10Y Treasury Yields Hit CTA Liquidation Trigger: It’s About To Get Ugly

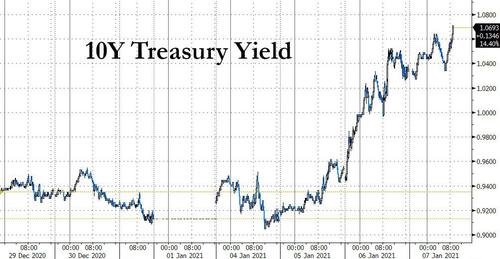

Yesterday’s unexpected “blue wave” reality washed over US markets, catalyzing a rise in 10Y Treasury yields past the CTAs’ near-term liquidation point of 1.02% (see “CTAs Will Puke Once 10Y Yield Hits 1.02%, Sparking Liquidation Cascade“) with yields rising as far at 1.050% at one point…

… a level that has been surpassed this morning with the 10Y yield rising as high as 1.07%.

This jump in Treasury yields, Nomura’s Masanari Takada writes today, had ripple effects in other markets, influencing the flow of futures sales through loss-cutting by trend-followers and delta hedging in UST futures (TY) options markets. In the US equity market, on the flip side of concentrated selling of growth and momentum stocks was a conspicuous shift toward high-beta and value stocks, and sentiment in and of itself held solid overall (more on this below) even though as we explained, a 1% increase in yields could hammer PE multiples by as much as 18%.

So what does the spike in 10yr yields mean for CTAs’ strategies? To answer this question, Takada highlights two main points.

- Expect lingering pressure on CTAs to sell off their TY long positions at a 10yr UST yield at or above 1.02%.

- While CTAs could even shift to shorting TYs, for this to be sustainable yields would have to remain at or above 1.10% and some sort of macroeconomic theme would need to come into play (such as the Fed abandoning its accommodative stance). This looks somewhat far-fetched as things stand.

Some more details on these two points from a quantitative standpoint.

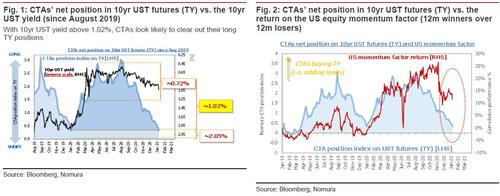

Regarding the first point, Takada estimates that CTAs have been sporadically cutting losses since 10yr UST yields reached around 1.02%, and they appear likely to keep closing out long positions with yields at 1.02% or higher. Even if other investor types (such as those with longer-term horizons) buy USTs on dips and push yields back below 1.02%, CTAs look likely to unwind their TY long positions heading toward the end of January, as TY longs have already lost much of their allure (Figure 1).

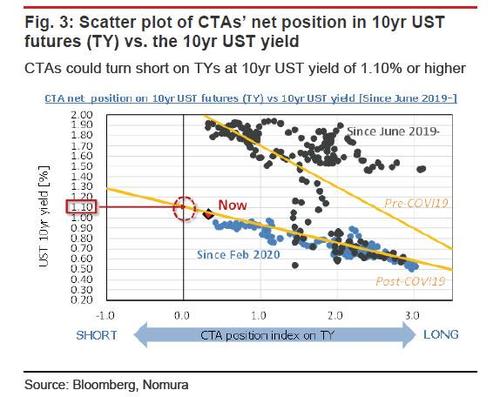

Regarding the second point, one cannot rule out the possibility that CTAs could turn short on TYs out of a surplus of momentum. In such an event, however, 10yr UST yields would need to remain above 1.10% at least (Figure 3).

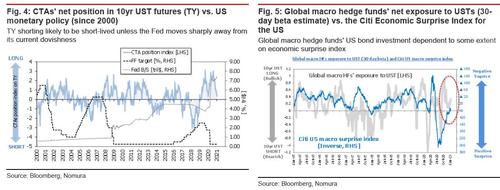

The Nomura quant then notes that the only previous cases in which CTAs have persistently built up short positions in TY have been cases when markets came to expect tightening by the Fed or when global macro hedge funds sold UST on an ongoing basis in reaction to acceleration in the US economy (Figures 4 and 5).

Given all this, although the median range for 10yr UST yields is now above 1.02%, it would seem that for them to sustainably exceed 1.10% would require a clear change of heart among the major macro investors toward bearishness on USTs. On the other hand, with the 10Y now at 1.07%, the CTA shorting threshold is now perilously close.

CTAs liquidation of long Treasury positions yesterday was also event-driven to some extent, pushed along by blue wave expectations. But even without the swelling of blue wave expectations, it seems likely that 10yr UST yields were under some upward pressure from CTAs’ accelerated portfolio reallocation (selling bonds and buying stocks) since the end of 2020.

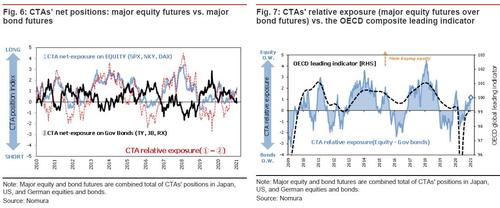

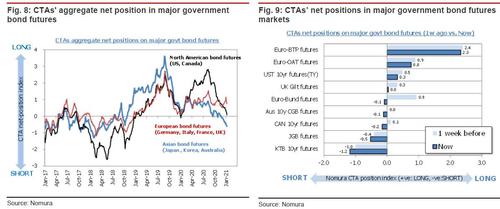

In fact, Takada claims that CTAs’ DM exposure (Japan, US, Germany) has been steadily shifting to overweighting equities, supported by the recovery in global economic momentum. In contrast, their bond exposure, which had been overweight in 2020, is now shifting toward neutral, or even slightly underweight. Apart from UST futures (TY) and some European bond futures, CTAs look to have already shifted net short on major bond futures.

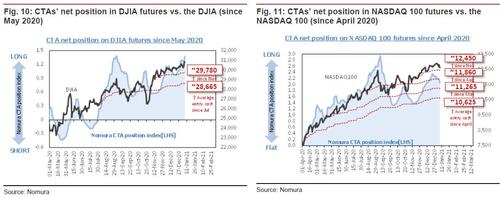

In any case, CTAs are likely to step up their portfolio reallocation further in the near term, and this is likely to result in stronger mechanistic buying pressure in equity futures markets as they sell – or outright short – Treasurys. But as was seen in the US equity market yesterday. persistently high 10yr UST yields can prove to be headwinds, and CTAs are taking the tack of unwinding long positions in NASDAQ 100 futures while accumulating longs in DJIA futures. Investors should take note that buying pressure from trend-followers varies noticeably from stock to stock.

In summary, if and when CTAs turn from sellers to outright shorters, accelerating the downward momentum in the 10Y price (and spike in yield), it may turn ugly fast, because as Morgan Stanley explained yesterday, while a slow push higher in the 10Y yield won’t affect risk assets materially, “should that adjustment in rates occur more rapidly, all stock prices will adjust lower, perhaps sharply, rather than just go sideways.”

Tyler Durden

Thu, 01/07/2021 – 09:34

via ZeroHedge News https://ift.tt/35j7fLY Tyler Durden