Tomorrow Q4 Earnings Begin In Earnest: Here’s What To Expect… And Why They Don’t Matter

Earnings season ramps up this week as 43 companies in the S&P 500 will report – the highlights will be Bank of America, Netflix, Charles Schwab and Goldman Sachs tomorrow, then on Wednesday, releases will come from Procter & Gamble, UnitedHealth Group, ASML Holding, Morgan Stanley and BNY Mellon. Finally on Thursday, we’ll hear from Intel, Union Pacific and IBM.

So what to expect?

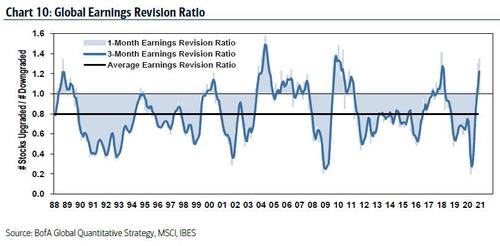

According to BofA, the bank’s one-month Global Earnings Revision Ratio increased in December from 1.30 to 1.35 to reach a two-year high. The recovery in earnings expectations has been supported by continuing accommodative monetary and fiscal policy and the start of global distribution of multiple vaccines. In the past, when the Ratio has been near current levels, the MSCI All Country World Index has averaged 11.3% over the subsequent 12 months. And since the global earnings cycle has a 76% correlation with the Global Wave, BofA says that “the rising Global Wave suggests a sustained earnings recovery could support the next leg of an equity market rally.”

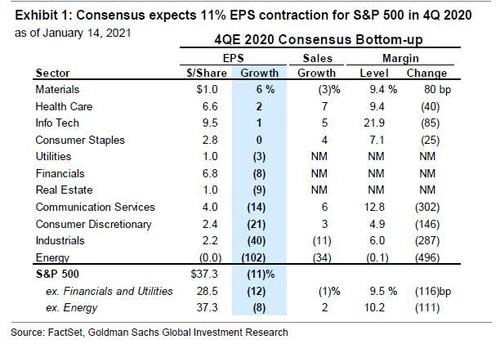

In terms of actual quantitative expectations, Goldman’s David Kostin writes that consensus expects S&P 500 firms to report 4Q year/year EPS growth of -11% as virus restrictions hampered the growth of cyclical sectors. Excluding Energy, S&P 500 EPS is expected to fall by a more modest 8%.

LIke earnings, margins are forecast to contract by 116 bps to 9.5%, falling in 7 of 8 sectors. In contrast, consensus estimates that sales will only fall by 1% (and rise by 2% ex-Energy).

Beneath the surface of the market, earnings growth is expected to vary widely across sectors. In contrast with the index-level decline, Health Care will post 2% year/year EPS growth and Info Tech earnings will grow by 1%. Overall, analysts expect cyclical sectors will report the largest earnings declines. Consensus expects EPS to contract by 102% for Energy, 40% for Industrials, and 21% for Consumer Discretionary. Materials represents a notable exception; its 6% expected EPS growth for 4Q is the largest of any S&P 500 sector.

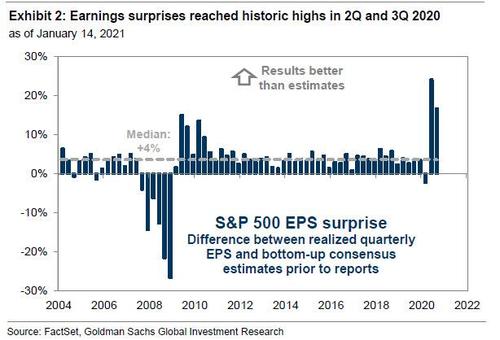

Looking ahead, Goldman notes that risks to 4Q EPS estimates “appear tilted to the upside.” If current consensus forecasts are realized, the year/year growth rate will have decelerated from 3Q, but this to Kostin would be inconsistent with the improving trajectory of economic activity. Putting this in context, since 2003 realized S&P 500 EPS has averaged 4% greater than consensus expectations at the start of reporting season. However, in 2Q and 3Q, the aggregate S&P 500 surpassed consensus expectations by 24% and 17%, respectively.

In both quarters, the realized decline in margins was ultimately less than expected. On the other hand, Goldman warns that the delayed passage of a fiscal stimulus deal may have constrained consumer spending and poses a downside risk to S&P 500 EPS estimates.

The irony is that like the past few quarters, nothing that is reported will actually matter (which is why stocks have been sloshing around in a sea of liquidity with zero concerns about fundamentals). Indeed, consistent with the previous two quarters, Goldman expects “investors will look through 4Q results and focus on company commentary about the trajectory of recovery in 2021.”

That said, as investors look to 2021, (ultra loose) policy remains a key driver for corporate profits. Joe Biden laid out his economic plan on Thursday, where he proposed a fiscal stimulus package of $1.9 trillion, designed to support the economy as it emerges from the pandemic recession. Core components of the package include direct stimulus checks of $1,400 per person, further expansion of unemployment benefits through September, $370 billion for additional state and local government aid, and $190 billion for public health funding. Biden indicated that he would seek bipartisan support for the bill (60 votes) rather than pass it via reconciliation (50 votes). In response, Goldman’s political economists increased their fiscal assumptions and now assume Congress will enact $1.1 trillion in additional stimulus, well below what BIden has proposed. But, they expect a second proposal dealing with taxes, infrastructure, and benefit programs to pass around mid-year. That should also be over a trillion dollars.

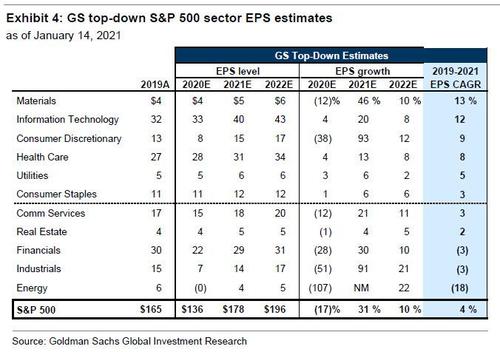

In this context, Kostin notes that he recently revised his top-down S&P 500 EPS forecasts “to reflect the policy implications of unified Democratic control in Washington, DC.” Following the Democratic victories in the Georgia run-offs – which as a reminder as recently as two months ago was seen as bearish for markets – Goldman economists turned uber bullish, and now incorporate the likelihood of increased fiscal spending as a result lifting their 2021 real US GDP growth forecast. They also raised their 2021 S&P 500 EPS growth rate by 2 pp to +31% ($178). But at the same time they lowered their 2022 EPS growth rate by 2 pp to 10% ($196) to reflect the positive impact of greater fiscal spending but also the headwind of higher corporate taxes.

Going back to Goldman’s 2021 EPS estimate, these remain 6% above the consensus bottom-up forecast of $168 because the bank expects upward revisions in the near future. Consensus 2021 EPS estimates for the overall S&P 500 index have risen by less than 1% since November 9 when Pfizer/BioNTechannounced the surprisingly-high efficacy of its vaccine candidate. Additionally, consensus forecasts have historically been too pessimistic coming out of recessions (e.g., in 2010). In particular, Goldman warns that analysts tend to underestimate margin rebounds in recovery periods. Instead the bank sees three sources of potential margin upside: (1) operating leverage, which currently stands at the highest in a decade, (2) moderating costs (e.g., labor, T&E), as SG&A expenses currently account for an elevated share of S&P 500 revenue, and (3) the growing weight of high margin industries in the S&P 500.

The real story, however, will be at the sector level: here, Goldman expects 8 of the 11 sectors to surpass their 2019 EPS by the end of 2021. As vaccine rollout develops, the bank expects sectors with the highest degree of operating leverage—namely, Consumer Discretionary and Energy—to deliver some of the fastest EPS growth this year.

In addition to operating leverage, last week we noted that Goldman’s Commodities team brought forward their expectations for higher Brent prices, which should support Energy EPS growth. Still, sespite the cyclical rebound, Goldman expects 2021 EPS will remain below 2019 levels in three sectors: Energy, Industrials, and Financials. On the other end, Tech will continue to deliver rapid growth and represent the largest share of S&P 500 EPS given its exposure to long-term secular trends.

Tyler Durden

Mon, 01/18/2021 – 21:45

via ZeroHedge News https://ift.tt/3nWs06H Tyler Durden