Overconfidence Meets Impatience To Set Up The Crash Of 2021

Authored by John Rubino via DollarCollapse.com,

Commentary on America’s overvalued stock market can be found pretty much everywhere these days. These arguments are compelling, and are becoming more so as stocks keep rising.

The latest clue that we’re in yet another bubble is margin debt, which is money that investors borrow against their existing stocks to buy even more. A spike in its use means two things:

-

First, investors have had some success in the recent past and are now convinced of their own genius.

-

Second, they’re growing impatient and (being infallible) are comfortable using leverage to make a fast killing.

Overconfidence and impatience are a bad combination in most situations. But they’re frequently deadly in equities. Put another way, when margin debt peaks, so, frequently, does the market.

Where is it now? Way up here:

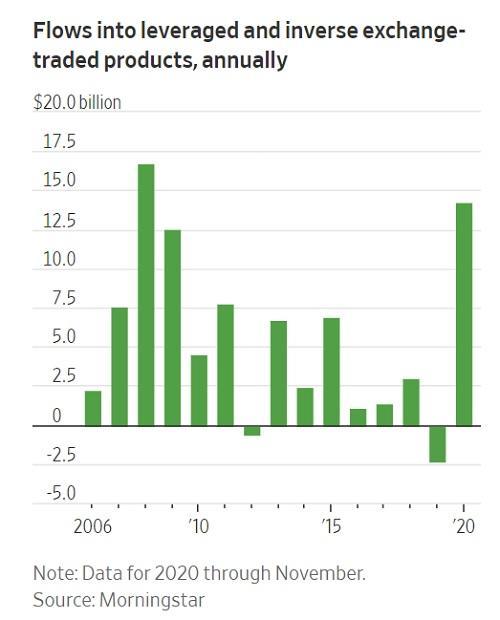

Another sign of the same dangerous attitude is excessive use of leveraged ETFs. As with margin debt, the soaring popularity of these volatile “trading vehicles” reveals an investment community swinging for the fences.

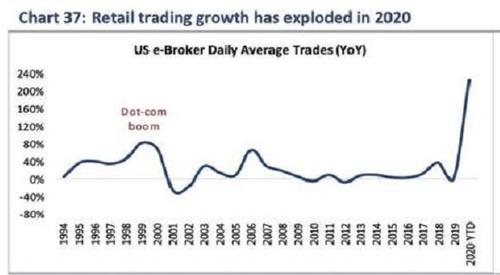

Who exactly are these cocky, impatient people betting the farm on their own awesome judgment? Mostly, they’re retail investors, which explains a lot.

The government has responded to the covid pandemic by sending people free money while using interest rates and other fiscal/monetary tools to elevate financial asset prices. So the young traders who deposited their covid checks in free stock trading apps like Robinhood have only ever experienced a raging bull market in hot stocks, and can’t yet envision anything else.

The result? Huge spikes in stocks that professionals view as overvalued and therefore good short sale candidates. Amateur traders are swamping “the shorts,” pushing stocks like Tesla (where shorts lost $40 billion in 2020) to levels that pretty much guarantee an epic plunge the minute new stimulus money is withheld or even delayed.

The first half of this year, meanwhile, is an ideal candidate for a stimulus delay.

The just-completed bill was both paltry (below $1 trillion — chump change in today’s hyperinflationary world) and hard to cobble together. The next one will be even harder since legislators will want to give the latest stimulus time to work. This means the government will require some kind of crisis before acting again. Stocks, now the most fragile of a long list of fragile sectors, are likely to provide that crisis. Cue the crash of 2021.

Tyler Durden

Mon, 01/04/2021 – 05:00

via ZeroHedge News https://ift.tt/3nbJMm3 Tyler Durden