BofA: Bitcoin Is Now “The Mother Of All Bubbles”… This Is How It Could Burst

Back in late 2017 when bitcoin surged higher to reach what would be its all time high of just under $20,000, a veritable cottage industry of experts calling bitcoin the biggest bubble in history emerged. But while the bubble-callers were vindicated for a few years, little did they know that just three years later what they thought was the biggest bubble ever, would be surpassed several times over with bitcoin now more than double its Dec 2017 all time high on the back of global central banks injecting $1.3 billion in liquidity in the market each and every hour.

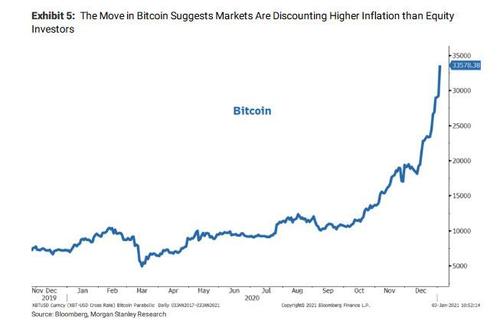

What is behind this epic move higher? Simple: as Morgan Stanley’s Michael Wilson explained on Monday, with the Fed now openly manipulating and depressing yields, and the CPI a useless, politically-motivated indicator, bitcoin has emerged as one of the only accurate inflationary metric available to traders. This is what Wilson said:

We believe the big surprise of 2021 could be higher inflation than many, including the Fed, expect. Currently, the consensus is expecting a gradual and orderly increase in prices as the economy continues to recover. However, the move in asset prices like Bitcoin suggest markets are starting to think this adjustment may not be so gradual or orderly (Exhibit 5). We concur. With global GDP output already back to pre-pandemic levels and the economy not yet even close to fully reopened, we think the risk for more acute price spikes is greater than appreciated. That risk is likely to be in areas of the economy where supply may have been destroyed and ill prepared for what could be a surge in demand later this year—e.g. restaurants, travel and other consumer/business related services…inflation can be kryptonite for longer duration bonds which would have a short term negative impact on valuations for all stocks should that adjustment happen abruptly…. The best inflation hedges are stocks and commodities in the intermediate term.

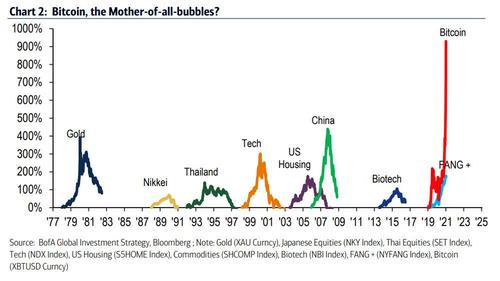

Today, BofA’s Michael Hartnett picks up on this theme and writes that as a result of the “violent inflationary price action past two months, bitcoin is up 180%, with the cryptocurrency market now more than >$1tn as Bitcoin past 2 years blows-the-doors-off prior bubbles.” And just in case we need visualization, here is how Bitcoin is now the “mother of all bubbles.”

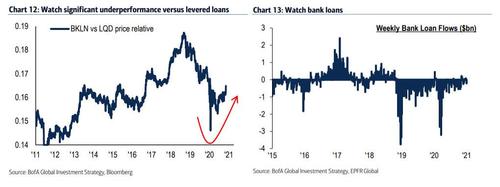

So is bitcoin’s liquidity-fueled explosion here to stay? Nobody knows – and anyone who claims otherwise is a liar and a charlatan – but just to hedge, Hartnett lays out several “liquidity warning signs” explaining that the “contrarian bear catalyst in 2021” will be rates not profits, so keep an eye on early warning signs that rates are turning bearish for risk, among which are:

- Credit: LQD drops below $133 and/or levered loans start to significantly outperform

- Dollar: surprise rally as weaker Europe & Asia growth require bout of US dollar strength.

- China: CNY and SHCOMP follow Chinese bond yields lower signaling weaker growth

- Inflation: inflation prints spook Fed balance sheet bulls (food prices at 6-year highs, up 20% past 8 months)

- Froth: higher yields trigger losses in speculative favorites e.g. XBT, TSLA.

- Rate-sensitives: classic lower rate plays such as XHB, SOX breakdown.

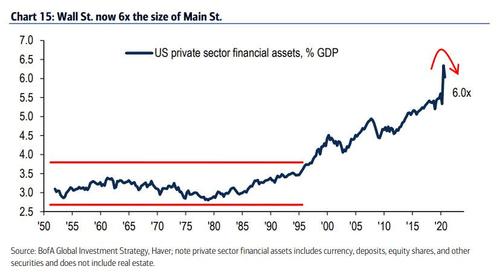

As Hartnett concludes, warning that the bursting of the bubble remains the biggest bull risk, the “decade-long backdrop of maximum liquidity and technological disruption has caused maximum inequality & massive social and electoral polarization…value of US financial assets (Wall Street) now 6X size of GDP.”

Hartnett’s surprisingly frank slam of the biggest asset bubble ever – of which bitcoin is merely a symptom – concludes by pointing out that “investor price action is increasingly speculative (IPOs, SPACs), wealth gains are obscene… but extreme asset bubbles are a natural end to nihilistic bull markets of past decade; bubbles (e.g.) in risk asset prices ignore rising rates & humiliated investors worried about “peak positioning”; we’ll know if it’s a bubble by end-Q1.”

But until then… just buy everything.

Tyler Durden

Fri, 01/08/2021 – 15:01

via ZeroHedge News https://ift.tt/39cgEpK Tyler Durden