FOMC Minutes Preview

Submitted by NewSquawk

Preview: FOMC December meeting minutes due 6th January at 19:00GMT/14:00EST

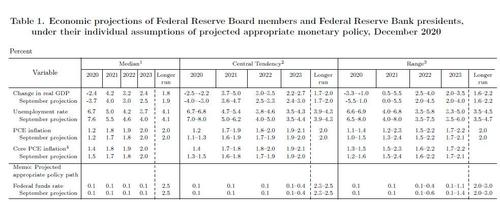

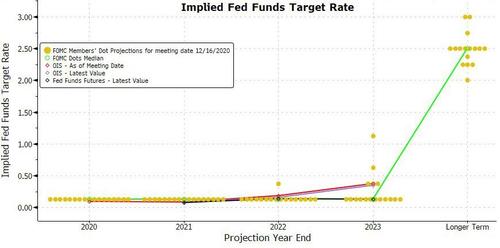

MEETING RECAP: The FOMC held the FFR target between 0.00-0.25%. It also enhanced its statement language to state a specific level for its asset purchases (USD 80bln Treasuries, USD 40bln MBS – unchanged levels) and removed references to buying at “the current pace”, while also linking purchases to further progress being made towards reaching maximum employment and price stability goals. Notably, the Fed did not extend the weighted average maturities of its purchases (analysts judged the chances as 50/50 going into the meeting), with some suggesting that a January decision may be more appropriate, allowing the Fed to see how the pandemic’s resurgence and fiscal stimulus plays out. Meanwhile, its forecasts saw near-term GDP upgraded, but 2023 onwards (including the long-term) was lowered; the unemployment rate projections were lowered across the forecast horizon, and the long-term dot was unchanged. The core inflation profile was lowered in 2020, but upped for 2021 and 2022, although interestingly, the longer-term inflation dots remained unchanged.

FISCAL STIMULUS: Going into the meeting, Fed officials had been warning heavily on the need for further fiscal stimulus. That uncertainty is now out of the way after US President Trump late December finally signed the Bill, and there is an expectation that the incoming Biden administration will continue to add fiscal support. Furthermore, with Democrats now looking to control the Senate too, Schumer has promised that one of the first things the Senate would deliver is $2,000 stimulus checks. That has helped officials become more constructive in their assessment of the medium-term (though still note the short-term challenges), since that stimulus will help protect Americans through the latest bout of the pandemic’s resurgence, which analysts say lessens the need for the Fed to act.

TAPERING: Some officials – Kaplan and Bostic, notably – have already started the discussion about when the Fed might taper the rate of its asset purchases, with some suggestion that this could be seen in 2021. (Note: tapering asset purchases must not be conflated with raising rates, which are currently expected to be held at current levels through the Fed’s forecast horizon). The updated statement links the rate of asset purchases to substantial further progress being made towards the Fed’s maximum employment and price stability goals, both of which currently have some way to go. And the language in the statement is loose enough to allow the central bank a degree of flexibility. Traders will note any discussion of the conditions the Fed will need to see before it becomes more confident in having a wider debate about tapering purchases. However, the short-term challenges may result in some language within the minutes that intimates that the Fed could add accommodation if the situation demands, so it may still be too soon to expect any hints of tapering in the December minutes.

WAM EXTENSION: As Treasury yields continue to test the top-end of their cyclical range, with 10-year yields yet to breach the psychological 1.0% mark, we continue to look for commentary to assess the likelihood that the Fed will increase the weighted average maturity of asset purchases, which is currently around 6.6 years; extending the maturity profile will allow the Fed to achieve a more ‘stimulatory effect’ and would also serve to place a soft cap on longer-dated yields. Another argument for extending WAMs is to match the issuance profile of the Treasury, which has been moving issuance further along the yield curve, while the Fed’s purchases have not kept pace. Powell was asked in the press conference about the conditions the Fed would need to see before it extended WAMs, However, the Fed chair gave little away, and instead reiterated that the Fed could up asset purchases in circumstances required, and these could be focused on the long-end.

INFLATION: The Fed’s new inflation framework entails allowing average inflation to overshoot its 2% target during economic growth cycles before it mulls lifting rates; accordingly, its discussions on the theme should be viewed with a longer-term lens, particularly since Chair Powell has said that he is prepared to look through any short-term spikes in services inflation this year (analysts have said these are most likely to be a temporary phenomenon related to annualised base effects in Q1). The lowering of the near-term inflation profile in the projections may indicate that other officials on the Committee agree with Powell, and commentary may err on the dovish side.

Tyler Durden

Wed, 01/06/2021 – 12:30

via ZeroHedge News https://ift.tt/3hPkLfx Tyler Durden