Vaccine Stocks In The Coming Vaccine Glut

Submitted by Thomas Kirchner of Camelot Portfolios

-

Production capacity is built for billions of doses of vaccines.

-

Vaccines are priced for high income countries but unaffordable for poorer countries.

-

Vaccine manufacturers may be less profitable than stock prices imply.

Stocks of the developers of Corona-vaccines have been among last year’s top performers. Moderna, for example, at its peak in early December had jumped as much as 800% and added a stunning $50bn in market capitalization. Similarly. Pfizer added about $40 bn, while its partner BioNTech added $22 bn in market value [i]. And these are not the only vaccine companies around. The announced total production capacity of all manufacturers for 2021 is now in the billions of doses. While it is great for anyone who wants to get vaccinated that there is so much vaccine production capacity and so much competition, the flipside of competition is always an erosion of profitability. With many billions at stake, it is time for investors to do some basic math on capacity, pricing and future prospects for profitability.

Enough doses for everyone

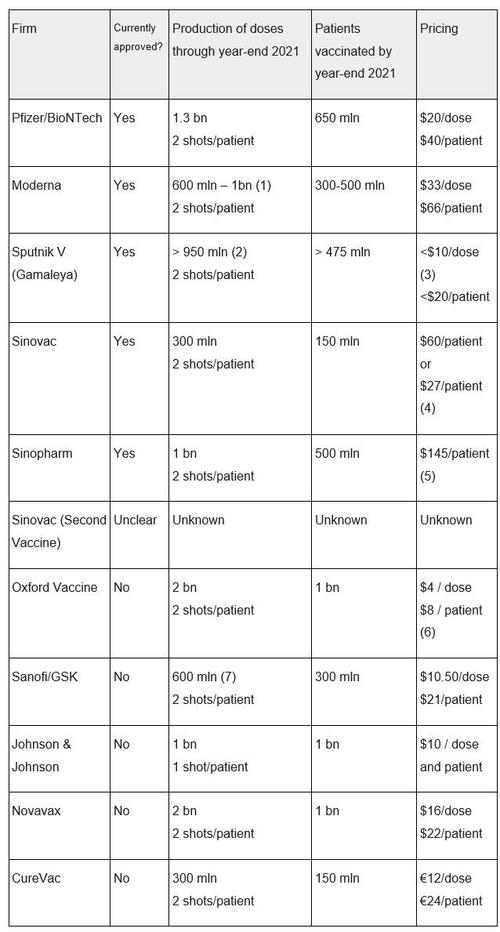

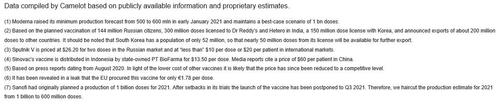

In the table below, we list different vaccines along with their production guidance for 2021 and pricing. We believe that the vaccines approved in different jurisdictions around the world so far, and the associated production capacities, will be sufficient to inoculate 2.5 billion people by the end of 2021. If only three additional vaccines (JnJ, Novavax and the Oxford vaccine) are approved, then production capacity will be sufficient to vaccinate at least 5.5 billion people by the end of the year. However, the actual number is likely to be even higher because Chinese and Russian vaccines are expected to be manufactured under local licenses in many developing countries.

India, for example, has a thriving generics industry and is particularly strong in manufacturing vaccines for its population of 1.3 billion people [ii]. So far, Indian licenses for only 300 million doses of the Sputnik V vaccine have been announced publicly. We expect the production in India to significantly exceed this number. India is known by some to manufacture medications in disregard of intellectual property rights and without paying license fees, so it is likely that Covid-vaccines will be pirated in a similar manner as other medications. We estimate Indian production to be sufficient to vaccinate at least another 500 million persons who are not included in the listing below.

Of a total population of around 7.8 billion people globally [ii], we expect at least 6.5 billion to be vaccinated by the end of 2021, which corresponds to 84%. We would also note that the above table does not include all potential vaccine producers that are still far from approval. China alone claims to have 7 firms in various stages of vaccine development. Therefore, if multiple also-rans make it to market, it is even possible that by the end of 2021, global Covid vaccine production will exceed 100% of the world’s needs.

Vaccines are priced for developed markets

Whether distribution and affordability will keep pace with production is a different question.

Priced at $40-66 per patient, the vaccines by Pfizer and Moderna are priced quite clearly for markets in developed countries. This is the price for the vaccine only. Its administration costs extra.

In the U.S., Medicare will pay $28.39 for doctors to administer a single-dose vaccine, and a total of $35.33 for the administration of a vaccine that requires two shots [iii]. Private insurance in the U.S. generally pays a little more. In the case of a Medicare patient, the total cost of Pfizer’s vaccine will be $75.33, whereas that of Moderna will be $101.33. Clearly, these are costs that insurers in developed economies can shoulder. However, in poorer countries, vaccinations with these vaccines could be cost-prohibitive for the majority of the population. Of course, in poorer countries the cost of administering vaccines is likely to be lower than in the U.S. However, the vaccines themselves could still be too expensive to be affordable.

Only 1.3 billion people or 17% of the world’s population live in developed nations where per capita incomes exceed $12,535 per year [iv] and high-priced vaccines can be sold. In the rest of the world, manufacturers will struggle with pricing. We foresee a bifurcation of vaccine markets outside of the developed world. The “bottom billion”, a term former World Bank economist Paul Collier coined for the world’s poorest nations, will probably have access to the vaccine through the generosity of donors. A so-called “COVAX alliance” led by the World Health Organization along with several aid organizations such as the GAVI alliance, has procured 2 billion doses of vaccine, including 500 million from Johnson & Johnson [v]. Initiatives such as this will ensure that the world’s poorest will have access to vaccine.

Where we see challenges is vaccination for the 5.7 billion people in middle income countries, in particular poorer middle income countries. By the World Bank’s definition, these are countries with per capita incomes of $1,036 to $12,535, with lower middle income countries having less than $4,046 per capita per year [vi]. At the lower end of that income range, a vaccine for $40 or even $66 represents 4-6% of an annual income. In addition, costs for distribution and administering will be substantial. A freezer to store vaccines costs $5,000 – 15,000 [vii]. Few countries in that group may be able to vaccinate their citizens at these prices.

That leaves two options: either, many of these 5.7 billion people will not be vaccinated, which would leave vaccine manufacturers with plenty of unsold inventory. Or, vaccine prices will have to decline. Perhaps not by a little, but by a lot. Finally, there is another option: that a low cost manufacturer will simply take market share from the high cost Pfizer and Moderna vaccines. While we cannot predict which scenario will happen, it is clear that none of these outcomes may be good for stockholders of the makers of high-priced vaccines.

Vaccine stocks priced for perfection?

Vaccine makers’ stock prices have been weak since peaking in early December, but many are still valued richly. As an example, we will evaluate Moderna. It still has about $36 billion of market value built in for its Corona-vaccine. If it were to produce 1 billion doses at the top end of its guidance and sell them for $33 each, it may have to achieve a 110% profit margin for this valuation to arguably make sense. Of course, there is a risk that the virus will not be eradicated by a one-time vaccination, but that regular booster vaccinations will become necessary. In this case, Moderna’s valuation makes more sense. If an annual booster shot is necessary and Moderna can achieve a 5.5% profit margin on 1 billion doses sold at $33 each, then the current stock price would be fair value at a 20x PE multiple. However, this is fair value under several highly speculative assumptions: the need for annual re-vaccinations and 1 billion doses produced each year at a high $33 price per dose. As we pointed out previously, we do not believe that this price level is sustainable given the fierce competition that is likely to emerge during 2021 [viii].

As excited as we are about the vaccines and the success of operation warp speed, we have to limit our enthusiasm for vaccine stocks, which we believe in many cases may be highly overvalued.

* * *

[i] Author’s calculations based on data provided by Bloomberg for the period 2/15/20 – 12/3/20.

[ii] population.un.org/wpp/DataQuery/

[iii] U.S. Centers for Medicare & Medicaid Services: “Medicare COVID-19 Vaccine Shot Payment ” January 6, 2021.

[iv] data.worldbank.org/country/XD

[v] Stephanie Nebehay, Kate Kelland: “COVAX programme doubles global vaccine supply deals to 2 billion doses” December 18, 2020

[vi] data.worldbank.org/indicator/SP.POP.TOTL

[vii] Lisa Baertlein, Carl O’Donnell: “U.S. states race to buy ultra cold vaccine freezers, fueling supply worries.” Reuters, November 13, 2020.

[viii] Author’s analysis of Moderna.

Tyler Durden

Thu, 01/14/2021 – 06:00

via ZeroHedge News https://ift.tt/2XCZsob Tyler Durden