China Slams Jack Ma’s Ant Group, Orders It To Halt Expansion, Return To Online Payment Roots

Last week we reported that after having disappeared off the face of the earth (almost literally) for the past month following Beijing’s crackdown on the now botched Ant Financial IPO, Jack Ma tried to rebuild some burned bridges when China’s richest man – who had successfully pissed off China’s most powerful man, dictator-for-life Xi Jinping – announced his Ant Group, the world’s largest fintech company, would slash borrowing limits for some users of its popular digital credit-card service “a sign the financial-technology giant is dialing back risk in its lending business following pressure from Chinese regulators.”

According to Ant, one of the fintech giant’s consumer-lending platforms, Huabei, lowered credit limits for some younger borrowers “to promote more rational spending habits”, or generally in line with what Beijing hopes to achieve even as it floods the economy with its own trillions in new credit.

In any case, Ma’s peace offering was summarily ignored because just hours later, we learned that China had formally kicked off an investigation into alleged monopolistic practices at Alibaba – and unlike in the US, an anti-trust probe is almost certain to result in a breakup of the company in the not too distant future – escalating a campaign of scrutiny over the country’s internet giants. In response BABA shared tumbled double digits, dropping to the lowest level since July.

Then it only got worse overnight, when Ant Group said it has been instructed to “rein in the influence of technology on its financial services” as China’s financial regulators seek to further ring-fence the industry to prevent uncontrolled growth in the industry from leading to financial risks.

In a Sunday statement by People’s Bank of China’s deputy governor Pan Gongsheng, “Ant must return to its origins in online payments and prohibit irregular competition, protect customers’ privacy in operating its personal credit rating business, establish a financial holding company to manage its businesses, rectify any irregularities in its insurance, wealth management and credit businesses, and run its asset-backed securities business in accordance with regulations.”

Delivered in the form of answers to questions from the media, the statement underlined the fintech giant’s failure to meet regulatory requirements and its monopolistic behavior. It also outlined the requirements that the company must now meet as soon as possible, including the creation of a revamp plan and an implementation timetable.

“Ant needs to return to its roots of [electronic] payments,” Pan said, laying out the company’s first regulatory requirement. He was speaking on behalf of China’s major financial regulators, including the People’s Bank of China, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission (CSRC) and the State Administration of Foreign Exchange.

Ant ignored regulatory requirements, engaged in regulatory arbitrage and squeezed peers by using its market-leading status, he added.

As Bloomberg notes, while the central bank’s statement on Sunday was short on specifics, it presents a serious threat to the growth and most lucrative operations of billionaire Jack Ma’s online finance empire. Regulators stopped short of asking directly for a breakup of the company, yet stressed it was important Ant “understand the necessity of overhauling its business” and told it to come up with a plan and timetable as soon as possible.

Beijing also berated Ant for sub-par corporate governance, disdain toward regulatory requirements, and engaging in regulatory arbitrage. The central bank said Ant used its dominance to exclude rivals, hurting the interests of its hundreds of millions of consumers.

In short, to avoid a far worse fate, Beijing has ordered to Ant to become a mere shadow of its former fintech giant self; in Wells Fargo-ing the (former) fintech giant, Beijing has also made it clear it will not tolerate any private sector competition when it comes to credit expansion (as part of China’s preparation to roll out the digital yuan).

Ant said in response that it will set up a special team to comply with regulators’ demands. It will maintain business operations for users, vowing not to increase prices for consumers and financial partners, while stepping up risk controls. The Hangzhou-based firm needs to set up a separate financial holding company to comply with rules and ensure it has sufficient capital, regulators added.

The ring fence around Ant’s fintech business is part of an overall move against the twin pillars of Alibaba Group Holdings’ sprawling internet business – Alibaba’s e-commerce platform and affiliate Ant’s fintech business.

The regulators said on Sunday that they required Ant to enhance the transparency of transactions on its platform, to prevent illegal competition, obtain the necessary permits for its individual credit service, and to protect personal data privacy. They also required that the company establish a financial holding company to ensure it has sufficient capital, and that connected transactions were conducted legally. They said they wanted Ant to revamp its businesses such as loans, insurance and wealth management, and strengthen the management of its securities related institutions.

“Ant needs to fully be aware of the seriousness and necessity of the revamp, and as soon as possible, create [a] revamp plan and implementation timetable based on regulatory requirements,” Pan said. He added that, at the same time, the company had to function normally to ensure the continuity and quality of its financial services.

China’s antitrust regulator, the State Administration of Market Regulation, which began investigations into Alibaba’s operations, fined a unit of the company on December 14 for failing to disclose its takeover of department store operator Intime Retail Group between 2014 and 2017. On Sunday, Pan also pointed out the flaws in Ant’s corporate management system, and that the company had hurt consumers’ legal interests, which had led to complaints being filed.

“Ant will establish a rectification working group and fully implement requirements raised at the meeting to bring into line the operation and development of our financial related businesses,” the company said in a statement on Sunday. “We will enlarge the scope and magnitude of opening up for win-win collaboration, review and rectify our work in consumer rights protection, and comprehensively improve our business compliance and sense of social responsibility. Ant will make its rectification plan and working timetable in a timely manner and seek regulators’ guidance in the process.”

The latest salvo against Ant could further crippled its IPO plans. Fang Xinghai, the CSRC’s vice-chairman, said last month that the resumption of its listing would depend on how it adapted to Beijing’s new rules for fintech.

As an aside, Pan said that Beijing will continue to encourage financial technology companies but explicitly only “within the bounds of the law”, translation – as long as said expansion does not infringe on the PBOC’s mandate. He also stressed that the central government will continue to clamp down on illegal behavior and regulate all financial activities.

“We appreciate financial regulators’ guidance and help. The rectification is an opportunity for Ant to strengthen the foundation for our business to grow with full compliance, and to continue focusing on innovating for social good and serving small businesses,” Ant said on Sunday.

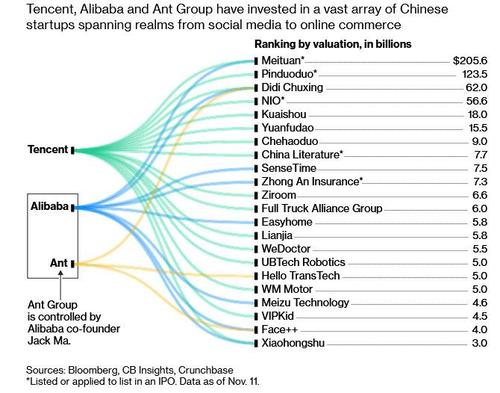

In its ongoing crackdown on Jack Ma, Beijing is eager to make an example out of Ma’s Ant, the largest among a raft of new but pervasive fintech platforms. Past crackdowns of this nature have dealt short-term blows to companies, leaving them mostly unscathed. Social media giant Tencent Holdings, for instance, became a prominent target of a campaign to combat gaming addiction among children in 2018. While its shares took a hit, they eventually recovered to all-time highs.

“I don’t think regulators are thinking of breaking up Ant, as no fintech company in China has a monopoly status,” said Zhang Kai, an analyst at market research firm Analysys Ltd. “The act is not just targeting Ant but also sending out a warning to other Chinese fintech companies.”

Unless… as Bloomberg concedes, there is the possibility that Ma went too far in his insults on Xi, and a far more troubling outcome would be if regulators moved to break up Ant Group. That would complicate the shareholder structure, and hurt the company’s fastest-growing businesses. Valued at about $315 billion before its initial public offering was halted, Ant corralled investments from the world’s biggest funds. Among them: Warburg Pincus LLC, Carlyle Group Inc., Silver Lake Management LLC, Temasek Holdings Pte and GIC Pte.

The global investors backed the company when it was valued at about $150 billion in its last round of fundraising in 2018. A break-up would make the return on their investments uncertain, with the timeline for an IPO that was due in November now pushed into the distant future.

The government could ask Ant to spin off its more lucrative operations in wealth management, credit lending and insurance, offloading them into a financial holding company that will face tougher scrutiny.

“The emerging reality is China’s regulators are adopting similar regulation toward banks and fintech players,” said Michael Norris, research and strategy manager at Shanghai-based consultancy AgencyChina.

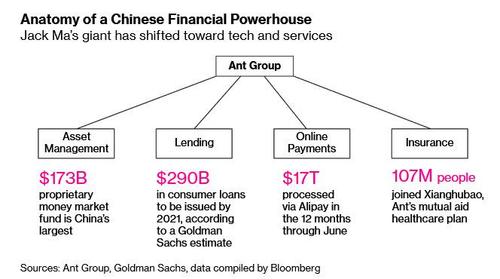

Ant’s payments business alone leaves much less to the imagination. While the service handled $17 trillion of transactions in one year, online payments have largely been loss-making. The two biggest mobile payments operators, Ant and Tencent, have heavily subsidized the businesses, using them as a gateway to win over users. To make money, they leveraged the payments services to cross sell products including wealth management and credit lending.

“Ant’s growth potential will be capped with the focus back onto its payments services,” said Chen Shujin, a Hong Kong-based head of China financial research at Jefferies Financial Group Inc. “On the mainland, the online payments industry is saturated and Ant’s market share pretty much reached its limit.”

The worst case scenario would be for Ant to forgo its money management, credit and insurance businesses, halting its operations in the units that service half a billion people. Its wealth management business which includes the Yu’ebao platform that sells mutual funds and money market funds, accounted for 15% of revenue.

Credit tech, which includes Ant’s Huabei and Jiebei units, was the biggest revenue driver for the group, contributing 39% of the total in the first six months this year. It made loans to about 500 million people. That outcome would be underpinned by the idea that China’s leaders have grown frustrated with the swagger of tech billionaires and want to teach them a lesson by killing off their businesses — even if it means short-term pain for the economy and markets.

Between them, Alibaba, Ant and Tencent commanded a combined market capitalization of nearly $2 trillion in November, surpassing state-owned behemoths such as Bank of China as the country’s most valuable companies. Additionally, as Bloomberg notes, the trio have invested billions of dollars in hundreds of up-and-coming mobile and internet companies, gaining kingmaker status in the world’s largest smartphone and internet market by users.

As Hinrich Foundation fellow Alex Capri summarized it simply, “the Communist Party is the end-all and the be-all in China. It controls everything. There is nothing that the Chinese Communist Party doesn’t control and anything that does appear to be gyrating out of its orbit in any way is going to get pulled back very quickly,” he said, adding “we can expect to see more of that.”

Tyler Durden

Sun, 12/27/2020 – 12:30

via ZeroHedge News https://ift.tt/3psNeKs Tyler Durden