Key Events In The Coming Busy Week

Tyler Durden

Mon, 12/07/2020 – 10:04

With just three weeks left in 2020, the newsflow refuses to let up and as DB’s Jim Reid writes there’s lots of European events this week although a US fiscal deal could steal the limelight with the weak payrolls number on Friday perhaps focusing minds.

On matters European, Brexit talks are reaching a denouement (with concerns that the Brexit deal may unravel later today as noted earlier), the disputes over the EU’s long-term budget and recovery fund continue, a summit of EU leaders is scheduled for Thursday and we’ll see the final ECB meeting of the year on the same day with the central bank expected to recalibrate its policy stance.

Over in the US, the aforementioned stimulus talks, as well as the FDA meeting on Thursday when they’ll discuss an Emergency Use Authorization for the Pfizer/BioNTech vaccine will be the highlights. Elsewhere the U.K. will become the first major economy to roll out a Covid vaccine (Pfizer/BioNTech) from tomorrow. So all eyes on how the logistics of that goes.

Starting with the U.K., Brexit will be back squarely in the global headlines today as negotiations continue in Brussels over a trade deal with the EU, with less than 4 weeks remaining until the end of the transition period. Over the weekend there’ve been a number of developments, with a Saturday call between Prime Minister Johnson and European Commission President von der Leyen acknowledging “significant differences” on the three main outstanding issues, but agreeing to continue talks. Last night there were media reports that there’d been a breakthrough on fish, but on the UK side a government source told journalists that this wasn’t the case, saying that “There’s been no breakthrough on fish. Nothing new has been achieved on this today”. Furthermore, Bloomberg and others are still reporting that it’s the level-playing field that’s the biggest issue, with the EU wanting guarantees that the UK will commit not to undercut EU standards in a range of areas, but the UK seeing that as an unacceptable infringement on its sovereignty. All eyes will be on news reports today, with another call between Johnson and von der Leyen scheduled for this evening. In terms of the market reaction, sterling has moved slightly lower this morning, down -0.16% against the US dollar.

Running parallel to this, today also sees the UK government’s controversial Internal Market Bill arrive back in the House of Commons. As a reminder, this is the bill which sought to break parts of the already-reached Withdrawal Agreement with the EU, with the EU reacting very negatively to its publication. After it passed the House of Commons, the House of Lords amended the bill to take out the controversial sections, but the government have said they intend to reinstate them back in the Commons today. This will not be taken well by the EU so a Brexit deal beforehand would suit everyone. If not the relationship between the two could sour at a very bad time.

On the data front, the highlights will include the US CPI reading for November on Thursday, before we get the University of Michigan’s preliminary consumer sentiment index for December the following day. Elsewhere, we’ll get the UK’s GDP release for October on Thursday.

Below is a day-by-day calendar of key global events, courtesy of Deutsche:

Monday December 7

- Data: Germany October industrial production, US October consumer credit

- Politics: UK Prime Minister Johnson and European Commission President von der Leyen speak, UK House of Commons debates Internal Market Bill

Tuesday December 8

- Data: Germany December ZEW survey, Euro Area final Q3 GDP, US November NFIB small business optimism index, Japan October core machine orders (23:50 UK time)

Wednesday December 9

- Data: China November CPI, PPI, Japan preliminary November machine tool orders, Germany October trade balance, US weekly MBA mortgage applications, final October wholesale inventories, October JOLTS job openings, Japan November PPI (23:50 UK time)

- Central Banks: Monetary policy decisions from the Bank of Canada, and Central Bank of Brazil

Thursday December 10

- Data: UK October GDP, France October industrial production, US November CPI, monthly budget statement, weekly initial jobless claims

- Central Banks: ECB monetary policy decision

- Politics: European Council summit begins

- Other: US FDA discuss Emergency Use Authorization for Prizer/BioNTech vaccine

Friday December 11

- Data: Italy October industrial production, US November PPI, preliminary December University of Michigan consumer sentiment index

Central Banks: Fed Vice Chair Quarles, and ECB’s Holzmann and Centeno

* * *

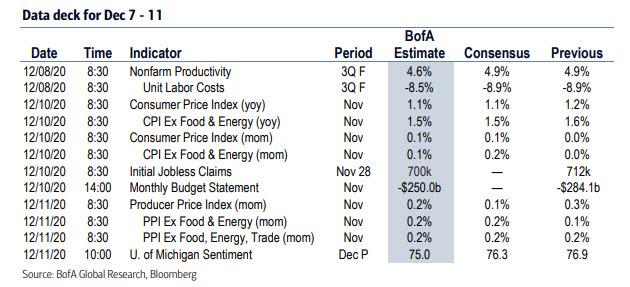

FInally, focusing only on the US, the key economic data releases this week are the CPI and jobless claims reports, both on Thursday. Vice Chair for Supervision Quarles is speaking at an event on Friday, but otherwise there are no major speaking engagements from Fed officials this week, reflecting the FOMC blackout period. Below is a full summary of Goldman’s expectations for the week’s key events:

Monday, December 7

- There are no major economic data releases scheduled.

- 10:00 AM Pending home sales, October (GS -1.5%, consensus +1.0%, last -2.2%): We estimate that pending home sales declined by 1.5% in November, reflecting a further deceleration in regional home sales data.

Tuesday, December 8

- 08:30 AM Nonfarm productivity, Q3 final (GS +4.9%, consensus +4.9%, last +4.9%); Unit labor costs, Q3 final (GS -8.6%, consensus -8.9%, last -8.9%): We estimate nonfarm productivity was unrevised at +4.9% (qoq ar) in Q3. We estimate growth in Q3 unit labor costs – compensation per hour divided by output per hour – was revised up to by three tenths to -8.6% in Q3.

Wednesday, December 9

- 10:00 AM JOLTS job openings, October (consensus 6,300k, last 6,436k)

- 10:00 AM Wholesale inventories, October final (consensus +0.9%, last 0.9%)

Thursday, December 10

- 08:30 AM CPI (mom), November (GS +0.09%, consensus +0.1%, last flat); Core CPI (mom), November (GS +0.06%, consensus +0.1 %, last flat); CPI (yoy), November (GS +1.04%, consensus +1.1%, last +1.2%); Core CPI (yoy), November (GS +1.47%, consensus +1.6%, last +1.6%): We estimate a 0.06% increase in November core CPI (mom sa), which would lower the year-on-year rate by a tenth to 1.5% on a rounded basis. Our monthly core inflation forecast reflects a virus-driven pullback in airfares, deceleration in shelter inflation, and modest declines in new and used car prices. We also expect another decline in the health insurance component. On the positive side, we estimate a return to positive education inflation—as fall-semester tuition cuts are now reflected in the index, in our view. We estimate a 0.09% increase in headline CPI (mom sa).

- 08:30 AM Initial jobless claims, week ended December 5 (GS 750k, consensus 725k, last 712k); Continuing jobless claims, week ended November 28 (consensus 5,270k, last 5,520k):We estimate initial jobless claims increased to 750k in the week ended December 5.

Friday, December 11

- 08:30 AM PPI final demand, November (GS +0.2%, consensus +0.1%, last +0.3%); PPI ex-food and energy, November (GS +0.2%, consensus +0.2%, last +0.1%); PPI ex-food, energy, and trade, November (GS +0.2%, consensus +0.2%, last +0.2%): We estimate a 0.2% increase in headline PPI in November, reflecting stronger energy prices but weaker food prices. We expect a 0.2% increase in the core measure excluding food and energy, and also a 0.2% increase in the core measure excluding food, energy, and trade.

- 10:00 AM University of Michigan consumer sentiment, December preliminary (GS 77.0, consensus 76.0, last 76.9): We expect the University of Michigan consumer sentiment index to edge up by 0.1pt to 77.0 in the preliminary December reading, given positive news on a vaccine, higher equity prices, and an increase in our Twitter Sentiment Index, but continued deterioration in the national virus situation.

- 12:40 PM Fed Vice Chair for Supervision Quarles speaks: Federal Reserve Board Vice Chair for Supervision Randal Quarles will speak on bank supervision at a virtual event.

Source: Deutsche Bank, Bank of America, Goldman

via ZeroHedge News https://ift.tt/2LfidLo Tyler Durden