It Is Striking How Similar Wall Street’s Forecasts For 2021 Are

Tyler Durden

Sat, 12/12/2020 – 16:30

Reflation narratives are becoming consensus, but there is little reason to be contrarian for contrarian’s sake

Strategists are flooding client inboxes with year-ahead forecasts and themes, and it’s striking how similar the arguments are. The common conclusion from these reports is that portfolios should be positioned for an economic recovery.

We are data-led, and there is nothing in our indicators to contradict the recovery view. There is little reason to be contrarian for contrarian’s sake at present, and we will stick to this view as long as the data justifies it.

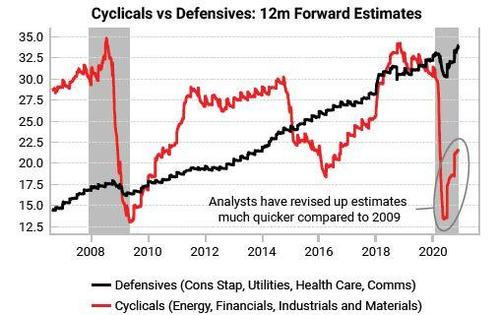

BAML’s global Fund Manager Survey shows that real money balances are shifting towards equities with cyclical overweights. At the same time, equity analysts are revising their forecasts upwards for cyclical companies.

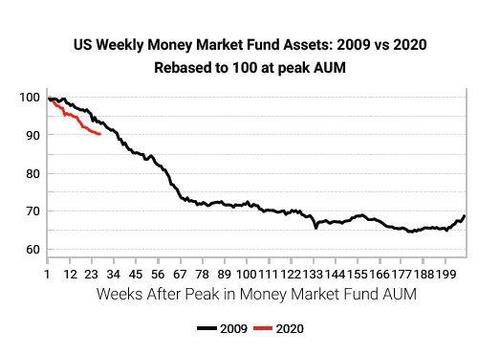

However, we still think there’s a lot more room until reflation trades become crowded. Money-market assets are very elevated and we see from 2009’s experience that it takes a while for money to be deployed into riskier assets.

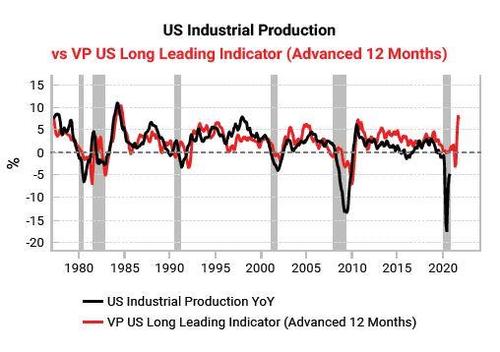

While today’s recovery may not feel like one, the data is supportive. Our leading indicators are at historic highs.

Weekly economic data also remains positive.

We have maintained that there is a lot of stimulative potential waiting in the wings, but economic gains can only be realised as virus-related restrictions are eased. The prospect of an effective vaccine is a massive boost to the recovery path. As we discussed in a recent report, voluntary restrictions on mobility are a persistent drag on the recovery. So even as government-mandated restrictions remain, a timeline for a vaccine will allow fear to subside and help further lift economic activity.

This is good news for European countries that are going through their second lockdown and have had their recoveries deferred.

Europe will also see support from China’s strong recovery. China often leads eurozone economies, and so China’s recovery ultimately underpins the European recovery.

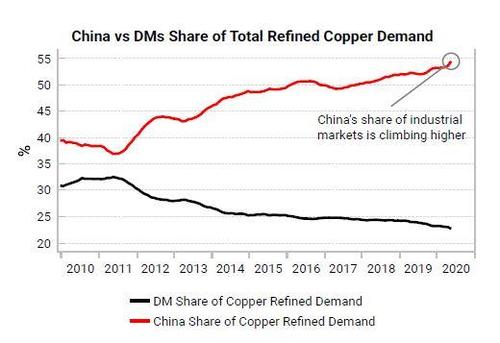

Moreover, as Western demand has fallen, China has filled the vacuum in industrial markets.

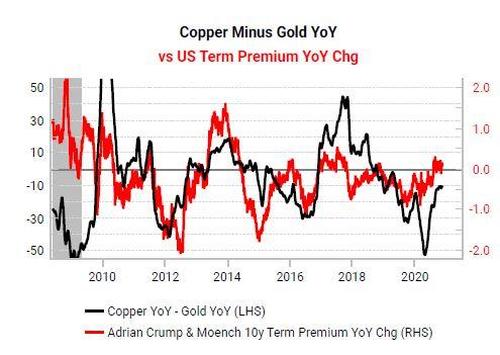

As Western demand recovers, this will strengthen the reflation dynamics that we usually see at the end of recessions. Copper vs gold is a useful barometer of global reflation that is continuing to recover. The continued rise in term premium is also consistent with the reflationary dynamics in play.

via ZeroHedge News https://ift.tt/2W8yELx Tyler Durden