Netflix Soars After Huge Subscriber Beat, Company Projects It Will No Longer Need External Financing

Tecent earnings reports from streaming giant Netflix have been a mixed bag: the company missing badly a year and a half ago when US subs declined while forecasting the first annual drop this decade, then smashing expectations a little over a year ago, then beating expectations four quarters ago but disappointing in its guidance, then smashing expectations with a blowout first quarter half a year ago in which it added a record 15.8 million subs thanks to covid, but once again offering a surprisingly muted outlook for a post-covid world, then tumbling two quarters ago when the company reported earnings for its first full “post Corona” quarter and warned that “growth is slowing”, before plunging last quarter when the company reported a huge miss in both EPS and new subs, which at 2.2 million was tied for the worst quarter in the past five years, while also reporting a worse than expected outlook for the current quarter, investors were on edge today to find out not whether the company would beat or miss expectations, but rather if Netflix, remains a pandemic-proof company and if the slowdown Reed Hastings warned about is for real and has pulled forward even more subscribers due to covid?

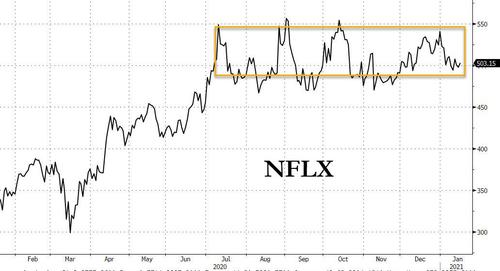

To be sure, despite medicore at best earning, the company has been riding a wave of optimism, its stock soaring in early 2020, putting it in the top 20 for S&P 500 companies, similar to the gains seen by other shutdown beneficiaries Amazon.com and Ebay. Still, after surging to a record high in early July, the stock has traded rangbeound, unable to break out to a new high. And while there’s no doubt that viewership has surged during the Covid-19 lockdowns in the U.S. and much of the world, there are complications: the virus has brought TV and film production to a halt, a situation that may only get more dire for Netflix as the months wear on. But the biggest question remains how many future subs has covid brought to the present?

Indicatively, consensus expects 6.1 million new subs this quarter, higher than the company’s own guidance of 6 million, and a big rebound from the mere 2.2 million new subs added in Q3. Revenue is expected to come in at $6.63BN, up from $6.44BN in Q3, and resulting in EPS of $1.39, down from the $1.74 last quarter. This is as streaming video remains on a hot streak since the pandemic struck. Something else to watch: Netflix bears will get added ammunition if 1Q guidance misses consensus for 7.45 million new users.

At the same time, the world’s largest paid streaming service is also facing more intense and cutthroat (or rather cut-price) competition than ever. Comcast’s Peacock platform has been rolling out for a few months, along with the short-form video service Quibi. And AT&T’s big bet on streaming, HBO Max is also up and running now while Disney+ has been a massive hit.

Bloomberg notes that in the all-important Netflix subscriber guessing game, the web traffic research site SimilarWeb suggests the service averaged about 1.5 million new subscribers globally per month in Q4. That’s below the 6 million target the company has given and down from Q4 2019. On the plus side, SimilarWeb notes, subscribers have been rising each month in the quarter and are up sharply from the disappointing Q3.

Meanwhile, as Bloomberg notes, with ViacomCBS announcing today that its new Paramount+ streaming service will launch March 4, it’s worth a closer look at Netflix’s movie strategy. The streaming business was built initially on the appearance of other people’s films, including all those blockbusters Disney used to license them. Paramount+ adds yet another big studio to the list of those with its own streaming service.

So was Q4 the quarter that would finally unleash another repricing higher for Netflix stock, or has the triple top telegraphed pain ahead? Well, the bulls may have finally lucked out, despite a bit of a heart attack initially, because after Bloomberg first reported a miss in EPS sending the stock sharply lower first, it then reported a huge beat in Q4 subs… even if it still predicted a far lower than expected subscriber print for Q1 2021. Here are the details:

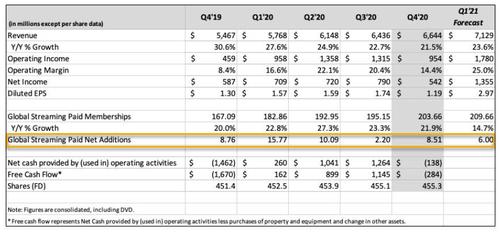

- Netflix 4Q EPS $1.19, Est. $1.38

- Netflix 4Q Rev. $6.64B, Est. $6.63B

This is the data that hit first and sent the stock lower, but it was quickly followed by the catalyst behind the sharp reversal higher in the stock, namely the 2.5MM beat in Q4 paying subs:

- Netflix 4Q Streaming Paid Net Change +8.51M, Est. +6.06M

The number was good enough to even allow investors to ignore the disappointing Q1 outlook of just 6.0 million subs, well below the 7.45MM expected:

- Netflix Sees 1Q Streaming Paid Net Change +6.00M, Est. +7.45M

And some more details on the outlook:

- Netflix Sees FY21 Operating Margin 20%

Some more Q4 stats:

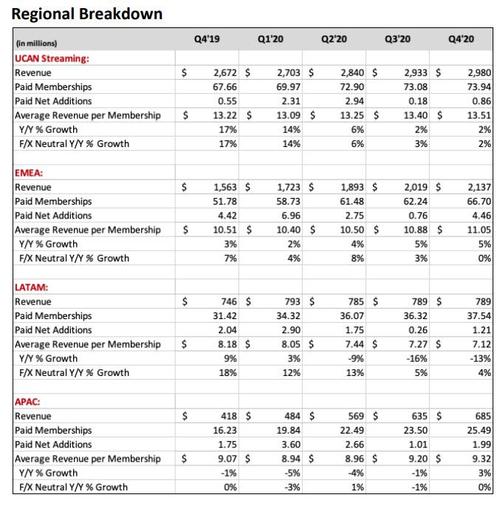

- UCAN streaming paid net change +860,000 vs. +180,000 q/q, estimate +430,620

- EMEA streaming paid net change +4.46 million vs. +760,000 q/q, estimate +2.56 million

- LATAM streaming paid net change +1.21 million vs. +260,000 q/q, estimate +1.21 million

- APAC streaming paid net change +1.99 million, +97% q/q, estimate +1.82 million

- Streaming paid memberships 203.7 million, +22% y/y, estimate 201.2 million

- Operating margin 14.4% vs. 20.4% q/q, estimate 13.4%

- Operating income $954.2 million, -27% q/q, estimate $891.5 million

- Negative free cash flow $284 million vs. positive $1.15 billion q/q, estimate negative $128.8 million

Here is the full breakdown:

And the full forecast:

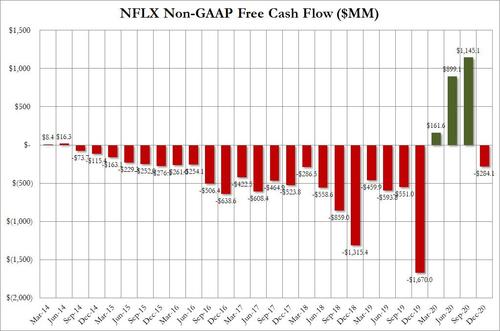

But while the company’s subscriber outlook was disappointing it was more than offset by a surprising addition to the letter, namely that “combined with our $8.2 billion cash balance and our $750m undrawn credit facility, we believe we no longer have a need to raise external financing for our day-to-day operations.”

The cash flow positive forecast came at a good time: just as the company announced that net cash generated by operating activities in Q4 was -$138 million vs. -$1.5 billion in the prior year period, while free cash flow (FCF) for the quarter dropped to -$284 million vs. -$1.7 billion in Q4‘19, but sharply below the $1.145 billion positive FCF in Q3, bringing full year 2020 free cash flow to +$1.9 billion vs. -$3.3 billion in 2019.

The result is that NFLX stock has soared almost $50 after hours, on the combination of the strong subscriber beat and the company’s forecast that it will be cash flow positive going forward.

Developing

Tyler Durden

Tue, 01/19/2021 – 16:13

via ZeroHedge News https://ift.tt/39QjUHw Tyler Durden