Eurodollar Curve Chaos As Fed Does “Full 360 Degree” In Tapering Debate

As Deutsche Bank’s Jim Reid writes in his EMR report, “the big theme yesterday was a big intraday swing in rates as the European session saw yields rise everywhere but with this more than reversing late in the US session.”

The rally back seemed to start just ahead of the latest Treasury auction and accelerated on better than expected results. Early in the US trading day, US Treasury yields had climbed a further +3.9bps to 1.185%, their highest level since March before dropping -5.6bps to finish the day down -1.7bps at 1.129%.

They are fairly flat in Asian trading as we type. US yields likely also fell due to the coordinated comments from Fed governors George, Bullard and Rosengren who all indicated that tapering was not imminent.

As Reid concludes, “we’ve only had 7 business days this year and we’ve already had a full 360 degree tapering debate played out by the Fed” and observes that “Fed Reserve president George, considered one of the more hawkish central bank officials, says it is “too soon to speculate” on when monetary policy support should be pulled back and that the Fed is not likely to react even if inflation rises just over 2%.”

Taken together with Fed governor Rosengren’s comments about not expecting “the US economy to reach a sustained 2% inflation rate” over the next two years it was an evening for market participants to reassess their views on a potential tapering schedule.

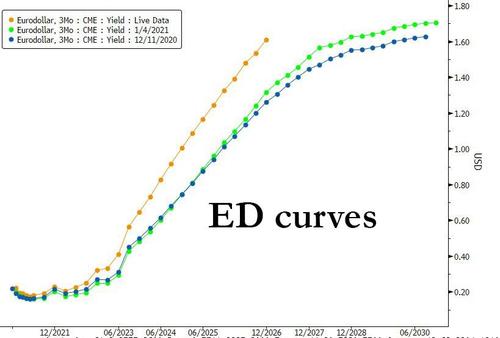

Meanwhile, a look at the ED curve shows rather aggressive steepening as rate hike expectations are brought forward.

The reason for this as Bloomberg’s Stephen Spratt noted yesterday is that in the past week there has been “a surge in option bets which pay off as more Federal Reserve hikes are priced in, though all of them are targeted at rates two or three years from now”, which is makes sense since Goldman – which has the inside ear on Fed decisions – recently pulled forward its “lift off” forecast to the second half of 2024.

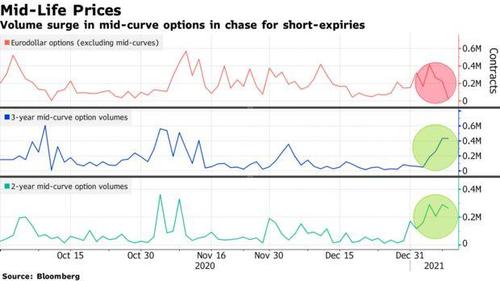

As Spratt further explains, given the Fed’s mantra of lower rates for longer, “traders don’t expect hikes this year and are unwilling to pay up for expensive options with long-dated expiries. The solution: a rush into so-called mid-curve options with short-term expiries but are priced off rates a couple of years out. This allows traders to focus bets on 2023 and 2024, without having to hold the options for more than a few months.”

The option activity spike is in response to heightened expectations for aggressive reflation, after Biden vowed “trillions” in fiscal stimulus after the recent Democratic blue sweep.

Volumes in this part of the option market have surged to the highest since November in some cases as U.S. President-elect Joe Biden prepares to release proposals for a stimulus package worth trillions of dollars on Thursday, spurring wagers on additional rate hike premiums in Eurodollar futures.

One final observation from Spratt: “While a huge variety of bets have been made, there has been one stand-out in what’s known as March 2021 three-year mid-curves. More than 100,000 puts were traded betting on higher rates in the March 2024 contract, even though the options themselves expire the same month this year.”

In short, consensus has now fully priced in a rate hike cycle beginning some time in early 2024. Alas, consensus is always wrong, which begs the question: will the Fed hike sooner or – much more likely – never, since in a world where there will soon be $300 trillion in debt, central banks can no longer raise the cost of money – and debt – without also unleashing the apocalypse.

Tyler Durden

Wed, 01/13/2021 – 15:45

via ZeroHedge News https://ift.tt/2KcT3Nl Tyler Durden