Bonds, Stocks, & Bullion Bid As Complacency Careens Beyond Dot-Com Highs

Tyler Durden

Tue, 12/08/2020 – 16:01

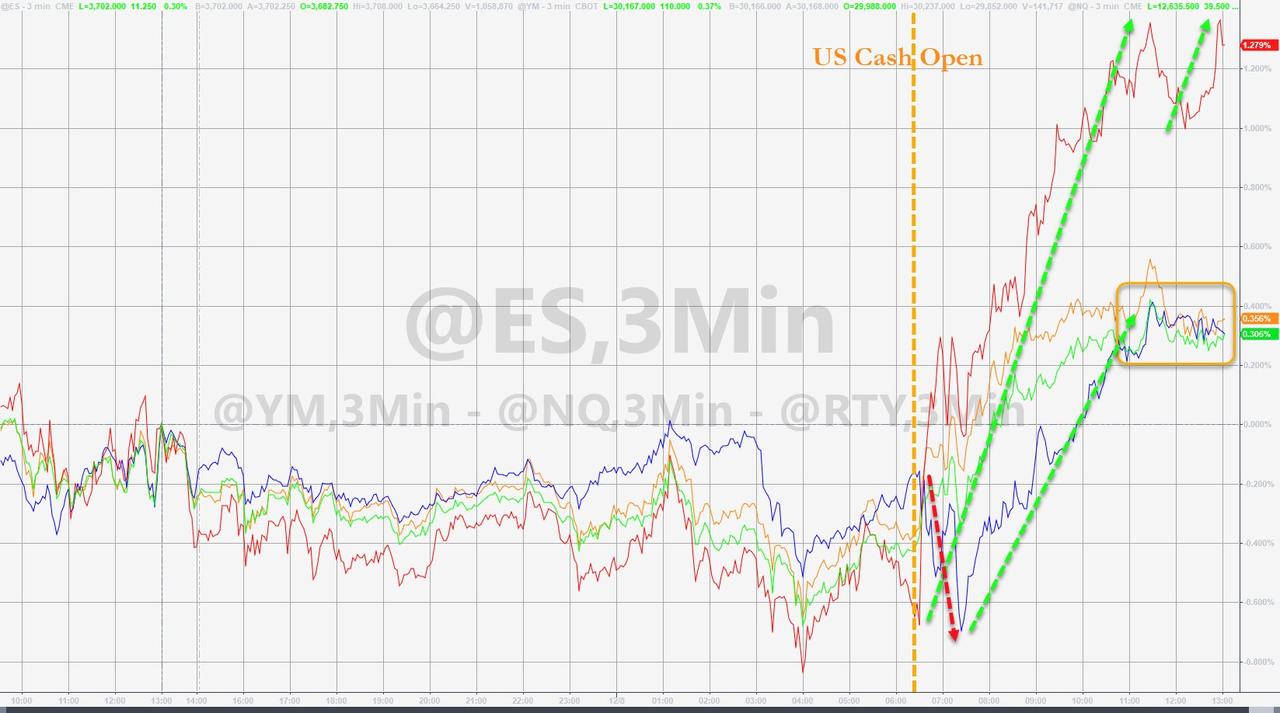

Stocks oscillated gently lower overnight then went wild as the cash markets opened, soaring all day but appeared to roll over a little when McConnell suggested slashing the liability protections and state/local aid from the COVID Relief bill (implicitly reducing the amount of free money to be handed out) and extended losses a little more when headlines on SCOTUS taking up Texas’ election case against MI, PA, and WI…

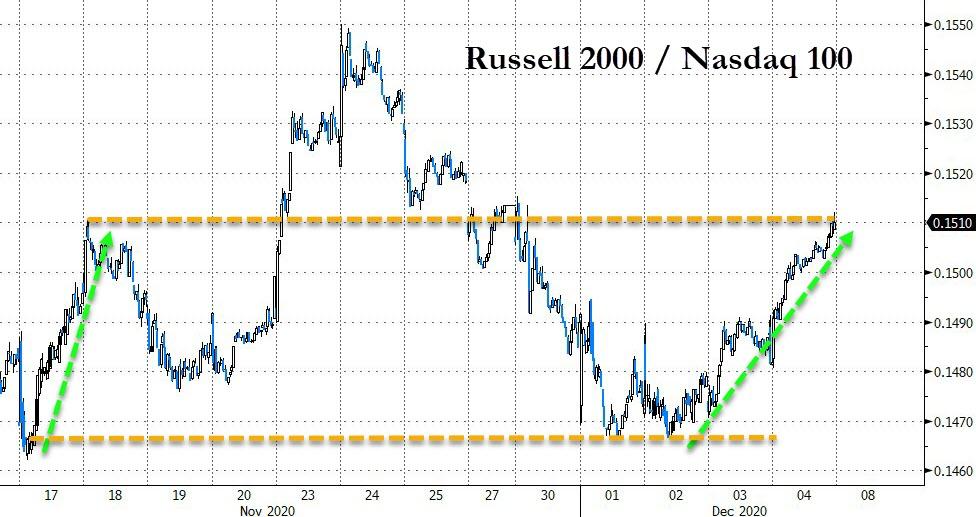

Small Caps continued their rebound against mega-tech again…

Source: Bloomberg

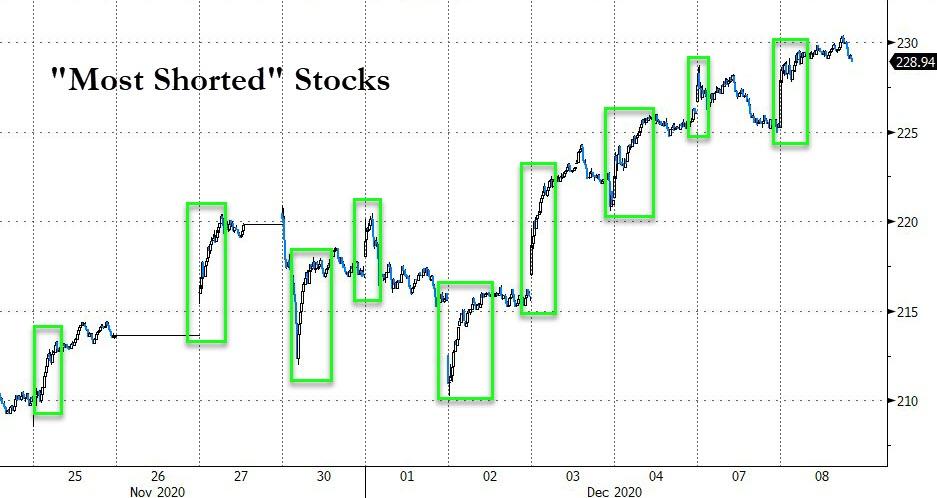

Another day, another massive short-squeeze…

Source: Bloomberg

The SMART money ain’t buying it…

Source: Bloomberg

“This is madness”…

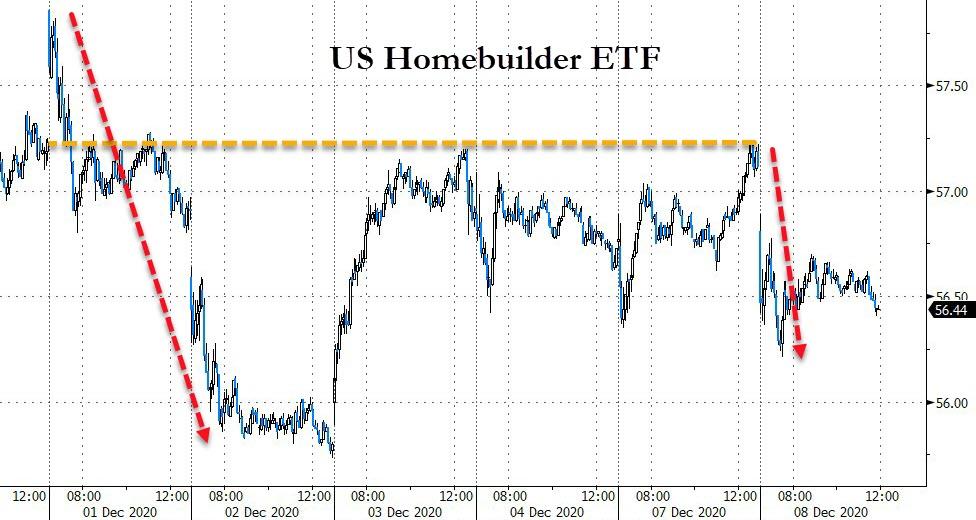

Homebuilders got hit today…

Source: Bloomberg

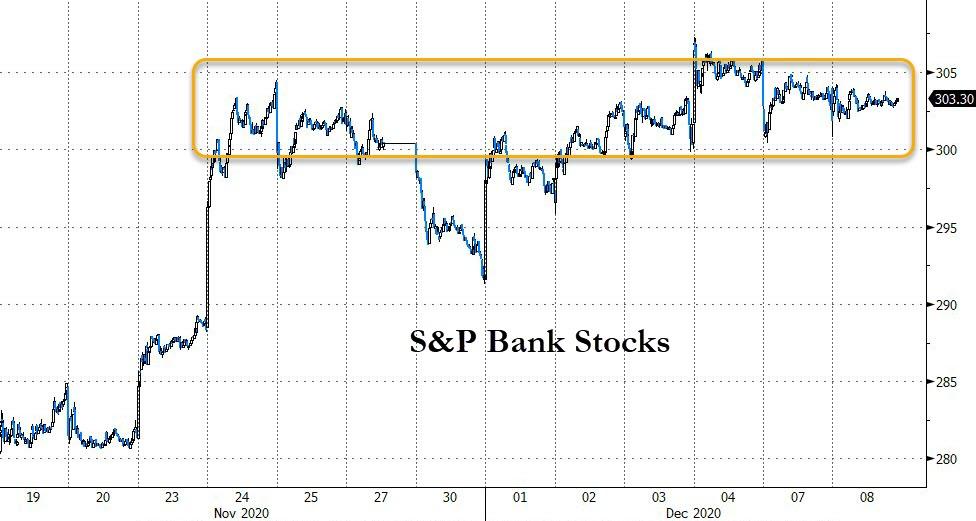

Bank stocks have trod water for two weeks now…

Source: Bloomberg

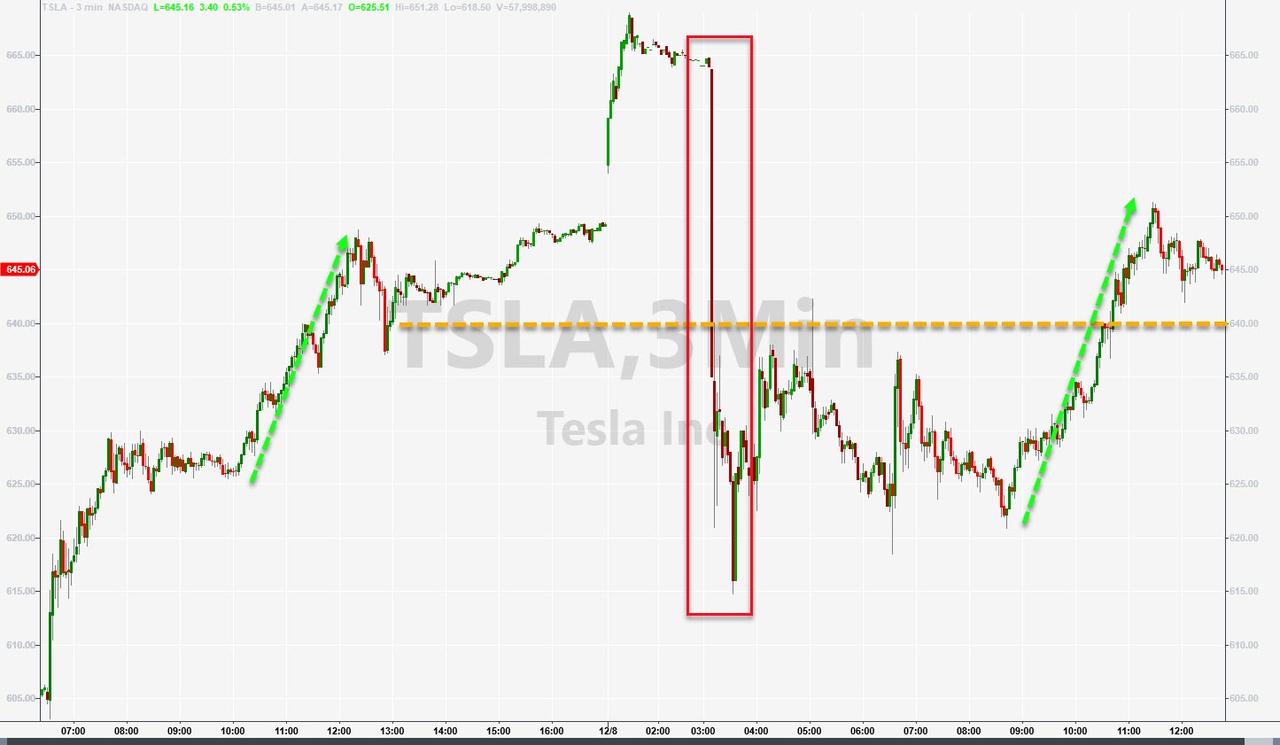

TSLA managed to get green despite selling another $5 billion of stock…

Notably, Cyclicals relative to Defensives continue to have stalled at a key level. Is it time to catch down to yields?

Source: Bloomberg

The value rotation is starting to lag again…

Source: Bloomberg

Despite stocks gains, bonds were also bid today – erasing all of the payrolls spike in yields…

Source: Bloomberg

And so was bullion…

Source: Bloomberg

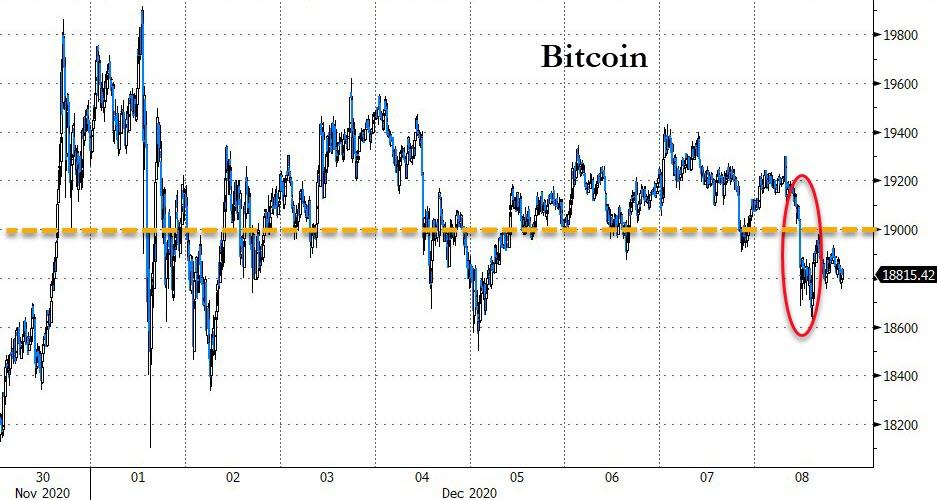

But Bitcoin was sold back below $19k…

Source: Bloomberg

As the dollar chopped around in a newly unusual tight range…

Source: Bloomberg

Copper’s exuberant run higher relative to gold appears to have stalled out at key resistance. We’ve seen this before (cough Q1 2019 cough)…

Source: Bloomberg

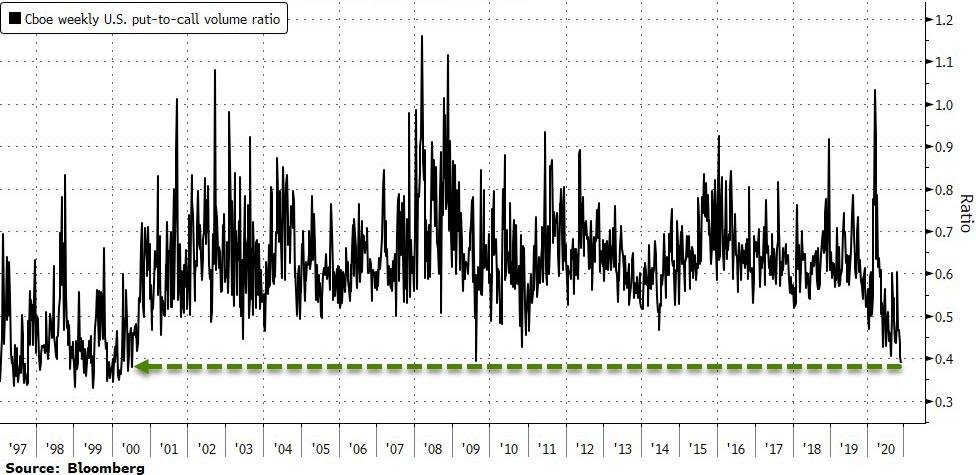

Finally, complacency has gone to ’11’ as the weekly Cboe ratio of volume traded in puts versus calls fell to the lowest since July 2000 just as the S&P 500 Index hit an all-time high.

Source: Bloomberg

This implies extreme positioning to the upside, as investors look beyond short-term uncertainty toward a continuing global recovery in 2021.

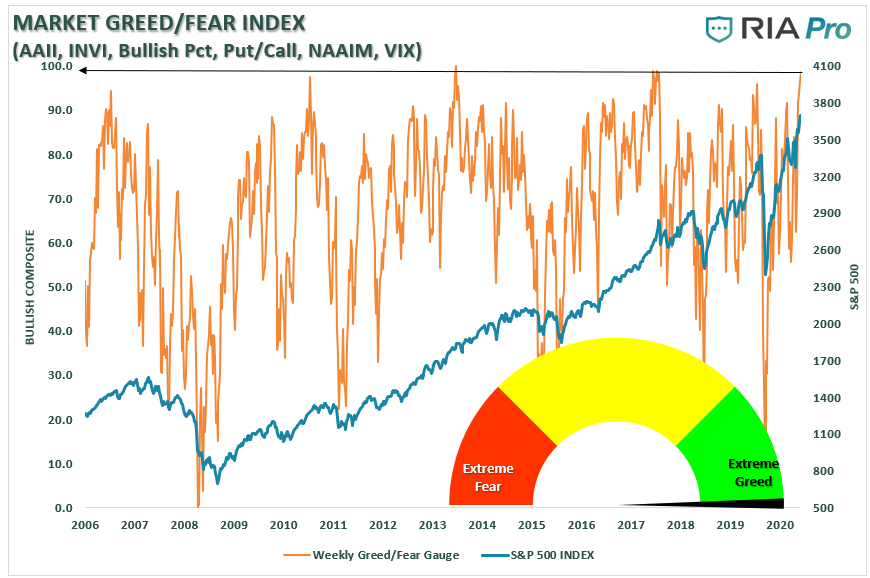

And Greed is good-est…

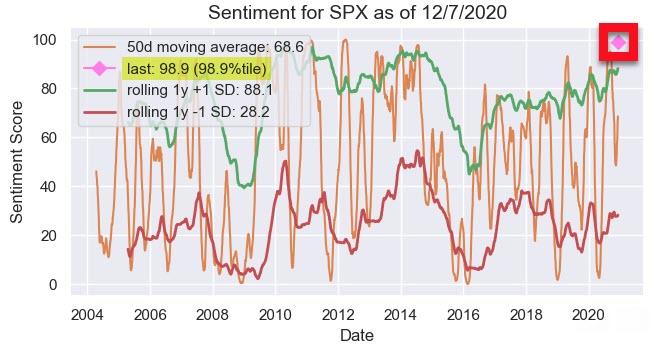

And Nomura Stock Sentiment is at its highest since 2004…

What could go wrong?

Especially with global stocks over $100 trillion and massively extended relative to world GDP…

Source: Bloomberg

via ZeroHedge News https://ift.tt/2VVJuo0 Tyler Durden