Big-Tech & Bonds Battered But Bitcoin Bid On ‘Blue Wave’, Gold Pumped’n’Dumped

Well, that was quite a day!!

As it became clear the Republicans were losing the Georgia race, early this morning Bill Blain noted earlier that he was pinged awake by an American chum:

“This is bad in so many ways that people don’t yet realise. America’s second civil war has now officially begun.”

Blain added that this was from a senior Republican not given to hyperbole.

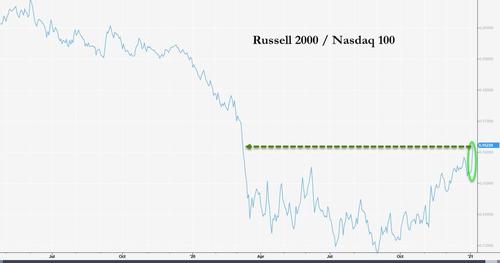

After a major divergence overnight as Georgia signaled a ‘blue wave’ loomed (Reflation trade – Small Caps up, Nasdaq down), stocks soared out of the gate as soon as the cash market opened (and Schumer promised $2000 checks for all). But that all fell apart as scenes of protests in DC sparked major selling. The S&P is back to unchanged YTD and Nasdaq down 2% while Small Caps are up over 4% YTD…

Tech stocks were the only sector to end red today… despite the utter chaos in DC?… but financials were best…Energy names remain best in 2021 for now.

Source: Bloomberg

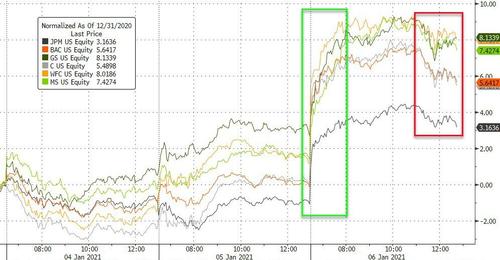

Banks love Bidenomics and the Blue Wave…

Source: Bloomberg

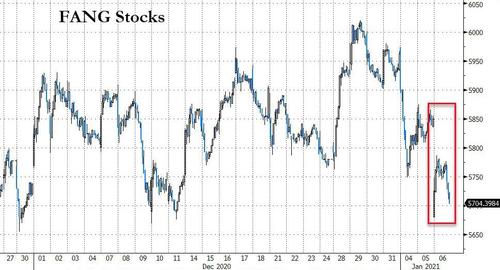

FANG Stocks tumbled to lowest close since Thanksgiving

Source: Bloomberg

The Small Caps-Big-Tech rotation surged up to its highest since March…

“Most Shorted” Stocks were screaming higher in 2021, until the Capitol was breached…

Source: Bloomberg

And since it is the most shorted stocks that end to do far better than the most popular ones, especially during market-wide squeezes such as the one seen since March, here is also the list of 50 most-shorted stocks. As usual, our advice is to go long the most hated names and short the most popular ones – a strategy that has generated alpha without fail for the past 7 years, ever since we first recommended it back in 2013.

Seems like that worked out well.

VIX spiked back above 26 after falling to a 22 handle early in the day…

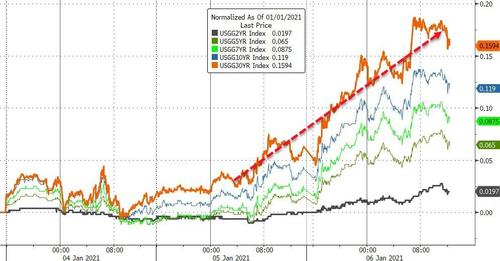

Treasury yields surged on the ‘blue wave’ reflation trade…

Source: Bloomberg

With 10Y Yields bursting above 1.00%. While the surge felt large, the last two days 13bps jump is smaller than the 16bps jump in early November after the election night…

Source: Bloomberg

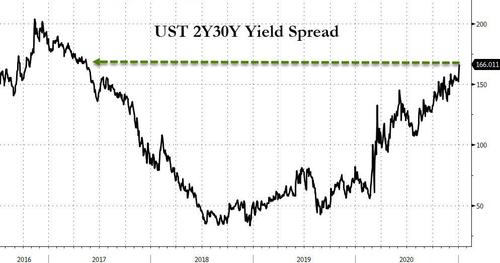

The yield curve steepened aggressively today, with 2s30s up 7bps to 166bps – its highest since May 2017…

Source: Bloomberg

Real yields spiked today, weighing on gold…

Source: Bloomberg

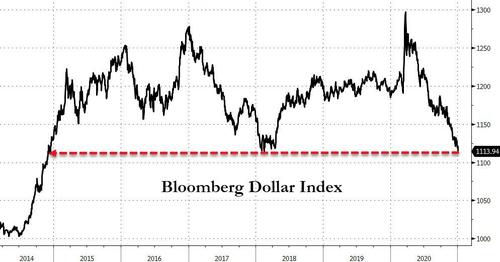

The dollar ended the day lower…

Source: Bloomberg

And broke below the 2018 lows at its lowest of the day…

Source: Bloomberg

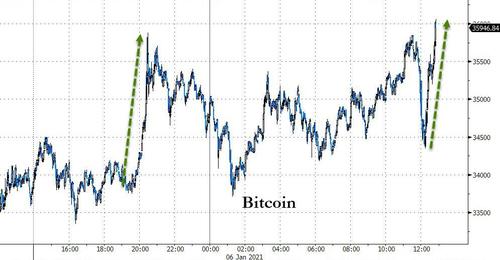

Cryptos surged on the GA results with Bitcoin spiking to new record highs above $36,000 as DC protests escalated…

Source: Bloomberg

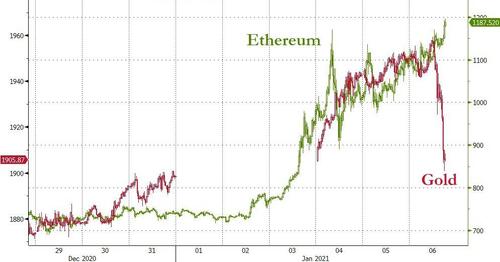

It’s been a big year so far for cryptos…

Source: Bloomberg

As cryptos rallied gold followed but this morning saw gold get monkeyhammered lower as crypto pushed on higher…

Source: Bloomberg

Gold futures ramped overnight up to pre-vaccine levels then puked back lower to erase YTD gains…

WTI rallied to almost $51 after inventory data – its highest since Feb…

Finally, as stocks rally amid anarchy in Washington, the Smart Money remains on the sidelines…

Source: Bloomberg

Tyler Durden

Wed, 01/06/2021 – 16:05

via ZeroHedge News https://ift.tt/3pWLMAw Tyler Durden