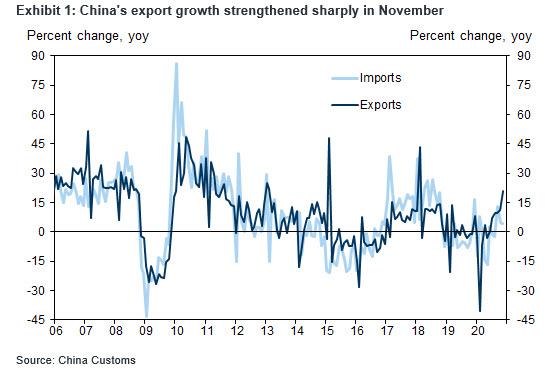

The news hit Hang Seng shares and pulled Asian equities lower, weakening the Yuan and pushing the Shanghai Composite down 0.8% even after 21.1% jump in China exports – the most since early 2018 – pushing its trade surplus to a monthly record high and underlining how global demand for pandemic-related goods is supporting a growth rebound in the economy. Equities in Japan also dropped while Taiwan and South Korea climbed

“There are uncertainties that weigh on sentiment — the U.S. sanction on China, the U.S. fiscal plan that’s yet to be endorsed, and a Brexit deal that didn’t happen over the weekend,” said Mohit Kumar, a strategist at Jefferies International. “Any pullback from last week may be shallow though as overall, I think the market remains optimistic that we will get a fiscal deal and a Brexit deal this week.

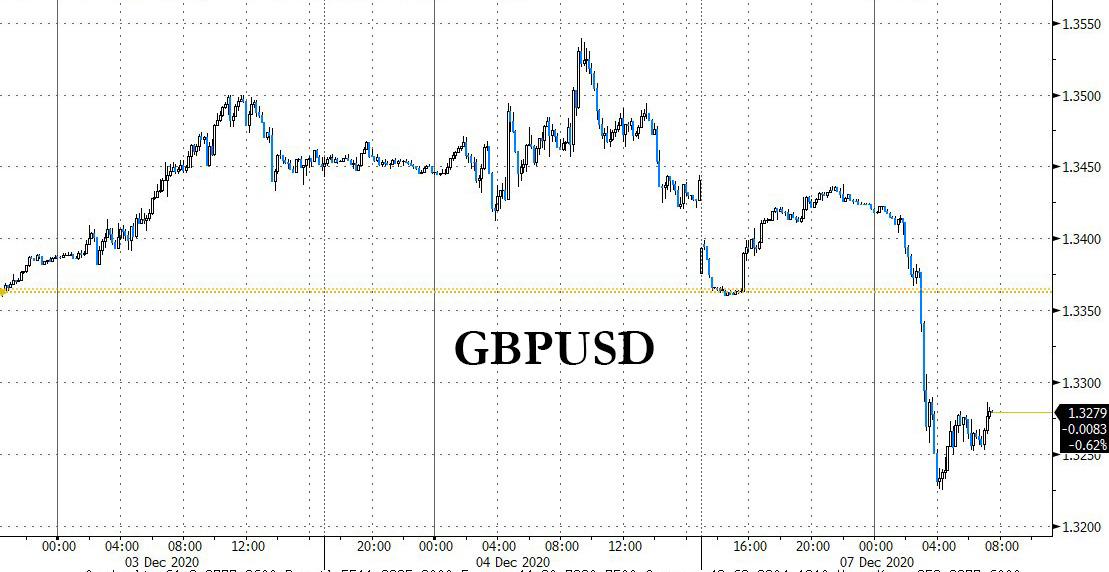

Sentiment soured further after the pound tumbled 1.3% against the dollar, dropping as low as 1.3225 after hitting a high of 1.539 on Friday, its biggest drop in three months with gilts rallying, amid concern that trade negotiations between the U.K. and the European Union could collapse. The selloff catalyst was a report from The Sun according to which Prime Minister Boris Johnson is ready to pull out of talks within hours, coupled with a warning from a British official who said that Brexit talks could fail on Monday unless negotiators make progress in the next few hours as 11th hour negotiation posturing and jawboning peaks. Prime Minister Boris Johnson is due to speak to European Commission President Ursula von der Leyen on Monday evening and that conversation will be a make-or-break moment, another U.K. official said.

In Europe, the Stoxx Europe 600 declined 0.4%, led by autos, travel and energy sectors also underperforming while the export-heavy FTSE 100 Index climbed 0.5%. The Stoxx 600 Banks Index dropped 2%, the biggest decliner on the European sector leaderboard amid a wider underperformance of cyclical stocks. HSBC shares were the biggest drag on the index, falling 2.1%, as the lender is once again swept into Hong Kong’s turmoil. A former pro-democracy lawmaker, who has fled into self-imposed exile, accused the bank of freezing accounts he and his family held. Other U.K. banks Lloyds -4%, Barclays -2.2% among weakest in banks sector as talks on post-Brexit trade deal continue.

Meanwhile, talks aimed at delivering fresh coronavirus aid gathered momentum in the U.S. Congress on Friday, as a bipartisan group of lawmakers worked to put the finishing touches on a new $908 billion bill. After months of deadlocked negotiations between Republicans and Democrats, pressure has mounted on policymakers to help people and businesses hit hard by the surging pandemic, especially after a set of weak labor market indicators.

In rates, Treasuries were higher following bigger gains for gilts facing increased chance of a hard Brexit. Demand emerged in Asian session to buy Friday’s back-up in yields before gains were extended during London morning. Yields were lower by more than 3bp across long end, with 10-year around 0.94%, 2.5bp richer on the day; curve is flatter with 2s10s, 5s30s spreads each tighter by ~2bp. Gilts outperform Treasuries by 3bp, bunds by 1bp. A new Treasury auction cycle starts Tuesday with record $56BN in 3-year note, followed by 10- and 30-year reopenings for $38BN and $24BN over next two days.

In FX, as noted above the biggest mover was the sharp slide in the pound which weakened the most in three months on concern that trade negotiations between the U.K. and the European Union could collapse. At the same time, the dollar was set for its biggest advance in more than a month and Treasuries advanced as efforts to deploy a coronavirus vaccine were outweighed by renewed U.S.-China tensions. The Bloomberg Dollar Spot Index snapped a four-day loosing streak, to rise by as much as 0.6% as the greenback advanced versus almost all of its Group-of-10 peers. The euro fell below $1.21 and bunds advanced after the German state of Bavaria tightened coronavirus lockdown measures; Germany is looking to impose tougher restrictions on movement after a nationwide partial shutdown failed to bring contagion rates down to manageable levels. The Swiss franc and the yen were the best performers as investors sought havens amid a report that the U.S. is preparing to sanction at least a dozen more Chinese officials over their role in the recent disqualification of Hong Kong legislators.

In commodities, oil fell from its strongest close in nine months, hampered by weaker risk sentiment in global markets despite Asia hiking its prices to Asian customers. Gold dropped on a stronger dollar.

On the calendar, we get earnings from Coupa Software, Smartsheet, Casey’s, while the latest consumer credit data hits at 3pm.

Market Snapshot

- S&P 500 futures down 0.5% to 3,680.50

- STOXX Europe 600 down 0.5% to 392.19

- MXAP down 0.3% to 193.35

- MXAPJ down 0.07% to 641.34

- Nikkei down 0.8% to 26,547.44

- Topix down 0.9% to 1,760.75

- Hang Seng Index down 1.2% to 26,506.85

- Shanghai Composite down 0.8% to 3,416.60

- Sensex up 0.8% to 45,433.20

- Australia S&P/ASX 200 up 0.6% to 6,675.02

- Kospi up 0.5% to 2,745.44

- German 10Y yield fell 3.5 bps to -0.582%

- Euro down 0.3% to $1.2089

- Brent Futures down 1.2% to $48.68/bbl

- Italian 10Y yield rose 2.2 bps to 0.513%

- Spanish 10Y yield fell 3.0 bps to 0.051%

- Brent Futures down 1.2% to $48.68/bbl

- Gold spot down 0.5% to $1,830.49

- U.S. Dollar Index up 0.5% to 91.17

Top Overnight news from Bloomberg

- President Donald Trump and Senate Majority Leader Mitch McConnell will come “on board” with a $908 billion package to provide pandemic relief, according to a member of a bipartisan group that’s seeking legislation before the end of the year

- President Donald Trump said his attorney Rudy Giuliani, who has been leading efforts to overturn the results of the Nov. 3 general election, has tested positive for the coronavirus

- China’s exports jumped in November by the most since early 2018, pushing its trade surplus to a monthly record high and underlining how global demand for pandemic-related goods is supporting a growth rebound in the world’s second-largest economy

- Sales of the U.K.’s safest residential mortgage-backed securities, or prime RMBS, have collapsed this year and they are unlikely to pick up significantly in 2021 as banks instead utilize central-bank stimulus programs. That has left riskier deals from non-bank lenders dominating issuance amid a government-stoked housing- market boom

- Riksbank Deputy Governor Anna Breman says she wouldn’t hesitate to expand purchases further and consider other measures such as a rate cut, if conditions in the economy should worsen, according to minutes of the November meeting; Deputy Governor Martin Floden presented a “long list of objections to the proposed decision” to expand QE through to the end of 2021

A quick look at global markets courtesy of NewsSquawk

Asian equity markets were mixed despite the region initially taking its cue from the fresh record levels last Friday on Wall Street in which all major indices posted all-time highs. ASX 200 (+0.6%) was positive with strength in mining names and tech more than compensating for the early sluggishness in the financials sector after the RBA announced the Payments System Board began periodic review of retail payments and noted that the cap on what banks can charge merchants was too high and needs to come down. Nikkei 225 (-0.8%) initially gained but then faltered on the pressure of the recent currency strength and KOSPI (+0.5%) swung between gains and losses in a retreat from its record highs. Hang Seng (-1.2%) and Shanghai Comp. (-0.8%) gave up opening gains with sentiment dampened by several factors including another substantial PBoC liquidity drain and continued tensions between the world’s top two economies as President Trump’s administration is preparing sanctions on at least a dozen Chinese officials over Beijing’s move to disqualify elected legislators in Hong Kong, while FTSE Russell announced it is to remove 8 Chinese companies including Hangzhou Hikvision, China Railway Construction Corp. and China Spacesat from several products following the US blacklisting announcement. Participants also digested mixed Chinese trade data and Hong Kong underperformed as the rejig of its main index took effect in which the total number of constituents was increased to 52 from 50 with the inclusion of Anta Sports (2020 HK), Budweiser APAC (1876 HK) and Meituan Dianping (3690 HK), while the benchmark’s founding member Swire Pacific (87 HK) was removed. Finally, 10yr JGBs began softer after the recent retreat beneath 152.00 amid the bear-steepening in USTs post-jobs data, although prices have rebounded off their lows with some support from the soured risk appetite and with the BoJ present in the market for JPY 580bln of JGBs predominantly concentrated in 1yr-3yr maturities, while it also offered to purchase JPY 300bln of corporate bonds from Thursday.

Top Asian News

- U.S. Poised to Sanction More China Officials Over Hong Kong

- China Official Reserves Rise to Highest Since April 2016

- Hong Kong’s Top Chinese Stocks Drop on Sanction Risk Concerns

- Chevron Shuts Offshore Separator at Wheatstone LNG Plant

- JD Health Shares Trade 28% Higher in Hong Kong’s Gray Market

European equities trade mostly lower as the region took its cue from a similar APAC handover, with Eurozone bourses all in the red (Euro Stoxx 50 -0.5%) whilst UK’s FTSE 100 (+0.4%) bucks the trend. Meanwhile, US equity futures experienced some losses in lockstep with European counterparts but have since trimmed some of this downside. The sectoral performance in Europe sees a more defensive bias, with Healthcare and Staples outpacing peers, the former also aided by gains in AstraZeneca (+2.5%) following a broker upgrade at Morgan Stanley, and in turn providing the FTSE 100 with impetus as its largest weighted stock. Delving deeper into sectors, Oil & Gas and Financials reside as the straddlers amid lower oil prices and yields respectively. Meanwhile, Travel & Leisure retraces some of the recent gains seen in wake of the flurry of optimistic vaccine updates in recent sessions. Elsewhere, UK housing names reside at the foot of the Stoxx 600 amid Brexit jitters, which sees Berkeley Group (-7%), Persimmon (-5.8%), Barratt Developments (-5.0%), Taylor Wimpey (-4.0%) in deep negative territory. In terms of other individual movers, Micro Focus (+16%) catches a tailwind on a broker upgrade at Goldman Sachs. Deutsche Lufthansa (-0.7%) is modestly softer as the group is is expected to cut an additional 10k jobs in Germany next year alongside 20k jobs outside of Germany, according to sources. Finally, Pandora (+5.0%) is firmer after it stated that November had positive sell-out growth and organic growth, whilst reaffirming guidance assuming no lockdowns are imposed.

Top European News

- Elliott Is Said to Make Binding Offer for Swiss Baker Aryzta

- Vaccine Intensifies European High-Grade Managers’ Taste for Junk

- UBS’s Weber Sees No Deal With Credit Suisse in the Near Term

- Zero-Carbon Shipping Race Lures Yara to Upgrade Ammonia Plant

In FX, there has been a plethora of Brexit newsflow has seen renewed weakness in the British currency with the crux of headlines pointing to the remaining outstanding issues, with EU’s Chief Brexit Negotiator Barnier’s early-morning briefing to ambassadors seeing a mixed reception – with some pointing to a neutral briefing and other interpretations pointed to a gloomy prospect regarding an imminent trade deal, whilst he rebuffed weekend reports that a breakthrough has been made on fishing. On the domestic front, the Internal Market Bill (allowing ministers to override the WA) is poised to return to the House of Commons today – which could prove to be a sideshow given today’s crunch talks but seen in Brussels as an aggressive move heading into last-minute talks. Eyes will be on the phone call between UK PM Johnson and European Commission President von der Leyen, with the latest guidance pointing to a call in the afternoon (time TBC). In light of the developments above, and amid the UK PM ‘s threat of pulling out from talks within hours over EU demands, Cable retreated from best levels just shy of 1.3450, through the 1.3400 and 1.3300 psychological marks and below its 21 DMA (1.3294) to a current base sub-1.3250 ahead of 1.3200. The Sterling demise and lacklustre risk tone has fed into Dollar strength with DXY rebounding from its overnight base at 90.686 to a current peak at 91.241 – and with clean air seen ahead of the 91.500 psychological mark coinciding with the 2nd Dec high. As such, the Single Currency yielded its 1.2100 status (vs. 1.2140 at best), but with losses cushioned via the EUR/GBP cross which reclaimed a 0.9100 handle, with the current intraday band at 0.9021-9137.

- NZD, AUD, CAD, SEK NOK – The Dollar’s revival has pressured other G10s to varying degrees, with non-US Dollars the laggards notwithstanding the Sterling’s performances. The overall risk tone and lower Chinese import figures sees AUD/USD back under 0.7400 (vs. 0.7436 at best) and losing ground below the figure as the pair eyes its 21 DMA at 0.7332. NZD/USD threatens a break below 0.7000 having had fallen from 0.7050. The Loonie has trimmed some gains against the Buck seen in wake of last Friday’s jobs numbers, with softer oil prices also proving to be headwinds – and with clean air up to 1.2900. Similarly, EUR/NOK eclipsed last week’s ~8.900 high whilst the SEK side-lined the Riksbank minutes which largely consisted of reiterations and no new information. EUR/SEK makes headway above 10.2500 having had tested 1.3000 to the upside earlier.

- JPY/CHF – The traditional safe-havens have seen resilience despite the firmer DXY with losses seemingly cushioned by haven inflows. USD/JPY sees modest gains as the pair attempts to recoup some recent lost ground, with eyes from a technical standpoint on the 21 and 50 DMAs at 104.42 and 104.77 respectively. USD/CHF meanwhile focuses on Thursday’s 0.8954 high as the pair errs higher from its 0.8896 base.

In commodities, WTI and Brent front month futures kicked the week off on a softer footing following the rally seen last week on the back of OPEC+ expressing unanimity and flexibility with regards to future oil policy, with the next ministerial meeting planned for the 4th of January. Fresh catalysts for the complex have been light in early European trade with prices influenced by overall risk sentiment and Dollar action. Meanwhile, over the weekend Saudi Aramco released its OSPs for January whereby Saudi Arabia set January OSP to Asia at a premium of USD 0.30/bbl over Oman/Dubai which is an increase of USD 0.80/bbl from December and it set OSP to US at a premium of USD 0.55/bbl over ASCI which is lower by USD 0.30/bbl from December. Further, Friday saw the release of the Baker Hughes rig count which showed active oil rigs increasing by five whilst active natgas rigs fell by two. WTI Jan resides around USD 45.50/bbl having earlier fallen to a base around USD 45.40/bbl from best levels at USD 46.25/bbl. Brent Feb 21 briefly dipped below USD 48.50/bbl (vs. high 49.25/bbl). Elsewhere, precious metals were uneventful overnight before succumbing to the Buck, with spot gold meandering around USD 1830/oz after a short-lived dip below 1825/oz (vs. USD 1842/oz) whilst spot silver loses ground below USD 24/oz (vs. high 24.23.oz). In terms of base metals, LME copper prices dipped from eight-year highs amid the overall tone in markets alongside a decline of the red metal imports by China, whilst iron ore imports fell for a second consecutive month, dropping some 8.1% MM.

US Event Calendar

- 3pm: Consumer Credit, est. $16.1b, prior $16.2b

DB’s Jim Reid concludes the overnight wrap

I hope you had a good weekend. We spent a disproportionate amount of time playing with an app called “Elf Yourself” where you can superimpose photos of family or friends onto dancing characters and make a video. The kids loved it so if you have bored children to attend to over Xmas please download this app. You can see our clip if you look at my Bloomberg message header. It’s ridiculous!

Back to more sober matters and there’s lots of European events for us this week although a US fiscal deal could steal the limelight with the weak payrolls number on Friday perhaps focusing minds. It certainly helped encourage the market on Friday as both yields and equities rose following the disappointing data. On matters European, Brexit talks are reaching a denouement (famous last words), the disputes over the EU’s long-term budget and recovery fund continue, a summit of EU leaders is scheduled for Thursday and we’ll see the final ECB meeting of the year on the same day with the central bank expected to recalibrate its policy stance. Over in the US, the aforementioned stimulus talks, as well as the FDA meeting on Thursday when they’ll discuss an Emergency Use Authorization for the Pfizer/BioNTech vaccine will be the highlights. Elsewhere the U.K. will become the first major economy to roll out a Covid vaccine (Pfizer/BioNTech) from tomorrow. So all eyes on how the logistics of that goes.

Starting with the U.K., Brexit will be back squarely in the global headlines today as negotiations continue in Brussels over a trade deal with the EU, with less than 4 weeks remaining until the end of the transition period. Over the weekend there’ve been a number of developments, with a Saturday call between Prime Minister Johnson and European Commission President von der Leyen acknowledging “significant differences” on the three main outstanding issues, but agreeing to continue talks. Last night there were media reports that there’d been a breakthrough on fish, but on the UK side a government source told journalists that this wasn’t the case, saying that “There’s been no breakthrough on fish. Nothing new has been achieved on this today”. Furthermore, Bloomberg and others are still reporting that it’s the level-playing field that’s the biggest issue, with the EU wanting guarantees that the UK will commit not to undercut EU standards in a range of areas, but the UK seeing that as an unacceptable infringement on its sovereignty. All eyes will be on news reports today, with another call between Johnson and von der Leyen scheduled for this evening. In terms of the market reaction, sterling has moved slightly lower this morning, down -0.16% against the US dollar.

Running parallel to this, today also sees the UK government’s controversial Internal Market Bill arrive back in the House of Commons. As a reminder, this is the bill which sought to break parts of the already-reached Withdrawal Agreement with the EU, with the EU reacting very negatively to its publication. After it passed the House of Commons, the House of Lords amended the bill to take out the controversial sections, but the government have said they intend to reinstate them back in the Commons today. This will not be taken well by the EU so a Brexit deal beforehand would suit everyone. If not the relationship between the two could sour at a very bad time.

Over in Asia, equity markets are trading lower this morning for the most part, with the Nikkei (-0.59%), the Hang Seng (-1.69%) and the Shanghai Comp (-0.66%) all losing ground. The exception is the KOSPI, which has managed to gain +0.20%, but S&P 500 futures (-0.23%) are also pointing lower following the record high for the index on Friday. The declines have come as Reuters reported overnight that the US was preparing new sanctions on at least a dozen Chinese officials over the moves to disqualify opposition legislators in Hong Kong, with the report saying that this could come as soon as today. Meanwhile on the data front, China reported a +21.1% increase in exports year-on-year in dollar terms, stronger than the +12.0% increase estimated. Imports rose by a weaker-than-expected +4.5% yoy however (vs. +7.0% expected).

Moving back to EU negotiations, the other dispute to watch out for will be that with Poland and Hungary over rule-of-law conditions that have been proposed for the disbursement of funds, which both countries see as unacceptable interference in their domestic affairs. This issue is likely to be discussed at the EU leaders’ summit on Thursday and Friday, which is the last scheduled European Council meeting this year. It’s hard to believe this will be a stumbling block for the fund but it isn’t great for the smooth path of future integration.

Staying on Europe, the ECB will be announcing their latest monetary policy decision on Thursday. They’ve already preannounced a recalibration of the policy stance at this meeting at a point where inflation is running at -0.3% over the last year and the Euro is hitting two-year highs against the dollar last week. DB’s Mark Wall has suggested the recalibration will most likely focus on PEPP and TLTRO; and the intention of the recalibration is to maintain favourable financial conditions for longer, not to reduce the level of rates or yields further. DB expect an extension by 6 months of the PEPP net asset purchase period and the TLTRO3 discounted interest rate period beyond their current expiry in June 2021. DB also expect an increase in the PEPP envelope (EUR400bn) and other moves on TLTRO3 (e.g., additional tenders, possibly an adjustment to the lending benchmark, etc). No discount rate cuts are expected but the ECB will likely communicate very strongly its willingness and capacity to extend support even further and to ease the policy stance if needed to achieve its objectives. In effect, stronger informal forward guidance. Communications will likely be a key line of defence against a rising exchange rate. See here for their full preview.

Moving across the Atlantic to the US, the stimulus talks will remain in focus with a bipartisan group of senators today expected to table legislation for a stimulus bill amounting to around $908bn according to reports. There’s still tension on both sides so it won’t be an easy sell but things seem to be more positive than they were. On the monetary side, there won’t be much in the way of Fed speakers this week with FOMC members now in a blackout period ahead of meeting next week.

On the coronavirus, one of the main developments this week will be the US FDA’s meeting on Thursday to discuss an Emergency Use Authorization of the Pfizer/ BioNTech vaccine. Vice President Pence has told governors that the vaccine’s distribution could begin next week and then on December 17 we will see another FDA meeting to discuss an Emergency Use Authorization for the Moderna vaccine so there are some key events coming up.

Finally on the data front, the highlights will include the US CPI reading for November on Thursday, before we get the University of Michigan’s preliminary consumer sentiment index for December the following day. Elsewhere, we’ll get the UK’s GDP release for October on Thursday.

Recapping last week now and it was a story of three different deals: US fiscal stimulus, UK-EU Brexit negotiations and OPEC+’s meeting on production hikes. US stocks rose on the week as both Democratic and Republican politicians both sounded more bullish on getting a fiscal deal done in the near-term. The S&P 500 rallied +1.49% on the week (+0.70% Friday), while the NASDAQ composite rose +2.01% (+0.60% Friday) as both indices finished the week at record highs.

The cyclical trade remained strong as bank stocks on both sides of the Atlantic rallied with US banks up +1.62% while European Banks were up a larger +4.39%. European equities underperformed US stocks in general though as the STOXX 600 ended the week +0.21% higher (+0.59% Friday) while the FTSE (+2.87%) and IBEX (+1.61%) notably outperformed on the week.

Speaking of cyclicals, energy stocks rose with oil prices after OPEC+ members came to a consensus on delaying the productions hikes in Q1 2021. Both Brent Crude ($49.01/bbl) and WTI Oil ($46.01/bbl) closed at their highest levels since the pandemic started after rising +1.72% and +1.05% respectively.

Sovereign bonds sold off sharply as equity indices rose to post-pandemic highs in Europe and all-time highs in the US. US 10yr Treasury yields rose +13.5bps (+6.6bps Friday) to finish at 0.973%, which is the highest level since March. 10yr Gilt yields rose +6.7bps (+2.9bps Friday) to 0.35%, while 10yr Bund yields were up +4.1bps (+0.9bps Friday) to -0.55%. Inflation expectations rose notably, with US 5y5y swaps moving up +11bps bps on the week to 2.30% and EUR 5y5y swaps rising +5.1bps to 1.27%. Elsewhere in fixed income, the improving sentiment saw credit spreads in the US and Europe tighten on the week. US HY cash spreads were -27bps tighter, while Europe HY cash spreads tightened -19bps. US IG was -7bps tighter and -2bps narrower in Europe.

The release of US payroll data was the data highlight from Friday, where we learned that the labour market rebound lost significant momentum last month. The US added +245k jobs (+460k expected), though the unemployment rate fell to 6.7%. The weaker numbers seemed to give the market hope that it would spur Congress and/or the Federal Reserve to enact further measures. Other data highlights included the November construction PMIs from Germany and the UK which were at 45.6 (45.2 prior) and 54.7 (53.1 prior) respectively.

via ZeroHedge News https://ift.tt/36VFoTv Tyler Durden