Goldman Expects Dems To Pass New $750BN Stimulus Next Month, Sending Economy Into Overdrive

Now that a “blue sweep” of Congress is reality, Wall Street has thrown out their existing market and economic forecasts and gone back to the drawing board to account for billions more in imminent stimulus.

Not surprisingly, the first to publish a new and improved projection deck was Goldman which overnight said it had revised its forecasts for GDP, the unemployment rate, inflation, and Fed policyto reflect the results of the Georgia Senate elections as well as the latest news about the slow progress of vaccination so far in the US and the new, more infectious strains of the virus that are spreading globally.”

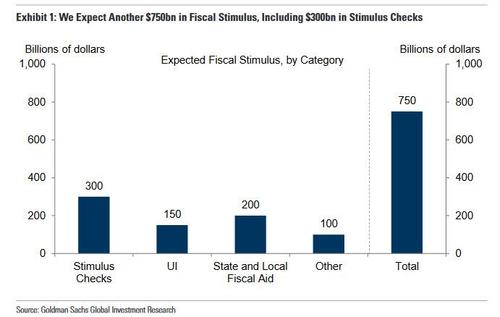

The reason for Goldman’s revision is that, as chief economist Jan Hatzius explains, with control of theHouse, Senate, and White House, Democrats are expected to pass further fiscal stimulus totaling about $750bn. This would include $300bn for additional stimulus payments, $200bn for fiscal aid to state and local governments, $150bn to extend both broader eligibility for unemployment benefits and a top-up at an amount that gradually fades overtime, and $100bn in other spending, as shown in the chart below.

On timing, Goldman expects that the bill will pass mid-February to mid-March and that the payments would occur quickly after passage.

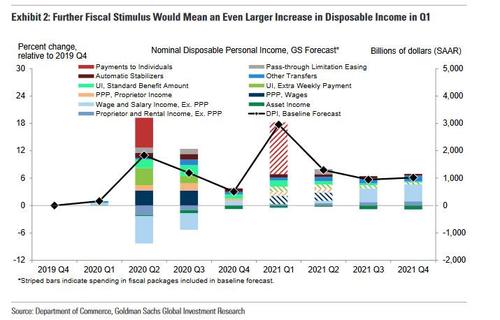

Needless to say, another round of fiscal stimulus would further boost disposable personal income, as shown below.

The huge spike in 2021Q1 reflects both the recently-passed $900bn package, which included $600 checks, additional unemployment benefits, and small business support, as well as the further $750bn package that Goldman now expects.

That said, while disposable income will grow impressively in Q1, substantially exceeding the 2020Q2 CARES Act high, Hatzius expects the impact on consumer spending to be much less front-loaded than usual because of the virus situation: “the pace of vaccination is off to a slow start in the US, and the new, more infectious strains of the virus that are spreading globally are likely to keep virus spread high for longer than we had previously expected. Even if early vaccination of high-risk groups alleviates some of the burden on hospital resources, virus spread and hospitalizations are likely to remain high among lower-risk groups who will not be vaccinated until later.As a result, state restrictions to control the virus will probably remain tight in Q1, and many households are likely to continue to cautiously avoid high-contact consumer services.”

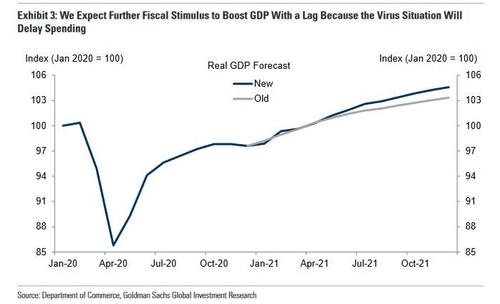

What about GDP?

Well, as shown in the next chart, Goldman has sharply revised its GDP forecast higher to incorporate this large fiscal boost to disposable income that would arrive at a time when the virus situation makes households less likely than usual to spend it. Taking both considerations into account, Goldman has made a large upgrade to its 2021 GDP path, but much of it only appears in the second half of the year. The underlying assumption is that the saving rate will rise sharply to above 20% in Q1, but then fall in the second half of the year as income normalizes but stimulus money boosts spending with a lag.

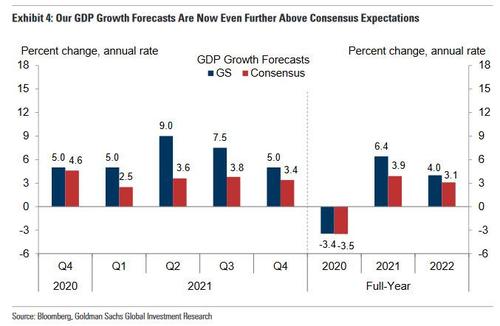

A visualization of Goldman’s estimates relative to consensus expectations. is shown below The bank now expects quarterly annualized GDP growth of +5% / +9% / +7.5% / +5% in 2021Q1-Q4, versus its previous expectation of +5% / +8.5% / +5% / +4%. The forecast is also well above consensus expectations throughout the year, with the largest differences in Q2 and Q3,when the bank expects a boom in consumer services spending as virus fears diminish.

For 2021 as a whole, Goldman now expects GDP growth of +6.4% on a full-year basis (vs. +3.9%consensus) and +6.6% on a Q4/Q4 basis (vs. +3.3% consensus). Looking further out, Goldman’s 2022 GDP growth forecast is now +4% on a full-year basis (vs. +3.7% previously) and +2.4% on a Q4/Q4 basis (vs. +2.7% previously). The stimulus-driven boost to 2021spending implies slower sequential growth in 2022, though some of the income boost will support spending next year too.

Leaning in the other direction, Democrats are expected to eventually pass tax increases for 2022 and beyond totaling about¼% of GDP that would be used to fund a roughly equivalent or slightly greater increase in government spending. Because the tax increases would be focused on corporations and high-income households, these tax and spending increases should net out as modestly positive for GDP.

What about unemployment and inflation?

In keeping with the economy in overdrive theme, Goldman lowered its unemployment rate path and now expects the unemployment rate to reach 4.8% at the end of 2021,4.3% at the end of 2022, 3.9% at the end of 2023, and 3.6% at the end of 2024, vs.5.2%/4.7%/4.2%/3.8% previously.

The bank also tweaked its inflation path for two reasons. First, its new forecast implies somewhat less slack over the next few years. Second, Goldman expects policy changes to boost 2021 healthcare services inflation relative to our previous expectations. Specifically, the recent $900bn bill included a 3.75% increase in Medicare payments for physician fees this year, and Democratic control of Congress is likely to mean that increased payments to hospitals for Covid patients will be extended through the end of this year. These additional payments are likely to expire in 2022, resulting in some payback on inflation next year.

In light of these changes, Goldman now expects core PCE inflation to reach 1.8% at end-2021,1.75% at end-2022, 1.95% at end-2023, and 2.1% at end-2024, even if 10Y breakevens are already trading north of 2.1% and strongly suggesting that the US economy is set to overheat in the coming 12 months.

Finally, what do these forecast changes mean for Fed policy according to Goldman?

While the FOMC’s simplistic forward guidance for asset purchases says that tapering will begin when “substantial further progress has been made toward the Committee’s maximum employment and price stability goals”, it is impossible to know what numerical thresholds Fed officials have in mind. Goldman’s best guess is that the bank’s year end-2021 unemployment forecast of 4.8% would meet the “substantial further progress” bar, but the end-2021 inflation forecast—just reaching 1.8%, boosted by a healthcare policy distortion—would fall a hair short. In other words, even as most household frogs are boiling in surging prices, the Fed will once again decide that – with the help of various hedonic adjustments – inflation is nowhere to be found, and will instead keep reflating a massive asset bubble!

As a result, Goldman expects tapering to begin in 2022 when the laughably fabricated and erroneous core PCE is running at about 1.85%.

Goldman has also brought forward its forecast of the timing of liftoff – i.e., rate hikes – from early 2025 to the second half of 2024, mainly because under the revised forecast inflation would reach 2% and be plausibly “on track to moderately exceed 2 percent for some time”somewhat earlier than the bank previously assumed. This is a smaller pull-forward than Hatzius’ simulations of the impact of a blue wave suggested because the very slim margin in Congress is likely to result in less fiscal expansion than the bank had assumed in that earlier analysis.

Tyler Durden

Thu, 01/07/2021 – 13:32

via ZeroHedge News https://ift.tt/2Lp1aqd Tyler Durden