Key Events In The Coming Busy Week: Central Banks Close Out With A Brrrr

Tyler Durden

Mon, 12/14/2020 – 09:45

Looking ahead at the last full week of the year, DB’s Jim Reid writes that it is going to be fairly busy with the highlight being the FOMC on Wednesday, while the BoJ (Friday) and BoE (Thursday) will close out the reminder of the main Central Bank meetings for 2020 this week. Ahead of that, Wednesday sees the global flash PMIs and tomorrow sees China’s monthly data dump. As a curiosity, today sees the Electoral College formally allocate their Presidential votes. Also don’t forget those US stimulus talks, which have the air of Brexit talks given the constant artificial deadlines and never-ending negotiations.

Discussing the latest Brexit event, UBS’ chief economist Paul Donovan is ever laconic: “The interminably tedious EU-UK divorce continues as expected. There is nothing useful to say on the situation, but that will not stop politicians from saying things. Just ignore them.” That about sums it up.

A bit more detail on the central bank meetings first. Starting with the US, DB economists write that they expect the FOMC to maintain the current pace and composition of asset purchases. The most important innovation for this meeting is likely to be an enhancement to the QE guidance by adopting qualitative outcome-based language. On top of this, the latest Summary of Economic Projections will be released, where economists expect there to be upgrades to the growth and unemployment forecasts. However, with a persistent shortfall in core inflation and uncertainty over the virus and the fiscal outlook, the median assessment of the federal funds rate should be unchanged through 2023.

In the UK, the Bank of England will also be holding their final meeting this year on Thursday, though we don’t expect any changes to the Bank’s policy settings after they increased QE by a further £150bn at their last meeting in November. For the Bank of Japan on Friday, our economists (link here) believe that they’ll vote to keep their present policy stance intact. The question for the BoJ is whether they extend their support for corporate financing beyond the end-March expiration date. On this DB now believe they will take action this week.

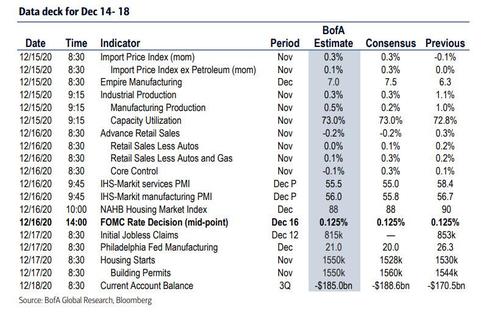

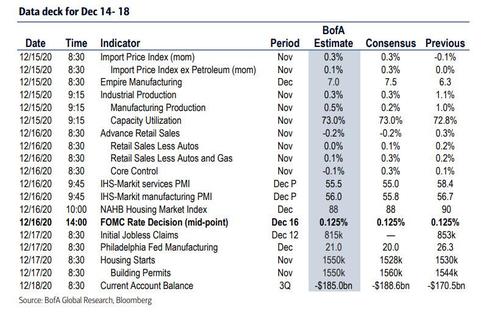

Outside of the aforementioned flash PMIs, there’ll also be an increasing amount of hard data from the US for November, with the week ahead seeing the release of figures on industrial production, retail sales, housing starts and building permits. BofA writes that it expects a weak November retail sales report with headline sales declining 0.2% and core sales inching 0.1% lower. Although YOY growth for retail sales remains stellar, the bank has seen a stalling MOM in October and November. The housing data should be firm with starts and building permits rising modestly in November while NAHB moderates from record levels in December. Regional manufacturing and IHS-Markit surveys should similarly point to continued growth

Courtesy of IGSquawk, here is a snapshot of key events this week:

I hope everyone had a great weekend! Here’s your 3-min Sunday night read to get prepared for the week ahead.

Weekend DOW via @IGSquawk seen marginally higher (+0.18%, up 52.8pts) pic.twitter.com/FZGuHBOBtQ

— Anthony Cheung (@AWMCheung) December 13, 2020

And here is a full day by day summary of the top events, courtesy of Deutsche Bank:

Monday December 14

- Data: Japan October tertiary industry index, final October industrial production, Euro Area October industrial production

- Politics: US Electoral College votes for President

Tuesday December 15

- Data: China November industrial production, retail sales, UK October unemployment rate, November claimant count rate, US December Empire State manufacturing survey, November industrial production, capacity utilisation, Japan November trade balance (23:50 UK time)

- Central Banks: ECB’s Rehn and Bank of Canada Governor Macklem speak

Wednesday December 16

- Data: Flash December PMIs for Japan, France, Germany, Euro Area, UK and US, UK November CPI, Euro Area October trade balance, US weekly MBA mortgage applications, November retail sales, October business inventories, December NAHB housing market index, Canada November CPI

- Central Banks: Federal Reserve monetary policy decision

Thursday December 17

- Data: EU27 November new car registrations, Euro Area final November CPI, US November housing starts, building permits, December Philadelphia Fed business outlook, Kansas City Fed manufacturing activity, weekly initial jobless claims, Japan November nationwide CPI (23:30 UK time)

- Central Banks: Monetary policy decisions from Bank of England, Bank Indonesia and Bank of Mexico

- Other: US FDA discuss Emergency Use Authorization for Moderna vaccine

Friday December 18

- Data: UK December GfK consumer confidence, November retail sales, Germany November PPI, December Ifo business climate indicator, US Q3 current account balance, November leading index

- Central Banks: Monetary policy decisions from the Bank of Japan and the Central Bank of Russia

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the retail sales report on Tuesday and the jobless claims report on Thursday. The December FOMC meeting is this week, with the release of the statement at 2:00 PM ET on Wednesday followed by Chair Powell’s press conference at 2:30 PM. There are no other scheduled speaking engagements from Fed officials this week, reflecting the FOMC blackout period.

Monday, December 14

- There are no major economic data releases scheduled.

Tuesday, December 15

- 08:30 AM Empire State manufacturing survey, December (consensus 6.9, last +6.3)

- 08:30 AM Import price index, November (consensus +0.3%, last -0.1%)

- 09:15 AM Industrial production, November (GS +0.7%, consensus +0.3%, last +1.1%); Manufacturing production, November (GS +0.5%, consensus +0.2%, last +1.0%); Capacity utilization, November (GS 73.2%, consensus 73.0%, last 72.8%): We estimate industrial production rose by 0.7% in November, with a weather-driven drop in utilities more than offset by higher mining and auto production. We continue to believe the manufacturing sector is outperforming and will exhibit resilience during the third wave of coronavirus infections. We estimate capacity utilization rose by 0.5pp to 73.2%.

Wednesday, December 16

- 08:30 AM Retail sales, November (GS -0.9%, consensus -0.3%, last +0.3%); Retail sales ex-auto, November (GS -0.6%, consensus +0.1%, last +0.2%); Retail sales ex-auto & gas, November (GS -0.6%, consensus +0.2%, last +0.2%): Core retail sales, November (GS -0.3%, consensus +0.2%, last +0.1%): We estimate that core retail sales (ex-autos, gasoline, and building materials) declined by 0.3% in November (mom sa). As discussed in our holiday sales update, credit card data sources weakened on net, and we believe the report will be depressed by waning fiscal support, pandemic-driven declines in mall traffic, and a high hurdle for sequential growth in e-commerce following outsized gains earlier in the year. Relatedly, we expect payback from Amazon Prime Day, which was moved from July to October this year. On the positive side, we expect a sequential increase in the grocery category, consistent with the credit card data and a boost from pandemic-related stockpiling. We estimate a 0.6% decline in the ex-auto ex-gas category, reflecting reduced dining activity. We estimate -0.9% and -0.6% for the headline and ex-auto measures, respectively.

- 09:45 AM Markit Flash US manufacturing PMI, December preliminary (consensus 56.0, last 56.7)

- 09:45 AM Markit Flash US services PMI, December preliminary (consensus 55.8, last 58.4)

- 10:00 AM Business inventories, October (consensus +0.6%, last +0.7%)

- 10:00 AM NAHB housing market index, December (consensus 88, last 90)

- 02:00 PM FOMC statement, December 15-16 meeting: As discussed in our FOMC preview, we expect the FOMC to adopt outcome-based forward guidance for asset purchases indicating that purchases will continue “until the labor market is on track to reach maximum employment and inflation is on track to reach 2 percent,” a softer version of the thresholds used for liftoff of the funds rate. We think the Fed is slightly more likely than not to extend the weighted average maturity of its Treasury purchases, though it is a close call.

Thursday, December 17

- 08:30 AM Housing starts, November (GS +0.2%, consensus flat, last +4.9%); Building permits, November (consensus +0.4%, last flat%): We estimate housing starts increased +0.2% in November, reflecting higher permits and better weather as well as a drag from the virus.

- 08:30 AM Philadelphia Fed manufacturing index, December (GS 20.0, consensus 18.3, last 26.3): We estimate that the Philadelphia Fed manufacturing index declined by 6.3pt to 20.0 in December, reflecting weaker business confidence measures and additional impact from the virus resurgence.

- 08:30 AM Initial jobless claims, week ended December 12 (GS 770k, consensus 800k, last 853k); Continuing jobless claims, week ended December 5 (consensus 5,500k, last 5,757k): We estimate initial jobless claims decreased to 770k in the week ended December 12.

- 11:00 AM Kansas City Fed manufacturing index, December (consensus +8, last +11)

Friday, November 20

- 08:30 AM Current account balance, Q3 (consensus -$190.0bn, last -$170.5bn)

Source: Deutsche Bank, BofA, Goldman

via ZeroHedge News https://ift.tt/34cSdGZ Tyler Durden