2021 Constanza Trades

By Mark Orsely, head of Macro Strategy at PrismFP

Long time readers will know that The Macro Scan takes a twist at year end to present next year’s “Costanza Trades” or the “Not Top Trades of 2021.” A friendly push back against all the bank “year ahead” pieces that tend to be widely consensus. As one friend noted with regards to 2021, “this year it almost appears that bank “year ahead” pieces were written collaboratively it is so consensus.”

For those of you not familiar with George Costanza, his character on the sitcom Seinfeld could do no right when it came to employment, dating, or life in general. In one episode, George realizes over lunch at the diner with Jerry that if every instinct he has is wrong; then doing the opposite must be right. George resolves to start doing the complete opposite of what he would do normally. He orders the opposite of his normal lunch, and he introduces himself to a woman that he normally would never have the nerve to talk to: “my name is George,” he says, “I’m unemployed, and I live with my parents.” To his surprise, she is impressed with his honesty and agrees to date him! Doing the opposite was the right thing. Watershed!

Employing the Costanza method to trading is an interesting exercise. Ask yourself what are the trades that make complete rational sense, and all your instincts say are right…now consider the opposite. Basically, what you end up constructing is an out of consensus portfolio. If you can back those out of consensus views with fundamental and technical justification; there is potentially a high amount alpha in these trades.

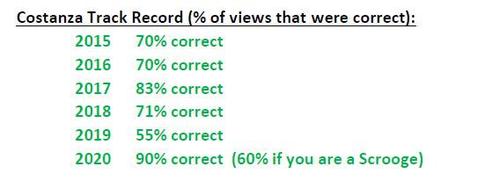

Performance of last year’s Costanza may be highly controversial. I would argue that Costanza pushed back against the consensus reflation view heading into 2020, warned that the market was extremely susceptible to the slightest growth hiccup, and that he was proven right by the end of March when the hiccup (or cough/fever), COVID, arrived. Clearly Costanza would have closed his book and monetized his view at the end of March like any good PM and realized a 90% success rate on his trades. Even if you are being the Grinch and want to mark-to-market his book now, Costanza is still 60% right!

Let us give Costanza the benefit of the doubt of a March monetization of his views, and thus the 90% success rate.

Costanza can almost copy and paste last year’s themes. The reflation narrative has gripped markets , growth prospects are merry and bright, “value” will outperform “growth”, vol will compress, rate curves will steepen, and the Dollar will continue to depreciate.

Costanza sees two possible paths in his 2021 outlook that will define his trade expressions. In summary, either:

a) A reemergence of growth risks will crush reflationist once again, and/or

b) Spiking inflation, from too hot reflation, leads to stagflation (think corp margin compressions that lead to layoffs)

2021 Costanza Trades:

1) Short “Value” stocks vs. long “Growth” stocks (-SVX / +SGX)

2) Short EM (MES1 future)

3) Long US 6m10yr 1.25% payers or wide payer spreads

4) Long US 30yr bond

5) Short Sept ’22 Fed Funds (FFU2)

6) Long DXY (USD Index)

7) Short IG and HY (CDX wideners/buying protection)

8) Short Metals (Copper and Iron Ore)

9) Negative on Digital Currencies (no specific trade)

Bonus: Short Robinhooders + short calls

Costanza views the following as the main risks to markets reflation narrative in 2021:

-

Renewed economic weakness or double dip recession:

-

Unemployment claims are beginning to rise again – 20.6 million Americans are currently receiving some kind of unemployment benefits

-

Rising amount of people saying they expect a loss of income in the next four weeks

-

Both suggestive of a weakening consumer – Dec. retails sales soft

-

-

Potential COVID vaccine disappointments – side effects become > benefits (reports this weekend that a small number of patients are getting Bell’s Palsy), vaccines could prove ineffective against new strains of COVID (UK?)

-

Section 13.3 expiration that backstopped credit markets + regional COVID re-closures leads to a bankruptcy spike, another round of missed cash flows, and ultimately a default cycle which was originally delayed due to Fed policy (now gone under the reported fiscal deal)

-

If Dems take both Georgia Senate seats, the Dem sweep could lead to higher taxes and re-regulation – a reversal of the prior four years

-

All the various forces we have discussed in recent Macro Scans that could lead to an inflation impulse causes widespread margin compression, a sooner than expected Fed response, or just generally higher nominal yields that the economy cannot sustain – too much debt to service and rising yields would exacerbate the issue

-

Techlash – governments continue to reign in monopolistic activities by the big tech firms who have propelled most of the 2020 rally which causes wide scale risk-off

-

Biden administration gets an early geopolitical test

-

China increases Taiwan threats

-

Foreign (Russia?) hacking of the US government and corporations is being deemed as an act of war. Sen. Chris Coons (D-Del.): “It’s pretty hard to distinguish this from an act of aggression that rises to the level of an attack that qualifies as war. This is as destructive and broad scale an engagement with our military systems, our intelligence systems as has happened in my lifetime.”

-

SolarWinds lost $3b of market value due to the hack. Are other companies at risk?

-

Trump silence on the topic means the (Russian?) hack issue is being punted to Biden

-

-

-

Retail/Robinhood frenzy ends – as labor market tightens; day traders could return to work

-

A splintering OPEC finally fractures leading to increased oil production, crushing prices and reflation signals

-

Yellen pivots the US back to a strong Dollar policy reversing Trump’s four years of welcoming weaker USD

Let us go through each trade and assess the likelihood of Costanza once again beating the street.

* * *

1) Short Value (SVX) vs. long Growth (SGX)

Easily one of the most popular themes heading into 2021 on the back of the economic recovery led by housing, the massive fiscal and monetary response which keeps financial conditions easy, and vaccines that will increase confidence in the economic upturn.

Thus, buy the laggards that have been depressed, will benefit from COVID health risks fading away, and have much lower P/E multiples than their “growth” brethren. “Value” P/E = 22, “Growth” P/E = 36.

Value proponents will point to the fact that the downtrend in the Value/Growth ratio has been taken out to the upside and is now making slightly higher highs…

However, Costanza will point to the fact that “Growth” has been outperforming “Value” for the past 13 years so there are much larger structural forces at play outside of COVID. Yes, there could be a short-term, tradeable bounce for “Value,” but the long-term, structural trend towards a world dominated by tech will eventually rematerialize.

Looking back at the 20yr chart of the value/growth ratio (below), we see two regimes where “Value” outperformed:

-

2000 tech bubble (purple box in chart below) –more about the tech correction than reflation. Are we in a similar regime? Not even close. Multiples are high but in 1999, you could have put “.com” on any stock and it would have gone parabolic and had a 100+ P/E. It was a true mania. Valuations are not nearly as high (36x vs. 53x on earnings; 33x vs. 118x on free cash flow). Sure, there are hot IPO’s, but the big Tech companies that are driving indices have real businesses and extremely strong balance sheets that are flush with cash. Also, how much do P/E’s matter in a ZIRP/NIRP world?

-

2003-2006 (blue box in chart below) – the economy was coming out of a short recession (same as now), the Fed was uber easy (same), housing was booming (similar), materials were thus bid (definitely starting to see this), EM was reflating (potentially starting to happen), and vol was nonexistent (not seeing that quite yet). Therefore, there are clear similarities between now and the regime that led into the housing bubble/GFC (will ours be a debt explosion?)

We are therefore sympathetic to the consensus thought of “Value” over “Growth” given how similar ‘20/’21 is to ’03/’06.

Costanza just views the multi-decade technological revolution as a more permanent force on the markets. The world is shifting towards Fintech (payment systems) not traditional banks. Cloud infrastructure not material companies. Solar/wind/electric firms not oil conglomerates. Online retail not brick and mortar.

Therefore, when looking at the long-term chart of the Value/Growth index, Costanza will ride the structural downtrend. There will likely be short-term pain as value squeezes higher early next year up to the 2015 downtrend resistance, but Costanza believes it will fail there and reengage the long-term downtrend….

Lastly, Costanza will have to vote for both GOP candidates in Georgia to prevent a Democratic sweep of all three government branches that could lead to an all-out tax assault on Big Tech and destroy his long “Growth” view.

-

Instinct: economic expansion led by vaccines and one more round of stimulus will lift the depressed “Value” sector as tech companies deal with increasing regulatory scrutiny

-

Costanza: the world is not shifting back to banks and energy companies. It is a digital world, economic growth will moderate in 2H especially when base effects work against the data, and tech companies have extremely healthy balance sheets (this is not 1999)

Estimated probability of Costanza being right: 65%

When the market is this hyped up about reflation, we tend to see some sort of an economic disruption. In the recent past it has been Fed overtightening (2018), Trade Wars (2019), and COVID (2020).

The point here is Costanza is not prescient. When reflation is this well positioned, the smallest growth risk can cause an outsized correction. Additionally, outside of “for a trade,” do you really want to fight powerful, long-term mega trends?

* * *

2) Short EM (MES1 future)

Long EM is very similar to the “Value” expression discussed above. COVID vaccine success will lift EM growth which is also benefiting from the general US Dollar depreciation. Further, EM countries levered to commodities, which are rallying sharply, will get an additional tailwind for better growth in 2021. EM central banks are indicating that rates will stay low, and QE/TTLRO policies will remain in place lockstep with their DM brethren. Biden’s policy will be more friendly to EM than the previous administration is another common consensus thought.

The technical setup corroborates the fundamental backdrop. A bullish inverse head and shoulder pattern is underway that targets a move above 1500…

Then going back to the idea we discussed above regarding how similar the environment is to the 2003-2006 era, recall after a 10yr USD rally in USDBRL, for example, the early 2000s was a period of EM reflation and therefore EM currency appreciation.

Present day, we have just witnessed 10yrs worth of USD appreciation versus BRL. Considering how similar the environment is to 2003, are we now looking at a multi-year rally in EM just like pre-GFC?

However, Costanza, as always, sees a very crowded position and less talked about risks such as:

-

Slower distribution of the vaccine in EM will mean a delayed growth recovery plus potential new COVID strains

-

US onshoring supply chains away from China

-

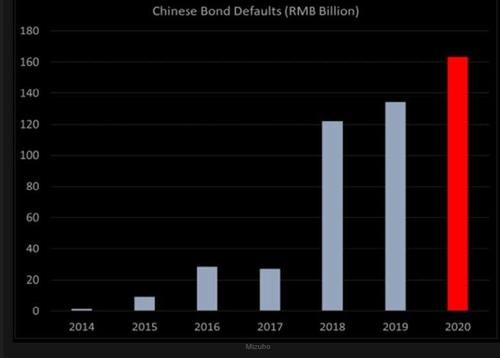

Chinese debt concerns finally surfacing. This amusing headline hit on 12/15:

-

China temporarily halted domestic ratings agency amid concerns about corp defaults, inflated ratings

-

-

“Chinese flu” retribution – China is in the world’s crosshairs over their lack of quality information dissemination in the early days of COVID (see deteriorating relationship with Australia, for example)

-

Geopolitical risks as China looks to increase their influence in the region – most at risk is China testing the US “strategic ambiguity” policy towards Taiwan. Recall China believes Taiwan is rightfully Chinese territory. The intelligence community does not believe that China will hold good on their “one country, two systems” policy over the long-term, and that an invasion is inevitable

-

Biden’s “green” and human rights policies could adversely affect some of the large EM countries (China, Brazil, India)

-

Asia’s balance of payment issues that could lead to excess currency strength and then lead to slower growth

-

Rising inflation which leads to stagflation

-

Policy normalization across EM in 2H 2021 could reverse 1H gains

Instinct: EM countries will benefit from vaccination progress, EM central banks are accommodating, USD is weakening, inflation tame, commodity levered countries will see a boon, and Biden will be more friendly to EM

Costanza: China growth will slow and drag down the rest of EM due to supply chain losses, countries are pushing back on China for their COVID response which is feeding into worse trade relations (Australia), China/Taiwan risks, and potential for quicker policy normalization in 2H 2021

Estimated probability of Costanza being right: 30%

Although Costanza is going short EM and he is normally right, we prefer the EM long much more so than the US “Value” long for reflation. EM has the commodity exposure and the tech exposure. Meaning things the world needs, and we see a similar trajectory as the 2003-2006 era of EM strength. It may not last all year, and perhaps Costanza proves correct ultimately, but we likely see EM outperformance at least in 1H but likely over the course of the whole year.

* * *

3) Long US 6m10yr 1.25% payers or wide payer spreads

This might not strike you as an anti-consensus trade in a world in love with reflation. The idea here while yes, the market generally believes in higher rates, through observing interest rate option flow, there seems to be a growing consensus that rates will not rise too high due to Fed policy. So, selling downside strikes via put 1×2’s, put trees, or flies have become very common, as well as selling US puts to fund EU downside.

Therefore, Costanza wants to own the right tail in rates. In this case playing for a break of 1.25% on the 10yr rate which will prove uncomfortable for those who are underestimating the inflation impulse.

With regards to the consensus reflation view, inflation is good until it is not, and there are two macro risks that rising inflation brings:

-

Inflation rises too fast, nominals must follow to some extent, and higher nominals/real yields once again break the economy and equity market (a la January 2018, December 2018 as your most recent examples). We often say, “yields can never rise past the level of growth or debt sustainability comes into question.” Meaning, once rates rise above level of GDP, for example, you can no longer grow your way out of the debt.

-

Inflation rises, yields only rise slightly as Fed controls the curve, but rising input prices forces margin compressions which corrects an equity market that is priced for near perfection

Stagflation is a regime that most people on Wall St today will find unfamiliar, and I can guarantee you the Robinhooders will find that environment challenging.

Notice during the 1970’s when inflation (black) and yields (10yrs in orange) lurched higher together, the Dow (purple) never rallied…

Thus, while this is a Costanza trade to push back on the “Fed will cap yields thesis,” it is also a very good hedge for 2021 for the crowded narrative of higher risk assets. In our view, inflation that is hotter than the Fed is targeting is a significant risk. In other words, the Fed better be careful of what they wish for (they want 2.5% but may get > 3%).

6m10yr yields are starting to track inflation expectations and are “underpriced” compared to 10yr breakevens…

The entry point for payer spreads is in the lowest quartile over the past 10yrs and well below its mean…

Instinct: growth and inflation are picking up, but the Fed will limit the rate rise. Position for a limited rate rise via put 1×2’s and put trees

Costanza: this period is unique in that both supply side and demand side inflationary forces are in play concurrently, the Fed passed on explicitly stating that they will extend the WAM of its portfolio at the Dec FOMC, the market has sold short the optionality for much higher rates

Estimated probability of Costanza being right: 60%

Costanza likes the convexity here with market participants short the 1% to 1.25% area on yields. As we discussed in recent Macro Scan pieces (that clearly Costanza is reading), the regime shift towards inflation is watershed.

From the Macro Scan on Dec. 13th , “tis the season to be inflated”…

1) Demand side:

-

High savings rate.

-

Pent up consumer demand coming out of COVID – consumers have money + eager to spend

-

Company inventories are being rebuilt off very low levels post trade wars.

-

Output gap potentially closing sooner than expected as demand rebounds faster than supply.

-

Likely additional fiscal stimulus from the US.

-

The new administrations shift towards Green energy, which adds a new bullish input for commodity demand. This is also emboldening other regions to follow:

-

“Xi Jinping on Saturday targeted a steeper cut in rates of carbon emissions relative to economic activity by 2030”

-

“EU leaders said to set path for climate neutrality with stricter 2030 targets and endorsed 55% cut in greenhouse gases from 1990 levels”

-

-

The forthcoming progressive Fed/Treasury coordination (“Feasury”) to lift the lower income into the middle class and solve the structural long-term unemployment issue. (i.e.: a pure focus on ESG from the “Feasury”)

-

Radical right tail risk if the Democrats take Georgia to “Spread the Fed” and provide new channels to perform “digital helicopter drops.”

-

Short-term, the pent up demand to perform activities like traveling and dining out causes a sharp snap back in service sector prices.

-

Medium-term, the shift to Green energy keeps demand high for the necessary commodity inputs.

-

Longer-term, the new “Feasury” programs introduce inflation in a whole new part of the economy.

2) Supply Side:

-

Capacity constraints, largely driven from shopping at home, which is something that will not shift back to brick-and-mortar post-COVID, is leading to higher shipping and trucking rates.

-

Chronic underinvestment in the metal sector. There is not enough supply to match the Green demand. Higher prices are needed to spur investment into the sector.

-

Following the COVID collapse into negative prices in April, sharp energy production cuts will now mean not enough supply to match the COVID recovery/vaccine theme. The travel industry, which now means a drawdown of jet fuel supplies, is at risk of a rubber band like snap back as soon as the spring.

-

After the exodus out of cities and into the suburbs, US housing supply is at generational lows. This type of housing shortage leads to people paying up for homes, and another source for commodity inflation (copper, lumber, etc.).

-

Against this theme has been a collapse in rental prices but will the housing shortage begin to firm rental prices as there is no living alternative? Meaning you must rent as you cannot buy.

-

-

Supply chains shifting from low-cost regions to higher cost regions (not to mention the cost of move the supply chain).

For us, it is not if inflation will arrive, it is to what degree; tame or hot. With the market essentially selling strikes between 1.0% and 1.25% which is indicative of a consensus view of tame inflation, Costanza is taking the stance that it could run hot and is positioning for the breakout as base effects alone will have ~3% headline CPI by the early spring.

The real upside will come if some of the deflating forces on CPI (rents) start to reverse as COVID risks decline and suburban housing shortages force folks back into the cities where price declines will incentivize renting again (plus increasing stories about the city dwellers who moved to the country finding it too dull and moving back to the city). Costanza believes that could take place after the winter months.

* * *

4) Long US 30yr bond

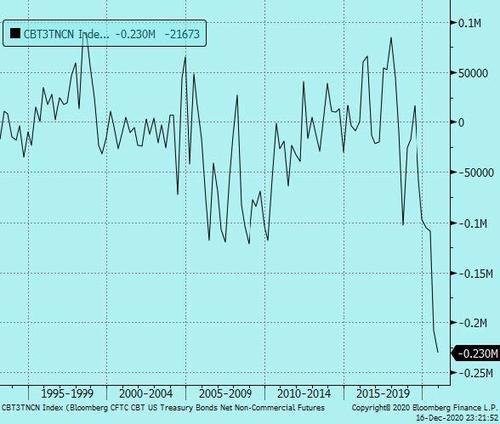

This is probably more what you were expecting Costanza to say and is one of Costanza’s pure risk-off trades as short positioning in the very long end is extremely crowded. While the Fed controls the front-end/belly, the long end will feel the effects of increased UST supply due to rising deficits and will benefit from any additional stimulus in 2021 (infrastructure?). Intuitively, this theory makes sense, however, everyone is already positioned for it.

“Spec” positioning for US 30yr futures…

What Costanza really likes about this trade and combining it with the 10yr payer idea above (so essentially in a 10s30s flattener) is that 10s30s curve flattens when in reflation and certainly in stagflation.

Notice below that periods when CPI (purple) is high (denoted by red vertical lines), 10s30s curve flattens…

Instinct: Vaccine is being rolled out, economy is recovering, another round of stimulus is coming which will all drive long end yields higher (especially since the Fed is usually less active in the long-end)

Costanza: strong risk off trade on any growth interruption due to crowded positioning, and most importantly, when combined with trade #3, 10s30s flattens during reflation or stagflation

Estimated probability of Costanza being right: 75%

Notice Costanza’s sequencing here. Essentially for an inflation spike in 1H which will profit the 6m10yr payer, and then for slow growth (stagflation) over the rest of the year which will benefit the long 30yr position in 2H. Will both work for Costanza?

* * *

5) Short Sept ’22 Fed Funds (FFU2)

One lonely Fed official thinks there could be a rate hike in 2022 while the other 16 say no hike until 2023 or later. Market participants are taking them at their word with roughly 28% chance of one hike priced through 2023.

Costanza has learned a few things about trading Fed policy over the years:

-

NEVER take the Fed at their word – Costanza remembers when the Fed was still talking rate hikes in January 2019 and started a cutting cycle just five months later

-

Fed officials are notoriously bad at predicting the future and certainly with regards to the macro landscape. To be fair, economists take backwards looking data and extrapolate it forward. Therefore, they do not tend to identify regime shifts very well.

So, when the Fed says they will not hike rates through 2023, Costanza would warn that it is not that the Fed truly believe they will not hike rates until then, it is just that they need to ensure strong forward guidance that compresses rates RIGHT NOW.

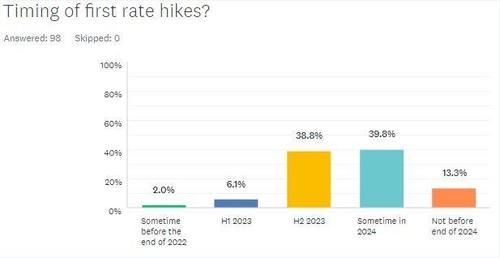

Yet according to our client survey conducted this past week, 91% or respondents are taking the Fed at their word after the sharpest yet shortest recession in our lifetime.

If the economy normalized faster than most of us expected this year, wont the Fed have to normalize faster as well?

If the inflationary regime develops that The Macro Scan has discussed recently, there could easily be moments when the market challenges the Fed on hold through 2023 mantra. Likely in 1H as positive base effects work in the data’s favor and the pass through of higher metal prices plus China’s inflation impulse hits in earnest.

Selling FFU2 is a low-cost option for the view inflation develops more robustly than the Fed anticipated which leads to tapering and potential for rate hikes sooner than we expected.

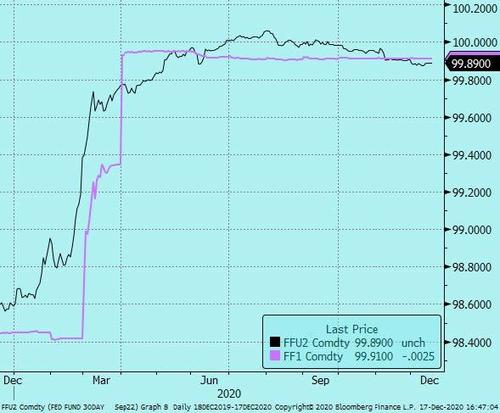

FFU2 (black) is only 2ps below the 1st Fed Funds contract – in other words, the market is implying just an 8% chance of a 25bp hike almost two years from now, or 12:1 leverage if the market prices in just one hike by then….

Instinct: Fed is explicitly stating their intention to keep rates at 0.1% through 2023, there is a greater likelihood of negative rates

Costanza: the macro tailwinds are blowing strong for an inflationary impulse, it could turn out to be stronger than the Fed wished for which forces them to hike rates sooner than the Fed is currently indicating (or causes the market to at least price in the potential of a hike)

Estimated probability of Costanza being right: 60%

We like where Costanza’s head is at with regards to reading Fed policy and the potential for a strong bout of inflation. Again, the point here is not necessarily that we think the Fed will, with 100% certainty, hike by September ’22. However, there will be moments the market begins to believe that is possible. Therefore, Costanza could return 3x on his option like payout profile on FFU2. In other words, this is cheap optionality that the market will be right on reflation and may be underestimating the potential inflation impulse in 2021.

* * *

6) Long DXY (USD Index – which is mainly vs. Euro)

The widely held view of weaker USD revolves around the following main ideas:

-

The Fed can “out dove” the ECB and the US gov’t can institute fiscal stimulus sooner and larger than the EU

-

A reversal of the multi-year “TINA” mentality – money that was previously flowing into the US is now reversing and going into EM, EU, and Japan

-

Ample Dollar liquidity – the Fed has flooded the funding markets with Dollars, and the US is importing goods at a torrent pace and thus saturating the world with Dollars via the trade channel

-

And even though UST issuance is rising, with the Fed buybacks, there is no global “crowding out” effect

-

As always, a good reflation environment starts with a weaker Dollar. When looking at the long-term chart, reflationist can certainly hang their hat on the very clear technical regime shift/trend break towards further Dollar depreciation…

In a world where the US government provided trillions of Dollars of fiscal stimulus funded through deficit expansion, and then the Fed purchased USTs to compress yields; the US engineered negative Real Yields. It is notable that Real Yields lead the Dollar. Therefore, if you lag Real Yields (black) by one year, you get the forward path of the US Dollar (purple)…

Our belief is 5yr Real Yields will move further negative in 2021 which will only lead to additional USD depreciation.

However, as always, Costanza has an out of consensus, yet reasonable view why the Dollar could very well squeeze shorts:

-

Assuming the GOP wins one of two seats in the Georgia Senate election, further fiscal stimulus is unlikely

-

If we get a decent burst of inflation in 1H 2021, the Fed may not be able to stay as accommodative as today

-

A stagflationary environment that compresses corporate margins could lead to layoffs and slow the economy

-

Yellen pivots away from Trump’s weak Dollar regime and back to the classic strong USD policy

-

Any exogenous, risk-off event, that the FX market is now highly susceptible to, will cause a massive Dollar short squeeze and investors rotate back into Dollar assets (back to TINA)

Instinct: additional fiscal stimulus is coming, the Fed will have to buy more bonds to fund the new administrations ESG policies, the Fed will keep rates on hold through 2023, the financial pipes are flushed with Dollar liquidity

Costanza: inflation/yield spike could end the Fed easing cycle and thus the growth recovery, split US government means no more stimulus

Estimated probability of Costanza being right: 20%

As we have spoken about at length in recent Macro Scans, we think there are monumental shifts underway in both monetary and fiscal policy and how the two interrelate to combat ESG issues. Therefore, we see much deeper negative Real Yields in 2021. Costanza has his work cut out for him on his long Dollar view and will likely need an exogenous shock for his DXY long to be profitable.

* * *

7) Short IG and HY CDX

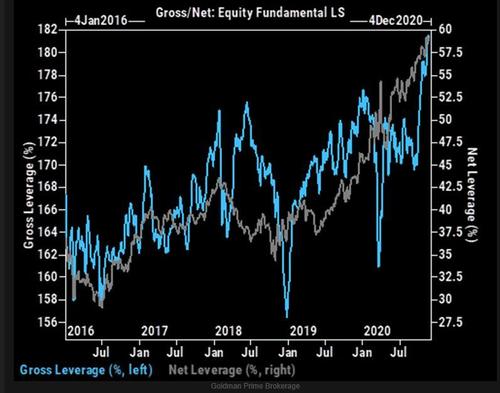

Another one of Costanza’s outright risk-off expression for 2021 in the face of historic long risk asset positioning.

Why Corporates?

-

Mnuchin’s removal of Section 13.3 corporate credit facilities eliminate an important market safety net, and closes backdoor stimulus in 2021 (and looking like the new stimulus deal keeps the SMCCF removed)

-

The Fed and Treasury actions in 2020 only postponed a proper corporate default cycle. Will partisan DC politics in 2021 unleash a wave of bankruptcies, fallen angels, and widening credit spreads?

-

Robinhooders cannot put on CDX tighteners

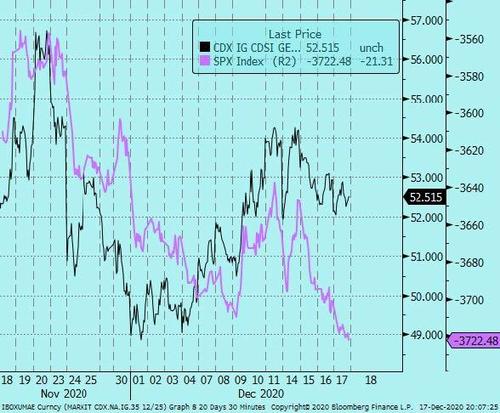

Since the clarification from the Treasury Secretary on the Corporate Credit Facilities, IG credit spreads have tightened 1bp. During that same exact time, S&P’s have rallied 1100bps.

IG CDX spread (black) vs. S&P’s (inverted in purple)…

Instinct: decreasing corp supply, strong economic recovery, COVID vaccine, and accommodative Fed will keep corporate credit spreads compressed

Costanza: IG spreads are in the tightest 90th percentile over the past 10yrs, risk asset positioning is extremely skewed to the long side, Fed policy only delayed a default cycle not avoided one, no more fiscal support for the struggling service sector going forward, small corporations are witnessing tightening credit conditions (the percentage of domestic banks tightening standards for commercial and industrial loans are both at their highest levels since 2009)

Estimated probability of Costanza being right: 70%

We know from our years of watching the Costanza portfolio that when positioning is this one sided, Costanza is rarely wrong over the long-term.

We therefore agree with Costanza that the greatest risk in the market lies in the corporate credit market. A sector that no longer has a Fed backstop, and one that relies on the smooth transmission of cash flows (whereas equities rely on the belief of forward earnings). Meaning, companies will need cash to pay back their debt obligations and given the renewed economic shutdowns into the winter months and the delayed fiscal support; there will likely be more downgrades and defaults in 2021 after this year witness 2,338 S&P downgrades (vs. 659 upgrades).

In 2020, there have been 143 defaults in the US, which is the highest since 2009.

There is a general degradation of the investment grade sector. Some key points from our friends at Quill Intelligence with regards to the mounting debt problem and interest coverage

-

Total debt with less than 2x leverage now makes up just a fifth of IG – meaning 80% now has unhealthy leverage

-

Those with 4x leverage, the riskiest bucket, now makes up 36% of IG which is 2x larger than the long-run average

-

BBB-, the lowest possible IG rating, now has an interest coverage ratio of 6.5 which is a nine-year low (vs. 9.18 in 4Q 2018)

The point is there is significant risk of a fallen angel cycle which could crowd out the HY market.

Additionally, rising nominal yields (due to rising inflation) will exasperate the interest coverage issues described above and generally make it more difficult to fund operations. We are obviously not talking the Apple’s of the world. Costanza is more concerned about the small business, lower credit sector. Another reason for trade #1 to work (short “Value” / long “Growth”)

Costanza is warning that the angel on top of your Christmas tree could fall….

* * *

8) Short Metals (Copper and Iron Ore)

There have been studies that looked at which markets were the best predictors of economic growth. Equity, Fixed Income, FX, or Commodities (specifically metals). The study found metals were the best prognosticators, something that always resonated with us over the years especially as we peruse our Macro PCA model and see metals often as the top driver of various assets.

Thus, our early call on the reflation story coming out of the spring was largely predicated on the cross asset signaling in things like iron ore. Metals once again proved clairvoyant and boosted our clients returns via the various equity upside strategies we recommended (ESM0 3100 calls, ESZ0 3600/3700 call spread, ESH1 3800/3900 call spread).

When looking at the move in industrial metals likes Copper and Iron Ore, it is incredible to digest that they have retraced 10 years of losses in just nine months. Both metals are about back to decade highs…

Metals have been a focal point of recent Macro Scan pieces not because of the simple reflation story we started pitching in the spring, but because of the monumental regime shift underway in the US towards Green energy. A complete reversal of the prior four years under Trump. Additionally, the US pivoting towards Green is emboldening other regions like China and Europe to increase their commitment towards Green energy.

Green energy requires a substantial amount of metals. After a decade of lower prices that encouraged production cutbacks, there simply is not enough global supply to meet the coming Green demand.

Total Copper Inventories….

Thus, much higher metal prices are required to stimulate new investment in mining that leads to more supply. This is one of the key drivers of our inflation view in 2021.

Before you dismiss commodity inflation as headline only, consider that metals are a key input into many components of core inflation: housing , autos, appliances, and recreation (bikes for example) to name a few. Therefore, the metals rally is extremely significant to the macro backdrop and what rising core inflation means for central bank policy.

Costanza, naturally, thinks most of the above is priced in as we arrive at decade highs for metals, and sees risks to the bullish copper and iron ore view:

-

Mining regions that had temporary COVID disruptions are now back online (Chile)

-

China, a big player in the copper and iron ore market, can cap commodity prices –

-

As an example, the China National Development and Reform Commission just announced they will cap thermal coal fuel and approved more imports after record high prices and mining disruptions

-

China Iron & Steel Association held a video conference with Rio Tinto, one of China’s biggest iron ore suppliers, days after an online meeting with rival miner BHP, and said the current ore price was “unreasonable”. CISA questioned whether miners had deliberately restricted supplies to send prices soaring

-

-

New production sources: Ukraine, Canada, Chile, Liberia

Instinct: reflation, global green energy revolution, asset rotation out of large/liquid markets like equities and bonds into the smaller/less liquid commodity markets will keep metal prices soaring

Costanza: China will act to contain prices, the crowded Dollar short will get squeezed, there will be a negative growth surprise risk in 2021, and as commodities always do – production will increase as prices rise which will eventually cap prices

Estimated probability of Costanza being right: 80%

Not to say that metal prices will not keep rising in the short-term until production can match demand, but by the end of the year, Costanza will likely prove to be right. So, a potential metal bubble first, and then a burst later.

* * *

9) Negative on Digital Currencies (no specific trade)

One thing you must give Costanza is he has bravado! He is essentially shorting the world’s future way of exchanging currency or at the very least a digital store of value.

The bull case is quite simple as global central banks devalue their currencies, alternative forms of exchange gain attractiveness.

Most important is the growing acceptance by institutional investors. Some large hedge funds, asset managers, and insurance companies have turned into crypto proponents.

While Costanza will push back at the inability to use these crypto’s to buy goods or real assets, the regime shift to take note of is that institutions have just declared digital currencies as legitimate.

The thing with some crypto currencies is there is a finite amount of them that can be produced. So, like we are seeing in some metals markets (which do not have the problem of having a finite amount) is when a large amount of assets gets reallocated out of liquid sectors like gold or fixed income; we can see outsized moves higher in less liquid assets (digital currencies).

In other words, there is a historic allocation shift underway into the asset class where you cannot produce enough to match the oncoming demand, and liquidity concerns will exacerbate this issue.

Instinct: central banks are devaluing traditional forms of currency, large asset managers are shifting into the sector providing financial legitimacy, finite production

Costanza: central banks are in the process of creating their own digital currencies, countries can prohibit these forms of non-regulated currencies and exchanges at any time rendering them all potentially useless

While Costanza’s points above are valid, they are likely themes to consider another year. Again, we view the monumental shift into crypto by large asset managers to be a defining moment.

* * *

Bonus: Short Robinhooders + short calls

One of the new dynamics in the market is the arrival of retail traders, Robin Hood account holders, and endless call buying from this new participant.

According to CB Insights, “Robinhood gained approximately three million new users in the first four months of 2020. These so-called “pandemic day traders” traded 9x as many shares as E-Trade users and 40x as many shares as Schwab users during Q1’20. They also traded 88x as many risky options contracts as Schwab users during that period.”

NIO, a top Robinhood holding, has gone parabolic post-pandemic…

It has also forced The Macro Scan to spend a lot more time thinking about equity gamma than ever before as retail learned to use call options.

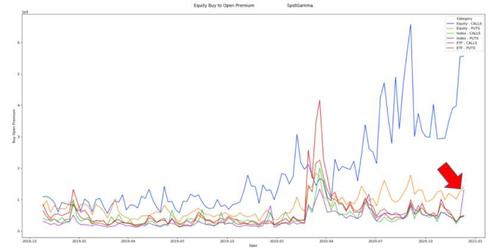

Equity ETF (symbolic of retail flow vs. institutions that uses future options) call volumes have spike in 2020…

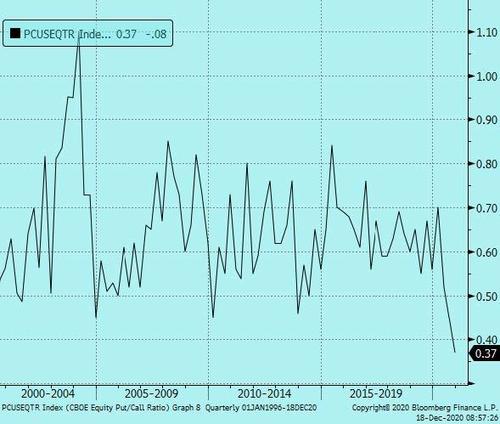

Put/Call ratio – another signal of strong call demand…

An interesting thought to consider is that this retail player has made significant money this year, so they are unlikely to pull out of the market without some significant shock that wipes out their cash/positions. In fact, 2021 could see an increase presence from retail as they roll their gains into new positions (doubling down).

That means we have not seen peak frenzy yet. This is not tulips or the “dot.com” bubble thus far.

Costanza, of course, sees a classic retail account destruction forthcoming, likely due to the new inflation impulse which will complicate the “equities always go up” mantra.

Instinct: a successful 2020 means retail/Robinhooders roll their gains into 2021 causing even more disruption

Costanza: as labor market tightens; unemployed day traders return to work, inflation complicates the markets direction causing option decay and cash bleed (recall the Dow was down to flat in both the late 70’s and ’03-‘06 inflation rise), regulations change ending $0 commissions forcing Robinhooders out of the market, Fed induced vol coma causes option decay to zero

Estimated probability of Costanza being right: 51%

Typically, retail gets blown out of the market at some point. We see the difficult inflation into stagflation environment one potential macro catalyst but recognize that an easy Fed will also mean potentially another year of easy profits. This one is too close to call but given Costanza’s track record, we give him the slightest of edges.

* * *

2020 was the year of years:

-

WW3 fears run rampant on social media as the US strikes Iranian army general Soleimani

-

San Francisco 49ers lose a heartbreaking Super Bowl (ok maybe that only affected me)

-

Black swan health event that leads to a historic equity market crash, and funding strains

-

Fed takes US policy rates to near 0% and institutes QE at a magnitude that puts the post GFC period to shame

-

Treasury institutes trillions of dollars of fiscal stimulus

-

Unprecedented lockdowns lead to Tiger King craze

-

The world learns how to school and work remotely, changing the office space landscape forever

-

WTI front month contract trades with a negative price

-

Subsequent epic equity bull market recovery rally that pierces March highs

-

Australia burns

-

Kobe Bryant tragically dies

-

We begin to watch sports with no fans

-

Pentagon releases UFO footage

-

Quantas offers flight to nowhere

-

California wildfires burn uncontrollably and wipe out parts of Napa

-

US social unrest turns violent

-

Murder hornets

-

We lose Chadwick Boseman and Ruth Bader Ginsberg

-

Overhyped US election evet that leads to a volatility collapse, year-end rally

-

I begin to wear sweatpants out of the house

-

A middle-aged skateboarder, drinking Cranberry juice to a 70s rock hit brings calm to the world

That list could have gone on forever. The point is, there could not have been more regime shifts, vol moments, and memes than 2020 (we hope).Wishing everyone happy holidays, a very happy new year, and a more benign 2021.

Kind Regards,

Mark Orsley

Tyler Durden

Wed, 12/23/2020 – 13:25

via ZeroHedge News https://ift.tt/3nPa3rA Tyler Durden