Why Is There An Increasing Share Of Women Leaving The Labor Force

Submitted by DataTrek Research

Women’s Work: The Key to 2021’s Recovery

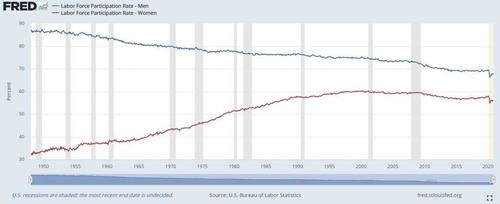

We continue to believe that progress in female labor force participation (LFP) is a central issue to watch in gauging the strength of the US labor market and economic recovery in 2021 and beyond. History shows female LFP has been a critical long-run driver of the size of the American workforce back to World War II as well as defining the contours of more recent secular trends:

-

Female LFP (red line in the chart below) nearly doubled from post-WWII (32.0 pct in January 1948) to its peak of 60.3 pct in April 2000. It fell to 56.4 pct in September 2015, but rose to 57.9 pct in January 2020. It has lost 2 points from January 2020 (57.9 pct) to November (55.9 pct).

-

By contrast, male LFP (blue line) has been in structural decline since WWII, from 86.7 pct in January 1948 to a low of 69.7 pct in November 2015, excluding 2020.

It has also lost 2 points from this past January (69.4 pct) to November (67.4 pct).

Takeaway: even though female and male LFP have both declined 2 points since January, a larger percentage of women have left the workforce than men since then. The civilian labor force for men ages 16 and older has contracted by 1.9 million since January through November versus 2.2 million for women.

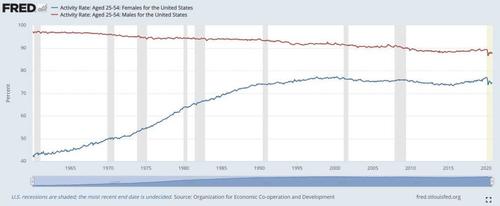

As we look ahead to 2021, let’s examine how male and female LFP have ebbed and flowed in the prior 5 recessions. We looked at the labor force participation rates for women and men aged 25 to 54 to cut out demographic issues that skew traditional datasets. Here’s how they shaped up:

2008-2009 (Higher female LFP, lower male LFP):

-

Female LFP (blue line in the chart below): Rose by 0.4 points from the start of the recession in December 2007 to the end in June 2009. It declined thereafter through 2015, but rose from then on to a record high of 77.0 pct in February 2020.

-

Male LFP (red line): Dropped by 0.9 points by the end of the recession, waned thereafter and then flattened until picking up in 2017 through early 2020.

2001 (Lower female and male LFP):

-

Female LFP (ages 25 to 54): Fell by 0.7 points from the start the recession in March 2001 to the end that November. It was relatively flat around 75 pct until the next recession in 2008.

-

Male LFP: Declined by 0.5 points by the end of the recession, but was relatively stable around 90 pct until the next recession.

1990-1991 (Flat female LFP, higher male LFP):

-

Female LFP (ages 25 to 54): Remained at the same rate of 74.0 pct through the start of the recession in July 1990 to when it ended in March 1991. It climbed higher from there before flattening at around 76-77 pct from 1997 until the next recession in 2000.

-

Male LFP: Rose by 0.1 point during the recession, but slowly declined thereafter.

1980-1982 (Higher female LFP, lower male LFP):

-

Female LFP (ages 25 to 54): Increased by 3.2 points from January 1980 to December 1982.

-

Male LFP: Fell 0.6 points during the recession, followed by a continued downward trend.

1973-1975 (Higher female LFP, lower male LFP):

-

Female LFP (ages 25 to 54): Rose by 1.5 points from November 1973 to March 1975, and then kept ascending.

-

Male LFP: Declined by 0.7 points during the recession and was flat around 94 pct until the next recession in 1980.

Takeaway: female participation has actually increased in most recessions back to the 1970s, while male participation broadly fell. The loss in workforce participation for women in the current recession is unique especially relative to the Financial Crisis, when participation actually rose slightly for this cohort.

So why is there an increasing share of women leaving the labor force in the latest recession? Two major reasons stand out to us:

#1: Women account for an outsized share of service sector jobs, which have been disproportionately hurt by business shutdowns. For example, here are a few occupations where women make up the larger percentage of the workforce (2019 BLS data):

-

Education, training and library occupations (9.5 million total employed): 73.6 pct female

-

Office and administrative support occupations (17.8 million): 70.9 pct female

-

While women make up just a little over half (54.5 pct) of food preparation and serving related occupations (8.4 million total employed), they account for 71.3 pct of waiters and 82.1 pct of hosts at restaurants, lounges and coffee shops.

Takeaway: the growth in service sector jobs after the Financial Crisis helped pull women into the labor force, especially during the strongest period of the last economic expansion from 2015 through early 2020. The novel nature of 2020’s public health crisis has made retaining or finding these types of jobs difficult and unpredictable amid changing business restrictions. Additionally, anecdotal evidence from the Fed’s Beige Book reports over the past few months have showed business contacts struggle to bring workers back amid their fears of infection.

#2: Women also tend to bear the majority of childcare responsibilities, as the latest Beige Book out earlier this month alluded to: “Providing for childcare and virtual schooling needs was widely cited as a significant and growing issue for the workforce, especially for women.”

Takeaway: It has been especially challenging for many women to work amid school closings and remote learning for their kids this year.

Bottom line: widespread distribution of vaccines next year should meaningfully help women’s ability to return to the labor force as kids are able to go back to school and service sector workers are less at risk of infection or business re-closings. Female involvement in the workforce has been the largest determinant of overall participation for decades amid the structural decline in male LFP; the former will play an important role in driving US labor market gains in 2021 while the latter will likely at best revert back to the mean. With progress in female LFP historically increasing net participation, it will also play a key role in the size of the US tax base and US economic output.

Tyler Durden

Wed, 12/23/2020 – 12:45

via ZeroHedge News https://ift.tt/3mEd7oY Tyler Durden