Bullion, Bonds, & Big-Tech Bid; Bitcoin Bust On Biden’s Big Day

Did we just begin to ‘greatly-rotate’ back to a deflationary regime?

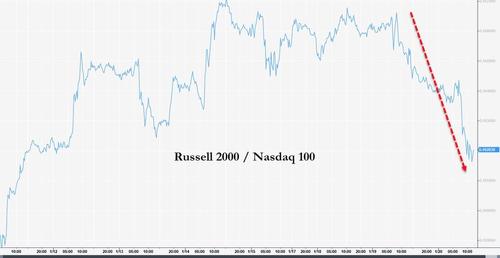

Nasdaq dramatically outperformed today (Small Caps lagged)…

All four major US equity indices closed at record highs.

Small Caps underperformed Big Tech by the most since the election…

Value underperformed growth by the most since the election…

Source: Bloomberg

Of course, NFLX helped boost big-tech and MS hindered big banks today…

Source: Bloomberg

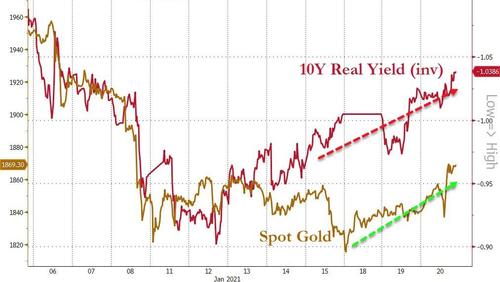

Gold is surging as real yields slide…

Source: Bloomberg

Intraday, gold was monkeyhammered lower into the London Fix, then ripped back higher above the 100- and 200-DMA…

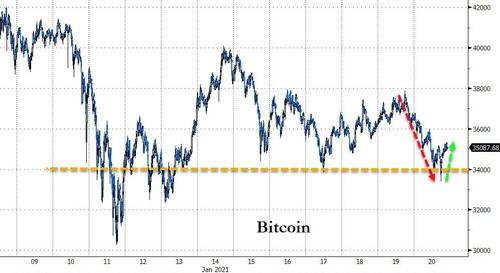

Bitcoin is rolling over as demand for gold picks up… (2nd biggest gold outperformance of Bitcoin since Thanksgiving)

Source: Bloomberg

Bonds ended the day unchanged, bid during the US day session after modest weakness overnight…

Source: Bloomberg

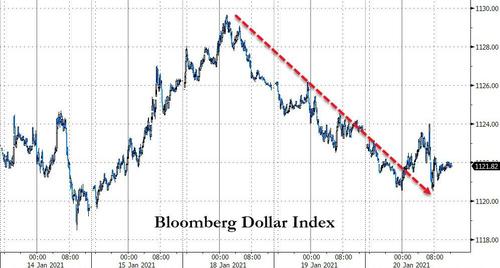

The dollar continued to drift back lower…

Source: Bloomberg

Bitcoin dipped back below $34,000, before bouncing back above $35,000…

Source: Bloomberg

Since last Friday, ETH is notably outperforming BTC…

Source: Bloomberg

WTI ended the day higher but was fading into the close (below $53 briefly) ahead of tonight’s API inventory data…

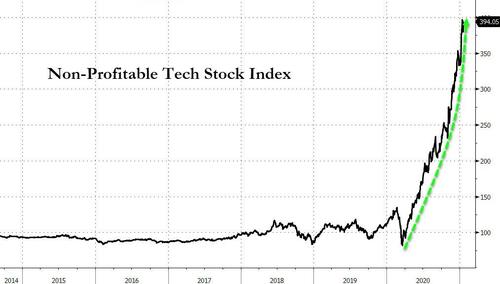

And finally, this is just funny stuff. As Bloomberg’s David Wilson notes, earnings have been anything but a prerequisite for U.S. technology stocks to surge in the past 10 months. The performance of a Goldman Sachs Group Inc. index of unprofitable companies shows as much. The gauge increased almost fivefold from a record low on March 18 through last Wednesday, when it set a record.

Source: Bloomberg

Goldman’s indicator also climbed five times as much as the S&P 500 Technology Index during the period. “These are extraordinary moves that are likely unsustainable at this point,” Jonathan Krinsky, Bay Crest Partners LLC’s chief market technician, wrote in a report Sunday that highlighted the index.

Tyler Durden

Wed, 01/20/2021 – 16:00

via ZeroHedge News https://ift.tt/3o9b2Ck Tyler Durden