Citadel Securities Posts Record $6.7BN Revenue In Year It Dominated Retail Orderflow

It is probably not a coincidence that in the year when Citadel Securities was fined for frontrunning of client orders (after threatening to sue for reporting just that a few days earlier), that the company reported blowout revenues, even though Ken Griffin’s firm will surely claim the two are completely unrelated.

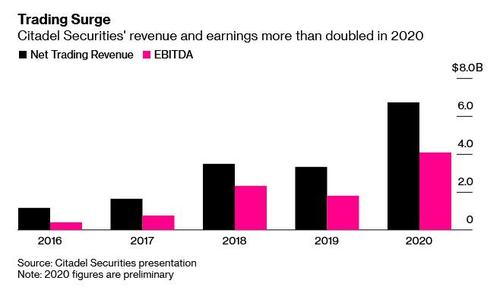

As Bloomberg reports, citing a private presentation to investors, Q4 net trading revenue of $1.7 billion brought the firm’s full-year total to $6.7 billion, almost double the previous high in 2018. The blockbuster result come after some of its traders moved from Chicago and New York to set up shop in a Palm Beach hotel in late March as the pandemic upended lives and markets across the globe. The results of the privately-held company were released in presentation to investors as part of a $2.5 billion loan Citadel Securities is seeking.

The success of Citadel Securities – which is perhaps best known for being the biggest buyers of Robinhood stock and option orderflow (which remains a perfectly legal strategy for Wall Street exchanges) with the intent of “price improvement” – comes in a year that was defined by economic pain and despair for many, but will go down as the most profitable for Wall Street firms in history. As Bloomberg notes, traders across investment banks profited from volatility sparked by the pandemic and an explosion in stock-market trading by people cooped up at home on apps such as Robinhood, with Citadel pocketing a huge portion of the orderflow unleashed by millions of newly hatched Gen Z traders.

Citadel Securities’ results also highlight how insulated it is as a pure trading firm from the health catastrophe, which forced the biggest investment banks to set aside billions to cover future soured loans.

“2020 was certainly a record year in terms of equity volumes,” said Bloomberg Intelligence analyst Larry Tabb, noting that U.S. equity volume was up 44% in December compared with January, with options volumes up 53% in the same period. “We haven’t seen anywhere near this going back to probably 2009.”

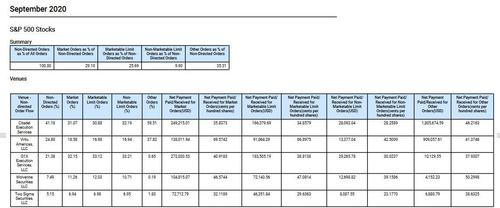

Behind the company’s success is its growing domination of all US equity trading, and near dominance of retail orderflow: Citadel Securities estimates that it commands 27% of equity volume market share in the U.S., according to the presentation, up from 21% in 2017. It’s particularly dominant in retail order flow, with 46% of the market.

But wait there’s more: according to Bloomberg, Citadel’s EBITDA for Q4 was $1 billion and a whopping $4.1 billion for the year, also a record. It also means that Citadel has an EBITDA margin of more than 60%, an unprecedented number even for a high-margin brokerage.

As its revenues soared, so did its balance sheet: at the end of the third quarter it had assets of $84.2 billion, a 61% increase from the end of 2019, while its equity capital was up 37% in the same period.

And in a record year across the board, the firm, owned 85% by Ken Griffin who also runs a separate hedge fund and which had an impressive 24% return in its flagship Wellington fund, also paid out a record $1.9 billion in equity distributions, which means that Ken Griffin may soon singlehandedly be propping up the entire ultraluxury segment of the US housing market.

Tyler Durden

Fri, 01/22/2021 – 13:23

via ZeroHedge News https://ift.tt/2Mi7lN3 Tyler Durden