JPMorgan Flip-Flops Again, Says Bitcoin May Hit $100,000 “But Such Price Levels Would Be Unsustainable”

Back at the start of November, JPMorgan quant NIck Panigirtzoglou – perhaps tasked with being the skeptic in-house bitcoin strategist – predicted that based on position indicators and technicals, “bitcoin’s overbought positions by momentum traders such as CTAs could trigger profit taking or mean reversion flows over the near term.” Bitcoin, which was then trading around $14,000 not only did not mean-revert or “profit-take”, but absolutely exploded over the next few weeks and by the end of November it rose to just why of its previous, 2017 highs, trading just below $20,000.

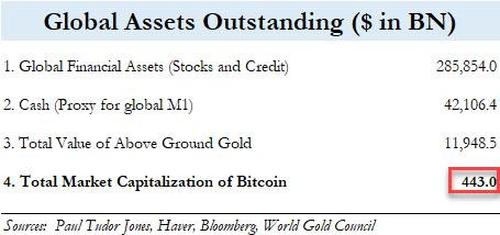

Of course, anyone who had shorted bitcoin on the back of Panigirtzoglou’s trade reco was not happy, which may explain why less than three weeks later the JPM quant admitted that he was wrong and scrambling to goalseek a bullish narrative to placate the bank’s institutional clients who were now clearly (mostly) long bitcoin, proposed a gold-parity thesis, according to which there is some $42 trillion in cash sloshing around, the value of above ground gold at $12 trillion is about 27x greater than the market cap of bitcoin today, which at its all time high is still just $443 billion. In short, if the value of bitcoin were to reach parity with gold, the price of one bitcoin would have to increase to $$650,000 from its current price of $24,000.

This time Panigirtzoglou – who gave up trying to justify the relentless move higher with fundamentals, technicals, or any conventional methodology – was right directionally, and bitcoin proceeded to nearly double from its price of $18,000 at the end of November to a new all time high of $33,600 hit on Sunday.

Which brings us to today, when seemingly eager to repeat his mistake from two months ago when he prematurely called an end to the record bitcoin run, Panigirtzoglou has published a new report asking in “Has bitcoin equalised with gold already?” (spoiler alert: not by a long, long short… but as usual JPM has its own theory).

What is the latest JPM thesis? Well, having failed to spot the inflection point in bitcoin’s price using “technicals and momentum”, Panigirtzoglou has now flipped and instead is relying on valuation to tell him whether the price of the crypto is too high. Yes, a banking quant is using “valuation” of an intangible fiat-alternative monetary unit as a basis for a trading reco. And one wonders why almost nobody reads sellside research anymore.

In any case, in JPM’s latest attempt at flip-flopping calling what may be the most important price inflection point in the world today, the JPM quant writes that after bitcoin’s tremendous run in recent weeks – on the backs of both rapid institutional adoption and continued retail buying – the “valuation and position backdrop has become a lot more challenging for bitcoin at the beginning of the New Year.” Which, of course, is obvious: the higher something goes, the more likely it is to go down as well as up. If only JPM was as accurate in calling the first leg of the rally higher it may even have credibility in calling such inflection points, whether it uses technicals or – as in this case – valuations methods to come up with its conclusion.

What is even more amusing is that having been already burned once, Panigirtzoglou is especially cautions and begins by caveating that he “cannot exclude the possibility that the current speculative mania will propagate further, pushing the bitcoin price up towards the consensus region of between $50k-$100k, we believe that such price levels would prove unsustainable.”

In other words, bitcoin can triple from here… but then it will reverse. That is clearly profound insight, and we hope that anyone who trades on such a reco has a balance sheet at least as big as that of JPM should they decide to short bitcoin here and then suffer billions in margin calls if the crypto currency were to first hit $100,000 per bitcoin.

Which brings us back to the question of just what “valuation” methods does JPM use to conclude that bitcoin’s run is coming to end? As Panigirtzoglou explains, “we had previously used two valuation metrics for bitcoin, one based on its comparison to gold and one based on its mining cost or intrinsic value.“

Because when “valuing” bitcoin the first thing that comes to mind is how much cheaper is it relative to another asset which can’t be valued, and the other “valuation” matric is to ascribe the cryptocurrency’s “value” to its cost of extraction… as if it were some commodity that is dug out of the ground and used for various industrial applications.

This is where you know Wall Street is reeeeeally starting to stretch in trying to ascribe a “fundamental” value to a price which reflects just two things: the trillions in excess liquidity chasing after non-fiat monetary units (which will survive after central banks destroy fiat with their pathological money printing), and expectations that inflation is about to explode which unfortunately markets can no longer represent using conventional means such as 10Y yields (more on that in a follow up post).

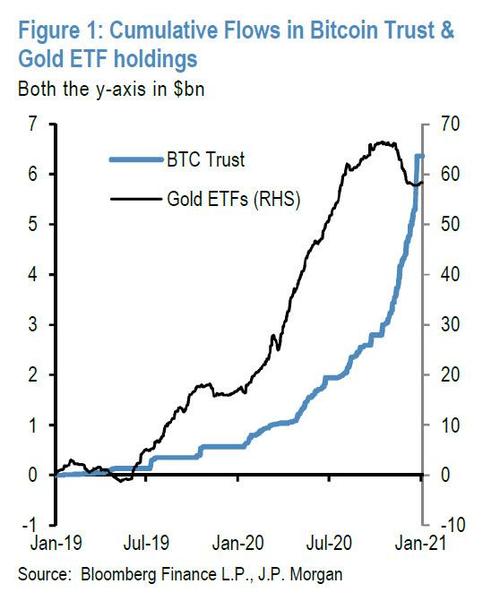

To give the JPM quant the benefit of the doubt, we lay out his reasoning which somehow can be summarized in this bi-axial chart which is supposed to show that bitcoin is now more popular than gold… if only one ignores the units of the left and right axis, although judging by the IQ of JPM clients that may not be a very far-fetched assumption, to wit:

Bitcoin’s competition with gold has already started in our mind as evidenced by the more than $3bn of inflows into the Grayscale Bitcoin Trust and the more than $7bn of outflows from Gold ETFs since mid-October.

There is little doubt that this competition with gold as an “alternative” currency will continue over the coming years given that millennials will become over time a more important component of investors’ universe and given their preference for “digital gold” over traditional gold. Considering how big the financial investment into gold is, a crowding out of gold as an “alternative” currency implies big upside for bitcoin over the long term. As we had mentioned previously in the Oct 23rd F&L, “Bitcoin’s competition with gold,” private gold wealth is mostly stored via gold bars and coins the stock of which, excluding those held by central banks, amounts to 42,600 tonnes or $2.7tr including gold ETFs.

So using this simplistic “valuation” of claiming that the market cap of bitcoin should reach parity with gold, Panigirtzoglou “explains” that “mechanically, the market cap of bitcoin at $575bn currently would have to rise by x4.6 from here, implying a theoretical bitcoin price of $146k, to match the total private sector investment in gold via ETFs or bars and coins.”

So even JPMorgan admits bitcoin can rather easily rise about 5x higher from here. But short it, please. Anyway, the JPM quant continues:

But this long term upside based on an equalization of the market cap of bitcoin to that of gold for investment purposes is conditional on the volatility of bitcoin converging to that of gold over the long term. The reason is that, for most institutional investors, the volatility of each class matters in terms of portfolio risk management and the higher the volatility of an asset class, the higher the risk capital consumed by this asset class. It is thus unrealistic to expect that the allocations to bitcoin by institutional investors will match those of gold without a convergence in volatilities. A convergence in volatilities between bitcoin and gold is unlikely to happen quickly and is in our mind a multi-year process. This implies that the above $146k theoretical bitcoin price target should be considered as a long-term target, and thus an unsustainable price target for this year.

Pay attention kids because this is called both thesis creep and “goal-seeking” – or how to hit a conclusion based on variable that you yourself have introduced into the equation and which you then use to validate your own thesis. Because here’s a counter argument: how many buyers of bitcoin are buying it because i) they say it has to hit parity with the value of gold and ii) it has to have the same vol-adjusted return profile or else they won’t buy any more?

None, you say? Why you are correct, of course, but more importantly what this little experiment has taught us is how to read between the lines of a forced conclusion that is only there because someone got a tap on the shoulder. Most likely from their trading desk. The question then is how is JPM’s trading deks axed, and the logical response is that JPM merely wants to buy whatever the bank’s clients have to sell.

Translation: JPM is now buying bitcoin.

But going back to JPM’s “bearish” thesis – at least on its client-facing side – the next part is even more laughable: you see, the price of bitcoin is too high compared to its mining cost!

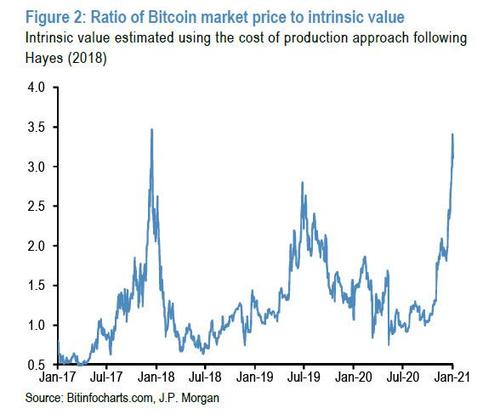

Our second valuation metric is based on the mining cost or intrinsic value of bitcoin. The ratio of the bitcoin market price to its intrinsic value is shown in Figure 2.

The current ratio is higher than its previous mid-2019 peak and matches its end-2017 peak, again raising concerns about valuations.

Actually no, it doesn’t but please go on, because here the goalseeked thesis gets really amusing: .

This is not say that the mining cost is driving the market value. The opposite is likely true. In the early years, bitcoin’s production cost had naturally stronger influence on the price because new coin generation was a higher percentage of existing stock or supply. Now that more than 18m bitcoins have been mined already (vs. max supply of 21m) and new coin generation is a smaller percentage of the existing supply, the influence of the production cost on the price has likely diminished. Thus, in the current conjuncture, the market price is likely driving the production cost rather than the other way round.

Well thanks for at least admitting that your entire “second valuation” approach is complete garbage.

However, this causality does not mean that the bitcoin price would be diverging from its mining cost on a sustained basis. Similar to gold, when the bitcoin market price is well above the production cost, mining activity and mining difficulty should increase pushing the cost of production up towards the market price, thus inducing some convergence. But similar to previous episodes, some of that convergence could happen with an adjustment in the market price also. We thus view the acute divergence of Figure 2 as another valuation challenge for bitcoin.

No, you don’t: you yourself admitted the two are not linked. You are merely trying to create a mental model in investor minds that bitcoin is too expensive and that may well be achieved since bitcoin has exploded higher and it just needs some remotely credible catalyst to force some profit taking… such as this note. But to argue that anything more than a brief drop will be triggered by such a goalseeked analysis is almost as naive as believing that the cost of “mining” bitcoin has anything to do with its price, which is entirely driven by how many trillions central banks are printing at any given moment and nothing else! But, again, this is all a useful model of how to spot and avoid garbage goalseeked narratives.

Oh, and speaking of intrinsic value of bitcoin, let’s recall what none other than Panigirtzoglou’s own boss said back in Sept 2017:

“It’s worse than tulip bulbs. It won’t end well. Someone is going to get killed,” Dimon said at a banking industry conference organized by Barclays. “Currencies have legal support. It will blow up.”

Alas, while Panigirtzoglou could have stopped here and saved himself some jeers and snickers, he decided to continues and boldly go in “analyzing” bitcoin using the same failed approach he applied in November when anyone who followed his trade reco would have blown up almost instantly. Instead, he goes on to not only “value” bitcoin, but to appraise its upside potential in terms of positioning and momentum.

On the first, he refutes his own argument from a month ago that the Grayscale Bitcoin Trust represents mostly institutional investors and instead now argues, that “it is wrong to view all these institutional flows of last year as entirely driven by long-term investors.”

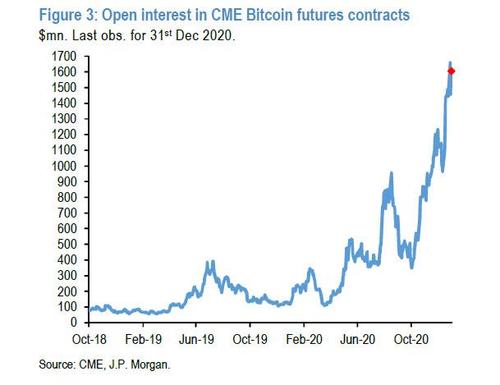

We believe that a significant component of last year’s institutional flows into bitcoin reflect speculative investors seeking to front run other more real-money institutional investors. The frothy positioning in CME bitcoin futures is one manifestation of this speculative institutional flow which encompasses momentum traders such as CTAs and quantitative crypto funds. Indeed, bitcoin futures, the preferred vehicle of speculative investors, saw a sharp increase in open interest in recent weeks (Figure 3), pointing to intense buildup of futures positions. This is also true with our more carefully calculated bitcoin futures position proxy shown in Figure 4, which experienced a similarly steep ascent in recent weeks to unprecedented territory.

So… when it suited JPM to extrapolate “deep value”, “long-term” institutional bias and positioning from Grayscale flows that’s all it was, but now that Panigirtzoglou has a mandate to hammer crypto, Grayscale can be whatever he decides it should be. Got it.

Same thing for the other “risk”, namely of momentum traders reversing, which incidentally is what Panigirtzoglou got dead wrong in early November before admitting as much. Alas, it appears he hasn’t learned that particular lesson and is once again betting that CTAs will start selling soon even though bitcoin continues to be the one security with the most tangible trend in the entire investing universe.

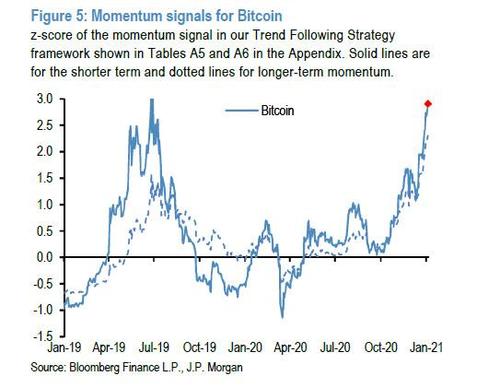

Figure 5 shows that the short look-back period momentum signal rose this week to 3.0 stdevs, and the long look-back period to 2.3 stdevs, i.e. to even higher levels than the previous peaks of mid-2019. Both are well above our 1.5stdev threshold typically associated with overbought conditions and a high risk of mean reversion.

The JPM quant then makes similar argument about retail investors saying “Unfortunately, there are some signs that retail interest has also increased sharply.” Why unfortunately? Because as he then explains, “The speculative mania by retail investors characterized the bitcoin surge during 2017.” Perhaps, but the mania by institutional investors is what characterizes the current surge and has far greater impact on the overall direction. Furthermore, as the following far less conflicted and much more objective analysis from Skew shows, institutional participation in the current phase higher dwarfs retail interest by orders of magnitude, no matter how hard JPMorgan would like to get its clients to sell to its prop traders.

and institutions are embracing #bitcoin pic.twitter.com/v9jN3iYClY

— skew (@skewdotcom) December 27, 2020

There is some more self-serving and unjustified arguments in JPM’s report, but the goalseeked conclusion is clear:

we believe that the valuation and position backdrop has become a lot more challenging for bitcoin at the beginning of the New Year. While we cannot exclude the possibility that the current speculative mania will propagate further pushing the bitcoin price up towards the consensus region of between $50k-$100k, we believe that such price levels would prove unsustainable.

In other words, bitcoin may well triple from here, but it could also drop. Which, of course, is why JPM’s quants are paid the big bucks…. especially when they are tasked with sparking a mini high net worth selloff just so either JPM’s own prop desk or a preferred institutional client can get in cheaper. Which, incidentally, is the whole purpose of JPM’s report.

And while the reasons behind Panigirtzoglou’s report are clear and transparent, our question is whether the following statement from JPM CEO Jamie Dimon in Sept 2017 is still valid:

Dimon also said he’d “fire in a second” any JPMorgan trader who was trading bitcoin, noting two reasons: “It’s against our rules and they are stupid.”

To this all we can add is that anyone tho bought bitcoin in Sept 2017 may well be stupid… but they are now retired. Which is also why those same “stupid” JPM traders – who clearly trade bitcoin now – are now so desperate to shake out the weak hands who believe their self-serving, goalseeked “research.”

Tyler Durden

Mon, 01/04/2021 – 20:00

via ZeroHedge News https://ift.tt/35a1MHg Tyler Durden