Morgan Stanley Reports Blowout Quarter Cementing The Bank’s Best Year In History

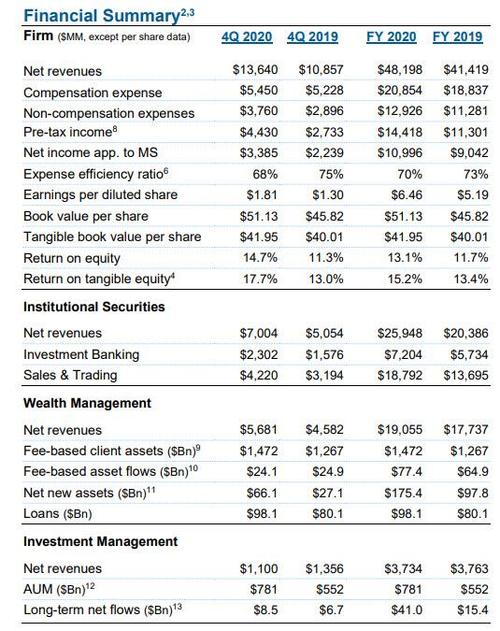

Concluding the big banks flurry of Q4 updates, this morning Morgan Stanley reported results for the final quarter of 2020 and in it will probably not be a big surprise that, just like Goldman yesterday, they were a blowout: the big bank reported Net Income of $3.39BN, up 50% from $2.24BN a year ago resulting in adjusted EPS of 1.92 (the company used a 23% effective tax rate vs 15.7% a year ago) smashing estimates of 1.27, on blowout revenue of 13.6BN, up 26% Y/Y and more than $2BN above the consensus estimate of 11.54BN.

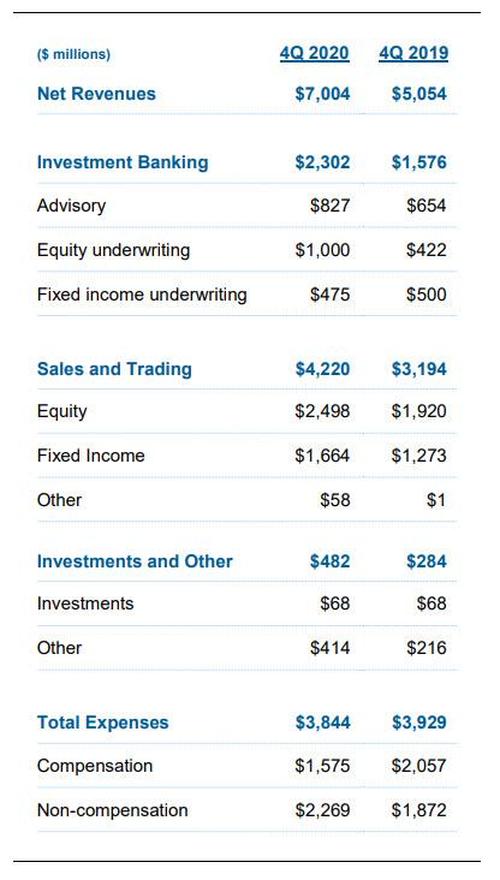

The impressive quarter was driven by stellar results in the bank’s core Institutional Securities (i.e., sales & trading and ibanking) division, which smashed expectations:

- Equities sales & trading revenue $2.50 billion, +30% y/y, estimate $2.15 billion

- FICC sales & trading revenue $1.66 billion, +31% y/y, estimate $1.51 billion

- Institutional Investment Banking revenue $2.30 billion, estimate $1.64 billion, as equity underwriting more than doubled from a year earlier.

Some more details:

Investment Ba

– Advisory revenues increased from a year ago “driven by higher M&A completed transactions.“

– Equity underwriting revenues increased from a year ago “driven by higher revenues on IPOs, blocks and follow-on offerings.“

– Fixed income underwriting revenues decreased from a year ago “as lower volumes contributed to a decline in bond revenues, partially offset by higher event driven activity.“

Sales and Trading net revenues up 32% from a year ago:

– Equity sales and trading net revenues increased from a year ago “reflecting strong performance across products and geographies driven by increased client activity, with particular strength in derivatives.“

– Fixed Income sales and trading net revenues increased from a year ago “reflecting strong performance across businesses, benefitting from strong client engagement and market volatility, with notable strength in foreign exchange and credit products.”

Other sales and trading net revenues increased from a year ago reflecting gains on investments associated with certain employee deferred compensation plans.

Curiously, within Institutional Securities, and similar to Goldman yesterday, compensation expense decreased from a year ago driven by lower discretionary compensation, partially offset by increases in the fair value of deferred compensation plan referenced investments. At the same time, non-compensation expenses increased from a year ago driven by higher volume related expenses, higher litigation expense, and an increase in the provision for credit losses on unfunded lending commitments.

The same was not true for the bigger bank in general, with compensation expenses rising 4.2% to $5.45 billion, and above the estimated $5.08 billion, while non-compensation expenses $3.76 billion, +30% y/y, estimate $3.26 billion.

Morgan Stanley’s iconic wealth management group also posted an impressive quarter, with net revenue of $5.68 billion rising +24% y/y, and also beating estimates of $5.01 billion. The firm leans on managing money for affluent individuals and other clients for more than half its revenue every quarter, a business being boosted by the takeovers of Eaton Vance Corp. and E*Trade Financial Corp.

The blowout quarter helped Morgan Stanley deliver its best year on record, generating $48.2BN in revenue and just under $11BN in net income. As Goldman notes, ten years into Gorman’s tenure atop the firm, it has carried out two of the largest deals by a top Wall Street bank. That’s been accompanied by record earnings and a stock surge which has lifted the firm’s market capitalization to more than $135 billion — effectively ending Morgan Stanley’s reputation as Wall Street’s smallest big bank.

“The firm produced a very strong quarter and record full-year results, with excellent performance across all three businesses and geographies,” Morgan Stanley CEO James Gorman said in a statement Wednesday.

And judging by the stock reaction, the market agreed, with MS shares rising as much as 3% premarket after the latest blowout quarter from the bank.

Tyler Durden

Wed, 01/20/2021 – 08:16

via ZeroHedge News https://ift.tt/3bURf75 Tyler Durden