As Wall Street’s Love For Uranium Returns, One Analyst Lists 4 Reasons To Buy The Biggest Miner

Tyler Durden

Wed, 12/09/2020 – 18:45

Over the past week we have discussed the impressive surge higher in the handful of public uranium miners and various tracking ETFs:

- Uranium Stocks Soar: Is This The Beginning Of The Next ESG Craze

- Uranium Stock Surge Accelerates After 2nd Covid Case At World’s Highest-Grade Uranium Mine

Then, overnight, GLJ Research picked up on these moves, publishing a report explaining why it is time to buy, noting not only the growing ESG investor interest, but also listing four catalysts why the Uranium Sector could be poised to move sharply higher.

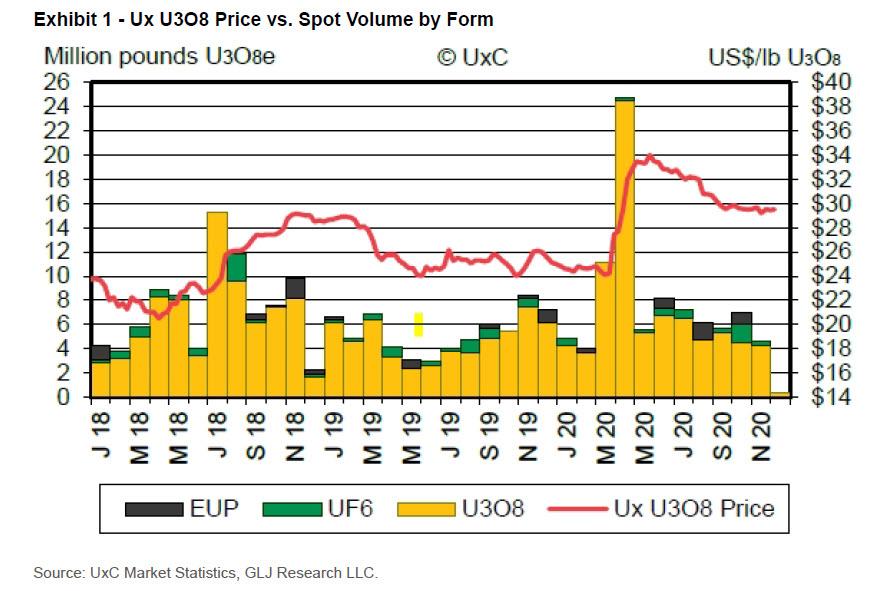

As Gordon Johnson writes, echoing much of what we have said int he past week, behind the impressive rally in uranium stocks since Oct 28 (+32.6% vs. +12.9% for S&P 500) “we believe the recent strength in “nuclear stocks” is due partially to higher spot volumes in Oct./Nov. (Ex. 1)…

… but also…”

- the U.S. Senate Committee on Environment and Public Works, last week, passing a bill that could fund a uranium strategic reserve through Sep. 2021 in the amount of $150mn (down from the initial $1.5bn over 10yrs announced by President Trump earlier this year), and exclude any Chinese or Russian company involvement in supplying the stockpile (implying, following a long lay-off, the US uranium industry may be in the midst of a revival – the Democratic Party included nuclear in its party platform for the first time in five decades (link), likely due to grid issues associated w/ solar, and Joe Biden’s energy plan (link) includes a carve out for nuclear power),

- the 11/28/20 announcement by Cameco that someone at its Cigar Lake mine tested positive for COVID-19 (link),

- the subsequent 12/7/20 announcement by Cameco that a second person tested positive for COVID-19 at its Cigar Lake mine (link), and

- indications last night that the Ukraine (i.e., the 9th largest global producer) has idled all three of its uranium mines due a to lack of funding (link) – admittedly, these mines are capable of just 2.0mn lbs/year of output U3O8, which is <2% of global production (assuming Cigar Lake is running at nameplate). That said, with the global Uranium market in a fundamental supply deficit, any curtailments (no matter how small) will go to helping absorb the inventory overhang from years of excess supply - Cameco and Kazatomprom, which represent ~55% of current global Uranium production, are managing their output with one objective in mind: higher prices.

In short, as GLJ summarizes “with interest in alternative energy and low GHG emissions markets gaining momentum among ESG investors, we see the uranium sector as well positioned to attract new funds as a “catch-up” play, particularly given the Global Uranium ETF Index is up just +6.5% over the past five years, vs. +80.3% for the S&P 500 over the same timeframe.”

“When you add to the above discussions we’ve held with Uranium investors over the past few days, we feel some of the “sidelined” money is poised to come flowing back into the Uranium space. And should Cameco announce further COVID-related issues at Cigar Lake, and ultimately shut the mine down (albeit, temporarily), we feel this would provide acute tailwinds to Uranium contract negotiations currently underway. As a reminder, while uranium spot prices are currently $29.48/lb, when considering spot prices moved above quoted contract prices in the month of May/June, a dynamic which last occurred dating back to 7/30/07…

… it is our opinion that the Uranium market is currently defined as a sellers market; this can be further evidenced by Cameco’s 3Q20 contracted price being up +13% YoY – Ex. 3.”

There is more in the full report (readers can skim it at their leisure) which looks at industry dynamics and supply and demand, as well as deal volumes, but we will fast forward to the conclusion:

The Uranium sector supply/demand balance is the tightest we’ve seen since pre-Fukushima. Furthermore, producers who account for over 50% of global supply are keeping capacity at bay for the sole purpose of driving Uranium prices higher. When you add to this the Uranium stocks are now gaining attention from ESG investors due to their low GHG footprint and quintessential role as a clean energy alternative, we see the set-up for incremental/new Uranium investments as opportune. Under this backdrop, we prefer Cameco given its low-cost industry positioning and solid balance sheet – Cameco currently boasts a cash-to-debt ratio of 79.5%, which was enabled by the company fortifying its balance sheet during the most recent downturn.

GLJ’s full note is below:

via ZeroHedge News https://ift.tt/3m057y9 Tyler Durden