Stocks, Crypto, & Bond Yields Soar After “Darkest Moment In American History”

The hyperbole from every talking-head on what occurred in DC yesterday could not have been more, well, hyperbolic… from “Pearl Harbor” comparisons to the “darkest day in American history” to calls for Trump’s immediate execution/termination/impeachment/exile (take your pick).

Before introducing his Justice Department picks from Wilmington, Delaware, on Thursday, Biden offered comments on Wednesday’s [chaos at the Capitol] which he deemed “one of the darkest days in the history of our nation” and “an unprecedented assault on our democracy.”

“All of us here grieve the loss of life, grieve the desecration of the people’s house. But what we witnessed yesterday was not dissent. It was not disorder. It was not protests. It was chaos,” Biden said.

“They weren’t protesters. Don’t dare call them protesters. They were a riotous mob, insurrectionists, domestic terrorists.”

But, that didn’t stop stocks – which apparently love all the chaos…

As everything ripped higher again at the cash open and even the Nasdaq managed to push into the green for 2021… Small Caps continue to charge highest…

NOTE – after Monday’s opening plunge, each day has seen a buying panic at the cash open…

Record highs for stocks!

We even heard someone defending this farce by saying that stocks rallied during WWII, even before we won – oh great!

And if this rise was due to ISM data, that’s an utter farce because of the misattribution of COVID-lockdown-driven supply chain disruptions causing longer delays for Supplier Deliveries (that is not a positive factor!).

Elon Musk became the richest man in the world, because…

Source: Bloomberg

Value stocks are leading the way in 2021…

Source: Bloomberg

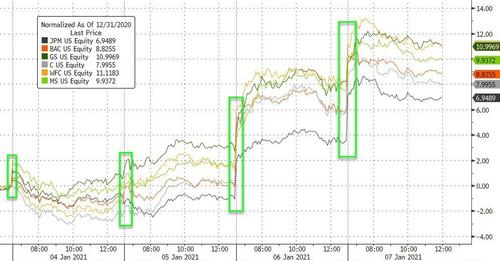

Banks were aggressively bid again…

Source: Bloomberg

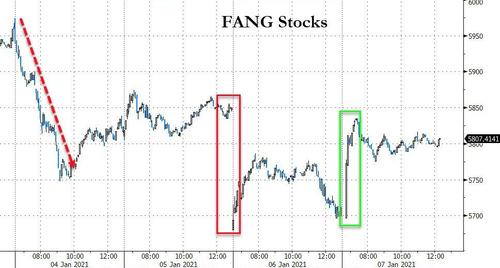

While FANG stocks bounced back notably…(as they shut down Trump’s accounts)

Source: Bloomberg

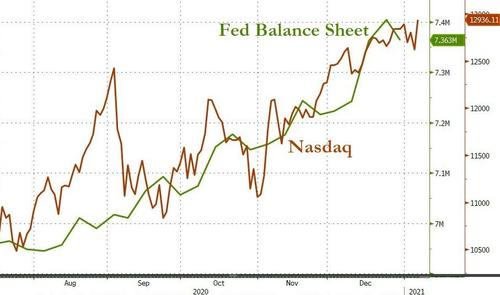

And all thanks to the fact that the Fed is still monetizing 0.6% of US GDP every month…and are not going to stop anytime soon…

Source: Bloomberg

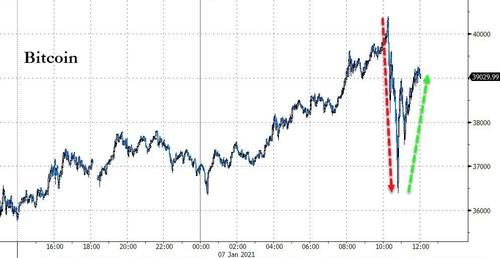

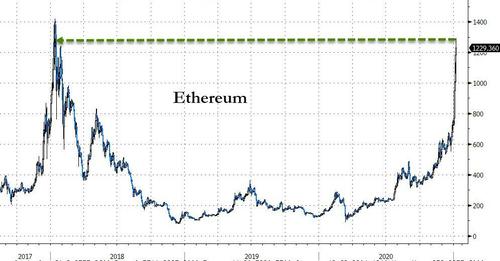

Cryptos were also enthralled – perhaps more correctly – by the chaos…

Source: Bloomberg

Bitcoin topped $40k before getting monkeyhammered and then bouncing back hard…

Source: Bloomberg

Ethereum remains below its record high but is getting close…

Source: Bloomberg

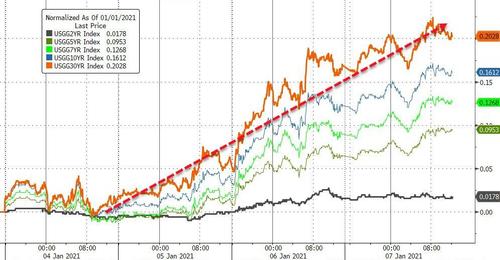

And as the reflation trade takes hold once again, Treasury yields spiked further (up 3-4bps)…

Source: Bloomberg

And this didn’t help – KAPLAN: EXPECT YIELDS TO RISE DUE TO BETTER ECONOMIC OUTLOOK

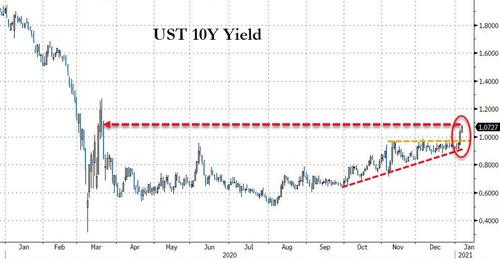

10Y Yields move higher – nearing 1.09% intraday and the highest since the spike in March…

Source: Bloomberg

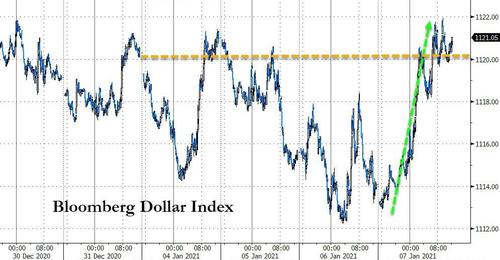

The dollar surprised, spiking to 2021 highs…

Source: Bloomberg

Gold managed gains despite the dollar gain, but erased most of yesterday’s DC-based fear moves…

Oil also managed gains with WTI closing just shy of $51…

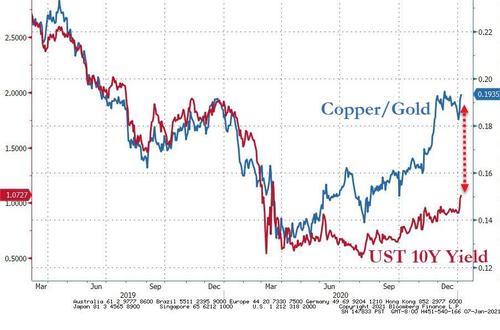

And if commodities are right, 10Y yields have a long way higher to go… 2.00%?!

Source: Bloomberg

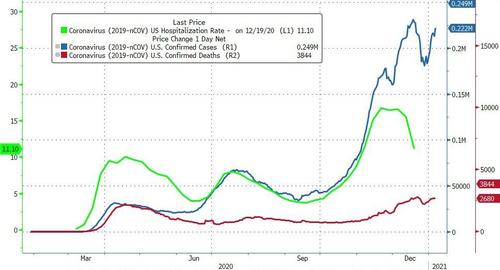

Finally, on the bright side, we hardly heard a word about the deadly pandemic that has dominated media coverage for months…

Source: Bloomberg

Tyler Durden

Thu, 01/07/2021 – 16:00

via ZeroHedge News https://ift.tt/3s733sn Tyler Durden