“Full-Tilt Insanity Mode” – Nomura Warns This Week’s OpEx Is “Absolutely Going To Matter” For ‘Weaponized Gamma’ Crowd

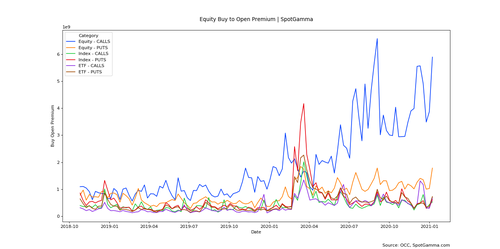

The world appears to be stock in what Nomura’s Charlie McElligott calls “Robinhood / YOLO / ‘weaponized gamma'” nonsense as the equity buy-to-open premium is soaring in individual stocks (and indices)…

Specifically, the Nomura MD notes that it is Op-Ex week, and the options positioning is absolutely going to matter, particularly off the back of this recent market heater and potential speculative sentiment overshoot.

Regarding the positioning, McElligott warns that there is a TON of $Gamma set to roll-off, which matters when Delta is this “extreme long” and thus could very likely be monetized as a “supply source” to potential correction in price – IWM net Delta is 98.8%ile with 54% of $Gamma rolling-off; QQQ Delta 98%ile, 60% Gamma coming-off; SPX Delta 90%ile, Gamma 39% rolling-off) – WHERE THINGS COULD GET SLIPPERY LOWER:

-

SPX / SPY Gamma vs spot “flip” at 3667 incl this week / 3679 ex Friday expiry

-

QQQ Gamma vs spot “flip” at 310.53 this week and ex Friday expiry

-

IWM Gamma vs spot “flip” at 201.49 this week / 200.25 ex Friday expiry

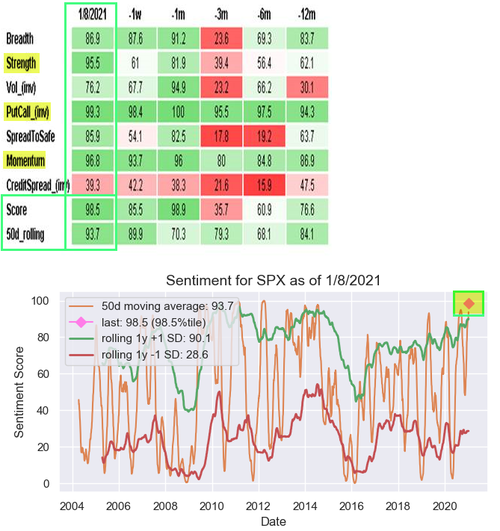

Regarding sentiment and outside the Retail proxy insanity, we are in full-blown “overshoot” mode too, with our Nomura Sentiment Index for SPX at last 98.5%ile (since 2004).

Finally, McElligott concludes with a warning: When taking the sentiment extreme in conjunction with options positioning, the very short-term set-up has been for an “UP into” trade thx to the earlier mentioned ‘”Long Dealer Gamma” and Vanna tailwind….but we have to be ready for the “down trade” window opening around Wednesday’s VIX expiration and thereafter, with Gamma coming-off and current “extreme long” Delta position showing potential for monetization to get the ball rolling lower, especially with such a risky sentiment froth clearly established with likely “weak hands” on any impulse correction

Tyler Durden

Mon, 01/11/2021 – 12:10

via ZeroHedge News https://ift.tt/35sJQIc Tyler Durden