“6 Months For A Regime Change”: Why One Strategist Believes The Market Will Crash In The Second Half Of 2021

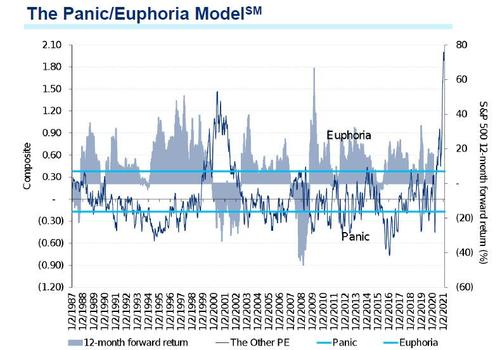

By now it is clear to everyone that: i) we are living in an “epic” market bubble (as defined by Jeremy Grantham, who also see s “spectacular” crash coming), and ii) one which is made all that more acute by a historic level of euphoria (according to Citi, Goldman and BofA), with Citi’s euphoria sentiment indicator at the euphoria-est stage in history as the latest Panic/Euphoria model shows

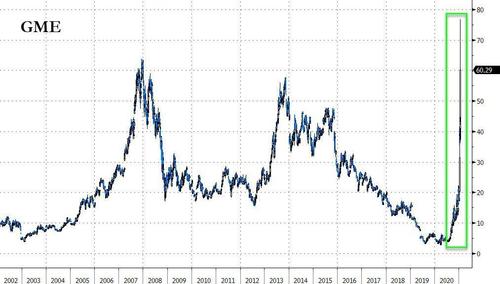

Ok, fine, the market is now more insane than it has ever been and the result are Volkswagen-esque short-squeeze explosions like the one we just saw in Gamestop, which made the Big Short (Squeeze) Michael Burry even richer.

But while everyone knows this is a bubble of unprecedented euphoria proportions, what everyone wants to know is how – and more importantly when – it will end.

Just yesterday we got two attempts to answer that question, the first from Jeremy Grantham, who told Bloomberg that he sees a “spectacular” crash in “the next few months.” Another, less alarmist prediction, came from BofA CIO Michael Hartnett, who while not expecting anything “spectacular”, predicted a sharp drawdown in risk as soon as this quarter, as this simply has to happen to reduce the record froth in this “late-stage speculative blow-off” and allow the normal move higher to resume.

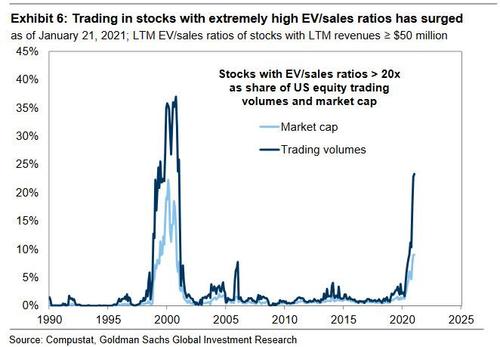

Adding to the pile up, in his latest Weekly Kickstart note even the ever-cheerful Goldman head equity strategist, David Kostin, admits that a part of the market that appears frothy “and may pose a broader risk is extremely high-growth, high-multiple stocks.” As the Goldman strategist points out, “like negative earners and penny stocks, trading volumes and share prices of stocks with EV/sales multiples over 20x have soared.”

However, these firms are much larger, collectively accounting for 23% of trading volumes during the past month (96thpercentile since 1985) and 9% of market cap. Some of this appreciation is appropriate given record low interest rates. Firms with EV/sales ratios greater than 20x accounted for 2% of trading volumes in 2019. That share rose to 10% in August 2020 as interest rates plunged. However, their share of volumes has doubled again during the most recent market rally.

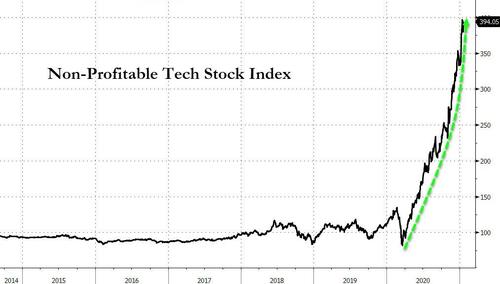

Another way of showing this: the Fed’s injections of trillions have made it so investors have run out of new trash to buy, so they are piling into the same old trash to the point where the riskiest assets are also the most attractive ones.

The chart above should come as no surprise to our regular readers: after all for the past decade we have said that we are now in a (non) “market” where fundamentals and logic don’t matter, so instead you have armies of retail daytraders rushing into the most shorted names – something we said was the best trading strategy as far back as 2013 – and also everyone turning into a momentum trader, and just buying anything that goes up (and selling anything that doesn’t). The FT had an amusing take on that:

… the stock market has totally lost its marbles, and in a bid to make as much money in as little time as possible has decided to become one giant momentum trade which consumes ever more of itself as it feeds itself.

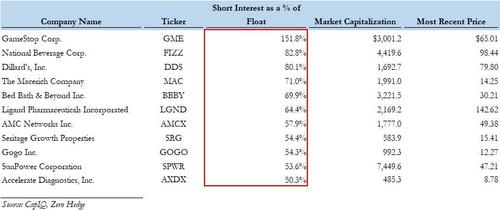

Incidentally, those who wonder what may be the “next Gamestop” where an violent short squeeze sends the stocks soaring, yesterday we showed a handful of companies where the short interest as a % of float is over 50% and are ripe to explode higher.

Now, these staggering meltups across stocks, sectors and the broader market, are starting to be a problem for Wall Street, whose analysts are once again badly behind the curve. Take Bank of America, which has a 2021 year end target of 3,800, or below the S&P’s Friday close. Or Wells Fargo which is at 3,850 and also below the recent all time high in the S&P, which was reached before January was even over.

So are strategists rushing to lift their price targets as they so always do when they chase prices and try to justify their recos to clients? Some – like Goldman, JPMorgan and Morgan Stanley are. Others, however, like Wells Fargo head strategist Chris Harvey refuses to do so and is keeping his S&P target of 3,850. Speaking with Bloomberg’s “What Goes Up” podcast, he discussed why he’s not ready to throw in the towel on his conservative target. He also discussed how Tesla Inc.’s entrance into the S&P 500 reminds him of when AOL joined the benchmark index more than 20 years ago, and why he sees it as a potential signal of the end of “growth-at-any-price” (not to be confused with GARP) type of investing,

Here are the highlights from his interview starting with why he’s sticking with his S&P 500 target:

“We knew that this is a very conservative target and we bias ourselves on the conservative side. Last year, we also had a lower target than the marketplace. And one of the things that was different from us is we had a lot of confidence in it. We never cut our price target. And when things got really dicey, we found real value. We felt comfortable in and around the market lows, telling people to put money to work. Also at this time last year, we ran into a similar situation where people were saying, ‘Hey Chris, are you going to raise your price target? Or what are you going to do?’ We said no. And right now the answer is no.”

“We have very conservative earnings estimates. Part of that is because we don’t know what the tax regime is going to look like. It’s a long year and we’ll see, and we have no problems raising our targets or changing when the information changes. What we really don’t want to do is to cut our target because we don’t want to tell people there’s value there when there really isn’t. And so we tend to err on the more conservative side.”

On why investment opportunities based on stimulus may be short-lived:

“To get to the tax situation: One of the reasons why we see the opportunity being much shorter is it appears to be a rent, not own, type situation. We’re super cheap, right? And frugal as the day is long. We don’t want to stick around for the bill. You’re going to have to pay that bill. You’re going to have to do that before the midterm elections. So that’s saying somewhere in the second half of this year, or the beginning of next year. It’s hard to say granularly what’s going to occur, but we know that we’ve spent a lot of money and sooner or later we do have to pay the bill and we think it’s coming. And so, unlike a lot of my peers, I’m a little bit worried about that because that’s not going to be a whole lot of fun.”

Why Tesla gives him an AOL flashback:

“The Spidey sense is starting to tingle, right? I remember 1998, 1999 and I remember what was happening. You had a lot of speculation, you had a lot of retail investors getting involved. And we have a lot of funny things going on now. But what was amazing to me is AOL at the time was a game changer. It was an amazing technology. The stock had an incredible run, a run I really hadn’t seen before.”

“And it was added to the S&P late in the year at a very large market cap, or very large weighting. That to me was the beginning of the end, right? ‘99 was a fantastic year for stocks, but after ‘99, many of your tech companies and many of your growth companies lost 50% to 100% of their value. Now you have another game-changing technology in Tesla. And you have a stock that has performed amazingly well. And it’s going into the S&P 500 when? December last year. At a very large weight or market cap. This is signaling that we’re close to the end of the ‘growth-at-any-price’ type investment strategy. It’s not a call-out on a particular stock, but what it shows you is that we’ve reached that level.”

“And so back in the late ‘90s, it took 12 months for that, for the regime change to occur. And what I’m telling clients now is in 2020, everything is accelerated, right? Everything that I thought was going to happen more or less occurred, but just in a very compressed time period. So if it took 12 months in the late ‘90s, we think it probably takes six months now for that regime change really to occur.”

Finally, on the potential “pain trade” for 2021:

“Funny enough, I think the big pain trade for a lot of people on the buy side is a recovery or a strong recovery, because many people haven’t traded in a post-recessionary environment. Many people have been trading in a low-growth or recessionary environment. And when growth is abundant, different things happen. The market rewards value and small caps and cyclicals and that could cause a lot of pain for much of the buy side, because they’re so steeped in that growth trade.”

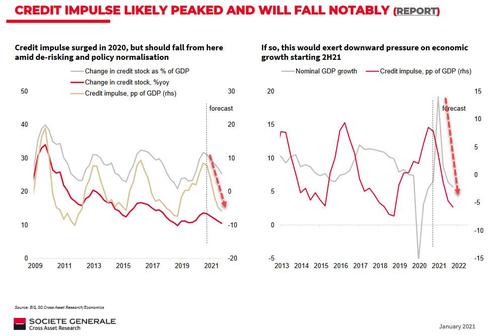

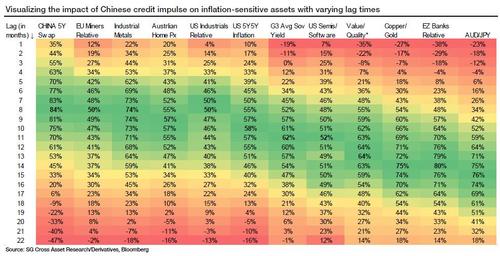

There is one more reason why the second half of 2021 will be very painful. As we first explained one month ago, the Chinese credit impulse has just peaked and is now set for a period of freefall as China scrambles to contain its recent lending spree, a move which will send its first derivative, the impulse, reeling and will have profoundly adverse impacts not only on Nominal GDP…

… but virtually every other asset class too.

To listen to the complete podcast with Harvey, click here.

Tyler Durden

Sat, 01/23/2021 – 14:25

via ZeroHedge News https://ift.tt/399gwIH Tyler Durden